Project Cash Flows

Project Cash Flows

Incremental after-tax cash flows

Relevant cash flows

1.

Opportunity Costs

2.

Sunk Costs (not relevant)

3.

Externalities

4.

Inflation

5.

Shipping & Modification Costs

Cash Flow Breakdown

1.

Initial Investment Outlay ( normally at t = 0 )

2.

Incremental Operating Cash Flows ( t = 1 through n )

3.

Terminal Cash Flow ( t = n )

Expansion Projects

Replacement Analysis

Stand-Alone Risk Measurement

1.

Sensitivity Analysis

2.

Scenario Analysis

3.

Simulation (Monte Carlo)

Risk-Adjusted Discount Rate (RADR)

Capital Rationing

Prepared by Jim Keys 1

Problems

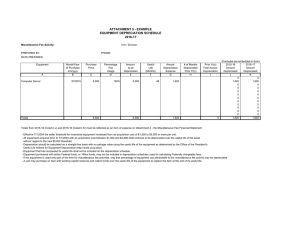

1) The president of Albatross Airlines has asked you to evaluate the proposed acquisition of a new airplane. The aircraft price is $40,000 and it is classified in the 3-year MACRS class. The purchase of the plane would require an increase in net working capital of

$2,000. The airplane would increase the firm's before-tax revenues by $20,000 per year, but would also increase operating costs by $5,000 per year. The airplane is expected to be used for 3 years and then sold for $25,000. The firm's marginal tax rate is 40% and the project's cost of capital is 14%. Use the following MACRS rates for 3-year property:

33%; 45%; 15%; 7% . a) What is the net investment outlay required at the beginning of the project?

b) What is the operating cash flow in the second year?

c) What is the total value of the non-operating (terminal) cash flow in the third

year?

d) What is the project's net present value?

2) Identify each of the following items as either a positive cash flow, negative cash flow, or no effect, and identify the dollar amount (if a cash flow). Assume a marginal tax rate of 40%:

Increase in Accounts Receivable by $5,000

Increase in Inventory by $10,000

Increase cash revenues by $100,000

Increase cash expenses by $60,000

Increase Accounts Payable by $10,000

Increase depreciation expense for tax purposes by $30,000

Prepared by Jim Keys 2

3) Suppose you are evaluating an asset that costs $400,000 that is depreciated for tax purposes using MACRS rates for a 5-year class. Assume a marginal tax rate of 30%.

What is the depreciation expense in the second year?

What is the depreciation tax-shield in the second year?

If you plan to dispose of the asset at the end of the third year, what is the asset's book value for tax purposes at the time of sale?

If you can sell the asset for $50,000 at the end of the fifth year, do you have a gain or a loss?

What are the tax consequences of this sale?

What are the cash flow consequences?

Answers

1) Expansion Project (WACC = 14%): a. ($42,000) b. $16,200 c. $18,120 d. $ 2,917

Detail

Year Cash Flow

0 ( $42,000 ) NPV = $2,916.85

1 14,280 IRR = 17.61%

2 16,200 PB = 2.39 years

3 29,520 MIRR = 16.58%

Prepared by Jim Keys 3

2) Increase in Accounts Receivable by $5,000

Negative cash flow of $5,000 (a use of funds)

Increase in Inventory by $10,000

Negative cash flow of $10,000 (a use of funds)

Increase cash revenues by $100,000

Positive cash flow

$100,000 - 0.40($100,000) = $60,000

Increase cash expenses by $60,000

Negative cash flow

-$60,000 + 0.40($60,000) = -$36,000

Increase Accounts Payable by $10,000

Positive cash flow of $10,000 (a source of funds)

Increase depreciation expense for tax purposes by $30,000

Positive cash flow

$30,000 (0.40) = $12,000

3) Second year: depreciation expense = $400,000 x 32% = $128,000.

Depreciation tax-shield = $128,000 x 30% = $38,400.

At the end of the 3rd year, you would have depreciated 20% + 32% + 19% =

71% or $284,000 of the asset's cost. The book value is $116,000 ($400,000 -

$284,000).

Another way to look at it: there is 12% + 11% + 6% = 29% of the

asset's cost remaining (29% of $400,000 = $116,000).

Book value at the end of the fifth year = 6% of $400,000 = $24,000.

Gain = $50,000 - 24,000 = $26,000.

Tax consequences: Tax = $26,000 x 30% = $7,800.

Cash flow consequences = $50,000 - 7,800 = $42,200.

Prepared by Jim Keys 4