Kentucky Fried Chicken- Intelligence - CI

advertisement

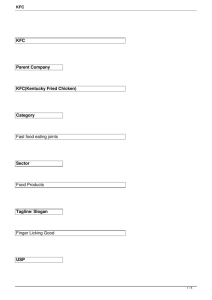

2010 Kentucky Fried ChickenIntelligence A.J. Lloyd, Talib Bensouda, Andrew Marson, Vania Mavrudis, Ricardo Yannuzzi SCS Competitive Intelligence 7/3/2010 KFC: Competitive Intelligence Report 2010 Table of Contents KFC Background and Overview ..................................................................................................... 3 Company Profile ......................................................................................................................... 3 Mission Statement....................................................................................................................... 3 Ownership and Organization ...................................................................................................... 3 Alliances ..................................................................................................................................... 4 Products and Technology............................................................................................................ 4 Market Overview ............................................................................................................................ 5 Market Trends and Growth ......................................................................................................... 5 Key Players ................................................................................................................................. 5 Strategic Analysis ........................................................................................................................... 5 Strengths ..................................................................................................................................... 5 Market Share ........................................................................................................................... 5 Differentiation ......................................................................................................................... 6 International Presence ............................................................................................................. 6 Weaknesses ................................................................................................................................. 7 Systemic .................................................................................................................................. 7 Branding .................................................................................................................................. 8 Opportunities............................................................................................................................... 8 Stability in Commodity Pricing .................................................................................................. 8 Emerging Markets ................................................................................................................... 9 Diversification in Mature Markets .......................................................................................... 9 Expansion of Multibranding ..................................................................................................... 10 Threats....................................................................................................................................... 10 Financial Overview ....................................................................................................................... 11 Past ............................................................................................................................................ 11 Present ....................................................................................................................................... 12 Financial Ratio Analysis ........................................................................................................... 12 Probable Outcomes and Predictable Crises .................................................................................. 14 Critical Success Factors ................................................................................................................ 15 Approach to Research ................................................................................................................... 15 KFC: Competitive Intelligence Report 2010 KFC Background and Overview Company Profile Kentucky Fried Chicken (KFC) is the market leader in the fast food, chicken on the bone market. Kentucky Fried Chicken was founded in 1952 by Colonel Harland Sanders and now operates in more than 108 countries.1 Yum Brands, an off shoot of PepsiCo, acquired the brand ‘concept’ in 1997, six years after the name was abbreviated to distance the chain from the implications of “fried” and ten years before the full name would be re-adopted.2 KFC remains headquartered in Louisville, Kentucky and serves approximately 12 million customers in more than 5,200 restaurants globally.3 Mission Statement Though Yum Brands only owns 17% of KFC locations in the US and 31% globally outright, their mission guides the development of the brand overall.4 Specifically, Yum’s global approach to growth and emphasis on product value is expressed in their mission to build their brands in China in every significant category; drive aggressive international expansion and build strong brands everywhere; dramatically improve US brand positions, consistency and returns; and drive industry-leading, long term shareholder and franchisee value.5 Ownership and Organization Certainly, the organization and ownership of Yum brands, and in turn KFC, influence the corporate principles by which they are guided. David Novak has been the Chairman of the Board at Yum since 2001, the CEO of Yum Brands since 2000 and the President since 1997. Novak reports to a board of executives and shareholders. He also devotes personal support to the United Nations World Food Programme and Dare-to-Care Food Bank hunger relief.6 Roger Eaton became the CEO of KFC in early 2008. He has been with Yum brands for 12 years in various high level executive positions. He is a veteran in the fast food industry and had held various positions in New Zealand (General Manager) and South Pacific (Regional Operations Director). While in the South Pacific, he achieved 27 consecutive quarters of profitable same store sales growth and consistent above target new restaurant builds.7 As a franchise, many KFC restaurants are independently owned and, according to the company’s best practice, run by a restaurant general manager (RGM), with one or more assistant managers 1 http://www.kfc.com/about/ http://en.wikipedia.org/wiki/KFC 3 http://www.kfc.com/about/ 4 SEC filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec 5 SEC filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec 6 http://www.yum.com/company/srofficers.asp 7 http://www.yum.com/company/srofficers.asp 2 KFC: Competitive Intelligence Report 2010 and an average of 20-35 employees.8 Independent and Yum-owned locations are directed by a code of conduct issued by Yum’s board of directors. This code of conduct includes a proprietary system dubbed CHAMPS (Cleanliness, Hospitality, Accuracy, Maintenance, Product Quality and Speed of Service) which is designed to systemize KFC operations across the brands and under the guidance of senior operators and regional “coaches” who work to ensure that operations are maintained in a standardized way and according to key customer value points. 9 The below chart summarizes the ownership activity for KFC in 2009, illustrating the imbalance of ownership in greater detail.10 Beginning of Year New Builds Acquisitions Refranchises Closures Other End of Year Total % of Total Company Franchisee Total 956 4,210 5,166 6 74 80 None 60 47 None 855 17 60 107 (12) 4,225 83 None 154 (12) 5,080 100 Alliances As a Yum Brand, KFC is inherently affiliated with the Pizza Hut and Taco Bell concepts. To be sure, Yum is the world largest proprietor of multi-branded fast-food locations of which the trio of brands is most often a part.11 Of these three brands, data from 2002 shows that KFC held 69% of their collective market share.12In addition to these retail alliances, KFC has also undertaken charitable alliances including animal welfare programs and aid to world hunger initiatives globally.13 Products and Technology As a brand/concept, KFC’s point of differentiation has historically been the Colonel’s secret recipe for fried chicken. Held under lock, the recipe is the lynchpin of KFC’s offerings internationally and is complemented by menu items such as coleslaw, mashed potatoes, biscuits and a variety of regionalized offerings catering to the tastes of the local markets.14 In addition to the specific menu items, KFC competes with other fast food chains on the basis of technology in 8 http://www.yum.com/investors/governance/default.asp http://findarticles.com/p/articles/mi_m3190/is_33_39/ai_n14923797/ 10 http://phx.corporateir.net/External.File?item=UGFyZW50SUQ9MjkzMDZ8Q2hpbGRJRD0tMXxUeXBlPTM=&t=1 11 http://cqx.sagepub.com/cgi/content/abstract/46/1/85 12 www.slideshare.net/skdrugs/KFC-case-study-presentation 13 http://www.yum.com/responsibility/div_community.asp 14 http://www.kfc.com/about/newsroom/default.asp 9 KFC: Competitive Intelligence Report 2010 automation, heating, food-production, shelf-life extension and ingredients such as oils.15 To this extent, KFC has introduced specialty ovens for grilled chicken and in 2006 announced a trans-fat free oil tested tirelessly to ensure the “same great taste” as the original.16 Market Overview Market Trends and Growth The global recession has contributed to an increase patronage for cheaper food options, such as fast-food. In addition, contemporary preferences for convenient food options have driven sales in fast food variably throughout the world with 73% of Americans stating that they eat fast foods out of convenience.17 Indeed, at least 33% of American consumers and 30% of consumers in the Asia Pacific region report eating take-away at least once a week.18 In Canada, one-quarter of consumers reports having eaten fast-food in the last day with a preference for chicken nuggets, fried chicken and French fries. KFCs in Canada are clustered in urban centres including Toronto, Montreal and Ottawa. Soaring food prices (notably wheat), health and diet concerns have slowed the growth of fast food chains since 2006 in North America.19 Emerging markets, however, are more likely to prefer international brands because of the perception of origin and thus present new and viable opportunities for growth in the fast food, quick service market that have offset the costs of the slowdown in domestic markets for major players like Yum.20 Key Players In addition to Yum Brands (KFC, Pizza Hut, Taco Bell and A&W), key players in the Quick Service Restaurant Market include McDonalds, internationally, and Burger King, Wendy’s, Sonic and Jack in the Box, domestically.21 Strategic Analysis Strengths Market Share KFC’s primary strength is its existing market share. The brand enjoys a 42% share of the chicken on the bone market globally which is nearly 3 times as much as their nearest competitor. The restaurant business in the US in 2009 comprised of 945, 000 restaurants. Yum’s restaurants 15 www.emeraldinsight.com/Insight/viewContentltem.do;jsessionid=CFF65F706386360802D69566ACCB6B?conten tType=Article&hdAction=Inkdf&contendid=1662892 16 http://www.kfc.com/about/newsroom/103006.asp 17 http://pewsocialtrends.org/pubs/?chartid=91 18 http://www.bangkokcompanies.com/categories/thai_companies_p495.htm 19 http://www.boston.com/business/personalfinance/articles/2008/03/09/surging_costs_of_groceries_hit_home/ 20 http://www.synovate.com/changeagent/index.php/site/full_story/brands_battle_for_emerging_market_hearts/ 21 http://www.wikinvest.com/industry/Fast_Food_Restaurants_(QSR)#_note-1 KFC: Competitive Intelligence Report 2010 accounted for 2% of those restaurants and KFC accounts for approximately one quarter of those. While the growth of same store locations in the US declined by 12% in 2009 in mature markets, like the US and Canada, it increased by 4% overall internationally and 16% in China.22 Differentiation KFC’s technological strengths include trademarked items and trade secrets including the colonel’s famous recipe, kept under lock and key, and zero-trans fat oil that, after years of testing, the company claims retains its “great taste.”23 International Presence 22 23 25 Top Markets KFC USA 5,166 Mainland China 2,497 Japan 1,150 Great Britain 689 Canada 780 Australia 572 Indonesia 336 Malaysia 431 South Africa 533 Mexico 328 Thailand 352 Korea 141 Philippines 166 SEC filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec www.answers.com/topic/KFC-corporation/thesecretrecipe, www.kfc.com/newsroom/021009-asp KFC: Competitive Intelligence Report 2010 Taiwan 131 Saudi Arabia 116 India 45 New Zealand 92 France 72 Puerto Rico 86 Spain 50 Russia 140 Hong Kong 72 Singapore 75 Egypt 90 Poland 93 KFC’s global diversification and ability to expand rapidly through its standardized model represents a significant strength in the market. Internationally, KFC’s parent company has opened more than four retail locations a day. KFC benefits most specifically in the Chinese market where the Yum brand’s “first-mover advantage” provided them early access to a market where the texture, taste and culture held appeal.24 According to fourth quarter earnings, KFCs in China averaged $1.4 million USD per unit with margins per restaurant over 20%. 25 A vast distribution centre in China in particular assists in opening new locations quickly and maintaining food quality.26 Weaknesses Systemic KFC’s weaknesses are primarily related to issues of organization and distribution. The dependence of the restaurant chain on the integrity of suppliers and distributors, for instance, 24 CNBC Special Report on China Features Yum! Brands: http://yum.com/company/china.asp SEC filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec 26 CNBC Special Report on China Features Yum! Brands: http://yum.com/company/china.asp 25 KFC: Competitive Intelligence Report 2010 means the company is dependent on third parties to ensure quality and consistency in their offerings.27 KFC’s decentralization of ownership inherent in the franchise model is a weakness, especially on a global scale, because of the distance it creates and variables it adds to the control of the brand. Whereby changes, such as the introduction of new menu items, may require operational changes across the board, the company acknowledges in their SEC filings that: “occasional disputes arise between the Company and its Concepts’ franchisees relating to a broad range of subjects, including, without limitation, quality, service, and cleanliness issues, contentions regarding grants, transfers or terminations of franchises, territorial disputes and delinquent payments.”28 Branding KFC’s family branding may be losing ground due to changing demographics. The appeals to mom and family value in particular may not hold water in light of emerging concerns regarding weight and health in North America.29 KFC’s slow growth of same store locations in North America points to the need to revitalize the brand in mature markets in the face of an increasingly saturated fast food market. Opportunities Stability in Commodity Pricing The commodity analysis hold rating indicates that chicken should stay the same price over the short term.30 Price of Chicken U.S. Cents per Pound: Month Value Feb 2009 86.70 Mar 2009 85.73 Apr 2009 85.38 May 2009 86.96 Jun 2009 88.17 Jul 2009 88.56 Aug 2009 86.77 27 http://www.time.com/time/magazine/article/0,9171,543845,00.html#ixzz0gkqVBCRA SEC filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec 29 http://www.betheboss.ca/franchise_news_september_2007%5Cpriszm231.cfm 30 http://www.prlog.org/10399245-wikiwealthcom-introduces-chicken-commodity-research-reports.html 28 KFC: Competitive Intelligence Report 2010 Sep 2009 84.88 Oct 2009 82.85 Nov 2009 82.13 Dec 2009 82.15 Jan 2010 83.00 KFC can use this trend analysis to help forecast cost savings in the short term. Emerging Markets Opportunities for the KFC brand include the brand’s potential to garner market share in international markets resultant to its global reach, an estimated 5% growth rate in emerging economies and the tendency for markets in those countries to perceive imported brands as superior to local ones and thus competitively advantaged. In particular, China’s estimated growth will accelerate to 9.4 percent next year from 8.5 percent in 2009 (Bloomberg survey of 31 economists).31 “On a market-by-market basis, nine of the top 10 markets in terms of frequency of fast food restaurant visits hailed from Asia Pacific”.32 As well, the Asia Pacific region has the most take-away addicts in which “Hong Kong ranks the world’s No. 1 in terms of frequency of fast food restaurant visits with 61 percent visiting fast food shops at least once a week to as frequent as more than once a day”.33 Labour costs are also significantly lower in Asia with China’s minimum wage being lower than 32 African countries, which is almost the lowest in the world. “China’s average annual wage is less than 15 percent of the world average, ranking 158th in the world”.34 This significantly reduces operating costs and makes it easier to aggressively expand in this region. Diversification in Mature Markets KFC in mature markets has the opportunity to develop incremental sales layers in the form of breakfast, new beverages and expanded protein options (such as their grilled chicken and boneless fillets).35 In April of 2009, KFC launched their new grilled chicken product nationwide in the U.S. to help them maintain/gain market share in the very competitive American fast-food market.36 31 http://www.bloomberg.com/apps/news?pid=20601109&sid=aBYSp0.XfXZs AC Neilson Survey: http://www.bangkokcompanies.com/categories/thai_companies_p495.htm 33 AC Neilson Survey: http://www.bangkokcompanies.com/categories/thai_companies_p495.htm 34 http://www.theepochtimes.com/n2/content/view/30453/ 35 SEC Filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec 36 http://www.kfc.com/about/newsroom/041409.asp 32 KFC: Competitive Intelligence Report 2010 Expansion of Multibranding Yum’s pattern of pairing KFC with Pizza Hut and Taco Bell locations, though at the expense of single-store locations, represents an opportunity to shoulder operational costs such as rent. In addition, the presence of multiple, related restaurants in a single location may attract consumers because of the variety and presence they offer. Threats Emerging concerns over diet and health present a threat to the KFC brand in mature markets, especially. According to Yum, 75% of consumers eat less fried chicken due to health concerns. To this extent, KFC’s strong historical identification with fried chicken is something many consumers have trouble looking past.37 Another threat to KFC is represented by the fact Yum brand’s worldwide revenue declined 4% due to the negative impact from foreign currency translation and refranchising.38 To be sure, for a brand hedging its bets on international development, there is a certain amount of risk associated with foreign currency fluctuations and other external instability. The KFC brand must also contend with the threat represented by animal welfare activists and ecologists, most notably PETA. Boycotts by these groups and the costs required to satisfy their demands both present liabilities to the brand in terms of how it is perceived and operations.39 Emerging Competitors are a threat to KFC in mature markets. Chicken-Fil A, a chain in the US, grew by a record 4% in the US in 2009 and has yet to penetrate multiple states with high populations, leaving it plenty of room to continue to grow in the coming years.40 Avian Flu is another potential threat to KFC to the extent it might compromise their food source. KFC has recognized that the Avian Flu virus is an ongoing threat to its most critical supply and to its brand. KFC has responded with on-the-shelf defensive ads accordingly. KFC and Yum Brands have spent months making plans to respond quickly in case of bird flu outbreaks in its markets worldwide. Executives have discussed the topic with government officials and outside health experts. These pre-emptive measures show that KFC management takes the Avian Flu as a threat to their survival.41 37 KFC Investor Day: http://phx.corporateir.net/External.File?item=UGFyZW50SUQ9MzQ1NjY2fENoaWxkSUQ9MzMzMTMyfFR5cGU9MQ==&t=1 38 SEC Filings: http://investors.yum.com/phoenix.zhtml?c=117941&p=irol-sec 39 http://www.time.com/time/magazine/article/0,9171,543845,00.html#ixzz0gkqVBCRA 40 Locker, Sarah E. Article from Nations News Restaurant: “Analyst: Long-dominant KFC may be surpassed by Chic-Fil-A”, Dec. 7th, 2009 41 http://adage.com/article?article_id=47317 KFC: Competitive Intelligence Report 2010 Back in 2005 when there was a large scare of the Avian Flu, Larry Miller, restaurant analyst with Prudential Equity Group, said in a investors note that chicken demand is slipping 20% to 40% in parts of Europe and China on Avian Flu fears. In Guantang, Shanghai's largest poultry wholesale market, sales had dropped by as much as 80%.42 Financial Overview Past Share price for YUM brands has steadily grown over the past ten years, peaking at $40USD in January 2008 and dipping to around $28USD a year later. The current share price is around $34USD. While indicative of YUM’s financial strength, this share price does not reflect the growth or value of KFC specifically. Rather, KFC’s financial performance overtime can be determined on the basis of sales per unit. The below table demonstrates that sales per unit for KFC have only grown by 2%, compared to Pizza Hut and Taco Bell which have grown by 3% and 4%, respectively.43 Year End (thousands) KFC US 2008 2007 2006 2005 2004 % growth $967 $994 $977 $954 $896 2% The table below is the comparison of the KFC U.S, International, and China divisions overall sales growth over the last five years split between company and franchisees owned stores.44 In Billions 2008 2007 2006 2005 2004 5-year growth KFC U.S. Company $1.2 $1.4 $1.4 $1.4 (4%) Sales: $1.2 Franchisee $4.0 $3.9 $3.8 $3.6 2% Sales: $4.0 KFC Company $1.3 $1.1 $1.1 $1.0 9% International Sales: $1.4 Franchisee $6.7 $5.7 $5.2 $4.7 13% Sales: $7.6 KFC China Company $1.7 $1.3 $1.0 $0.9 28% Sales: $2.5 Franchisee $1.1 $0.8 $0.7 $0.6 18% Sales: $1.1 42 http://www.msnbc.msn.com/id/9971549/ http://www.yum.com/annualreport/docs/highlights08.pdf 44 http://www.yum.com/annualreport/docs/highlights08.pdf 43 KFC: Competitive Intelligence Report 2010 This table shows that KFC’s China division shows the most promise, while the International division is consistently improving. However, KFC needs to improve sales in the very saturated and competitive U.S fast-food market. Present Revenue for Yum brands has increased steadily quarter by quarter, reaching $10.9 Billion USD in the last quarter of 2009 with a net income of $1.06 Billion USD and a growth of 6.9% over the year prior. Annual sales per restaurant, a better indication of KFC’s performance specifically, are on average $1.3 Million USD.45 Both of these numbers are average compared to industry competitors. Financial Ratio Analysis Debt/Equity: Yum Brands: 3.28 McDonalds: 0.75 Industry: 2.0046 In terms of leverage, Yum Brands has a high debt/equity ratio which may indicate that Yum Brands has been aggressive in driving its growth through debt. Certainly, the high debt/equity ratio also speaks to the capital-intensive nature of KFC’s expansion activities and the extent to which they might be banking on this for the future. Gross Profit Margin: Yum Brands: 20.6% McDonalds: 44.0% Industry: 35.2% Yum's Gross Profit Margin is about half of McDonald's and roughly 2/3rds of the industry's during the fiscal year of 2009. This could be attributed to a high cost of sales. Although there has been a slight decrease in amount of US franchises from 2007 to 2008, YUM Brands has opened an average of 3000 new restaurants internationally from 2004 to 2008. This consequently has attributed to possible high fixed costs and a high cost of sales. This in turn equates to a lower gross profit margin than the industry average and may indicate than YUM Brands is more concerned with increasing market share than profitability.47 Note: McDonald's has opened 650 new restaurants in 2009 and plans to open 1000 new restaurants in 2010 therefore Yum's low Gross Profit Margin might be related to other variables.48 Return on Assets: 45 www.wikinvest.com/stock/Yum!_Brands_(YUM) All Financial Ratios in Report: http://finapps.forbes.com/finapps/jsp/finance/compinfo/Ratios?tkr=yum 47 http://www.yum.com/annualreport/docs/highlights08.pdf 48 http://online.wsj.com/article/SB123296471149515055.html 46 KFC: Competitive Intelligence Report 2010 Yum Brands: 15% McDonalds: 15.1% Industry: 12.5% Yum has a higher than average return on assets than the industry and is on par with McDonalds. This is somewhat contradictory to the gross profit margin analysis, however it is an indication that their investments into new restaurants are paying off. Their new assets are boosting revenues and as economies of scale kick in overtime, their gross profit margin will rise to the industry average. However, they will only realize sustained returns on assets if they increase their same store sales because healthy revenue increase cannot be sustained by new investments (increased liability/reduced liquidity), therefore they might look into multi-branding, menu expansion or breaking into new markets like the coffee business or healthy food business. An example of this competition is McDonalds competing aggressively with Tim Horton’s and Starbucks to gain a piece of the coffee market pie. Earnings per Share: Yum Brands: 2.22 McDonalds: 4.11 Although Yum Brands enjoys lower earnings per share than McDonalds, the picture is not totally grim because there has been a steady increase annually in their earnings per share. 49 This might be attributed to increased revenue from investments but limited shares available in the stock market. However, EPS may drop if they decide to raise money by offering more shares in the market place for expansion. Current Ratio: Yum Brands: 0.7 McDonalds: 1.1 Industry: 1.0 Yum Brands has a lower current ratio than McDonalds and the industry average. This is an indication than Yum Brands maybe experiencing a higher accounts payable than accounts receivable. Inventory Turnover: Yum Brands: 56.4 McDonalds: 117 Industry: 97.8 Yum Brands has a lower than average inventory turnover rates pointing to possible issues of poor sales forecasting and/or poor supply chain efficiency. This can increase overhead costs such as increased costs of freezing (energy) and larger store space for warehousing inventory. This maybe an indication that Yum Brands is growing faster than its human resources and operational capacities (logistics) can handle. 49 Standard and Poor’s Feb. 27, 2010 Yum Brands Financial Analysis KFC: Competitive Intelligence Report 2010 Quick Ratio: Yum Brands: 0.4 McDonalds: 1.0 Industry: 1.0 When inventory is taken out of the equation, Yum Brands experiences an even lower than industry average in terms of liquidity. Yum Brands has a liquidity problem, with a drastically lower than average inventory turnover, current ratio and quick ratio. Yum Brands may have operational issues or bad sales forecasting techniques and is therefore keeping more inventory in store than needed. This problem might explain why they have a lower gross profit margin than the industry. Low liquidity ratios also indicate that their ability to repay short-term obligations is not good. It’s possible that the low liquidity is also a result of the franchise model whereby the parent company may have trouble or a lag in extracting payments from independent franchisees. Yum Brands could possibly fix this problem with better distribution and just-in-time inventory systems put into place. Asset Turnover: Yum Brands: 1.14 McDonalds: 0.8 Industry: 1.1 Companies with low profit margins tend to have a high asset turnover and those with high profit margins tend to have a low asset turnover; it indicates pricing strategy. This ratio is more useful for growth companies to check if in fact they are growing revenue in proportion to sales.50 Yum Brands has a high asset turnover indicating that although its returns on assets are on par with the industry, it is not making enough profit for every dollar of assets. This again points to the fact that costs are too high while they face very stiff competitive pricing market Probable Outcomes and Predictable Crises If anything is certain it is that KFC’s parent company will continue to invest in the chain’s development in emerging markets. This thrust is reflected explicitly in their mission statement and financials and further makes sense in the context of the market in general. This expansion, of course, will involve significant costs on behalf of the parent company which may make them more vulnerable to systemic issues including supply and the payment of franchise license fees, etc... KFC will also be vulnerable whereby there is no guarantee that the money spent adapting their menu to the tastes of new markets, like India, will show returns. Another probability is the diversification of menus in North America. Here again, the desire to add new protein options is something explicitly stated in company filings. However, the brand will need to balance the poles of diet and value in determining its offerings and it is possible that here again the investments in new product development will not yield adequate returns. 50 http://www.investopedia.com/university/ratios/assetturnover.asp KFC: Competitive Intelligence Report 2010 There is a strong likelihood that new builds of KFCs will be increasingly multi-branded units. Certainly, the multi-branded unit provides cost savings as previously discussed. This convenience is reiterated by the increasing need for Yum to maintain ownership of concept locations and manage the expenditures they are incurring in their expansion effort. Though store sales per unit may increase as a result of multibranding, it is possible that KFC’s brand equity will lose its differentiation, thus opening the door further for new competitors in the chicken, fast food market. It is also probable that KFC will be increasingly concerned with ethical operations. Though they’ve begun to make moves in placating animal welfare activists and implementing strategies to meet ecological demands, such as solar walls51, these initiatives and the restructuring they require are expensive to the parent company and tiresome to the independent owner. Moreover, the brand will need to commit significant resources to achieving ethical practice standards in all their global locations. In the least, these efforts will be a distraction and in the most they may significantly drain resources. The inability to meet these standards internationally and the carrying costs of doing so are both discouraging to shareholders. Yum Brand’s financials indicate the intention of Yum to grow the KFC brand in emerging global markets. Specifically, the low growth in the US compared with the relatively stable net margins and the high debt/equity ratio reflect the sorts of expenditures that are required in new builds and franchising internationally, compared to mature markets. In addition, operational and supply chain efficiency (just-in-time) will probably need to be improved drastically (i.e. purchase and implement better B2B inventory management systems). Critical Success Factors In sum, the success of the KFC brand will depend on its ability to: 1) Develop brand equity in new markets and sustain a differentiated brand in existing markets 2) Develop and sustain healthy relationships with franchisees and other stake holders 3) Provide an infrastructure that is flexible enough to adapt to local markets under the umbrella brand 4) Ensure the integrity of supply and distribution networks in the face of international variances, environmental crises and intensifying ethical concerns. Approach to Research Planning and Direction: our team decided that we needed to determine what the critical success factors and predictable crises for KFC are relevant to its global position under Yum brands. 51 http://www.kfc.com/about/newsroom/012610.asp KFC: Competitive Intelligence Report 2010 Data Collection: each team member was charged with researching one aspect of the company or market including, company profile, external market/environment factors and supply logistics. Once we were collectively comfortable with the general issues that defined KFC’s business, we further honed our research to focus on Yum Brands mission statement objectives: To build their brands in China in every significant category Drive aggressive international expansion and build strong brands everywhere Dramatically improve US brand positions, consistency and returns Drive industry-leading, long term shareholder and franchisee value Analysis: each team member was responsible for providing analysis on the aspects they researched. Once this was done, the group meant to discuss these pieces of analysis and synthesize them based on their relevance to the goal identified in the planning phase. Dissemination: the final analysis was prepared as a hand written report as well and presented to the class orally.