External Environmental Analysis - Towson University

advertisement

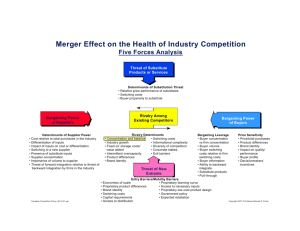

External Environmental Analysis 1 Lecture Topics • Purpose of External Environmental Analysis • Gathering Information for External Environmental Analysis • General Environment • Competitive Environment • Key Success Factors • Competitive Changes During Industry Evolution • Strategic Groups • National Competitive Advantage 2 Purpose of External Environmental Analysis • Organizations are affected by conditions in the environment • Managers need to be aware of these conditions in order to – Take advantage of opportunities that can lead to higher profits – Reduce the impact of threats that can harm the organization’s future 3 Gathering Information for External Environmental Analysis • Managers need information in order to know and develop an understanding about what is happening in the external environment • Three approaches to information gathering: – Scanning: general surveillance of environmental changes; looking for early signals of changes – Monitoring: close attention to specific developments that could affect the organization – Competitive Intelligence: following actions of competitors 4 Two Areas for Analysis • General Environment • Competitive Environment 5 The General and Competitive Environment General Environment Demographics Competitive Global Political/Legal Environment Threat on new entrants Bargaining power of suppliers Bargaining power of buyers Threat of substitute products Sociocultural Competitive rivalry Technological Macoreconomic 6 General Environment Demographics • Characteristics of a country’s population – Size of population and growth rate – Age distribution of population – Education levels – Income distribution – Ethnic diversity – Geographic distribution 7 General Environment Political/Legal • Political and legal conditions affecting business – Government policies toward business – Investment incentives – Business regulation: labor, environment – Education priorities – Budget conditions and plans 8 General Environment Technological • Technological developments relevant to a business – Telecommunications – Internet – On-line training – Product and process innovations 9 General Environment Macroeconomic • Impact of the economy on business – Size and change in gross domestic product – Per capita income levels – Inflation rate – Interest rates – Foreign trade deficit or surplus – Unemployment – Rates of saving and investment 10 General Environment Sociocultural • Influence of values, beliefs, and lifestyles of a country on business – Family relationships – Attitudes about work – Living arrangements – Styles of entertainment – Attitudes toward health 11 General Environment Global • International developments that can impact a business – Rise of China as economic power – Rising global trade and WTO – Intellectual property protection – Important political events: Iraq war – Search for low cost suppliers 12 Competitive Environment • The essence of strategy formulation is coping with competition. • The corporate strategists’ goal is to find a position in the industry where his or her company can best defend itself against these forces or can influence them in its favor. • Managers must understand the conditions of competition within their industry – Porter Five-Forces Model of Competition (determining the attractiveness of an industry) – Key Success Factors – Competitive Changes During industry Evolution – Strategic Groups – National Competitive Advantage 13 Defining an Industry • Industry – A group of companies offering products or services that are close substitutes for each other • Competitors – Rival companies that serve the same basic customer needs 14 Defining an Industry (cont’d) • Sector – A group of closely related industries • Market segments – Distinct groups of customers within a market that can be differentiated from each other based on their distinct attributes and demands • Changing industry boundaries 15 The Computer Sector: Industries and Segments 16 Five Forces Driving Industry Competition 17 Threat of New Entrants • Fundamental question: how easy is it for another company to enter the industry? • Factors making easy entry to industry – – – – – – Low economies of scale Low product differentiation Low capital requirements No switching costs for buyer Easy access to distribution channels Little government regulation 18 Supplier Power • Fundamental question: how badly does a supplier need your business? • Factors giving power to supplier: – Supplier industry dominated by few firms – Buyer is not important to customer – Supplier’s product is important input to buyer’s product – Supplier’s products have high switching costs – Supplier can “integrate forward” and become competitor of buyer 19 Threat of Substitutes • Fundamental question: what other products or services could perform the same function as your products or services? • Factors indicating high threat of substitutes: – Few switching costs for buyer – Price of substitute lower or quality higher than for your products – Firms offering substitutes have high profitability 20 Buyer Power • Fundamental questions: How badly does a buyer need your products or services? • Factors contributing to high buyer power: – – – – – – Few buyers compared to the number of sellers Buyers purchases high relative to seller’s sales Products are undifferentiated Buyer has low switching costs Buyer has low profits Buyer can “integrate backward” and supply the product to itself 21 Competitive Rivalry • Fundamental question: how intense is competition in the industry? • Factors leading to high competitive rivalry: – – – – – – Numerous or equally balanced competitors High fixed costs Slow industry growth Lack of differentiation or switching costs High strategic stakes High exit barriers 22 A Sixth Force: Complementors • Not a supplier • Offers service or product that affects industry’s performance • When complementors are important and their number is increasing – Demand and profits in the industry are boosted • When complementors are weak – Industry growth can slow and profits can be limited • Example: Internet Service Providers “complementors” to eBusiness firms 23 Strategic Implications of the Five Competitive Forces • Competitive environment is unattractive from the standpoint of earning good profits when: – Rivalry is strong – Entry barriers are low and entry is likely – Competition from substitutes is strong – Suppliers and customers have considerable bargaining power 24 Strategic Implications of the Five Competitive Forces • Competitive environment is ideal from a profit-making standpoint when: – Rivalry is moderate – Entry barriers are high and no firm is likely to enter – Good substitutes do not exist – Suppliers and customers are in a weak bargaining position 25 Key Success Factors • In many industries, there are certain actions or practices that a business must follow in order to compete in the industry. • May need effort to distinguish company from competitors • AN INDIVIDUAL COMPANY DOES NOT HAVE KEY SUCCESS FACTORS!!!! • KEY SUCCESS FACTORS ARE NOT THE SOURCE OF A COMPANY’S COMPETITIVE ADVANTAGE – THEY ARE REQUIREMENTS FOR COMPETING IN AN INDUSTRY AND DO NOT GIVE ANY FIRM A COMPETITIVE ADVANTAGE 26 Examples of Key Success Factors in Selected Industries • Pharmaceuticals: research and personal selling • Beer: advertising and distribution • Restaurant: quality food, service, location, notoriety • Retailer: location and priced-for-quality 27 Changes in Competition During Industry’s Evolution • Over time as an industry evolves, the nature and basis of competition changes • Managers must anticipate how the forces will change as the industry evolves and formulate appropriate strategies • Five Stages ( similar to product-life cycle) – – – – – Embryonic—introduction of product Growth Shakeout Mature Declining 28 Stages in the Industry Life Cycle 29 Shakeout: Growth in Demand and Capacity 30 Requirements in Each Stage of Industry’s Evolution • Embryonic: Know-how, educating customers, opening distribution channels • Growth: Know-how for continued innovation, financing, build demand • Shakeout: Dominant market position, low cost producer, high capacity • Maturity: low cost production, brand loyalty • Declining: lowest cost production, reduce capacity 31 Limitations of Models for Industry Analysis • Life cycle issues – The embryonic stage can sometimes be skipped – Industry growth can be revitalized – The time span of the stages can vary • Innovation and change – Innovation can unfreeze and reshape industry structure – An industry may be hypercompetitive, with permanent and ongoing change 32 Limitations of Models for Industry Analysis (cont’d) • Company differences – The importance of company differences within an industry or strategic group can be underemphasized – The individual resources and capabilities of a company may be more important in determining profitability than the industry or strategic group 33 Strategic Groups • Companies do not compete against all companies in an industry • Companies compete against several other companies that follow similar strategies • A strategic group consists of those rivals with similar competitive approaches in an industry • Examples ways of competing: – – – – Price Innovation Research Quality -- Range of products -- Customers served 34 Procedure for Constructing a Strategic Group Map STEP 1: Identify competitive characteristics that differentiate firms in an industry from one another STEP 2: Plot firms on a two-variable map using pairs of these differentiating characteristics STEP 3: Assign firms that fall in about the same strategy space to same strategic group STEP 4: Draw circles around each group, making circles proportional to size of group’s respective share of total industry sales 35 Types of Video Game Suppliers/Distribution Channels Example: Strategic Group Map of the Video Game Industry Arcades Arcade operators Publishers of games on CD-ROMs Home PCs Sony, Sega, Nintendo, several others Video game consoles MSN Gaming Zone, Pogo.com, America Online, HEAT, Engage, Oceanline, TEN Online/Internet Low (Coin-operated equipment) Medium (Console players cost $100-$300) High (Use PC) Overall Cost to Players of Video Games 36 Nation-State and Competitive Advantage • A country may provide a competitive advantage for a company • Need to identify national factors in order to determine – Where most significant competitors will come from – Where to locate production activities • Porter’s Diamond of Determinants of National Competitive Advantage 37 The Global and National Environments • Globalization of production and markets – Lower barriers to cross-border trade and investment – National differences in the cost and quality of factors of production – “Home” and “foreign” markets and competitors are blurring – Intensified rivalry – Intensified rate of innovation – Many new markets are open 38 Determinants of National Competitive Advantage Strategy, Structure, Rivalry Factor Endowments National Competitive Advantage Demand Conditions Related and Supporting Industries 39 Factor Endowments • Availability of traditional factors of production—land, labor, capital, entrepreneurship—provide cost advantages to companies located in countries possessing those factors • More significant, countries and their companies can create new factors such as a knowledgeable workforce and infrastructure that is rare and difficult to imitate • Factor endowments less important than the speed and efficiency of deploying those resources. 40 Demand Conditions • Large growing markets provide foundation for global competition • More significant, sophisticated and demanding consumers force companies to innovate and improve their products • Advances in products, services, and standards improve companies’ knowledge and capabilities for selling in other world markets 41 Related and Supporting Industries • Provide inputs and capabilities that help a company to improve its own products and capabilities • Helps reduce manufacturing costs through cost-effective, timely methods • Ongoing exchange of knowledge through research and development and joint projects improves both suppliers and companies 42 Strategy, Structures, and Rivalry • Different management ideologies lead to different emphases within a company • Japan and Germany both have engineers in top management and those country’s companies concentrate on process and product improvement • Intense domestic rivalry leads to product improvements and cost reduction in order to compete for domestic customers 43 Conclusions About Determinants of National Competitive Advantage • Firms succeeding in global markets first succeeded in intense competition in home countries • Competitive advantage for global firms comes from continuous improvement, innovation, and change. 44