Final Exam Review Packet

advertisement

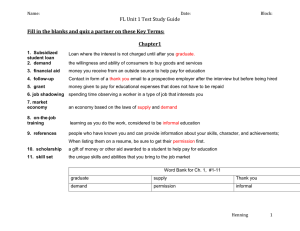

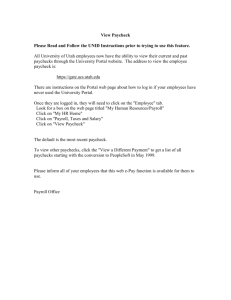

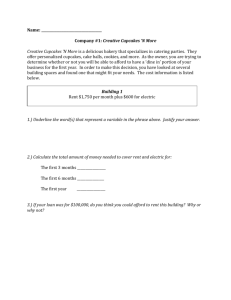

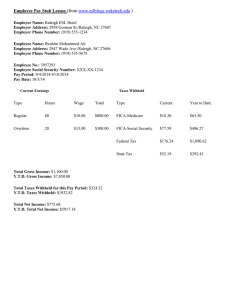

Personal Finance Name: ________________________________________ Pd: _______ Date: ___________________________ FINAL EXAM REVIEW #1 THE BULK OF IT (Find the chapter references in the left margin to help you answer each). CH. # 1. Financial goals are S.M.A.R.T. 2. Define short-term, intermediate, and long-term goals. 1 3. Define opportunity cost. 4. There are three important economic conditions: Consumer prices, consumer spending, interest rates. 5. Define inflation. 3 6. What is the economic indicator that measures price change? 7. What is the economic indicator that represents the monetary value of all goods and services produced in the US? 1 8. What is the central banking organization in the US? Who is the current chairperson? 9. If the economy is in a slowdown (recession) what action will be taken with interest rates? 10. If inflation is rapidly rising in an “overheated” economy, what action would the Federal Reserve most likely take concerning interest rates? 12 11. List at least three deductions that are required to be taken out of your paycheck. 12. What is the Net Worth formula? 13. What items do you find on a balance sheet? 14. Real estate assets on a balance sheet should be recorded at what value? 3 15. Define liquid asset. 16. What are the major income and expense sheet classifications? 17. Define insolvency. (i.e. when does it occur?) 18. List a couple examples of fixed expenses and variable expenses. Personal Finance Name: ________________________________________ Pd: _______ Date: ___________________________ 8 19. How long should your emergency fund last you? 20. What does FDIC stand for and for how much does it insure a bank account? 21. List the benefits of joining a credit union. 5 22. What kind of account is “locked in” at a fixed rate? 23. Define an outstanding check. 24. List a retail credit card. 25. List a major credit card. 26. Name the three major credit reporting agencies. 6 27. Where do the credit reporting bureaus obtain information? 28. The quality of one’s credit rating is maintained how? 29. Why should an individual be concerned with keeping a high credit score? 30. Which act limits a cardholder’s liability for lost or stolen credit cards to $50 per card? 3 9 31. According to the Debt Safety Ratio, your monthly credit payments should not exceed ______ % of your take home pay? 32. What kind of market has a high consumer confidence with economic growth? What market has a low consumer confidence with economic slowdown? 33. Name three major stock exchanges. 5 34. What is the formula for the rule of 72 and what does it indicate? 35. What could someone do to reduce the risk of peril to his/her home? 36. What discounts are available to drivers relative to their car insurance? 13 37. Define liability in regards to homeowner and/or car insurance. 38. Define negligence in regards to homeowners insurance. 12 39. What tax form tells an employer how much to withhold from your paycheck for tax purposes? Personal Finance Name: ________________________________________ Pd: _______ Date: ___________________________ 40. What tax form do you get from your employer before January 31st that defines your wages and the amount of federal income tax that was withheld that year? 41. There are different types of taxes in four major categories. What are the four categories? 12 42. What Department of Treasury agency is responsible for collecting taxes and enforcing the nation’s tax laws? 43. What is the federal income tax filing deadline and what must you make sure to do if you cannot meet the deadline? 44. What does it mean to pay yourself first? 8 45. What is the difference between a down payment and a security deposit? 7 46. What is the difference between paying rent and paying a mortgage? 47. What is the difference between a title, deed, and lease? 48. What is a tax audit? 12 THE FINANCIAL MATH Ch. 3 49. Debt Ratio 55. Compound Interest 50. Liquidity Ratio 56. Simple Interest Ch. 5 Pg.72 51. Debt-Payments Ratio 52. Savings Ratio Ch. 6 53. Debt-Payments – to – Income Ratio Pg. 163 Ch. 7 54. Housing Payment Ratio 57. Rule of 72 58. Balancing a checkbook / bank reconciliation