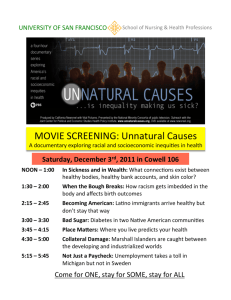

Unemployment

advertisement

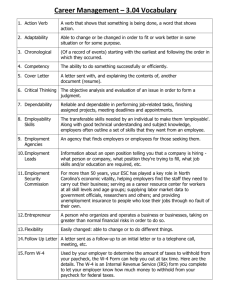

Objective 4.01 Students will be able to understand types of work compensation and forms used for work and income tax purposes. http://www.themint.org/kids/decoding-your-paycheck.html What are the ways in which an employee can be paid? What should employees know about employment and income tax forms? Types of monetary compensation---wages, salary, commissions, tips, bonuses Wages---an amount of money paid for a specified quantity of labor Minimum wage---the lowest wage employers may legally pay workers (set by the Fair Labor Standards Act) Types of wages---full-time, part-time, flexible/seasonal, and overtime Salary---a set amount of income paid for a set period of time worked Commission---income paid as a percentage of sales made by a salesperson Tips---also known as gratuities-monies paid by customers to those who provide services Performance Bonus---money in addition to base pay, either as reward for performance or as share of profit Production – money earned for a volume of product created, more product made = more gross earnings Federal law that first established Minimum wage Maximum hours, Overtime requirements Child labor laws # of hours, time limits Type of work Research: When was FLSA enacted? What is current minimum wage? What are limitations on legal jobs for a 16 year old? Type of jobs Hours 16 year olds can work Non-monetary compensation-employee does not get $ in paycheck, but employer pays for all or part of these benefits-also known as fringe benefits, or perks Benefits are not required by law, but are offered at the option of employers Individual employees may negotiate with their employer for a “benefits package”, especially in management situations Employees who are union members negotiate for their benefits Types of non monetary compensation Paid vacation, holidays and sick leave Insurance- group health, dental, life, vision Cost may be fully or partially paid by employer Savings/retirement plans if employer pays portion Education-related benefits---tuition, credits, job training Family -related benefits---child care, maternity leave, adoption leave/support, family leave Unemployment Tax- required by law to be paid at state & federal levels by employer Social Security - FICA requires employers to match every dollar contributed by employee to Social Security When making an employment offer/acceptance, benefits are a critical element. Employers offer the best compensation package available to recruit and keep high quality employees. Paycheck Direct deposit Payroll card Paycheck – Traditional paper document Issued to an employee for services rendered Most common method of payment for work Employer physically provides the employee with his/her paycheck Employee takes check to financial institution Monetary deductions subtracted for Mandatory systematic Federal/state income taxes Employer sponsored retirement Court ordered garnishment of wages Voluntary deductions Insurance Investments Loan repayments Pension contributions and other benefits Paycheck stub Attached to the paycheck to show the deductions Retained (kept)by employee for financial records Contents of paycheck stub gross pay, net pay, hourly wage, hours worked, state/federal withholdings, Social Security tax, employee’s name, Social Security number, total earned and withheld, year to date, last day of pay period When employers directly deposit an employee’s paycheck into an authorized account On payday, Employee receives a paycheck electronic notice showing deductions Direct deposit evidence cannot be cashed at bank More secure because there is no direct handling of the check & the employee knows exactly which day paycheck will be deposited and available for use DEFINITION: prepaid card offers employees an alternative to paper paychecks or directly depositing wages into an employee’s financial institution account BENEFITS TO EMPLOYEES Reduces or eliminates check cashing fees Offers ability to make purchases using credit card networks Offers 24-hour access to funds via ATMs; no need to wait in lines Reduces the need to carry a lot of cash Makes money transfers more easily available to families Provides a pseudo-bank account—funds do not need to be withdrawn entirely as when using a check casher Benefits to employers Reduces bank processing and check handling fees Reduces check printing costs Reduces likelihood of check fraud Reduces check reconciliation costs Increases employee productivity (no time off to cash or deposit paycheck) Reduces lost/stolen check replacement costs Income taxes are: Taxes paid on earnings Mandatory deductions from earnings Estimates of taxes owed Known as progressive taxes; the higher the income earned, the higher the % rate of taxes In contrast, sales taxes are regressive taxes; they impose same rate to all sales of goods; therefore; higher taxes (in comparison to earnings) are paid by those with lower incomes than those with higher. Used before beginning a job W-4 – the Employee’s Withholding Allowance Certificate; information provided here determines the percentage of gross pay to be withheld for taxes I-9 – the Employment Eligibility Verification form; information gathered in this form is for employers to verify eligibility of individuals for employment; helps avoid hiring undocumented workers or others who are not eligible to work in the United States Social Security card or other identification irs link: W-4 simulation Complete simulation 1 Completed by employee for employer payroll records Provides information for tax deductions Marital status Exemption status SIMILAR FORM - NC-4 FOR TAX WITHHOLDING FOR NORTH CAROLINA RESIDENTS irs link: calculate payroll taxes http://www.irs.gov/app/understandingTaxes/student/simulations.jsp Complete Module 1: W-4 Identity document Required use for Federal Income Taxes I-9 proves your right to work in US if you are not a citizen. Employment Identification and Verification Form Employers must complete and retain a Form I-9 for each individual they hire for employment for 3 years from date hired The form must be available for inspection by authorized U.S. Government officials (e.g., Department of Homeland Security, Department of Labor, Department of Justice). On the form, the employer must examine the employment eligibility and identity document(s) an employee presents to determine whether the document(s) reasonably appear to be genuine Used after end of year when filing income taxes W-2 - states amount of money earned and taxes paid through previous year Issued by employer to employee by January 31 of following year Form 1040/1040A/1040EZ - common forms for filing federal income tax return 1099 Forms - Tax forms that report other sources of income earned during a tax year. 1099-INT for interest income, 1099-DIV for dividends on investments, and 1099-MISC for other sources of income such as contract labor Reports actual income and deductions for the tax year Taxpayer must file by April 15th of the following year Actual due compared to estimated payments Results in either refund or additional payment to IRS SAMPLE 1099 FORM Reports income not related to employment Examples: 1099-DIV Dividends 1099- INT Interest income 1099-MISC Contract labor Distribution of pensions Miscellaneous income http://www.irs.gov/app/understandingTaxes/student/simulations.jsp Complete Module 2 & 3: W-2, Form 1099-Int, 1040EZ Complete Module 7: Standard Deduction Employees must retain appropriate records: Records of deductible expenses, including receipts and bank statements Social Security number serves two major purposes: (1) provides a record of your covered earnings for retirement and disability benefits and (2) serves as an identification number for the Internal Revenue Service Unwrap and slice the Payday candy bar. Read the ingredients list on the label. Note: Just as each candy slice contains some of each ingredient, so each paycheck contains specific kinds of information. Have students scan FEFE 1.13.1.F1 information sheet “Understanding Your Paycheck” and complete the graphic organizers Appendix 4.01A, “Forms of Compensation,” Appendix 4.01B, “Money In, Money Out,” and Appendix 4.01C, “Employment, Wage and Tax Forms” Have students complete the note-taking guide, FEFE 1.13.1. L1, “Understanding Your Paycheck and Tax Forms” as they view FEFE PowerPoint “Understanding your Paycheck.” Answer questions; discuss. (In advance, download a blank Form W-4 and Form I-9 from www.irs.gov). Stop at slides 12 and 13 and guide students as they complete Form W-4 and Form I-9. " W-4, work some more" “W-2 your taxes are due". 1040EZ as in "easy" and I-9-like the interstate- you travel from place to place and sometimes you travel across the border and you need to prove your citizenship, i.e. Canada, Mexico. Map your financial future Money doubles by the “Rule of 72” Your credit past is your credit future Start saving young Stay insured Budget your money Don’t borrow what you can’t repay Don’t expect something for nothing High returns equal high risks Know your takehome pay Compare interest rates Pay yourself first http://www.jumpstartcoalition.org/files2010/2010_J$_Calendar.pdf