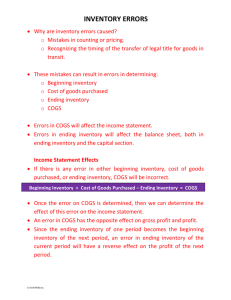

Chapter 8 Inventory Errors

advertisement

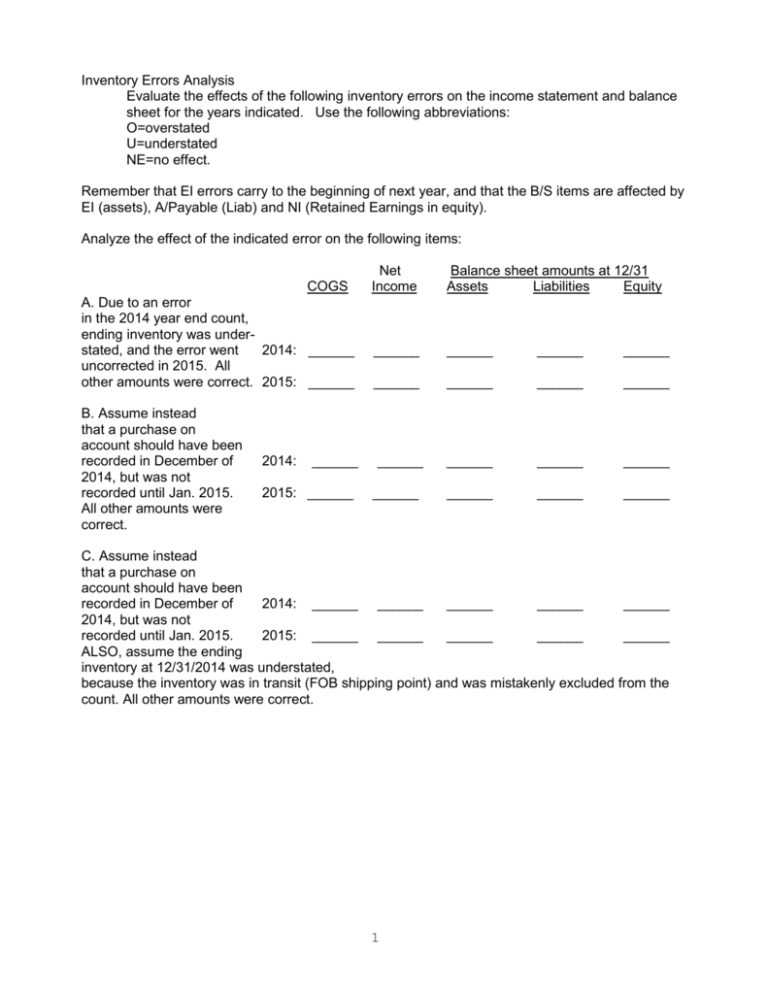

Inventory Errors Analysis Evaluate the effects of the following inventory errors on the income statement and balance sheet for the years indicated. Use the following abbreviations: O=overstated U=understated NE=no effect. Remember that EI errors carry to the beginning of next year, and that the B/S items are affected by EI (assets), A/Payable (Liab) and NI (Retained Earnings in equity). Analyze the effect of the indicated error on the following items: COGS A. Due to an error in the 2014 year end count, ending inventory was understated, and the error went 2014: ______ uncorrected in 2015. All other amounts were correct. 2015: ______ B. Assume instead that a purchase on account should have been recorded in December of 2014, but was not recorded until Jan. 2015. All other amounts were correct. 2014: ______ 2015: ______ Net Income Balance sheet amounts at 12/31 Assets Liabilities Equity ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ ______ C. Assume instead that a purchase on account should have been recorded in December of 2014: ______ ______ ______ ______ ______ 2014, but was not recorded until Jan. 2015. 2015: ______ ______ ______ ______ ______ ALSO, assume the ending inventory at 12/31/2014 was understated, because the inventory was in transit (FOB shipping point) and was mistakenly excluded from the count. All other amounts were correct. 1 Solution, including the analysis of the components of the COGS equation. Part A: EI understated in 2014. BI + Purch - EI = COGS 2014 U O 2015 U U NI U O Assets = Liab. U NE NE NE + SE U NE Part B: Purchase not recorded until 2015. BI + Purch - EI = COGS 2014 U U 2015 O O NI O U Assets = Liab. NE U NE NE + SE O NE Part C: Purchase not recorded until 2015 AND EI understated at end of 2014. BI + Purch - EI = COGS NI Assets = Liab. + SE 2014 U U NE NE U U NE 2015 U O NE NE NE NE NE 2