Inventory Errors on the Income Statement and the Balance Sheet.

advertisement

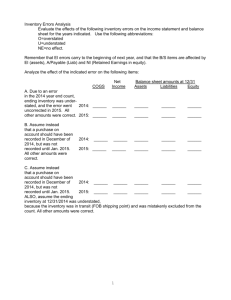

INVENTORY ERRORS Why are inventory errors caused? o Mistakes in counting or pricing. o Recognizing the timing of the transfer of legal title for goods in transit. These mistakes can result in errors in determining: o Beginning inventory o Cost of goods purchased o Ending inventory o COGS Errors in COGS will affect the income statement. Errors in ending inventory will affect the balance sheet, both in ending inventory and the capital section. Income Statement Effects If there is any error in either beginning inventory, cost of goods purchased, or ending inventory, COGS will be incorrect. Beginning Inventory + Cost of Goods Purchased – Ending Inventory = COGS Once the error on COGS is determined, then we can determine the effect of this error on the income statement. An error in COGS has the opposite effect on gross profit and profit. Since the ending inventory of one period becomes the beginning inventory of the next period, an error in ending inventory of the current period will have a reverse effect on the profit of the next period. D:\533578180.doc 2 Balance Sheet Effects Assets = Liabilities + Owner’s Equity Nature of Error nderstate Ending Inventory Overstate Ending Inventory D:\533578180.doc Assets = Liabilities + Owner’s Equity Understate No Effect Understate Overstate No Effect Overstate