FIL 404 - Special projects

advertisement

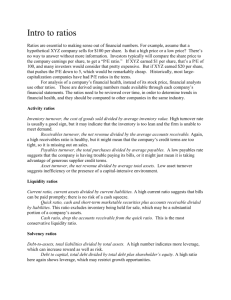

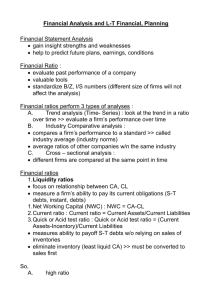

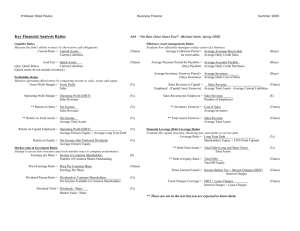

Topic 3: Analyzing Financial Statements (Copyright © 2015 Joseph W. Trefzger) In this chapter we analyze the relative strength of a company’s financial situation by computing ratios based on the Balance Sheet and Income Statement. Among parties that would utilize a ratio-based analysis of a company are the company’s managers, current or potential lenders (including parties that sell goods/services on credit), current or potential owners (stockholders), and professional “Wall Street” investment analysts who also advise lenders and owners. I. Ratio Analysis While the values shown on the balance sheet and income statement are useful (though not perfect representations of the economic values that should guide our decisions) in absolute terms, they are not always useful in relative terms – for making comparisons across companies, or across time periods. For example, if Company A had $100,000 in net income last year and Company B had only $95,000, can we conclude that A is the better managed company? No; consider a case in which A is a much larger company than B, but earned only a slightly higher income. We address this type problem by creating relative measures of performance. One such measure is the common sized balance sheet or income statement, in which we present percentages rather than dollar figures. [Each balance sheet account is stated as a percentage of total assets; each income statement account is presented as a percentage of total sales. Thus a company can be compared directly with a competitor that is larger or smaller, in terms of sales or assets.] An examination of the percentages from a common sized balance sheet or income statement is sometimes called vertical analysis, whereas a comparison of similar financial measures from different years would be called horizontal analysis. Another relative measure of performance is the ratio: a comparison of two values from a company’s most recent balance sheet, or from its most recent income statement, or one figure each from the most recent balance sheet and income statement. Of course, we could compute an almost endless number of ratios (especially if we kept breaking the balance sheet and income statement into more and more detailed categories). But a group of 10 - 15 carefully selected ratios can give us many helpful insights into a company’s financial strengths and weaknesses. These ratios can be classified into four groups: liquidity (short term solvency) ratios, asset management ratios, debt management (long term solvency) ratios, and profitability ratios. With ratios we can compare a company’s performance with that of a competing company that may be larger or smaller, or with its own performance in earlier years when it might have been larger or smaller. More commonly, we might compare the company’s ratios with average ratios for its industry (group of companies in the same line of business), or a peer group or aspirant group within that industry. Industry average figures are computed by organizations like Dun & Bradstreet and the Risk Management Association. [A serious professional analyst would typically follow the activities of only the few firms that constitute a particular industry.] There are specialized ratios that are useful in analyzing some industries, but that analysts of other types of companies would not typically look at (example: sales/square foot of floor area is useful in analyzing retailers; not useful in analyzing manufacturers or airlines or broadcasters). Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 1 The ratios presented below address general questions that tend to be of interest to analysts across a wide range of industries. The dollar values shown are taken from the sample balance sheet and income statement shown in our Topic 2 outline. A. Liquidity (short term solvency) ratios: indicate whether the company appears able to pay the money it owes in the short run (during the next year), based on the most recent balance sheet “snapshot” figures. Current Assets $745 Current Ratio = = 1.713 . Current Liabilitie s $435 Quick Ratio = Current Assets Other than Inventory $745 $385 = .827 . Current Liabilitie s $435 One interpretation of these ratios is whether the company could use its short-term assets to pay off its short-term liabilities, if it were unable to pay these amounts from its operating revenues (i.e., if the company ceased operations today). A less extreme interpretation is to think of the most recent balance sheet snapshot’s current asset and liability figures as representative of the company’s ongoing situation. A potential short-term lender would look carefully at one or both of these liquidity ratios before extending additional short-term credit. Such a party would like to see that the company’s current (or quick) ratio is no lower than the average current (or quick) ratio for similar firms. The quick ratio (sometimes called the acid test ratio) is a more conservative measure than the current ratio, in that it removes the least liquid of the current assets – inventory – from the numerator. (Cash, marketable securities, and accounts receivable are already in dollar terms, but inventory must first be sold to a customer – not always easy to do.) Which is the better measure? Recall that you are trying to measure the company’s ability to use its current assets in meeting its current liabilities. If inventory is readily salable, then it should be included in a liquidity measure (use the current ratio). If inventory is difficult to sell quickly, then a measure of the company’s liquidity probably should not include inventory as a relevant current asset (use the quick ratio). [Even more conservative is the cash ratio, (Cash + Marketable Securities)/Current Liabilities.] An old rule of thumb stated that the current ratio should always be at least 2.0, while the quick ratio should always be at least 1.0. But this rule is such an over-generalization as to be largely meaningless. The appropriate level depends on the predictability of cash flows for the type of firm being analyzed, and on the kinds of short-term assets and liabilities it holds – a question that can be answered only in the context of a comparison with similar firms, or an industry average. B. Asset Management Ratios: indicate whether the company is using specified assets efficiently in generating sales. After all, why tie money up in assets that would not, at least indirectly, help the company sell a greater amount of goods or services? We typically consider asset utilization through a series of turnover ratios, which tell us how much money had to be tied up in various asset categories for the firm to support its most recent annual sales level. The three most commonly computed turnover ratios are: Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 2 Inventory Turnover = Fixed Asset Turnover = Sales $710 = 1.844 . Inventory $385 Sales $710 = .645 . Net Fixed Assets $1,100 Total Asset Turnover = Sales $710 = .385 Total Assets $1,845 (its reciprocal, the capital intensity ratio, shows how much money had to be invested in assets to generate $1 in sales). Just about any analyst – a potential owner, or a potential long term or short term lender – would like to see the various turnover ratios higher than the industry average figures. The efficient use of assets – doing more with less – is a key to financial success. Note the way that each of these ratios is structured: by remembering sales ÷ ____ , you can quickly compute any designated turnover ratio. Even accounts receivable usage is sometimes examined through a receivable turnover: Receivable Turnover = Sales $710 = 2.290 , Accounts Re ceivable $310 though analysts sometimes look at a slightly different ratio called days’ sales in receivables (also known as the average collection period). From one viewpoint, days’ sales in receivables is just a computationally more complicated ratio that tells us the same thing as the receivable turnover, because it is based on the same information. But an advantage of days’ sales in receivables is that it has meaning even without an industry average or other comparison figure, because its value equals (or at least approximates) the number of days it takes the firm to collect when it sells goods or services on credit: Days’ Sales in Receivables = Accounts Re ceivable $310 = 159.37 . Average Sales per Day $710 / 365 Therefore, if customers are supposed to pay in full by day 60, the firm is facing a serious problem in collecting its bills. (Viewed slightly differently, we can take 365 ÷ days’ sales in receivables to get the receivable turnover, or 365 ÷ receivable turnover to get days’ sales in receivables. After all, receivables that get collected every 36 days [days’ sales in receivables] are getting “turned over” about 10 times each year [receivable turnover].) Similarly, 365 ÷ inventory turnover gives us days’ sales in inventory, a measure of the time it takes for inventory to be sold. Some textbooks or other sources show average daily sales as total annual sales divided by 360; this approximation for the number of days in a year (used traditionally in finance because it was easier to use a round number before calculators were commonplace) would be appropriate if the comparison ratios you got from a published source were based on a 360-day-year assumption, and you wanted to be consistent in making “apples-to-apples” comparisons. Note also that days’ sales in receivables would be more logically correct if it were based on credit sales rather than total sales, but finding credit sales for competing firms (to have meaningful comparison figures) Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 3 is hard to do, so analysts typically just assume that the computed ratio and published comparison figures are all a little wrong, in the same direction. My preference is to use a receivable turnover, and to interpret it as the level of receivables needed to support the most recent year’s sales. There are other areas where analysts’ judgment or preferences come into play. Inventory turnover is sometimes computed not as sales ÷ inventory, but as cost of goods sold ÷ inventory. The latter ratio actually answers a slightly different question than does the former. Cost of goods sold ÷ inventory answers “how many times did the inventory physically turn over (get replaced in full) during the most recent year?” Sales ÷ inventory attempts to answer “how much inventory had to be kept on hand at any given time to support the level of sales experienced in the most recent year?” Either question seems equally valuable in providing insights into inventory usage, so we might prefer to use sales ÷ inventory to be consistent with our other turnover measures. But be sure that the ratio you use as a comparison figure (an industry average, for example) is computed in the same manner as is the ratio for the company you are analyzing. C. Debt Management (long term solvency) ratios: indicate whether the company is obtaining too much of its long-term financing from lenders (rather than owners), who can sue the company and force it to go out of business if they are not repaid in a timely manner. (Debt management ratios sometimes are also called “gearing” ratios.) First, consider: Times Interest Earned Ratio = EBIT $200 = 10. Interest $20 Times interest earned (also known as the Interest Coverage ratio) helps the analyst to see whether the money left after workers, material suppliers, etc. have been paid tends to be sufficient to allow the one remaining required payment – interest – to be made. (Income tax is owed only if the company has positive income, and the company’s owners are not legally entitled to any particular payment – they simply receive what is left after all others are paid.) A related ratio sometimes shown in textbooks is Cash Coverage, whose EBIT + Depreciation numerator is a better measure of the firm’s cash position than is EBIT alone. An even more complete measure is Fixed Charge Coverage, in which we determine whether there are sufficient revenues to cover all fixed charges: interest, lease payments, and principal due on long-term loans. The idea – and it is a good one – is that a company is in just as much trouble if it can not pay for assets it leases as it is if it can not pay interest on money it has borrowed to buy assets; either way the assets are repossessed and the firm can not produce anything. But because of this ratio’s complexity, and our desire to commit our working list of ratios to memory instead of having formula sheets, we will address the general idea with the times interest earned ratio. The next three ratios all address the same question: how much of the company’s total asset base was paid for by lenders (rather than by owners): Debt Ratio = Trefzger/FIL 240 & 404 Total Liabilitie s $435 $225 $660 = .358 . Total Assets $1,845 $1,845 Topic 3 Outline: Analyzing Financial Statements 4 Debt to Equity Ratio = Total Liabilitie s $435 $225 $660 = .557 . Equity $1,185 $1,185 Equity Multiplier = Total Assets $1,845 = 1.557 . Equity $1,185 (By “equity” in the above ratios we mean total stockholders’ equity: Common Stock at Par + Paid-in-Capital in Excess of Par + Retained Earnings. Preferred stock, if a firm has issued any, is in many ways a form of debt; it is not included in our equity measure here.) Why do we consider three separate ratios that all tell us the same thing (and all of which can be computed if we know any of the three)? Part of the answer is simply personal preference: some analysts prefer the Debt Ratio, which provides an absolute measure of debt usage (debt as a proportion of total financing), whereas others prefer the Debt to Equity Ratio, which provides a relative measure of debt usage (debt relative to equity). The Equity Multiplier is a transformation of Debt to Equity that is useful in the DuPont analysis, which we will see later. Because Debt + Equity = Total Assets, it must be true that Equity Total Assets Debt , or Equity Equity Equity Debt Total Assets 1 . Equity Equity Therefore, if we know the Debt to Equity Ratio, we need simply add 1.0 to find the Equity Multiplier (our Equity Multiplier here, 1.557, is simply 1 + the Debt to Equity ratio of .557). Or consider that if the Debt Ratio (liabilities ÷ assets) is .358, then equity ÷ assets must be .642 (such that .358 + .642 = 1.00, since 100% of the financing must come from debt and equity together), so the Equity Multiplier (assets ÷ equity) must be 1 ÷ .642 = 1.557. Or if you know that Debt to Equity is .557, then there is 55.7¢ in debt financing for every $1.00 in equity financing, or 55.7¢ in debt financing for every $1.557 in total financing, for a Debt Ratio of .557 ÷ 1.557 = .358. D. Profitability Ratios: indicate whether the company’s income represents a sufficient return relative to sales, or a sufficient return on the investment in assets made by all money providers, or a sufficient return on the owners’ investment. Profit Margin = Net Income $126 = .177 . Sales $710 Return on Assets (ROA) = Trefzger/FIL 240 & 404 Net Income $126 = .068 . Total Assets $1,845 Topic 3 Outline: Analyzing Financial Statements 5 Return on Equity (ROE) = Net Income $126 = .106 . Equity $1,185 Profit margin is the most common income statement-based profitability measure. Others include gross margin (gross profit/sales) and operating margin (operating income/sales); these deal with the firm’s ability to generate returns without considering administrative and/or financing costs. Just about any analyst – a potential owner, or a potential long-term or short-term lender – would like to see the various profitability ratios higher than the industry average figures. The profit margin is largely a measure of cost control; a higher profit margin indicates better control of costs. (It could, arguably, reflect an effective pricing policy, but in a competitive market we generally assume that a company sets its price at whatever the competition allows it to charge.) While Return on Assets is one of the most often-cited measures of business performance, there is actually a logical inconsistency in the ROA computation. Specifically, in ROA we compare net income (the financial return to the owners) with total assets (the total money put up by both the owners and the lenders). [ROA might be seen as too pessimistic, since it includes both lenders’ and owners’ investment in the denominator while including only the owners’ return in the numerator.] Two variations on the ROA measure are attempts at dealing with this inconsistency: Basic Earning Power Ratio (BEP) = Return on Invested Capital (ROIC) = EBIT $200 = .108 . Total Assets $1,845 EBIT (1 tax rate ) $200 (1 .3) = .076 . Total Assets $1,845 In BEP we compare EBIT (the money left for lenders and owners, after operating costs have been paid) to the total asset figure that represents the lenders’ and owners’ investment. [But BEP is actually too optimistic, ignoring the income tax that must be paid before owners can be compensated.] ROIC involves an additional refinement of the numerator in which we subtract income taxes from EBIT, since the amount to be paid in income taxes will not be available for the owners. [Note that ROIC’s numerator of $200 x .7 = $140 is the sum of the $126 net income available to the owners, plus the $20 interest – $6 tax savings = $14 net cost of paying the lenders.] [Note also that if higher borrowing is to lead to a higher ROE, BEP must exceed the pre-tax interest rate, which means that ROIC must exceed the after-tax interest rate.] BEP, ROIC, ROA, and ROE are designed to tell how good a job the company’s managers have done in delivering financial returns to the providers of money (lenders and owners together in the BEP, ROIC, and ROA cases; owners alone in the ROE case). If these percentages are lower than the industry averages (or other comparison measures), we might argue that the lenders and owners would have been better off directing their financial resources to other uses. A measure similar to ROIC, but computed in dollar rather than percentage terms, is Economic Value Added (EVA), one of the “hot” topics in finance in recent years. In computing EVA [a term copyrighted by Stern-Stewart Company], we are looking at whether money was left after Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 6 the company provided fair returns to the lenders and owners, such that there was profit in an economic sense. A problem with traditional accounting-based measures is that net income – the “bottom line” in traditional analysis – is not adjusted for a fair financial return to the company’s owners. For example, if a large company’s income statement showed $1.00 in net income, we might be tempted to say, “At least it’s positive; it’s something.” But that $1.00 is the financial return to the owners, who may have invested millions of dollars – a very poor percentage return. EVA is the total money that was available to compensate the lenders and owners in the most recent period, minus the total cost to the firm of delivering the returns expected by these investors during that period, with the important elements of risk and taxes factored in. It is computed as EVA = NOPAT – [(Total Assets)(% Cost of providing investor returns)] = [(EBIT)(1 - t)] – [(Total Assets)(% Cost of providing investor returns)]. We could argue over whether to identify the “capital” providers as the entire right-hand side of the balance sheet (my own choice); or only as the owners, all of the long-term lenders, and notes payable (the short-term lenders that require explicit rates of return). [Accruals and accounts payable are sometimes thought of as not carrying measurable financing costs, although in a philosophical/economic sense we know that no money is provided for free and, as noted in Topic 2, we do have a method for quantifying the cost of accounts payable financing.] The average percentage cost of having obtained this money, called the “weighted average cost of capital,” or WACC (the subject of Topic 5), reflects the after-tax cost, on average, of delivering appropriate returns to the company’s lenders and owners. We multiply the amount of capital by the average cost of capital to find the annual dollar cost of providing fair financial returns to the investors. NOPAT would be computed, from the balance sheet and income statement provided in Topic 2, as (EBIT)(1 – t) = ($200,000)(1 – .30) = $140,000. If the average percentage cost of providing fair returns to the lenders and owners, who have supplied $1,845,000 for the purchase of assets, is 7.5%, then the dollar cost of giving fair returns to the money providers is .075 x $1,845,000 = $138,375. Therefore, EVA = [($200,000)(1 - .3)] – [($1,845,000)(.075)] = $140,000 - $138,375 = $1,625. A positive net income, if not positive enough, might leave some of the investors (the owners) with a less-than-fair rate of return. But a positive EVA indicates that the company generated after-tax returns greater than its after-tax, risk-adjusted costs (risk is adjusted for in the 7.5% weighted average cost of capital), thereby creating $1,625 in true value for the owners in the most recent year. (As long as net income is positive, so that we know the lenders have gotten a fair rate of return, we could actually compute EVA simply by focusing on the owners’ residual position: net income minus the cost of delivering a fair dollar return to the owners. The benefits of computing EVA as shown in our computation above are that it also can be used in the negative net income case [EVA would, of course, be negative], and it forces us to think about firms’ typical need to deal with both lenders and owners in raising money.) Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 7 A recent twist on the EVA idea is EVA Momentum, a measure in which we divide the change in a company’s EVA by the change in its sales for the prior period. According to Stern-Stewart Co., which developed the EVA and EVA Momentum measures, EVA Momentum would be expected to be about zero for most firms most of the time, so positive EVA Momentum is good; it is difficult to both grow in size and increase EVA. The benefit of this measure is said to be that it can not be manipulated the way many ratios can, because the numerator takes into account fair financial returns to both the lenders and owners (unlike the net income, which can grow even as a firm’s owners are harmed proportionally), and the denominator is an already-reported prior period’s sales. II. The DuPont Analysis In the 1950s, financial analysts at DuPont Corporation spotted an interesting algebraic relationship involving the two traditionally most common profitability measures: Return on Assets (ROA) and Return on Equity (ROE). ROA can be decomposed into the Profit Margin and the Total Asset Turnover; while Return on Equity (ROE) can be broken into the Profit Margin and Total Asset Turnover (ROA), along with the Equity Multiplier (which relates to the degree of debt financing). Shown symbolically: NI NI S = × TA S TA NI NI S TA TA = × × = ROA × ROE = EQ S TA EQ EQ ROA = On either side of the = sign we have NI/TA or NI/EQ, respectively (because S in the ROA case, and both S and TA in the ROE case, cancel in cross-multiplication). So the logic is unassailable (although we can still have our beefs with ROA as a useful measure, as discussed above). But the beauty is that we have taken two very important numbers – the rate of return earned on the entire investment in assets (ROA) and the rate of return earned on the owners’ money (ROE) – and broken them into component parts that can be compared individually to published figures (industry averages, last year’s figure for the company, etc.). So if, for example, ROA is low, we can try to learn whether the problem relates to poor cost control (a low profit margin) or an inefficient use of assets in supporting sales (a low total asset turnover); otherwise we might waste time trying to improve performance in areas where we are already strong (or at least competitive) while neglecting our weaknesses. Let’s look at a couple of interesting points underlying the logic of DuPont. First, consider ROA. Two firms could have the same ROA figures even if their profit margin and asset turnover figures were very different. In fact, we expect mass retailing firms to have low profit margins. So why would anyone (lenders, owners) direct their resources to such companies? The answer is that the asset turnover is pretty high: much of the asset base for grocery and discount stores is inventory, of which only a small fraction of total annual sales is on hand at any given moment (recall that the balance sheet is a “snapshot”). Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 8 On the other hand, why would investors channel their money to heavy manufacturing firms, whose asset turnover ratios are low because of the need to have large sums of money always tied up in massive buildings and expensive machines? The answer is that the profit margin for such firms is high. (A grocery chain might have a 1.5% profit margin and a total asset turnover of 8, while a manufacturing firm might have a profit margin of 8% but a total asset turnover of only 1.5; in either case ROA would be 12%. But we should not expect that all firms would have equal ROAs. We would expect, rather, that ROEs would be equal for two firms that investors viewed as having similar risks for owners.) Then consider ROE. We see that ROE consists of ROA and something relating to debt financing (we use the Equity Multiplier measure for algebraic convenience). So if ROE – the owners’ share of the pie – is low, we might try to raise it by improving ROA (making the pie bigger) or by increasing the use of debt financing (reducing the number of people who share the pie). Note that the equity multiplier (sometimes called the financial leverage multiplier), TA ÷ EQ, must be at least 1.0 (assets must be at least the amount contributed by owners), and if there is any debt financing at all then TA/EQ must be greater than 1.0. So ROE must be at least as high as ROA. And if there is no debt financing, then the total asset base was paid for by the owners, so the asset total and the equity amount must be equal (Equity Multiplier = 1), and ROE = ROA. But that does not mean we should always try to raise ROE by making greater use of debt financing; doing so is a high-risk strategy. ROE rises if all goes well, but if, for example, revenues are lower than had been expected, then the need to pay interest to the larger lender position might leave little or no net income for the equity position (so ROE would fall rather than rise). We would not necessarily view favorably a company that has a higher ROE than its competitors, but achieves it only by borrowing more heavily than other firms. [There is, theoretically, an optimal level of debt financing – an optimal capital structure – for a firm, based on the amount and type of assets it holds and the type of technology it utilizes. Deviating from that debt level is actually likely to reduce, rather than enhance, ROE. Or consider that a higher Equity Multiplier leads to a higher ROE only if ROA does not change, but with more debt financing more interest will be paid, leading to a lower Profit Margin and lower ROA.] III. Interpreting the Ratios Let’s assume that the average ratios for companies in XCorp’s industry are as shown (along with ratios computed above for XCorp): Ratio Current Ratio Quick Ratio Times Interest Earned Debt Ratio Debt to Equity Ratio Equity Multiplier Inventory Turnover Receivable Turnover Fixed Asset Turnover Total Asset Turnover Trefzger/FIL 240 & 404 XCorp 1.713 .827 10.0 .358 .557 1.557 1.844 2.322 .645 .385 Industry Average 1.612 .743 11.9 .250 .333 1.333 1.841 2.493 .647 .407 Topic 3 Outline: Analyzing Financial Statements 9 Profit Margin Return on Assets (ROA) Return on Equity (ROE) .177 .068 .106 .173 .079 .105 What conclusions might we draw? XCorp’s liquidity position seems strong, since its current and quick ratios are higher than the industry averages. The company makes more use of debt financing than do competing firms, as evidenced by XCorp’s higher debt ratio (or, equivalently, its higher debt to equity ratio or equity multiplier). XCorp appears to be about as efficient in using fixed assets and inventory to generate or support sales as are competing firms, as suggested by fixed asset and inventory turnover ratios that are similar to the industry averages. But the receivable turnover and total asset turnover are somewhat low (if we computed a days’ sales in receivables it would be somewhat high), suggesting a high level of receivables (and thus of total assets also) relative to sales. [A low turnover ratio means that sales is low relative to the supporting level of assets.] The latter observation would be consistent with high current and quick ratios (if the problem were too much inventory rather than too much in receivables, the current ratio would be higher than the industry average but the quick ratio likely would not be). XCorp seems to be controlling its costs about as well as its competitors, as shown by a profit margin close to the industry average. ROA is somewhat low – not surprising, since we know the company holds an excessive amount of receivables. Yet ROE is at about the industry average. How? XCorp uses debt financing more heavily than do its competitors on average, so its Equity Multiplier is higher than the industry average. This situation is not good; XCorp uses its assets (specifically, receivables) inefficiently, and kept its most recent year’s ROE at the same level as its competitors only by taking the risk of using more debt financing than its competitors use. IV. Some Problems We Must Recognize Creating financial statements is an inexact science (relating to the flexibility in some accounting rules). Furthermore, financial decisions should be made based on economic/market values, not on the historic/book values typically shown in financial statements. Therefore we must be careful in interpreting ratios that we compute from a company’s most recent Income Statement and Balance Sheet. Some of these problems are: Assets Are Bad Throughout your study of accounting and other business topics, you probably have been led to believe that assets are good. For example, if Firms A and B each earned $100,000 (operating income minus income taxes) last year, but Firm A had only $1 million in assets whereas Firm B had $1.2 million in assets, you would perhaps have responded that Firm B is the “better” company, because it is B’s equal in terms of sales but has a larger asset base. But we might be on more solid ground in noting that Firm A is the more efficient company, because it has been able to do more with less. Firm B may have machines sitting around “collecting dust,” not used in a sufficiently productive way to justify their being held. If it can get along with one delivery truck, a firm should not tie money up in having two. Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 10 Why is the holding of too large an asset base a problem? Recall what a balance sheet tells us. The “left-hand” side shows assets: all the things the firm makes use of in conducting business. The “right-hand” side shows who put up the money to pay for the assets: lenders and owners. These money providers are hard-nosed investors who expect to earn returns on funds they have committed. How can the managers of the firm deliver those returns in appropriate percentage terms (based on the risks the money providers face) if these managers accept money and then buy assets that are not needed? They would be better off not to have brought in the additional money and purchased the additional assets. Consider Firms A and B discussed above. Each is financed 50% with debt and 50% with equity. Lenders expect a return that costs the firm 7% after the related income tax savings, and owners (who face greater risks because they receive no returns until lenders’ claims are fully met) expect a 13% return. Firm A’s managers can provide $35,000 to the lenders (the 7% cost of the lenders’ $500,000 invested) and $65,000 to the owners (a 13% return on their $500,000), and all of Firm A’s money providers are properly compensated. Firm B’s managers need $42,000 to provide for the 7% cost of the lenders’ $600,000 investment, leaving only $58,000 as a return for the owners (owners receive the residual, or what remains after all other parties with claims on the firm’s cash flows – from employees and material suppliers to lenders – have been paid in full). That $58,000 represents only a 9.67% return on Firm B owners’ $600,000 investment. These owners will be undercompensated, based on the risks they face. Financial Statements Explain the Past, Not the Future: The relationships suggested by the ratios we compute will not necessarily hold true in the future. It would be pointless to use past relationships as indicators of expected future performance if circumstances are changing. For example, if recent increases in raw material costs can not be passed along to customers, then last year’s profit margin may indicate little about the company’s current strengths. In addition, the historic financial measures shown on the Balance Sheet and Income Statement might differ so much from current economic/market values that the ratios we compute could lead to incorrect interpretations or decisions. Specific Timing Issues: Liquidity ratios involve asset and liability items expected to result in cash collection or payment within one year. So a current (or quick) ratio greater than 1.0 seems to suggest that money will be available to pay bills that come due in the coming months. But what if the current liabilities come due for payment in two weeks, yet much of the current asset base (receivables and inventory) will not result in cash collections for several months? This issue illustrates why a ratio is best used as an “attention director;” you should never make a decision solely on the basis of a ratio’s computed value. (For example, a thorough liquidity analysis typically includes the completion of a month-by-month cash budget.) Inventory Valuation Treatment: Two physically identical firms might show different ratios simply because of FIFO vs. LIFO inventory accounting. If inventory costs have been rising, then the firm using LIFO – units bought recently from suppliers at high prices are the ones treated as having been sold – would show a lower profit margin (due to higher measured input costs of “new” inventory items used) but a higher inventory turnover (due to lower measured value of “old” inventory remaining in stock) than a physically identical firm that uses FIFO. Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 11 Value of Net Fixed Assets: Fixed assets are shown on the Balance Sheet at their original purchase price, minus any depreciation that has been claimed during the lives of those items. So a firm with old machines that are largely depreciated and barely still working might appear to be very efficient: it generates whatever sales level it enjoys with a very small (remaining) investment in assets. Its competitor with brand new machines, shown at a high value on the balance sheet (reflecting the recent purchase – especially if there has been inflation in prices – and low accumulated depreciation), might wrongly appear to be terribly inefficient. This case also illustrates why ratios are best used as attention-directors; a good analyst follows all the firm’s activities, looking beneath the surface numbers to gain true understanding. Seasonal Effects: Consider the case of two different toy retailers, one of which showed a much lower inventory on its most recent Balance Sheet than did the other, even though the sales totals shown on the two firms’ most recent Income Statements were equal. Was the first more efficient in using inventory to generate sales? No, in fact they are “identical twins.” But the first uses a calendar year ending December 31, when measured inventory (remember the “snapshot” idea) is at its post-holiday lowest level of the year. The other uses a fiscal year ending September 30, when measured inventory is at its pre-holiday highest level of the year. (The income statement covers the whole year, so all the busy and slow periods of the year are included.) What to do? At least recognize this type of measurement peculiarity, and do not try to correct problems that do not exist. You might also want to compute an average figure based on the inventory (or other asset or liability category) figures from the end of each quarter or month over the past year (though it might be quite difficult to get monthly figures from competing companies for comparison purposes). Good or Bad: Who Wants to Know? A high profit margin would tend to be viewed positively by almost any analyst (except in a pathological case, as when the firm slashes R&D or advertising expenses to make the current period look good while placing the firm in long-run jeopardy). But what about a current ratio that is higher than the industry average? A short-term lender would view that situation favorably, but a current or potential owner (or a professional analyst advising stock market investors) would be troubled by the accompanying drain on profitability (a firm typically does not earn high returns on its investment in current assets; recall the liquidity vs. profitability tradeoff discussed in our net working capital discussion in Topic 2). In fact, the inventory and receivable turnover ratios might be troublingly low in this case. Or consider a high debt or debt to equity ratio: a potential lender might see too much risk, while a potential owner might see a favorable use of tax sheltering and “leverage.” It may seem ironic that apparent strength in one area can be accompanied by weaknesses in others. (Some companies are said to engage in “window dressing” – activities with no economic substance, but that make some ratios look better – just before they produce financial statements. An example might be borrowing money long term, and then putting that money in a cash account, to improve the current or quick ratio.) Analysts should always be alert to these types of activities. Some Information May Not Be Available: For example, a publicly traded company must report sales on its annual income statement, but it need not report credit sales. An analyst examining Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 12 a company’s (or industry’s) credit sales may have to draw some inferences based on general industry practices, or on changes in receivables and sales as shown over a series of successive quarters or years. (Or recall the problem of finding monthly figures for competing companies, as discussed on the previous page.) Qualitative Factors Can Play a Role: Issues such as a firm’s reliance on one product line or supplier or customer, or its need to deal with strict regulation or foreign customs and currencies, affect the risks faced by companies and might affect how we would interpret ratios (especially if not all firms in the industry face these problems to a similar degree). What Industry? It can be difficult to assign a firm to an industry group for comparison purposes, especially if that firm produces a variety of goods and services. (Can you compare Coca Cola to Pepsi Cola, when Pepsi used to be in restaurants and still owns the Frito-Lay and Quaker Oats brands, while Coke just makes drinks?) Major financial publications offered very different views on the industry Caterpillar is in, even before Cat became a player in the consulting and financial services fields. Note also that it is hard to justify comparing a company’s ratios to an “industry” average if the company is much larger or smaller than most other companies in the same line of business. (Comparing a small software producer with Microsoft, or even with an “industry” average heavily influenced by Microsoft’s results, might not provide useful insights.) Of course, an alternative basis for comparison might be the ratios of the company’s closest (similarly sized) competitor, or even the company’s own ratios in one or more previous time periods. Appendix: A Brief Introduction to Financial Forecasting (We typically do not get to this section, because of time constraints) In this appendix we attempt to predict, or forecast, what a particular company’s balance sheet and income statement, and some key ratios computed from those statements, will look like in the coming year or at some other future date. Anticipating what free cash flow and other important measures will be in the future allows managers to plan, and allows investors to determine the value of holding a financial claim (as a lender or owner) in the company. A. Steps in a Basic Financial Forecast Predict sales for the coming year (or other period; five years is not uncommon), based on assumptions about the economy, industry, and company Complete a Pro Forma Income Statement and Pro Forma Balance Sheet (possibly for a series of different sales forecasts), typically based on Percentage of Sales Approach Determine the required addition to assets for meeting the projected sales level (recall that you typically want to hold assets only if they will help generate or support sales) Compute how much of the needed increase in the asset base can be financed with internal sources: Spontaneous increase in accounts payable (debt) and accruals Retaining earnings (equity) Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 13 Compute how much of the increased asset base must be financed with external sources: Issuance of new notes or bonds payable (debt) Issuance of new common stock (equity) The sales forecast is the key to financial forecasting, because the amount of assets a company must hold is a function of the level of sales it expects to have to support. If sales are forecast higher than they turn out to be, money will be tied up in assets that will not generate financial returns. If sales are forecast lower than they turn out to be, the firm will miss out on opportunities to make profitable sales, and may lose market share. So in addition to predicting sales, it is important to predict how likely it is that the sales forecast will be wrong by a large magnitude. B. The Percentage of Sales Approach We can create pro forma income statements and balance sheets (i.e., can predict what the income statement and balance sheet will look like at one or more future dates) with the percentage of sales approach. The underlying logic is that most of the costs shown on the income statement, most of the assets shown on the balance sheet, and at least one or two categories of liabilities on the balance sheet should be proportional to the level of sales. In other words, it is based on the idea that relationships that have held consistently in the past will continue to hold in the future (not always a reasonable assumption, so the percentage of sales approach is often, but not always, a useful tool). Here is an example of how we would use the sales forecast, along with relationships indicated in past income statements and balance sheets, to forecast what the income statement and balance sheet (and, by extension, some key financial ratios) will look like at some future date. Let’s say that the most recent income statement and balance sheet appeared as follows: Income Statement: For Most Recent Year ($ thousands) Sales $2,000 Cost of Producing & Distributing Goods 1,600 (80% of Sales) Operating Income $ 400 Minus Interest 100 ( 5% of Sales) Taxable Income $ 300 Minus Income Tax 102 (34% marginal rate) Net Income $ 198 Dividends Paid Earnings Retained Trefzger/FIL 240 & 404 $ 66 (1/3 of Net Income) $ 132 (2/3 of Net Income) Topic 3 Outline: Analyzing Financial Statements 14 Balance Sheet: As of End of Most Recent Year ($ thousands) Cash & Marketable Securities $100 ( 5% of Sales) Accounts Receivable 300 (15% of Sales) Inventory 400 (20% of Sales) Net Fixed Assets (plant & equipment ) 1,000 (50% of Sales) Total Assets $1,800 (90% of Sales) Accounts Payable & Accruals Notes Payable Long-term Debt Common Stock Retained Earnings Total Claims $240 (12% of Sales) 140 480 700 240 $1,800 (90% of Sales) Note that total assets held at the end of the previous year equaled 90% of the sales level for the prior year. (So the Total Asset Turnover ratio was $2,000 ÷ $1,800 = 1.111 .) Because we think of assets as being held primarily to support sales, we show each asset level as a percentage of the year’s sales. [Arguments might be made as to whether “fixed assets” should be expected to change as sales change; after all, aren’t they fixed? The issue is whether fixed assets are already being used to capacity, and whether small additions can be made to fixed assets in connection with small increases in sales. For example, if the firm is not yet producing at capacity, it could make and sell more without having to increase fixed assets. In our examples, we simplify by assuming that the firm is already producing at maximum fixed asset capacity, so any increase in sales necessitates adding fixed assets; and that fixed assets can be added proportionally with any increase in sales, although in “real life” this latter assumption might not always be appropriate.] We do not, however, necessarily expect “right-hand side” values to vary individually with the sales level (although the total of claims must be expected to vary directly with sales, since the assets that the investors pay for are expected to vary individually, and in total, with sales). Based on the relationships shown in the most recent income statement and balance sheet, and based on a sales forecast of $2.6 million for the coming year, we would expect the income statement for the coming year to appear as follows: Income Statement: Projected for Coming Year ($ thousands) Sales $2,600 Cost of Producing & Distributing Goods 2,080 (80% of Sales) Operating Income $ 520 Minus Interest 130 (5% of Sales) Taxable Income $ 390 Minus Income Tax 132.6 (34% marginal rate) Net Income $ 257.4 Dividends Paid Earnings Retained Trefzger/FIL 240 & 404 $ 85.8 (1/3 of Net Income) $ 171.6 (2/3 of Net Income) Topic 3 Outline: Analyzing Financial Statements 15 Our projection shows that – if past relationships continue to hold – we will earn $257,400 in net income in the coming year, $171,600 of which will be retained for the firm’s use. That money will be needed by the firm – after all, with the higher level of sales, the firm will have to hold a larger asset base, which will have to be paid for. How much in new assets will have to be held? We determine this figure by projecting a balance sheet for the coming period, also based on the assumption that most of the values in question relate to sales. The growth in assets is paid for through the retention of earnings and the obtaining of money from external parties. Based on past relationships, on a $2.6 million sales forecast, and on expected net income of $257,400 (with $171,600 added to retained earnings), a first pass at a balance sheet for the end of the coming year is as follows: Balance Sheet: Projected for Coming Year ($ thousands) Cash & Marketable Securities $130 ( 5% of Sales) Accounts Receivable 390 (15% of Sales) Inventory 520 (20% of Sales) Net Fixed Assets (plant & equipment ) 1,300 (50% of Sales) Total Assets $2,340 (90% of Sales) Accounts Payable & Accruals Notes Payable Long-term Debt Common Stock Retained Earnings Total Claims (Preliminary) $312 (12% of Sales) 140 (Assuming no change) 480 (Assuming no change) 700 (Assuming no change) 411.6 ($171.6 added to previous $240) $2,043.6 The total claims we have accounted for equal only $2,043,600 whereas the asset total needed is projected to be $2,340,000. So there is a shortfall in financing needed for the asset level we expect to have to hold: $2,340,000 - $2,043,600 = $296,400. This is the amount of money we will have to go ask someone to provide, to pay for part of the assets needed to support the higher sales level; we refer to this amount as Additional Funds (or Financing) Needed, or AFN. (This figure is sometimes also called External Financing Needed, or EFN.) To raise the AFN, the company will have to either borrow more money (from short- or long-term lenders) or else sell some additional common stock. For example, the firm might sell $96,400 worth of new long-term bonds and sell $200,000 of new common stock. (Actually, it would have to get a little more than those amounts from each type of money provider so that it would be left with $296,400 after paying the first year’s interest on the new bonds and the first year’s dividends on the new stock.) The decision on how to raise the needed $296,400 would be based on capital structure (debt/equity mix) issues, interest rates and other market conditions (a firm typically would not issue new common stock in an amount as small as $200,000, for example), management’s judgment, and other criteria. Then the firm’s managers should compute important ratios based on the pro forma statements and the preliminary AFN decision. If the ratios show that the changes would place the firm in trouble in one or more areas (based on liquidity ratios being too low or debt financing ratios Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 16 being too high, for example), then some revisions (and probably some tough choices) must be made. One approach might be to try to reduce the need for external financing, by striving to increase the profit margin, increase total asset turnover (effectiveness in using assets to generate sales, so that we might revise the assumption that it must hold more assets to generate more in sales revenue), and/or increase the proportion of net income retained (“retention ratio”) while decreasing the proportion paid out in dividends (“payout ratio”). The results might also be examined under various sales forecasts, so managers can understand how sensitive the company’s financial performance is to the level of sales and to various assumptions regarding the need for assets, and the methods for financing them. C. A Shortcut Approach to Finding AFN Note that, with some extra work, we could plug values into the pro forma financial statements that are not based on assumptions of consistent relationships over time. At the same time, if there is believed to be a consistent relationship between sales and various income statement/ balance sheet figures, we can achieve the same result as in the above analysis with a short equation that quickly isolates the need for extra assets and the spontaneous growth in some sources of financing. The difference (just as in the more systematic analysis above) is AFN. The equation is AFN = (A*/S0)S – (L*/S0)S – MS1(RR). It says, essentially, that the total new financing needed will be provided by spontaneous growth in liabilities, the income on the new higher sales level, and unspecified other amounts (the AFN, or additional funding needed). (A*/S0) is the proportion of assets that changed directly and proportionally with sales in the recent past (sometimes called the capital intensity ratio), (L*/S0) is the proportion of liabilities that changed directly and proportionally with sales in the recent past, S is the anticipated change in sales, M is the profit margin, S1 is the expected level of sales in the coming year, and RR, the retention ratio, is one minus the dividend payout ratio, or the proportion of the coming year’s net income that we think the company will keep as retained earnings. Based on our figures above, we note that assets totaling 90% of sales are expected to change with sales, liabilities totaling 12% of sales are expected to change with sales, the profit margin is $198/$2,000 = 9.9%, the coming period’s sales S1 is expected to be $2,600,000 (so the change in sales over the prior year, S, is expected to be $600,000), and the earnings retention ratio RR is 2/3 (so the dividend payout ratio is 1/3). Therefore, AFN = (A*/S0)S – (L*/S0)S – MS1(RR) AFN = (.90)($600,000) – (.12)($600,000) – (.099)($2,600,000)(2/3) = $540,000 – $72,000 – $171,600 = $296,400 (just as we found earlier using a pro forma balance sheet and income statement). Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 17 D. Some Observations We often think of growth (in sales and other things that grow with sales) as the key to financial success. But a company can get into more financial trouble by growing too much, or too fast, than by not growing at all. A firm that grows must locate new sources of financing, which may be a difficult and costly thing to do (among the costs can be obtaining new money when market conditions are unfavorable, and bringing in outsiders’ meddling along with their money). Note that if sales were expected to grow by only $100,000, then our result above would show AFN = (.90)($100,000) – (.12)($100,000) – (.099)($2,100,000)(2/3) = $90,000 – $12,000 – $138,600 = – $60,600 . Additional funding needed would be negative; the firm could pay for all needed new assets with spontaneous, internal sources and still have some money left over for other purposes. In fact, if we set AFN = 0 in the above equation and solve for S, we find that internal sources will pay for all new assets needed as long as the change in sales is no more than about $185,000. The AFN equation, and even our more thorough pro forma statement analysis, were based on the assumption that relationships between sales and other items are constant over time and across levels of sales. This assumption is not very realistic. Economies of scale (based on fixed costs and such conditions as greater predictability at higher output levels) may allow sales to grow with a less-than-proportional increase in some assets, while lumpiness (the need to buy buildings and machines in discrete units) may allow sales to grow only with a morethan-proportional increase in assets. If there is excess capacity, sales can grow without a greater investment in fixed assets. By how much? A company operating at only 50% of capacity can, obviously, double its output, say from $2,000 in sales to $4,000, without adding to fixed assets. We find the answer, with the excess capacity adjustment formula, as $2,000 ÷ .50 = $4,000. So if we were at 76% of capacity, sales could increase to $2,000 ÷ .76 = $2,631 without the need to buy more fixed assets. If the firm shown in our pro forma analysis were operating at 76% of fixed asset capacity, its sales could grow beyond $2,600 without the immediate need for added fixed assets. Fixed assets on the pro forma balance sheet would be only $1,000 , rather than $1,300 , and the $296.4 AFN would be reduced by $300 (to a slightly negative level). Spreadsheet models allow analysts to easily perform simple sensitivity analyses, in which they note the degree to which key output figures (such as important financial ratios) change with various changes in sales or other key input figures. Regression analysis (a statistical tool) and other computerized models allow companies to 1) use many years’ experience, rather than just one recent year’s, in describing the relationship between sales and other important values (although you could do that with pro forma Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 18 financial statements as well) and 2) assume non-linear relationships of various types between sales and other important values. We must be careful suggesting that a company reduce its AFN by reducing the dividends it pays (i.e., increasing its retention ratio). Common stockholders may view a reduction in dividends as a signal that the managers are quite pessimistic about the company’s future, and as a result the price at which the stock sells in the market may plummet. (We will discuss dividend policy in a later unit.) Trefzger/FIL 240 & 404 Topic 3 Outline: Analyzing Financial Statements 19