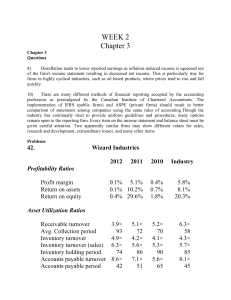

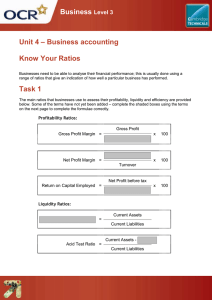

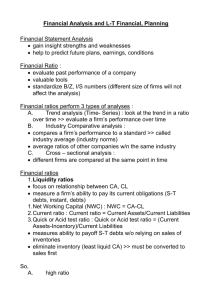

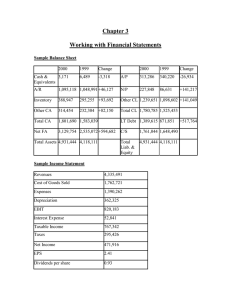

ratio analysis

advertisement

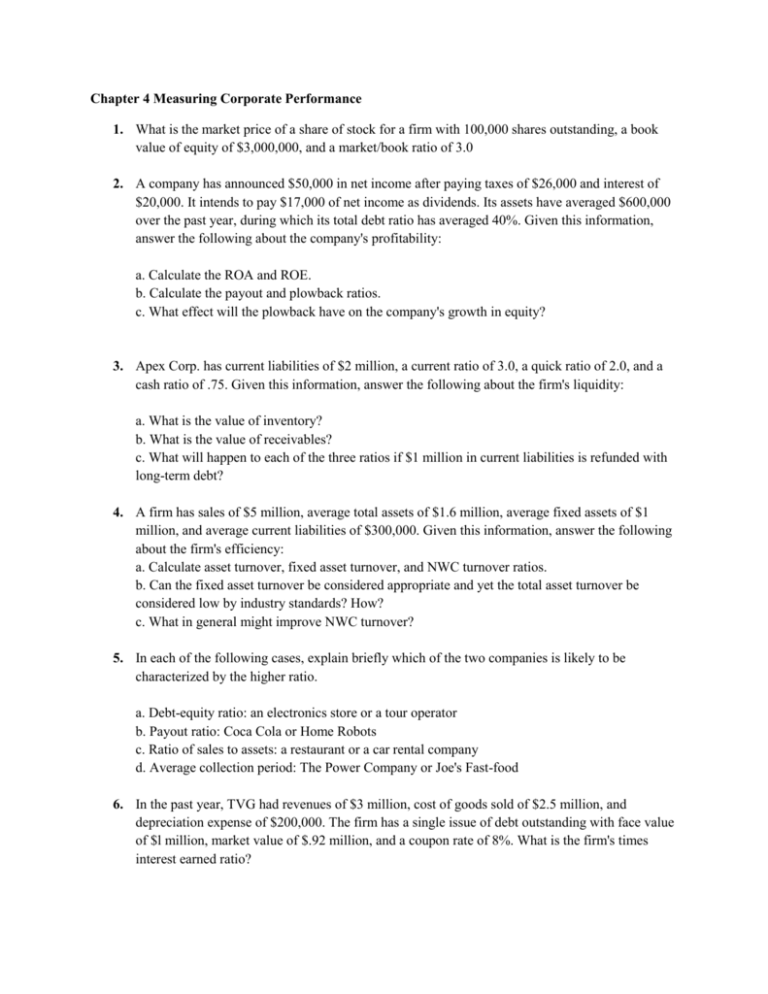

Chapter 4 Measuring Corporate Performance 1. What is the market price of a share of stock for a firm with 100,000 shares outstanding, a book value of equity of $3,000,000, and a market/book ratio of 3.0 2. A company has announced $50,000 in net income after paying taxes of $26,000 and interest of $20,000. It intends to pay $17,000 of net income as dividends. Its assets have averaged $600,000 over the past year, during which its total debt ratio has averaged 40%. Given this information, answer the following about the company's profitability: a. Calculate the ROA and ROE. b. Calculate the payout and plowback ratios. c. What effect will the plowback have on the company's growth in equity? 3. Apex Corp. has current liabilities of $2 million, a current ratio of 3.0, a quick ratio of 2.0, and a cash ratio of .75. Given this information, answer the following about the firm's liquidity: a. What is the value of inventory? b. What is the value of receivables? c. What will happen to each of the three ratios if $1 million in current liabilities is refunded with long-term debt? 4. A firm has sales of $5 million, average total assets of $1.6 million, average fixed assets of $1 million, and average current liabilities of $300,000. Given this information, answer the following about the firm's efficiency: a. Calculate asset turnover, fixed asset turnover, and NWC turnover ratios. b. Can the fixed asset turnover be considered appropriate and yet the total asset turnover be considered low by industry standards? How? c. What in general might improve NWC turnover? 5. In each of the following cases, explain briefly which of the two companies is likely to be characterized by the higher ratio. a. Debt-equity ratio: an electronics store or a tour operator b. Payout ratio: Coca Cola or Home Robots c. Ratio of sales to assets: a restaurant or a car rental company d. Average collection period: The Power Company or Joe's Fast-food 6. In the past year, TVG had revenues of $3 million, cost of goods sold of $2.5 million, and depreciation expense of $200,000. The firm has a single issue of debt outstanding with face value of $l million, market value of $.92 million, and a coupon rate of 8%. What is the firm's times interest earned ratio?