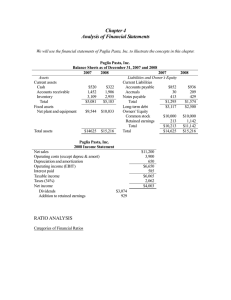

Financial Analysis Ratios

advertisement

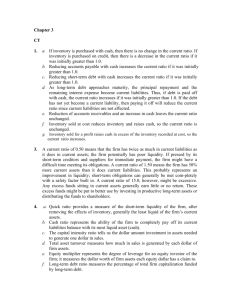

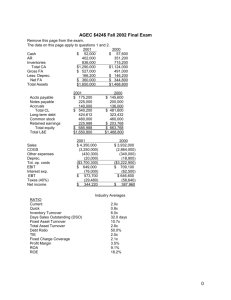

Professor Brad Poulos Key Financial Analysis Ratios Business Finance Summer 2009 AKA - "the Best Cheat Sheet Ever!" (Michael Hsieh, Spring 2008) Liquidity Ratios Efficiency (Asset-management) Ratios Measure the firm's ability to meet it's short-term cash obligations Current Ratio = Current Assets Current Liabilities Acid Test = Quick Assets (also: Quick Ratio) Current Liabilities (Quick assets do not include inventory) (Times) (Times) Profitability Ratios Measure operating effectiveness by comparing income to sales, assets and equity. Gross Profit Margin = Gross Profit Sales Operating Profit Margin = Operating Profit (EBIT) Sales Revenue (%) (%) Evaluate how efficiently managers utilize assets of a business. Average Collection Period = Average Accounts Receivable for receivables Average Daily Credit Sales (Days) Average Payment Period for Payables = Average Accounts Payable (Days Payable) Average Daily Credit Purchases (Days) Average Inventory Turnover Period = Average Inventory (Days Inventory) Average Daily Cost of Sales (Days) Sales Revenue to Capital = Sales Revenue (Times) Employed (Capital Asset Turnover) Average Total Assets - Average Current Liabilities Sales Revenue per Employee = Sales Revenue Number of Employees ($) ** Return on Sales = Net Income Sales Revenue (%) ** Inventory Turnover = Cost of Sales Average Inventory (Times) ** Return on Total Assets = Net Income Average Total Assets (%) ** Total Assets Turnover = Sales Revenue Average Total Assets (Times) Return on Capital Employed = Operating Profit (EBIT) Average Owner's Equity + Average Long Term Debt Return on Equity = Net Income after Preferred Dividends Average Owners' Equity (%) Financial Leverage (Debt Coverage) Ratios (%) Evaluate the capital structure, financing mix, and ability to service debt. Leverage Ratio = Long Term Debt Shareholders' Equity + LTD (Total Capital) ** Debt:Total Assets = Total Debt (Long and Short Term) Total Assets Market-value & Investment Ratios Attempt to assess how investors and stock markets react to company performance. Earnings per Share = Income to Common Shareholders Number of Common Shares Outstanding Price/Earnings Ratio = Price Per Common Share Earnings Per Share Dividend Payout Ratio = Dividends to Common Shareholders Net Income Available to Common Shareholders Dividend Yield = Dividends / Share Market Value / Share (%) (%) ($) ** Debt to Equity Ratio = Total Debt Total SH Equity (Times) (Times) Times Interest Earned = Income Before Tax + Interest Charges (EBIT) Interest Charges (Times) (%) Fixed Charges Coverage = EBIT + Lease Charges Interest Charges + Lease Charges (%) ** These are not in the text but you are expected to know them. (Times)