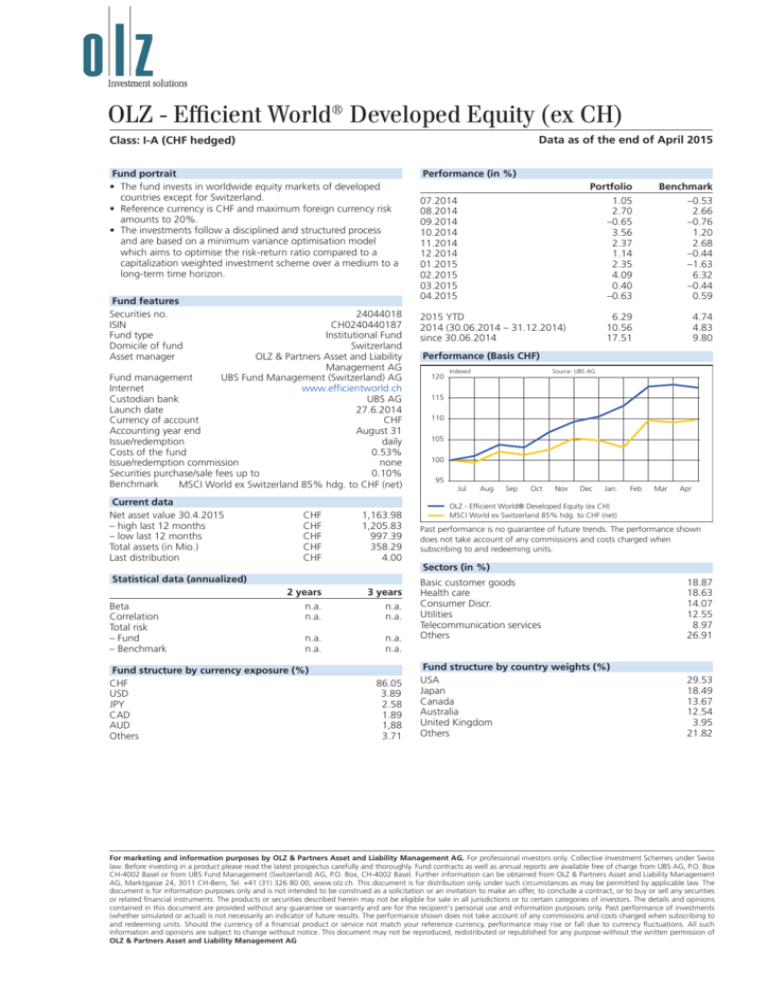

OLZ - Efficient World® Developed Equity (ex CH)

advertisement

OLZ - Efficient World® Developed Equity (ex CH) Data as of the end of April 2015 Class: I-A (CHF hedged) Fund portrait • The fund invests in worldwide equity markets of developed countries except for Switzerland. • Reference currency is CHF and maximum foreign currency risk amounts to 20%. • The investments follow a disciplined and structured process and are based on a minimum variance optimisation model which aims to optimise the risk-return ratio compared to a capitalization weighted investment scheme over a medium to a long-term time horizon. Fund features Securities no. ISIN Fund type Domicile of fund Asset manager 24044018 CH0240440187 Institutional Fund Switzerland OLZ & Partners Asset and Liability Management AG Fund management UBS Fund Management (Switzerland) AG www.efficientworld.ch Internet Custodian bank UBS AG Launch date 27.6.2014 Currency of account CHF Accounting year end August 31 Issue/redemption daily Costs of the fund 0.53% Issue/redemption commission none Securities purchase/sale fees up to 0.10% Benchmark MSCI World ex Switzerland 85% hdg. to CHF (net) Current data Net asset value 30.4.2015 – high last 12 months – low last 12 months Total assets (in Mio.) Last distribution CHF CHF CHF CHF CHF 1,163.98 1,205.83 997.39 358.29 4.00 2 years n.a. n.a. 3 years n.a. n.a. n.a. n.a. n.a. n.a. Statistical data (annualized) Beta Correlation Total risk – Fund – Benchmark Fund structure by currency exposure (%) CHF USD JPY CAD AUD Others 86.05 3.89 2.58 1.89 1,88 3.71 Performance (in %) 07.2014 08.2014 09.2014 10.2014 11.2014 12.2014 01.2015 02.2015 03.2015 04.2015 Portfolio 1.05 2.70 –0.65 3.56 2.37 1.14 2.35 4.09 0.40 –0.63 Benchmark –0.53 2.66 –0.76 1.20 2.68 –0.44 –1.63 6.32 –0.44 0.59 6.29 10.56 17.51 4.74 4.83 9.80 2015 YTD 2014 (30.06.2014 – 31.12.2014) since 30.06.2014 Performance (Basis CHF) 120 Indexed Source: UBS AG 115 110 105 100 95 Jul Aug Sep Oct Nov Dec Jan. Feb Mar Apr OLZ - Efficient World® Developed Equity (ex CH) MSCI World ex Switzerland 85% hdg. to CHF (net) Past performance is no guarantee of future trends. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Sectors (in %) Basic customer goods Health care Consumer Discr. Utilities Telecommunication services Others 18.87 18.63 14.07 12.55 8.97 26.91 Fund structure by country weights (%) USA Japan Canada Australia United Kingdom Others 29.53 18.49 13.67 12.54 3.95 21.82 For marketing and information purposes by OLZ & Partners Asset and Liability Management AG. For professional investors only. Collective Investment Schemes under Swiss law. Before investing in a product please read the latest prospectus carefully and thoroughly. Fund contracts as well as annual reports are available free of charge from UBS AG, P.O. Box CH-4002 Basel or from UBS Fund Management (Switzerland) AG, P.O. Box, CH-4002 Basel. Further information can be obtained from OLZ & Partners Asset and Liability Management AG, Marktgasse 24, 3011 CH-Bern, Tel. +41 (31) 326 80 00, www.olz.ch. This document is for distribution only under such circumstances as may be permitted by applicable law. The document is for information purposes only and is not intended to be construed as a solicitation or an invitation to make an offer, to conclude a contract, or to buy or sell any securities or related financial instruments. The products or securities described herein may not be eligible for sale in all jurisdictions or to certain categories of investors. The details and opinions contained in this document are provided without any guarantee or warranty and are for the recipient’s personal use and information purposes only. Past performance of investments (whether simulated or actual) is not necessarily an indicator of future results. The performance shown does not take account of any commissions and costs charged when subscribing to and redeeming units. Should the currency of a financial product or service not match your reference currency, performance may rise or fall due to currency fluctuations. All such information and opinions are subject to change without notice. This document may not be reproduced, redistributed or republished for any purpose without the written permission of OLZ & Partners Asset and Liability Management AG