Financial Accounting

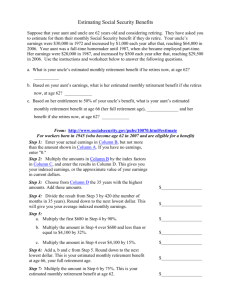

advertisement

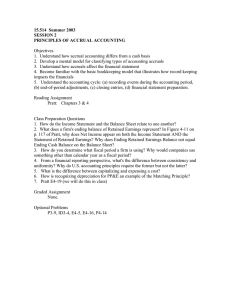

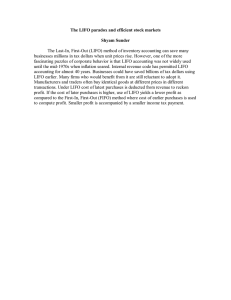

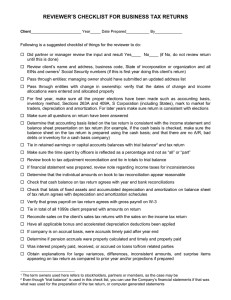

Financial Accounting Fall Term Professor: Jiří Novák Ph.D., BCG Corporate Chair Assistants: Mgr. Aleš Čornanič PhDr. Petra Kolouchová PhDr. Oliver Polyák Ing. Barbora Svárovská M.A. Office hours: by personal arrangement Contact: novakji@fsv.cuni.cz Credits: 3 U.S. credits (6 ECTS) Course Code: JEB044 Course Description: The aim of this course is to provide an understanding of the broad principles that govern the use of accounting, of the fundamental accounting concepts and of the ways in which they are interlinked. At the end of the course students should be able to understand accounting information, analyze it and draw conclusions for relevant economic decisions. Students should have some basic pre-knowledge of accounting relationships. Structure: The structure of this course will be divided between lectures and seminars. Lectures as well as seminars will meet once per week for 1.5 hours. Instructions: Please contact the IEF staff to learn more about the instructions for this course, including meeting times and how to register. Requirements: Students will be asked to submit three Home Assignments, take the Mid-Term Exam and the Final Exam. To pass the course students need to (i) pass the last attempt of the written final examination and (ii) collect at least 55 points for all course requirements cumulatively. Academic Honesty: Although the students are encouraged to exchange ideas in and outside class, everybody is required to submit their own work. That means that copying the work of other students or published materials is strictly prohibited. Course Content: 1) Accounting Framework – course outline, key concepts, types of accounting, financial reports 2) Balance Sheet – balance sheet equation, assets, liabilities, equity, recognition exercise 3) Income Statement – revenues, expenses, gains, losses, accounting cycle exercise 4) Revenues, Expenses – revenue recognition, expense matching, contingent gains and losses 5) Inventory Valuation – cost flow assumption, FIFO, LIFO, average cost, LIFO reserve 6) Accounts Receivable – direct write-off method, allowance method, sales returns and allowances 7) Fixed Assets – historical vs. fair value, depreciation, straight line vs. accelerated 8) Corporate Bonds, Leasing – discount/premium amortization; operating vs. capital lease 9) Accruals – IS vs. SCF, accruals and deferrals, classification of business activities 10) Cash Flows – direct method, indirect method, cash flows vs. earnings 11) Earnings Management – institutional settings, cash flows vs. earnings, accounting manipulation 12) Accounting Jeopardy – practical applications of accounting, tricky issues, interconnections Reading Materials: Required: Harrison, W.T., Horngren, C.T. (2008) Financial Accounting, Prentice Hall Supplementary: Stickney, C. P., Weil, R. L. (2003) Financial Accounting – An Introduction to Concepts, Methods and Uses. (Thomson, Mason, Ohio). Easton, P., J. Wild, R. Halsey, and M. McAnally (2007) Financial Accounting for MBAs. Third Edition. (Cambridge Business Publishers). White, G. I., A. C. Sondhi and D. Fried (2003). The Analysis and Use of Financial Statements (Wiley, New York; Chichester).