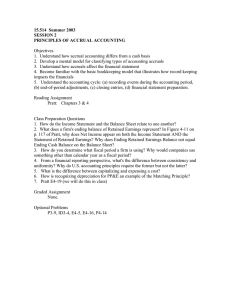

A Review of Earnings Management Accounting Seminar Week 3

advertisement

A Review of Earnings Management Accounting Seminar Week 3 Originally prepared by: Professor Farshid Navissi (Monash University) Semester 2, 2005 Updated by: Gatot Soepriyanto (Binus University) Semester 2, 2008 Agenda A Review of Earning Management (EM) Method of EM Incentives for EM Detecting EM Jones Model Step by Step guidance Modification of EM studies 2 2 “Numbers in the abstract are just that -numbers. But relying on the numbers in a financial report are livelihoods, interests and ultimately, stories of American Investors”. (The “Numbers Game”: Arthur Levitt – former SEC Chairman) 3 3 Earnings Management (EM) Defined Use of judgment in financial reporting and in structuring transactions to alter financial reports to influence the perceptions of stakeholders about the underlying economic performance of the company and / or influence outcomes that depend of the reported accounting numbers 4 4 EM and Corporate Fraud Virtually all managerial activities affect earnings constitute EM EM covers a wide variety of legitimate and illegitimate managerial actions that affect earnings EM may manifest in terms of the extremities of either conservatism or optimism Fraud typically comes into existence when firms try to paint an extremely optimistic picture of their operations through aggressive use of illegitimate practices 5 5 EM: Example Behaviours “Conservative” Accounting “Neutral” Accounting “Aggre ssive” Accoun ting WITHIN GAAP VIOLATES GAAP Tendency to understate earnings and to overstate liabilities Overly aggressive recognition of provisions Unbiased or neutral representat ion of the firm’s financial operations “Fraudulent” Accounting Tendency to overstate earnings and to understate liabilities Under statem ent of provisi ons Recording fictitious transactions e.g. Sales 6 6 Patterns of EM Income Maximisation Income Minimisation Extreme case known as “taking a bath” Income Smoothing Keeping earnings consistent over a long 7 7 Methods of EM Accounting Method Choice 1. Choice of accounting method affects the timing of when revenues and expenses are recognised in income For example the “percentage of completion” method permits the recognition of revenue on an ongoing basis, while the “completedcontract method” recognises revenue only at the completion of projects 8 8 Methods of EM Application of Discretionary Estimates 2. Even after the selection of accounting methods there remains the discretion of how the method is applied For example when depreciating assets using the straight-line method there still remains the issue of estimating the useful lives and the residual value using a longer useful life and larger residual value estimate will increase revenue in current accounting period 9 9 Methods of EM Accounting Method Timing 3. Exercising discretion over when and how to carry out activities that affect financial statements For example when to write-off impaired assets or recognise a liability as a contingent liability Control of Major Expenses / Revenues 4. For example how much to invest in R&D, advertising and maintenance expenses. Also firms can delay or accelerate the delivery shipments of goods to customers 10 10 Incentives for EM 1. Behavioral Incentives 2. Lending Contracts Accounting-Based Bonus Plans Political Costs Management Transition Market Based Incentives Dividend Payout Rates Management Buyouts Equity Offerings Analyst Expectations Share Repurchases Management Share Option Plans 11 11 Behavioural Incentives Lending Contracts Many debt arrangements contain restrictions relating to interest coverage, debt-to-equity, etc The desire to prevent the violation of these restrictions presents an incentive for the firm to manage earnings upwards in periods where the firm is close to breaching those restrictions Accounting-Based Bonus Plans Firms often reward managers on the basis of reported earnings or other accounting-based performance measures The desire to receive higher bonuses presents an incentive for the manager to manage earnings upwards in some periods 12 12 Behavioural Incentives Political Costs Large firms are often under scrutiny for their large profits The desire to circumvent increased regulatory intervention presents an incentive for the firm to manage earnings downwards Management Transition Poor performing managers often replaced with new management The possibility of “taking a bath” and attributing the poor performance to its predecessors presents an incentive for the manager to manage earnings downwards in the period immediately after appointment 13 13 Market-Based Incentives Dividend Payout Rates Shareholders may expect steady stream of dividends The desire to maintain its historical dividend payout rates presents an incentive for the firm to manage earnings smoothly Management Buyouts In an attempt to acquire more control managers may purchase a substantial equity stake in the company they manage The desire to purchase as many shares as possible presents an incentive for the manager to manage earnings downwards in the period prior to the buyouts 14 14 Market-Based Incentives Equity Offerings Earnings commonly used to value a firm going to public for the first time The desire to acquire more funds (via a high offering price) presents an incentive for the firm to manage earnings upwards in the periods prior to the offerings Analysts Expectations Financial Analysts (and/or management) often provide public forecasts of earnings The desire to meet or better those forecasts presents an incentive for the manager to manage earnings upwards in periods where it is anticipated that actual “unmanaged” earnings will fall short of the forecasted earnings 15 15 Market-Based Incentives Share Repurchases Firms with excess cash sometimes purchase their own shares for a variety of reasons The desire purchase these shares at a lower price presents an incentive for the firm to manage earnings downwards in the period prior to the repurchase Management Share Option Plans Firms often issue managers with share options as part of their remuneration package The desire to maximise their “profits” from these options presents an incentive for the manager to manage earnings downwards in the period prior to the award of the options and to manage earnings upwards in the period prior to the exercise of the options 16 16 Detecting EM It is impossible to detect every accounting choice that is made by every firm and to evaluate whether the choice has been made for opportunistic reasons Researchers have tended to focus on measures that provide an aggregate measure of earnings management Earnings is composed of two components 1. 2. Cash Flow from Operations Accruals 17 17 Detecting EM Operating cash flows are very difficult to exercise discretion over Researchers typically focus on the levels of total accruals made by firms Accruals are typically used by firms to recognise the consequences of transactions in the periods in which they occur Since accruals commonly involve discretion, accruals are more susceptible to manipulation 18 18 Detecting EM Many models exist to detect levels of abnormal accruals (discretionary accruals) Healy (1985), DeAngelo (1988), Jones (1991), Dechow, Sloan and Sweeney (1995) and Kothari, Leone and Wasley (2005). Basic idea is to use past firm accruals and financial information to estimate normal levels of accruals (non-discretionary accruals) in the period of investigation. The non-discretionary accruals in the period of investigation are then subtracted from the actual accruals to derive a measure of discretionary accruals 19 19 Jones (1991) Model Step 1: Calculate total accruals in time t TACt = [(∆CA - ∆Cash)/ TAt-1]–[(∆CL - ∆STD)/ TAt-1]– (Dep/ TAt-1) (1) Where ∆CA = change in current assets, ∆Cash = change in cash/cash equivalent, ∆CL = change in current liability, ∆STD = change in short-term debt included in current liabilities, ∆TP = change in income taxes payable, Dep = depreciation and amortization expense, and TA = total assets. Short-term debt is excluded from current liabilities because it relates to financing activities, as opposed to operating activities. 20 20 Jones (1991) Model Step 2: Estimate the coefficient of normal accruals in estimation period. Jones assumes that normal accruals are related to changes in revenue (sales) and by the level of plant, property and equipment (PPE): TACt/At-1= α0 + α1 (ΔREVt/At-1) + α2 (PPEt/At-1) + υt (2) Where: TAct is the total accruals of firm i in period t Ait-1 is the total assets of firm i at the end of period t-1 REVit is the change in revenue of firm i in period t Period t revenue for firm i - Period t-1 revenue for firm i PPEit is the balance of plant, property and equipment of firm i at the end of period t 21 21 Jones (1991) Model Step 3:The coefficients estimates from model (2) are then applied to the event years to predict the normal accruals NAt= ά0 + ά 1 ((ΔREVt /TAt-1) + ά 2 (PPEt/TAt-1) (3) Step 4: Finally, the magnitude of abnormal accruals (AN) is then obtained as the difference between total accruals computed in model (2) and the estimated (equation 3), that is: ANt = TACt – NAt (4) 22 22 Example? Lets assume that we would like to investigate whether a sample of 24 firms manipulated earnings upwards in 2004 1993 2003 10 Year Estimation Period 23 23 So what next? For each of the 24 firms we have to collect historical data (used in model 1) which will enable us to estimate the expected level of normal accruals in 2004. Lets assume we decide to gather 10 years of data for estimation purposes 24 24 Putting it all together For each firm we run regression (1) in the estimation period and obtain the parameter estimates of 1, 2, and 3 1993 2003 2004 10 Year Estimation Period TAit / Ait1 ˆ1.(1/ Ait1 ) ˆ 2 .(REVit / Ait1 ) ˆ3.(PPEit / Ait1 ) it 25 25 Putting it all together The parameter estimates are then applied to the event year to provide an estimate of expected normal accruals. Using discretionary accruals of the 50 sample firms, the mean and the statistical significance of the discretionary accruals is calculated 26 26 Evidence on Specific Accruals Models such as Jones (1991) use abnormal accruals as a proxy for earnings management But standard setters are more interested in which specific accruals are used in earnings management Depreciation estimates Bad debt provisions Deferred tax valuations 27 27 Modification of EM Research EM as the measure of financial reporting quality EM as the dependent variables is tested with others independent variables (e.g. GCG proxies and audit quality proxies) 28 28 Review Questions Using Jones (1991) model, please: Design the research methodology to investigate whether firm manage their earnings before a significant share repurchases. Design the research methodology to examine whether firm manage their earnings after management transition. Design the research methodology to test whether Big 4 CPA firms provide higher audit quality (lower EM) than non Big 4 CPA firms. 29 29 Assignments 30 30