DETERMINING THE VALUE OF THE BUSINESS

advertisement

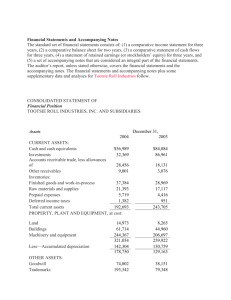

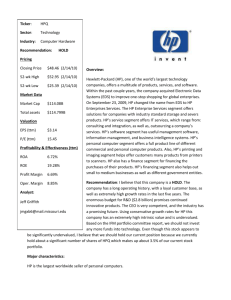

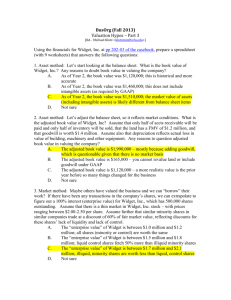

DETERMINING THE VALUE OF THE BUSINESS 1. Balance Sheet Technique—Subtract the Total Liabilities form the Total Assets (answer called net worth). This relies on the company’s net worth as a measure of its value (not recommended). 2. Adjusted Balance Sheet Technique—Make adjustment in the assets and liabilities to be sure that the listed value is today’s value. Then Subtract Total Liabilities from Total Assets (net worth) and that will be the new number that will reflect the actual market value. 3. Excess Earnings Approach—combines the value of future earnings potential to derive a value. A useful technique since it offers an estimate of intangible assets (goodwill) if there is any. Step 1 Step 2 Step 3 Step 4 Step 5 Step 6 Use the dollar amount from the adjusted Balance Sheet Method. (#2 above) Calculate the opportunity cost of investing in the business. Take the number from step 1 and take it times .25 (the investment cost for an average risk business). Add this number to the salary you intend to take from the business. Project new earnings (net profit). Compute extra earning power by subtracting your cost (step 2) from your net profit. Determine the value of intangibles. If the number in step 4 is zero or less, there is no excess earning/goodwill and the value of the business is the same as the amount figured using the adjusted balance sheet method. If the number is greater than Zero you take that number times 3 and add it to the amount from the Adjusted Balance Sheet Method to determine the value of the business. 4. Capitalized Earnings Approach—((Expected net profit minus your salary)/.25) .25 is the investment cost for an average business 5. Discounted Future Earnings Approach—based on the fact that a dollar earned in the future is less than the same dollar earned today. If using a BAII plus Texas Instruments financial calculator. Step 1 Project future earnings for the next five years. Use optimistic + pessimistic + (most likely x 4) divided by 6. This gives an average expected amount. Step 2 Set up your financial calculator as 1 N 25 I/Y 0 PMT expected amount as FV and then CPT PV. For year 2 you will change the N to 2 and change the FV amount to expected amount in year 2. Do this for all 5 years. Step 3 Estimate the income stream beyond 5 years by dividing the amount from year 5 by .25 (investment cost for an average-risk business). Take this amount and plug it into the FV of your calculator with 6 in the N category. This will give you the present value of year 6 and beyond. Step 4 Compute the total value (the sum of the present values for the six figures) If using a regular calculator. Step 1 Project future earnings for the next five years. Use optimistic + pessimistic + (most likely x 4) divided by 6. This gives an average expected amount. Step 2 Take the amount for year 1 times .8000 (present value factor for 1 year out) Take the amount for year 2 times .6400 (present value factor for 2 years out) Take the amount for year 3 times .5120 (present value factor for 3 years out) Take the amount for year 4 times .4096 (present value factor for 4 years out) Take the amount for year 5 times .3277 (present value factor for 5 years out) Step 3 Estimate the income stream for years 6 and beyond dividing the amount from year 5 by .25 (investment cost for an average-risk business) Take this amount times .2621 (present value factor for years 6 and beyond) Step 4 Compute the total value (the sum of the present values for the six figures) 6. Market Approach—uses the price earnings ratios of similar businesses (publicly traded ones) to determine value. Add the PE ratios of like business and divide by the number of PE ratios that you use to arrive at an average. Then multiply your net profit amount times that number to arrive at a value for your company.