amb balanced trust fund

advertisement

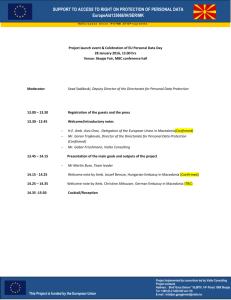

AMB BALANCED TRUST FUND RESPONSIBILITY STATEMENT This Product Highlights Sheet has been reviewed and approved by the directors or authorised committee or persons approved by the Board of Amanah Mutual Berhad and they collectively and individually accept full responsibility for the accuracy of the information. Having made all reasonable inquiries, they confirm to the best of their knowledge and belief, there are no false or misleading statements, or omission of other facts which would make any statement in the Product Highlights Sheet false or misleading. STATEMENTS OF DISCLAIMER The Securities Commission Malaysia has authorised the issuance of AMB Balanced Trust Fund and a copy of this Product Highlights Sheet has been lodged with the Securities Commission Malaysia. The authorisation of AMB Balanced Trust Fund and lodgement of this Product Highlights Sheet should not be taken to indicate that the Securities Commission Malaysia recommends AMB Balanced Trust Fund or assumes responsibility for the correctness of any statement made or opinion or report expressed in this Product Highlights Sheet. The Securities Commission Malaysia is not liable for any non-disclosure on the part of Amanah Mutual Berhad responsible for AMB Balanced Trust Fund and takes no responsibility for the contents of this Product Highlights Sheet. The Securities Commission Malaysia makes no representation on the accuracy or completeness of this Product Highlights Sheet, and expressly disclaims any liability whatsoever arising from, or in reliance upon the whole or any part of its contents. 1 Updated as at September 2015 This Product Highlights Sheet only highlights the key features and risks of this unlisted capital market product. Investors are advised to request, read and understand the disclosure documents before deciding to invest. PRODUCT HIGHLIGHTS SHEET PRODUCT NAME: AMB BALANCED TRUST FUND (AMBBTF) BRIEF INFORMATION ON THE FUND AMBBTF is managed by Amanah Mutual Berhad (AMB). It is a growth and income open-ended fund that pursues steady income and long-term growth through diversified investment in equities, bonds, convertibles, warrants and short-term money market instruments. Therefore the Fund does not provide capital protection or capital guarantee. The Fund’s objective is to provide a balance between income and long-term capital appreciation. PRODUCT SUITABILITY The Fund is suitable for all investors who are seeking a fully managed and balanced portfolio of investments and who have a long-term investment horizon. KEY PRODUCT FEATURES AMBBTF would focus on attaining a balance between long-term income and capital growth. It would invest partly in equities and partly in fixed income securities. AMBBTF’s strategy provides a careful selection of quality listed equities and listed/unlisted bonds, carrying minimum A3 rating by RAM or equivalent. FUND INFORMATION Base Currency MYR (Malaysia Ringgit) Launch Date 19th September 1994 Financial Year End 30th September Domicile Malaysia Registration Securities Commission Malaysia (SC) Manager Min 40% max 58% in equities Min 40% max 58% in fixed income securities Min 2% in Liquid Assets 50% of the performance of the FBM KLCI. 50% Maybank 12 Months Fixed Deposit Rate Note: The risk profile of this Fund is different from the risk profile of the benchmark. Income (if any) is expected to be distributed annually at the Manager’s discretion, subject to the approval from the trustee. Amanah Mutual Berhad (195414-U) Trustee Universal Trustee (Malaysia) Berhad (17540-D) Asset Allocation Benchmark Distribution Policy 2 Updated as at September 2015 Board of Directors Investment Committee Members (ICM) Tun Ahmad Sarji bin Abdul Hamid (Chairman) Tan Sri Dato’ Dr. Wan Mohd. Zahid bin Mohd. Noordin Tan Sri Dato’ Md. Desa bin Pachi External Investment Managers (EIM) CIMB-Principal Asset Management Berhad (304078-K) Auditors Messrs. Ernst & Young (AF:0039) Tax Advisor PricewaterhouseCoopers Taxation Services Sdn Bhd (464731-M) Solicitors Messrs. Zainal Abidin & Co. Tun Ahmad Sarji bin Abdul Hamid (Chairman) Tan Sri Dato’ Sri Hamad Kama Piah bin Che Othman Tan Sri Dato’ Dr. Wan Mohd. Zahid bin Mohd. Noordin Tan Sri Dato’ Md. Desa bin Pachi Encik Mohammad bin Hussin The Fund’s investment strategy does include temporary defensive positions to protect investor from significant losses. The EIM, upon approval from ICM of AMBBTF, will execute temporary defensive positions in dealing with adverse market conditions, unstable economic situation, political upheaval and other external factors affecting market. In this regard, the Fund may hold cash at higher level than what is prescribed in the asset allocation. The fund may also invest into cash equivalent instruments as the main asset in order to maintain low volatility. When there is excessive gains during best market scenario, AMBBTF shall realise as much profits from the portfolio holdings. This will be reflected as income to the Fund. With that, higher income distribution can be declared. KEY RISKS General Risk 1. 2. 3. 4. 5. Market risk Non-compliance risk Inflation risk Liquidity risk Fund management risk 6. 7. 8. 9. Operational risk Returns not guaranteed Loan/financing risk Force majeure risk (Source :Master Prospectus for Conventional Funds – Section 4) Specific risks associated with AMBBTF Equity risk AMBBTF is subject to the volatility of prices in the share market. The volatility of prices in each stock will affect the Fund’s value daily. The performance of individual stocks, which make up the portfolio, will fluctuate according to changes in the market value of the investments. The fluctuations can be significant in the short-term. This accounts for the market risk when investing in this Fund. However, this impact is minimised through portfolio diversification. Credit risk This is the risk that the issuer of a bond or money market instrument may default and not be able to make timely principal and/or interest payments of the instrument concerned which would ultimately cause a reduction in the value of the Fund. Instruments with a lower credit rating would normally have greater risk of defaults. 3 Updated as at September 2015 Interest rate risk This risk refers to how changes in the interest rate environment would affect the performance of a bond or money market instrument. In the event of an increasing interest rate environment, the value of bond or money market instruments in the Fund’s portfolio generally may decline as yields rise. Longer term bond and money market instruments are more sensitive to changes in interest rate. Interest rate, such as the overnight policy rate set by Bank Negara Malaysia, will have an impact on the investment decisions of the Fund. FEES, CHARGES & GST This table describes the charges that you may directly and indirectly incur when you purchase or repurchase units of AMBBTF. Manager / Distribution Channel (% of NAV per Unit) Fund Maximum Sales Charge 1 Repurchase Charge 5.0 Nil AMBBTF Annual Management Fee (% of NAV)2 Annual Trustee Fee (% of NAV) 2 0.75-1.50 Refer Table 1 The sales charge for investments under the EPF Members’ Investment Scheme shall not exceed 3% of NAV per unit, as regulated by EPF. Kindly refer to the Manager for the latest list of Funds approved by EPF for investment. Notes : 1. The sales charge is negotiable, subject to the Manager’s discretion. 2. Annual management fee and annual trustee fee are calculated as the percentage of the NAV of the fund, calculated on a daily basis before deducting the fees for the day. Table 1: Saiz of Fund First RM20 million Next RM20 million Next RM20 million Next RM20 million Next RM20 million Any amount in excess of RM100 million Rate per annum of the NAV of the Fund (%) 0.06 0.05 0.04 0.03 0.02 0.01 Table for switching charges for AMBBTF (Balanced) to other funds of AMB To recipient fund Equity Bond/Sukuk/ Fixed Income Balanced Money Market Up to 1% of amount switched MYR25 per transaction MYR25 per transaction Nil Switching from AMBBTF Distribution units of conventional funds cannot be switched into Shariah funds as it is not permitted under the Shariah perspective. However the principal amount of conventional funds is allowed to be switched into Shariah funds. Note: The above table is applicable for all switching transactions, except where the sales charge of the fund to be switched into is equal or lower than the sales charge of the fund switched from, in which case the switching fee shall be MYR25 only. 4 Updated as at September 2015 Transfer charge A Unit Holder may fully or partially transfer his Units in the Fund to any other Unit Holder in the same Fund. The transfer charge for AMBBTF is MYR25. Other annual operating expenses The auditor’s fees, tax agents’ fee and other relevant professional fees; the costs of printing and distribution of annual and interim reports, tax vouchers and warrants; cost of modification of the Deed other than those for the benefit of the Manager and/or trustee; and other notices to Unit Holders as well as expenses that are directly related and necessary for the administration of the Fund as set out in the Deed (including any applicable GST) shall be paid out of the fund. These costs have been factored into the quoted NAV per Unit as they are related and necessary to the business of the Fund. Goods and Services Tax (GST) On 1 April 2015, GST was implemented at the standard rate of 6% to replace the existing sales tax and service tax systems. Based on the Goods and Services Tax Act 2014 which was gazetted on 19 June 2014, the Fund, being a collective investment vehicle, will be making exempt supplies. Hence, the Fund is not required to be registered for GST purposes. The Fund will incur expenses such as management fees, trustee fees and other administrative charges which will be subject to 6% GST. The 6% input tax which may be incurred on such expenses will generally not be claimable by the Fund. Any fee or charges in relation to the purchase of Units such as sales charge, switching and transfer charges is payable by Unit Holders. The quoted charges for sales charge, switching and transfer charge in the above does not include GST. 5 Updated as at September 2015 VALUATIONS AND EXITING FROM INVESTMENT The valuation of Units is based on the NAV of the Fund and is calculated at the end of the Business Day. The NAV per unit of AMBBTF is available on our website (www.ambmutual.com.my), AMB’s office or any of its Distribution Channels. 1.Pricing of Units The Manager adopts the single pricing policy in calculating your investment. Single pricing equates to prices quoted and transacted at a single price. The price of Units is computed on a Forward Pricing basis. As such, Units of the Fund are transacted at the NAV per Unit at the next Valuation Point after receipt of the completed transaction request and acceptance by the Manager. Consequently, any changes in the underlying assets of the Fund will cause its Unit prices to vary. 2.Procedure to Repurchase Units Repurchase of Units can be made in part or entirety at any time by completing the repurchase form, which can be obtained at AMB’s office or any Distribution Channels. Below are the required documents/forms to be submitted to repurchase Units: (a) Individual investor (single or joint applicants) i. Completed repurchase form. ii. Photocopy of identity card, birth certificate (if joint applicant is a minor) or passport (if necessary). (b) Corporate investor i. Completed repurchase form. ii. Board resolution or any other necessary authorisation (if necessary). Partial repurchase of Units is permitted provided the applicable minimum holding is maintained for the Fund. There is no restriction on frequency of repurchase and number of Units a Unit Holder can redeem subject to the applicable minimum holdings. The Manager may elect not to permit a partial repurchase if the effect thereof would be that the Unit Holder holds less than the minimum holding applicable. 3. Payment for Repurchase of Units (a) By cheque Unit Holders will receive withdrawal proceeds payment by cheque payable to the Unit Holder's or jointholders' names only. The cheques will be mailed to the address of the Unit Holders based on the application form or as may be subsequently notified in writing to the Manager.Any charges incurred such as charges for outstation cheque will be borne by the Unit Holders. (b) Transfer to a bank account Unit Holders may give AMB an instruction in writing to transfer the repurchase proceeds to Unit Holders' nominated local bank account held in Unit Holders' own name. All bank charges for the transfer will be borne by the Unit Holders. The charge will be deducted from the repurchase amount before being paid to the Unit Holders relevant bank account. Unit Holders are required to provide AMB with the relevant bank account details in order for AMB to proceed with the transfer request. It is possible for delays in the banking system to occur which are beyond our control. If the funds cannot be transferred,AMB shall draw a cheque payable to the Unit Holders. Unit Holders may give AMB instruction in writing to transfer the repurchase proceeds to the Unit Holders' nominated bank account overseas held in Unit Holders' own name. All bank charges for the transfer will be borne 6 Updated as at September 2015 by the Unit Holders. The charge will be deducted from the repurchase amount before being paid to the Unit Holders’ relevant bank account. Note: No repurchase proceeds will be paid in cash under any circumstances. 4. Unit Pricing & Cut-off Time for Repurchase of Units Applications to repurchase Units will be processed on the same Business Day if received by 2.30 p.m. The applicable repurchase price would be based on the NAV per Unit at the end of the Business Day on which the application to purchase is received by the Manager. Any application received or deemed to have been received after this cut-off time would be considered as being transacted on the next Business Day and would be subjected to the Manager’s pricing on the next Business Day. The Manager will pay the net repurchase proceeds to the Unit Holder or the Unit Holder’s EPF account (where applicable) within 10 days from the receipt of the request to repurchase provided that all documentation are complete. In the event of any technical difficulties beyond the Manager’s control or should the redemption request result in the sale of assets which cannot be liquidated at an appropriate price or on adequate terms and is as such not in the interest of the existing Unit Holders, redemption monies may be paid at such other period as may be permitted by the relevant authorities from time to time. 7 Updated as at September 2015 CONTACT INFORMATION 1. For any enquiries and / or complaint (internal dispute resolution), you may contact: (a) AMB Client Services Unit (CSU): Tel : +603-2034 0800 Fax : +603-2162 5958 / +603-2163 3212 Email : ambcare@pnb.com.my Or you may also file your dispute at our premise: Amanah Mutual Berhad 34th Floor Menara PNB 201-A JalanTun Razak 50400 Kuala Lumpur (b) Distribution Channels Please refer to Section 20 of the Master Prospectus for Conventional Funds for details on the appointed Distribution Channels. Alternatively, you may also visit AMB’s website at www.ambmutual.com.my 2. If you are dissatisfied with the outcome of the internal dispute resolution process, please refer your dispute to the Securities Industry Dispute Resolution Center (SIDREC): (a) via phone to (b) via fax to (c) via email to : 03-2282 2280 : 03-2282-3855 : info@sidrec.com.my (d) via letter to : Securities Industry Dispute Resolution Center (SIDREC) Unit A-9-1, Level 9, Tower A Menara UOA Bangsar No. 5, Jalan Bangsar Utama 1 59000 Kuala Lumpur 3. You can also direct your complaint to the Securities Commission even if you have initiated a dispute resolution process with SIDREC. To make a complaint, please contact the SC’s Investor Affairs & Complaints Department: (a) via phone to the Aduan Hotline at : 03-6204 8999 (b) via fax to : 03-6204 8991 (c) via e-mail to : aduan@seccom.com.my (d) via online complaint form available at www.sc.com.my (e) via letter to : Investor Affairs & Complaints Department Securities Commission Malaysia 3 Persiaran Bukit Kiara Bukit Kiara 50490 Kuala Lumpur 8 Updated as at September 2015 APPENDIX : GLOSSARY “AMB” or “Manager” Amanah Mutual Berhad (195414-U). “AMBBTF” or “ the Fund” AMB Balanced Trust Fund. “Bursa Malaysia” The Malaysian stock exchange, operated and maintained by Bursa Malaysia Securities Berhad (635998-W). “Currency” The base currency of the Fund i.e MYR (Malaysian Ringgit). “Business Day(s)” A day on which the Bursa Malaysia is open for trading in securities. “Deed(s)” The deed(s) including any supplementary deed(s) between the Manager, the trustee and the Unit Holders for the Fund. “Distribution Channels” An institution, corporation or an organisation that is appointed by AMB for the purpose of marketing and distributing the Fund inside and outside Malaysia as allowed by the applicable laws. Details are provided in Master Prospectus for Conventional Funds dated 17th September 2015 on Section 20 page 190. “EPF” Employees Provident Fund. “External Investment Manager” or “EIM” The external investment manager Management Berhad (304078-K). “Forward Pricing” The price of a Unit that is the NAV per Unit calculated at the next Valuation Point after an instruction or a request is received. “FBM KLCI” FTSE Bursa Malaysia KLCI. “GST” Goods and Services Tax. “Investment Committee” or “IC” The investment committee of the Fund which is primarily responsible for formulating, implementing and monitoring the investment management strategies of the Fund in accordance with the investment objectives of the Fund. “Liquid Assets” Financial assets with characteristics including, but not limited to, the following: (i) easily convertible in large sums into cash at short notice; (ii) low counter –party credit risks; and (iii) have sufficiently deep secondary market which continues to exist during Tight liquidity situations. (Source: Bank Negara Malaysia Liquidity Framework 1998) “Long Term” A period of more than five (5) years. “NAV" or “Net Asset Value” The NAV of the Fund is determined by deducting the value of all the Fund’s liabilities from the value of all the Fund’s assets, at the Valuation Point. For the purpose of computing the annual management fee and annual trustee fee, the NAV should be inclusive of the management fee and trustee fee for the relevant day. “RAM” RAM Rating Services Berhad (208095-U). “SC” or “Securities Commission” Securities Commission Malaysia. 9 of the fund, CIMB-Principal Asset Updated as at September 2015 “Unit Holder(s)” A person or persons registered as holder(s) of Units of the Fund and whose name(s) appear(s) in the register of Unit Holder “Units” Units of the Fund. “Valuation Point” Such time(s) on a Business Day as may be decided by the Manager wherein the NAV of the Funds is calculated. Under normal circumstances, only one (1) valuation is conducted on each Business Day. For Funds with no foreign investments, the valuation of NAV of the Funds is conducted on each Business Day at the close of Bursa Malaysia. For Funds with foreign investments, the valuation of the Funds will be conducted after the close of business of Bursa Malaysia for the relevant day, as certain foreign markets in which the Funds may invest in have yet to close due to the different time zones of these countries. As such, the Valuation Point will thus be after the close of Bursa Malaysia but not later than 9.00 a.m. (or any other such time as may be permitted by the relevant authorities from time to time) on the following day in which the Manager is open for business. 10 Updated as at September 2015