'AMB VALUE TRUST FUND, AMB ETHICAL TRUST FUND AND

advertisement

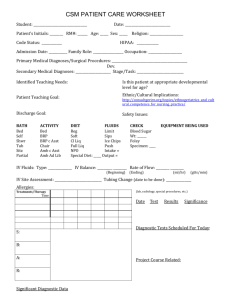

‘AMB VALUE TRUST FUND, AMB ETHICAL TRUST FUND AND AMB DIVIDEND TRUST FUND’ PROMOTION TERMS AND CONDITIONS 1. ELIGIBILITY This promotion is open to all Amanah Mutual Berhad’s new and existing investors aged 18 years and above. You may have a joint holder on your account. A designated account can be arranged for a joint holder below 18 years of age. 2. CAMPAIGN PERIOD This promotion is valid from 10 January 2011 until 30 June 2011, or such date(s) as may be determined by AMB at its sole discretion from time to time.* 3. SALES CHARGE The sales charge of 3% is only applicable for cash investment during the campaign period. Upon expiry of the said campaign period, the normal sales charge of 6.5% shall apply. 4. EPF INVESTMENT Purchases of unit trust fund under EPF Members Investment Scheme (EPF-MIS) are allowed for this promotion. The sales charge for unit trust under EPF-MIS is capped at 3% at all times subject to the rules and regulations by the EPF. Based on circular by Federation of Investment Managers Malaysia (FIMM) dated 3 September 2010, AMB funds approved under EPF-MIS are AMB Dana Ikhlas (AMBDI), AMB Dana Yakin (AMBDY), AMB Dividend Trust Fund (AMBDTF), AMB Ethical Trust Fund (AMBETF), AMB Index-Linked Trust Fund (AMBILTF), AMB Lifestyle Trust Fund 2014 (AMBLTF 2014), AMB Lifestyle Today (AMBLTF Today), AMB Unit Trust Fund (AMBUTF) and AMB Value Trust Fund (AMBVTF). 5. INITIAL INVESTMENT The minimum initial investment of the funds is RM 500. Subsequent investments can be made with a minimum of RM 100. 6. PAYMENT OF INVESMTENT Payment of investment can be in the form of cash, cheques and bank drafts. Payments by cheques/bank drafts must be made out in favour of “Amanah Mutual Berhad” and crossed “Account Payee Only”. 7. JOINT APPLICANT In the case of joint holder of units, who is 18 years of age and above, then both parties must sign the Application Form. In the case of death of a joint holder of units, the survivor will be the only person recognized by the Manager and the Trustee as having any little to or interest in such units. A joint holder who is below 18 years of age, a photocopy of his/her Identity Card or Birth Certificate must be enclosed. In the case of death of the first registered holder and before the minor attains the age of 18, the estate of the first registered holder will be recognized by the Manager and the Trustee as having the title to or interest in such units. For accounts with joint registered holders of units, all correspondences and payments relating to the units will be sent only to the first registered holder. 8. STATEMENT A statement will be issued upon receipt and acceptance of the application by the Manager. In case of joint holders, all correspondence and payments relating to the units will be sent to the first-named applicant. Statement will be dispatched by post at investors own risk. 9. REDEMPTION OF UNITS The registered holder may sell all or part of the units by completing and signing the form of Request to Repurchase. The redemption price shall be based in the Net Asset Value (NAV) price determined at the close of the business day on which the completed and valid repurchase request is received by the Manager. The Manager shall not comply with the request to repurchase or transfer of units if such compliance would result in the requisitioner being a Registered Holder of less than minimum balance. 10. COOLING OFF PERIOD A cooling off right is only given to an investor, other than those stated in Clause 11.10 of the Securities Commission Guidelines on Unit Trust Funds, who is investing in any unit trust funds managed by the Manager for the first time. The cooling off period is six (6) business days commencing from the date of purchased i.e. the date in which investment amount. Please refer to the latest Master Prospectus for calculation of refund. 11. RIGHTS OF MANAGER The Manager reserves the right to accept or reject any application in whole or part there of without assigning any reason. 12. DISCLAIMER Investors are advised to read and understand the content of the Master Prospectus dated September 17, 2010 and expires on September 16, 2011. If in doubt, please consult a professional adviser. For information concerning certain risk factors which should be considered by prospective investors, see “Risk Factors” commencing on page 37 of the abovementioned Master Prospectus.