Chapter 4 Financial Markets The demand for money Assumptions

advertisement

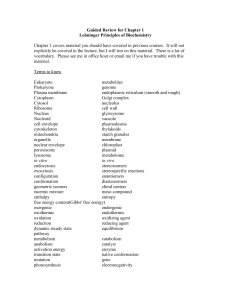

ECON2123 (Spring 2012) 14 & 15.3.2012 (Tutorial 5) Chapter 4 Financial Markets The demand for money Assumptions: There are only two assets in the financial market: money and bonds Price is fixed and Y is given, that is nominal GDP is given Wealth = Md + Bondd Money: high liquidity, but pays no interest (currency and checkable deposits) Bond: pays interest but cannot be used for transactions A person’s choice: hold currency or to buy bonds Trade off between holding money and bonds: liquidity and return Money demand depends on: (1) level of transactions, (2) interest rate on bonds, (3) other factors, like transaction cost and liquidity of bonds. Money demand function: Md = PL(i, Y) (Overall Money Demand) Money demand positively depends on Y and negatively depends on i. The determination of interest rate (1) The supply and demand for currency: Ms = PL(i, Y) (2) The supply and demand for central bank money: H = CUd + Rd (3) The supply and demand for reserves (Fed fund market): H – CUd = Rd H (4) Money Multiplier: PL (i, Y ) [c (1 c)] 1 The determination of interest rate (I): Supply and demand for currency Assume all money is currency, so there are no checking accounts or banks. Money demand function: Md = PL(i, Y) Money supply: M = Ms Money supply determined by central bank in most countries. (FED in US). The quantity supplied of money is independent of interest rate. The central bank can change money supply by conducting open market operations (OMO). If the central bank wants to increase money supply, it will buy bonds. (expansionary) If the central bank wants to reduce money supply, it will sell bonds. (contractionary) Balance sheet for the central bank: Assets Liabilities Bonds Currency Considers open market operations in terms of their effect on bond prices. Suppose a bond promises a payment of F (face value) in one year, PB is the current price of bonds. Then, interest rate (or rate of return) on this bond is given by i = (F – PB ) / PB PB =F /(1+ i) Nominal interest rate and the bond price are inversely related. For example, when the central bank purchases bonds, it increases the demand for them and tends to increase their price, which reduces the interest rate. Money market equilibrium The money market equilibrium is determined by the demand and supply of money. i Ms In the money market equilibrium, Md = Ms Equilibrium interest rate = i*. i* Md (given Y) Change in equilibrium (e.g. Y changes) M M* 2 The determination of interest rate (II): Supply and demand for Central bank money (H) Assume money includes currency and checking accounts in banks Banks receive funds from depositors (individuals and firms) and allow their depositors to write checks against (or withdraw) their account balances Balance sheet of banks: Assets Bonds Loans Reserves Balance sheet of central bank: Assets Bonds Liabilities Checkable deposits Liabilities Central bank money = Reserve + Currency Demand for central bank money = demand for currency + demand for reserves by banks Supply of money is controlled by the central bank (H: supply of central bank money) Equilibrium: H= CUd + Rd Demand for currency (CUd) Recall Md = $YL(i), people hold money in the form of currency by a fraction of c and in the form of checkable deposit by a fraction of (1 – c) where 0 < c < 1. Md = CUd + Dd = cMd + (1 – c)Md Demand for currency: CUd = cMd Demand for reserves (Rd) Banks hold reserves in part to protect against daily excesses of withdrawals (in currency or check form) over deposits and in part because they are required to do so by the central bank by a fraction of of their deposits. (reserve ratio) Demand for reserves: Rd = D = (1– c) Md The demand for central bank money H = Hd = CUd + Rd H = Hd = cMd + (1– c) Md H = Hd = [c + (1 – c)]PL(Y, i) The supply of central bank money is equal to the demand for central bank money i i H * In the money market equilibrium, H= CUd + Rd Equilibrium interest rate = i*. Hd = CUd + Rd H H 3 The supply and demand for reserves: Fed fund market Fed fund market: the market for bank reserves, and federal funds rate is determined. H = CUd + Rd H – CUd = Rd Supply of reserves = demand for reserves Money Multiplier H = [c + (1 – c)]PL(Y, i) H 1 MS is the money multiplier PL (i, Y ) where [c (1 c)] [c (1 c)] The money supply equals central bank money times the multiplier the central bank can control the money supply by controlling H c and are assumed to be fixed, 0 < c < 1 and 0 < <1, money multiplier > 1 An increase in central bank money leads to a larger increase in the overall money supply The Fractional reserve banking and the money multiplier A given increase in currency deposits creates only a fractional increase in bank reserves. The remainder of the deposit increase is used to purchase bank assets (e.g., bonds). The purchase puts more money in the hands of the non-bank public and hence creates more checkable deposits, and so on. Assume people hold currency and checkable deposit in the proportion of c and (1 – c) out of the overall demand for money, reserve ration is Suppose central bank increases H by $1 by buying bonds from Seller 1 Seller 1 gets $1, hold $c as currency and deposit $(1 – c) in a checkable account in Bank A Bank A keeps $ (1 – c) in reserves and buys bonds with $(1 – )(1 – c) from Seller 2 Seller 2 gets $(1 – )(1 – c), hold $c(1 – )(1 – c) and deposits $(1 – c)(1 – )(1 – c) in a checkable account in Bank B Bank B keeps $ (1 – c)(1 – )(1 – c) in reserves and buys bonds with $(1 – )(1 – c)(1 – )(1 – c) from Seller 3 … … Seller 3 gets $[(1 – )(1 – c)]2 Total increase in money supply Total increase in money supply = = $1 + $(1 – )(1 – c) + $[(1 – )(1 – c)]2 … … 1 = $1 [c (1 c)] H (overall money supply) [c (1 c)] 4 Example: Assume people only hold checking account, so c = 0 and = 0.1, so the money multiplier is 1/ Suppose H increases by 100 by buying bonds from Seller 1 Seller 1 deposit 100 in a checking account in Bank A Bank A keeps 10 in reserves and buys bonds with 90 from Seller 2 Seller 2 deposit 90 in a checking account in Bank B Bank A keeps 9 in reserves and buys bonds with 81 from Seller 3 … … … Total increase in money supply =100 + 100 (0.9) +100(0.92) +…+100(0.9n) = 100 [1/ (1 – 0.9)] = 1000 = H + H (1 – ) + H (1 – ) 2 +…+ H (1 – ) n = H [1/ (1 – (1 – )] = H/ (assume c = 0) Examples and Problems Question 1 Suppose that real money demand is given by Md = $Y(0.25 – i) where Y is $100. Also, suppose that the supply of money (Ms) is $20. Assume equilibrium in financial markets. (a) What is the real interest rate? In the equilibrium, Ms = Md 20 = 100 (0.25 – i) i = 0.05 (5%) (b) If the Federal Reserve Bank wants to increase i by 10% (from 5 to 15%), at what level should it set the supply of money? Let the new money supply be (Ms)’, (Ms)’ = 100 ( 0.25 – 0.15) (Ms)’ = 10 Question 2 A bond promises to pay $100 in one year. (a) What is the interest rate on the bond if its price today is $75? 85? 95? PB (1+ i) = 100 Solving for r When PB = $75, i = 33% When PB = $85, i = 18% When PB = $95, i = 5% (b) What is the relationship between the price of the bond and the interest rate? Negative (c) If the interest is 8%, what is the price of bond today? PB (1+ i) = 100 PB (1+ 8%) = 100 PB (1+ i) $93 5 Question 3 Suppose that a person’s yearly income is $80000. Also suppose that her money demand funciton is given by Md = $Y(0.3 – i). (a) What is her demand for money when the interest rate is 4%? 8% When i = 0.05, Md = 20800. When i = 0.1, Md = 17600 (b) Describe the effect of the interest rate on money demand. Explain. Money demand decreases when interest rate increases becauses bonds, which pay interest, become more attractive. (c) Suppose that the interest rate is 4%. In percentage term, what happens to the demand for money if her yearly income is reduced by 50%? New income = 40000, Md = 10400, that is demand for money drops by 50%. (d) Suppose that the interest rate is 8%. In percentage terms, what happens to the demand for money if her yearly income is reduced by 50%? New income = 40000, Md = 8800, that is the real demand for money falls by 50%. (e) Summarize the effect of income on money demand. How does it depends on the interest rate? A 1% increase (decrease) in income leads to a 1% increase (decerease) in real money demnad. The effect is independent of the interest rate. Question 4 Suppose that a person’s wealth is $50000 and that her yearly income is 60000. Also suppose that her money demand funciton is given by Md = Y(0.35 – i). (a) Derive the demand for bonds. What is the effect of an increase in the interest rate by 10% on the demand for bonds? BD = 50000 – 60000(0.35 – i). An increase in the interest rate of 10% increases bond demand by $6000. (b) What are the effects of an increase in wealth on money and on bond demand? Explain. An increase in wealth increases bond demand, but has no effect on money demand, which depends on income. (c) What are the effects of an increase in income on money and on bond demand? Explain. An increase in income increases money demand, but decreases bond demand, since we implicitly hold wealth constant. (d) “When people earn more money, they obviously will hold more bonds.’ What is wrong with this sentence? When people earn more income, this does not change their wealth right away. Thus, they increase their demand for money and decrease their demand for bonds. 6 Chapter 5 Good and Financial Markets: The IS-LM Model The IS curve: Goods market equilibrium IS curve: it captures the relationship between output and the interest rate such that the goods market is in equilibrium. In the goods market equilibrium, Aggregate supply of Goods = Aggregate demand for goods/ Total saving = Investment Y = C (Y – T) + I (Y, i) + G = ZZ I = I (Y, i): Investment positively depends on Y and negatively depends on i. Other factors affecting investment 45 ZZ ZZ A (For i) D ZZ’ (For i’) C Suppose there is an increase in interest rate (cost of borrowing for investment) Investment decreases Demand decreases Y decreases Equilibrium in goods market implies that the higher the interest rate, the lower the equilibrium level of output IS curve is downward sloping When i increases Firms borrow less and invest less Fall in I, since Y = C + I + G, therefore Y falls Movement along the IS curve Points on the left of IS Excess demand for goods (point D) Points n the right of IS Excess supply of goods (Point C) B Y Y** Y* B C i i’ ED for goods ES of goods i D A IS (G, T…etc) Y Y** Y* Factors shifting the IS curve: change in G, T, C0, I0…etc Factors affecting the slope of IS curve: MPC, MPI IS curve is flatter with higher MPC and MPI 7 The LM curve: Financial market equilibrium LM curve: it captures the relationship between output and the interest rate such that the financial market is in equilibrium. In the money market equilibrium, Real money demand = Real money supply Ms/P = YL(i) Ms1/P i i ES of money ED for money LM(Ms1/P) i= 30% i = 20% i =10% E B C i =30% C E i = 20% D A B D A i =10% Md/P(Y3=3000) Md/P(Y1=1000) Md/P(Y2=2000) M/P Y Y1=1000 Y3=3000 Y2=2000 At a higher level of Y, people demand more money at every interest rate The demand curve for money shifts out when Y increases, and equilibrium interest rate rises. Y and i are positively related All points on the left of LM Excess supply of money At Y1 = 1000, and i= 20% (Point E) All points on the right of LM Excess demand for money At Y3 = 3000, and i= 20% (Point D) Factors shifting the LM curve: change in Md/P (due to factors other than Y), Ms/P, introduction of credit card…etc Factors affecting the slope of LM: sensitivity of money demand to income and sensitivity of money demand to interest LM curve is flatter when sensitivity of money demand to income is lower and sensitivity of money demand to interest is higher 8 Goods market and financial market equilibrium i LM(Ms/P) i1 When the goods market and the financial market are simultaneous in equilibrium, interest rate and output is determined by the intersection point of IS and LM curve. IS (G, T) Y Y1 i LM( ( Ms / P) i2 i1 IS’ ( G2 , Taxes ) IS ( G1 , Taxes ) Y1 Fiscal policy: change in G or T Suppose G increases IS curve shifts out Interest rate and Y increases. C increases, I may increase or decrease, Md/P remains unchanged Crowding out effect Y Y2 i LM( ( Ms1 / P) LM’( Ms 2 / P ) Monetary policy: change in Ms/P Suppose Ms/P increases LM curve shifts out Interest rate falls and Y increases i1 [Ms/P increases, then i falls. When i falls, I increases and Y increases] i2 IS (G, T) Y1 Y2 Y C increases, I increases, Md/P increases Effectiveness of fiscal and monetary policy It depends on the slope of IS and LM curves Policy Mix: Combination of fiscal and monetary policy 9 Examples and Problems Question 1 Consider first the goods market model with constant investment that we saw in Chapter 3: C = c0 + c1YD and I, G and T are given. (a) Solve for the equilibrium output. What is the value of the multiplier? In the goods market equilibrium, Y = c0 + c1(Y – T) + I + G = ZZ Y = [1/ (1 – c1)] [c0 + I + G + c1T] The multiplier is 1/ (1 – c1) Now, let investment depend on both sales and the interest rate: I = b0 + b1Y – b2i (b) Solve for equilibrium output. At a given interest rate, is the effect of a change in autonomous spending bigger than what it was in part (a)? Why? (Assume c1 + b1 < 1.) In the goods market equilibrium, Y = c0 + c1(Y – T) + I + G = Z Y = c0 + c1Y – c1T + b0 + b1Y – b2i + G Y = [1/ (1 – c1 – b1)] [c0 – c1T + b0 – b2i + G] The multiplier is 1/ (1 – c1 – b1) 1/ (1 – c1 – b1) > 1/ (1 – c1) Effect of a change in autonomous spending is bigger than in part (a). An increase in autonomous spending now leads to an increase in investment as well as consumption. Next, write the LM relation as follows: M/P = d1Y – d2i (c) Solve for the equilibrium output. (Hint: Eliminate the interest rate from the IS and LM relations.) Derive the multiplier (the effect of a change of one unit in autonomous spending on output). M/P = d1Y – d2i, rearrange the terms, i = (d1Y – M/P) / d2 Substitute i = (d1Y – M/P) / d2 into Y = c0 + c1Y – c1T + b0 + b1Y – b2i + G Y = c0 + c1Y – c1T + b0 + b1Y – b2 [(d1Y – M/P) / d2] + G Y = [1/ (1 – c1 – b1 + b2d1 / d2)] [c0 – c1T + b0 + (b2 M/P)/d2 + G] The multiplier is 1/ (1 – c1 – b1 + b2d1 / d2) (d) Is the multiplier you obtained in part (c) smaller or larger than the multiplier you derived in part (a)? Explain how your answer depends on the parameters in the behavioral equations for consumption, investment, and money demand. Comparing 1/ (1 – c1) and 1/ (1 – c1 – b1 + b2d1 / d2), 1/ (1 – c1 – b1 + b2d1 / d2) is greater than 1/ (1 – c1) if (b1 – b2d1 / d2) >0. The multiplier in this part will be larger if b1 is large, b2 is small, d1 is small, and/or d2 is large. That is, if investment is very sensitive to Y, investment is not very sensitive to i, money demand is not very sensitive to Y, money demand is very sensitive to i. 1/ (1 – c1 – b1 + b2d1 / d2) is smaller than 1/ (1 – c1) if (b1 – b2d1 / d2) < 0. The multiplier in this part will be smaller if b1 is small, b2 is large, d1 is large, and/or d2 is small. That is, if investment is not very sensitive to Y, investment is very sensitive to i, money demand is very sensitive to Y, money demand is not very sensitive to i. 10