major trend index - The Leuthold Group

advertisement

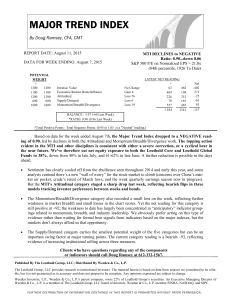

MAJOR TREND INDEX By Doug Ramsey, CFA, CMT REPORT DATE: August 19, 2015 MTI DECLINES to NEGATIVE Ratio: 0.88...down 0.02 S&P 500 P/E on Normalized EPS = 21.1x (84th percentile, 1926 To Date) DATA FOR WEEK ENDING: August 14, 2015 POTENTIAL WEIGHT + 1200 1200 1100 1100 1200 1200 600 600 1800 1800 Intrinsic Value Economic/Interest Rates/Inflation Attitudinal Supply/Demand Momentum/Breadth/Divergence Gain 7 Gain 16 Loss 17 Gain 32 Loss 73 LATEST NET READING + 62 457 477 190 211 253 78 139 526 507 1354 1546 Net -395 287 -42 -61 19 -192 BALANCE : -192 (-157 Last Week) *RATIO: 0.88 (0.90 Last Week) *Total Positive Points : Total Negative Points. (0.95 to 1.05 is a "Neutral" reading.) The Major Trend Index fell a bit further into negative territory in the week ended August 14th, dropping 0.02 to 0.88. The Momentum/Breadth/Divergence category again took the largest hit, with a major momentum submodel moving to a maximum bearish positive for the first time since the second half of 2011. Net equity exposure in both the Core and Global Funds remains unchanged after last week’s reduction to 38%. We wouldn’t rule out a move to an even more defensive posture in the weeks ahead (to 30-33% exposure), but we’ll need a little more evidence before doing so. Regardless of whether the indicators afford us that opportunity, stock market risks have shot up significantly. The Momentum/Breadth/Divergence category remains incredibly weak (+19) given that the S&P 500 now trades within 2% of its May 21st all-time high. Contrast this action to the week of the October 9, 2007 market top, when this category enjoyed a solid reading of +750 (… although the overall MTI had turned negative three months earlier). In other words, our 40-plus metrics relating to breadth, industry leadership, market momentum, and trend now rate significantly worse than at the last major market top. We can’t rule out a false alarm (and a bull market as long as this one is bound to sound a few of them), but the deterioration across other MTI categories amplifies this particular alarm. We’ve noted that the market has made several important intermediate-term lows coincident with a fleeting move by our Attitudinal composite into net positive territory. However, the market has so far had a tepid response to the net positive readings recorded the last two weeks of July, and the net reading is again in the negative zone— though not yet troublesome at –42. In any event, the market’s failure to bounce on this development is another change in market character. Clients who have questions regarding any of the components or indicators should call Doug Ramsey at 612-332-1567. Published By The Leuthold Group, LLC; Distributed By Weeden & Co., L.P. The Leuthold Group, LLC provides research to institutional investors. The material herein is based on data from sources we considered to be reliable, but it is not guaranteed as to accuracy and does not purport to be complete. Any opinions expressed are subject to change. Weeden Investors, L.P., Weeden & Co., L.P.'s parent company, owns 22% of Leuthold Group’s securities. An Executive Managing Director of Weeden & Co., L.P. is a member of The Leuthold Group, LLC board of directors. Weeden & Co., L.P. member FINRA, NASDAQ, and SIPC. FURTHER DISTRIBUTION OF INFORMATION CONTAINED IN THIS REPORT IS PROHIBITED WITHOUT PRIOR PERMISSION.