to the PDF

advertisement

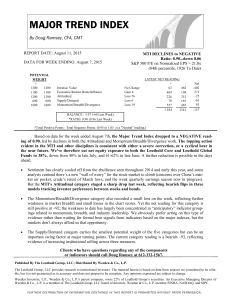

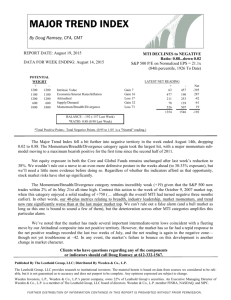

WEALTH MANAGEMENT April 30, 2015 by Brian Andrew & Doug Ramsey Opportunities in Global Markets ON THE RECENT STOCK MARKET STRENGTH By: Doug Ramsey We’ve described ourselves as reluctant bulls with our quantitative discipline driving our equity exposure. We look at economic data, sentiment and other data to create the Moving Trend FIGURE 1 Indicator (MTI) and what’s carried it is a momentum-type convergence, which in turn has driven the market. Most stocks participated fairly uniformly, which argues for market strength to continue. When most stocks are participating, odds are you will see higher highs. Internal strength tells us there should be higher highs ahead, but it is hard to see much beyond 4-6 months. Source: Leuthold Weeden Capital Management We see a couple early signs of potential problems. Transportation stocks have been a leading indicator of trouble for stocks. When this average starts to slow down, it isn’t a good sign. Over the last few years, these stocks have been on a tear – especially airlines – but they have recently turned. If we see further deterioration, that will be an official yellow flag. Additionally, high yield credit market spreads started to widen last summer, and when this happened in June of 2007, it led to trouble. Just 4 months later the stock market FIGURE 2 peaked. We’ve now had 10 months of widening spreads in the high yield market, which is a warning sign. ON CURRENT EQUITY VALUATIONS Stocks are considerably more expensive than Wall Street analysts say when using normalized earnings. Professor Robert Shiller suggested normalizing earnings by smoothing out earnings over ten years and then calculating a Profit Earnings Ratio (P/E) using this smoothing of highs and lows. Our preference is to take five year normalized earnings to look at where the market is priced. Using the five year measure, we had a bull market top in 1983 at just 11.3 times normalized earnings; but at the top of the tech bubble in 2000, the market topped out at 32.1 times. Take all of the bull market tops since 1950 and the average P/E ratio for the S&P Index with smoothed earnings is 28 times. We’re currently at 22 times. If markets were to roll over today, it Source: Leuthold Weeden Capital Management Cleary Gull | 100 East Wisconsin Avenue, Suite 2400 | Milwaukee, WI 53202 | (414) 291-4500 | (888) 349-1600 | clearygull.com | Copyright©2015 WEALTH MANAGEMENT April 30, 2015 would be at a pretty normal point. We argue that force of momentum will push at least the S&P Index and the Dow Index higher for at least four to six months. In the U.S. equity markets, the median stock P/E ratio is 21 times earnings, which is more expensive than the median stock values in October of 2007 or in 2000. U.S. Stocks are about 10% more expensive than we were at the last two bull market tops. In addition, the earnings are benefiting from far-and-away record profit margins, with typical net profit margin now at a record of over 10%. ON FORECASTING THE ECONOMY AND ENERGY It is well known that the stock market is a leading indicator of the economy. When we look at business cycle peaks, when the U.S. economy tops out, what does the stock market do in the 12 months leading up to that peak? In the past 11 of 12 tops, stock prices have been down, with an average decline of 9%. The only exception is in 1980 when stocks were flat. The stock market anticipates downturns and is rarely taken by surprise by an economic decline. FIGURE 4 The good news is valuations around the world are not quite as high. If we look at the MSCI USA Index for U.S. equities, prices are at 22.5 times earnings. The rest of the developed world trades at only 17 times earnings looking at the MSCI World Ex U.S. Index. There may also be value to be had in the less developed world. The MSCI Emerging Market Index is at 12.2 times earnings or almost half of the U.S. index value. This suggests developed Europe and emerging markets stocks may perform well over the next two to three years. Europe has real structural challenges, but those markets should do better than the U.S. indices. FIGURE 3 Page 2 Source: Leuthold Weeden Capital Management In contrast, few people forecasted the large drop in energy prices at the end of 2014. Fortunately, our models have kept us out of energy over the past year; but now the energy sector is shaping up to be an interesting value play. Supply is the issue. We have seen a lot of spending in commodity oriented pockets of the economy, creating a commodity production boom not just here, but globally. The capital spending of commodity producers in 2001 was $15 billion; in 2012 it was $120 billion. The level of capital spending is still quite high and it seems there is still more excitement than fear. Even though the price of oil is down sharply, we don’t see a lot of angst. So, we wouldn’t be surprised if there was another $15 to $20 (per barrel) downside to oil prices. Source: Leuthold Weeden Capital Management 36 Managing Cycles Page 3 ON PORTFOLIO CONSTRUCTION FIGURE 6 By: Brian Andrew We want to offer a view on portfolio construction given the ideas presented by Doug and others that inform our thinking. We find investor manager styles, like markets, move in cycles, so it becomes critical to identify where you are in the cycle as an investor. Decision making should not be binary – ‘I like the market or I don’t like the market,’ buy or sell. In downturns, the normal reaction is to sell out of the market rather than looking at how to stay in the market and become more defensive. Stock Market Layers • Top down vs. bottom up • Market cycle • Active vs. Passive • Valuation criteria • Stock selection criteria • Sectors/Industries Source: Cleary Gull ON THE ECONOMIC CYCLE FIGURE 5 $250 Domestic $100 Invested in March 2005 200 Standard & Poor's 500 Stock Index 150 100 Less 6 Best Months 05 06 07 08 09 10 11 12 We begin by looking at where we are in the economic cycle. With Total $216.12 8.01 the exception of commodities, Less 1 Mo. $198.75 7.11 most asset classes have done Less 2 Mos. $181.41 6.14 pretty well over the past couple Less 3 Mos. $168.68 5.37 of years, with both U.S. stocks Less 4 Mos. $157.65 4.66 and bonds up dramatically. Even Less 5 Mos. $144.75 3.77 real estate has gone up fairly Less 6 Mos. $130.49 2.70 dramatically. But how each asset T-Bills $114.48 1.36 class performs varies based on the time in the cycle. If we review the last five stock market declines of 15% or more, some patterns begin to emerge. Before a downturn, we see a relative outperformance 15 by intermediate bonds as an asset class. After the downturn, we see that they fall to the bottom in relative performance and that intuitively makes sense. But perhaps less obvious, small cap stocks underperform in the three months before a drop while after the drop, it is one of the best relative performers as an asset class. Another similar cycle can be seen in the relative outperformance of growth stocks compared to value stocks after a major downturn. S&P 500 Ending 10 Yr. Stock Index Value CAR 13 14 Source: Crandall, Pierce & Company If we look at attempts at market timing, you can see on this chart (Figure 5) of returns for the S&P 500 Index over the last 10 years, there is an 8% return over that period. If you missed just the one best month, the return drops to 7.1%. If you missed just the top 6 months of the 120 months in this period, the return drops to 2%. Trying to time the market by getting in and getting out doesn’t make much sense. Instead, we make an effort to allocate to different approaches or styles to manage downturns, rather than selling out completely. When we consider the variety of investment strategies and different approaches, we see the market in various layers (see Figure 6). Each of these layers can offer us a method to express what we feel is happening in the market at that time. ON ACTIVE VS. PASSIVE MANAGEMENT When the market is on an upswing, people get focused on how well the S&P 500 Index has performed, and therefore want to only use passive management. But here again, it’s not just a binary decision, it’s not either/or. At Cleary Gull, we use both actively and passively managed funds, depending on the cycle. We ask ourselves whether we passive by +0.99% on a three-year rolling basis, and it does so 78% of the time. When relative breadth gets very positive, say at 60%, then active beats passive by +2.35% and does so 100% of the time. How often does this happen? Relative breadth above 55% has happened 32% of the time since 1991 and 23% of the time since the start of our breadth data in 1927. Relative breadth above 60% has happened 11% of the time since 1991 and 8% since 1927. regimes that were favorable to either active strategies or indexing. Basically, when the market leadership is broad (as discussed earlier) and equity returns are less correlated, that’s a macro backdrop that tends to lend itself well to active management (i.e., the ability of the manager to pick winning stocks), all else being equal. For instance, the early to mid-1990s was a period during which classic GARP (growth at a reasonable price) investing WEALTH MANAGEMENT April 30, 2015 Page 4 FIGURE 7 EXHIBIT 1: The higher the percentage of relative breadth, the greater the tendency for active to outperform passive. In the late part of a market cycle, we see a relatively big change S&P 500 Total Return in historic performance, where AvP 3yr 3600 Relative Breadth small cap stocks fare less well than large cap stocks. Companies 1800 paying dividends have done better in this stage. People begin to look 900 for Growth At Reasonable Prices 5% 0.9 4% 0.8 (GARP) strategies, which tend 3% 0.7 2% to do better as people become 450 0.6 1% concerned about earnings growth 0.5 0% –1% 0.4 and decline in profit margins. In the –2% 0.3 –3% late part of a market cycle, breadth 0.2 –4% 0.1 tends to be wide, with more stocks –5% –6% 0 outperforming the index; and, as Dec-90 Dec-95 Dec-00 Dec-05 Dec-10 we have seen, active managers start Source: Haver Analytics, Morningstar, Fidelity Investments AvP 3yr = excess return of active over passive during rolling 3-year periods. Source: Haver Analytics, Morningstar, Fidelity Investments, as of Jul. 31, 2014. to do better as breadth opens up. 2 should be using more of one or the other at a given time in the markets, based on market breadth. Relative breadth AvP 3-yr. excess return S&P 500 Total Return MARKET REGIMES There are many layers to the stock market and many different strategies designed to take advantage of valuation differences. Our job is to understand economic and market cycles and to inform our thinking about how to construct a portfolio using those different strategies. We feel it is very difficult to both be right often enough and make money over time, all-in/all-out strategy; so we use these different levers in portfolio construction to lean in or lean out as we feel appropriate. FIGURE 8 Early vs. Late Cycle portfolio In this chart (Figure 7), the dark blue line represents the relative breadth of the U.S. stock market and the yellow line represents the rolling performance of active strategies. You can see when there is more relative breadth in the market, historically, the more likely active managers are to outperform. This is an example of a “layer” in stock market strategies we can utilize to your benefit in putting a portfolio together. Historically, active management of stock strategies does better close to the peak of markets than through the trough. When breadth is higher than 65%, active managers have outperformed the index 100% of the time and by an average excess return of 130 basis points. ON DIFFERENT STYLES OF MANAGEMENT Another lever we can utilize is the combination of different management strategies in a portfolio. Again, we do not use an all in/all out approach, but rather lean a portfolio in the direction of a more favorable or defensive positioning. An early cycle portfolio may differ significantly from a late cycle stock portfolio. In an early cycle portfolio, we have seen micro- and smallcap stocks do very well, as we saw in 2009. Particularly, value in the small cap space does well in the early part of a cycle. As momentum builds, passive starts to make more sense as passive has done better than active in the early part of a market cycle. Early Cycle Portfolio • Deep value • Momentum, high growth • Micro and small capitalization • Move toward passive Late Cycle Portfolio • Equity income and core value • Sustainable growth • Mid and large capitalization stocks • Active management Source: Cleary Gull Page 5 ABOUT THE AUTHORS Doug is the Chief Investment Officer of The Leuthold Group, LLC, and Co-Portfolio Manager of the Leuthold Core Investment Fund and the Leuthold Global Fund. In addition to his CIO and Portfolio Management responsibilities heading both the asset allocation and investment strategy committees, Doug maintains the firm’s proprietary Major Trend Index, a multi-factor model which evaluates the underlying health of the markets, both domestically and globally. He is also the lead writer for The Leuthold Group’s highly regarded institutional research publications. Doug Ramsey, CFA, CMT Chief Investment Officer The Leuthold Group, LLC Before joining the Leuthold team, Doug was Chief Investment Officer of Treis Capital in Des Moines, Iowa, where he managed equity portfolios and published a quantitative equity research product. Prior to that, he worked at Principal Global Investors. Doug is a Phi Beta Kappa graduate of Coe College in Cedar Rapids, IA, where he earned a Bachelor’s degree in Economics and Business Administration. He also played four years of varsity basketball at Coe, earning Academic All-America honors in 1986-87. Doug received an MA degree in Economics from The Ohio State University in 1990; he earned his CFA designation in 1996 and became a Chartered Market Technician in 2003. Mr. Andrew leads the investment research and strategy teams and is integral in establishing the firm’s investment policies and identifying strategies across all asset classes. Having worked as a Chief Investment Officer, Chief Operating Officer, president, portfolio manager and analyst of fixed income and equity securities of mutual fund and money management firms, he contributes to business and client services practices. Brian Andrew, CFA President and Chief Investment Officer Cleary Gull Mr. Andrew also chairs the firm’s Investment Policy Committee and serves on the Equity, Fixed Income and the Complements Strategy Groups. He has provided economic insight through monthly published pieces, webcasts, and other outside media outlets. In addition, he has been active in public speaking forums in investment management. Mr. Andrew received his Chartered Financial Analyst designation and is a member of the Milwaukee and Chicago Investment Analyst Societies. He received his B.S. in business and finance from the University of Minnesota and completed the Harvard Business School/CFA Institute Investment Management Program. He currently serves on the Advisory Board for the Marquette University Applied Investment Management Program. He has also been active in varying capacities on the boards of several municipal and not-for-profit organizations and currently serves on the Advisory Board for the University of Wisconsin-Milwaukee, College of Health Sciences. WEALTH MANAGEMENT April 30, 2015 ABOUT CLEARY GULL Cleary Gull (www.clearygull.com) is an SEC-registered investment advisory firm providing financial advice through two operating divisions: Investment Advisory Services and Investment Banking Services. Cleary Gull is a wholly owned subsidiary of Cleary Gull Holdings Inc. a privately held, employee-owned organization. Our investment advisory team provides investment advice with respect to over $2.1 billion of client assets for high net worth individuals and families, entrepreneurs, pilots, and not-for-profit hospitals and senior living communities across the nation. We are known for our combination of attentive service and sophisticated capabilities. With our decades of experience in financial security strategies we’ll help you face challenges that require a combination of financial, legal and tax expertise. What’s more, we work in conjunction with your other personal advisors to create a seamless financial plan for your future and to make sure you receive customized advice on such topics as trust and estate planning, taxes and retirement benefit services. Our investment bankers specialize in providing advice on exclusive sales, mergers and acquisitions, and private debt and equity capital placement, typically for transactions from $10 million to $200 million. Page 6