Leuthold Presentation

advertisement

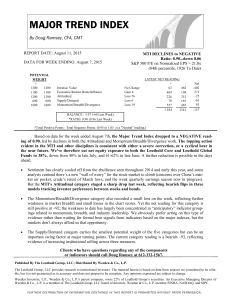

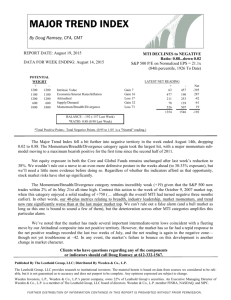

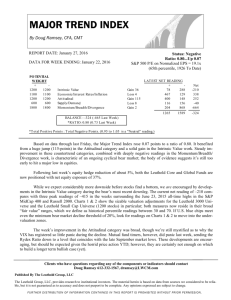

Playing The Bull Market’s Final Inning(s) Douglas Ramsey, CFA, CMT Mid-September 2013 FOR PROFESSIONAL USE ONLY. FURTHER DISTRIBUTION OF THE INFORMATION CONTAINED HEREIN IS PROHIBITED WITHOUT PRIOR PERMISSION. Disclosures This report is not a solicitation or offer to buy or sell securities. The Leuthold Group, LLC provides research to institutional investors. It is also a registered investment advisor that uses its own research, along with other data, in making investment decisions for its managed accounts. As a result, The Leuthold Group, LLC may have executed transactions for its managed accounts in securities mentioned prior to this publication. The information contained in The Leuthold Group, LLC research is not, without additional data and analysis, sufficient to form the basis of an investment decision regarding any one security. The research reflects The Leuthold Group, LLC’s views as of the date of publication, which are subject to change without notice. The Leuthold Group, LLC does not undertake to give notice of any change in its views regarding a particular industry prior to publication of their next research report covering that industry in the normal course of business. The Leuthold Group, LLC may make investment decisions for its managed accounts that are inconsistent with, or contrary to, the views expressed in current Leuthold Group, LLC reports. Weeden Investors, L.P., Weeden & Co., L.P.'s parent company, owns 22% of Leuthold Group’s securities. A Managing Director of Weeden & Co., L.P. is a member of The Leuthold Group, LLC board of directors. Weeden & Co., L.P. member FINRA, NASDAQ, and SIPC. 2 MTI is mildly bullish Major Trend Index Net Reading Intrinsic Value -215 Economic/Interest Rates/Inflation Attitudinal -7 -146 Supply/Demand 75 Momentum/Breadth/Divergence Ratio of Positive to Negative Points: Above 1.05 = Bullish Between 0.95 and 1.05 = Neutral Below 0.95 = Bearish 3 +435 1.12 It’s not exactly been a “global” bull market © 2013 The Leuthold Group 1700 United States 1600 (S&P 500) 1500 1400 1300 1200 Foreign Developed Markets (MSCI World Ex USA) Emerging Markets (MSCI) 1100 1000 1850 1800 1750 1700 1650 1600 1550 1500 1450 1400 1350 1200 1150 1100 1050 1000 950 900 850 2010 2011 2012 4 2013 “The tape” is mostly in gear… S&P 500 1500 Dow Jones 65 Composite 5000 4500 4000 3500 Dow Jones Transports 6000 5000 4000 Dow Jones Utilities 500 450 400 350 Russell 2000 1000 900 800 700 600 S&P 500 Financials 250 200 150 Morgan Stanley Cyclical Index 1000 NYSE Advance/Decline Line 40000 35000 30000 © 2013 The Leuthold Group 2010 2011 5 x10 2012 2013 July 22, 2013 S&P 500 bull market high Tape is in gear (cont.) Market Early Warning Signals: Prior S&P 500 Tops Vs. Today Date of Bull Market High July 16, 1990 July 17, 1998 March 24, 2000 October 9, 2007 Subsequent Decline -19.9 % -19.3 -49.1 -56.8 Dow 65 Composite Warning? Dow Transports Warning? Dow Utilities Warning? Russell 2000 Warning? S&P 500 Financials Warning? MS Cyclical Warning? NYSE A/D Line Warning? Total Number of Warnings* 1 1 1 1 1 1 1 1 1 0 1 1 1 1 0 1 1 0 1 1 1 1 1 1 1 1 1 1 7 5 6 7 Average: 6.3 Important Highs, March 2009 To Date April 23, 2010 April 29, 2011 August 2, 2013 -16.0 -19.4 -4.6 0 0 0 0 0 0 1 0 1 0 0 0 0 1 0 0 0 0 *A warning is issued when an index fails to "confirm" a new S&P 500 bull market price high during the preceding 21 trading days (one month). 0 0 0 1 1 1 © 2013 The Leuthold Group Usually most of these internal market measures will deteriorate before the final bull market peak is achieved. But at the August 2nd high, just one of these seven leading measures (DJ Utilities) had raised a warning flag. 6 Two longer-term warning signs… © 2013 The Leuthold Group © 2013 The Leuthold Group 1800 1700 1600 S&P 500 1800 1700 1600 S&P 500 1500 1400 1500 1400 1300 1300 1200 1100 1000 900 800 700 NYSE Weekly Advance/Decline Line NYSE High/Low Logic Index* 4300 2008 2009 2010 2011 2012 1100 1000 900 800 700 6 4100 2007 1200 (10-Wk. Avg.) 4200 The NYSE Weekly Advance/Decline Line generally acts stronger than its daily counterpart throughout a bull market. But the weekly version now looks weaker, and hasn't made a new high since mid-May. NYSE new 52week highs and lows are both at elevated levels, a sign that market strength is not as uniform as indicated by most other measures. Above 5% - Tape is "divergent"- BEARISH 5 4000 4 3900 3 3800 2 3700 1 Below 1% - Tape is "in gear"- BULLISH 3600 2007 2013 2008 2009 2010 2011 2012 2013 Index calculated as the lesser of NYSE Weekly New Highs and New Lows as a percentage of issues traded. 7 0 A possible sign of “distribution”? © 2013 The Leuthold Group SPDR S&P 500 ETF Trust (SPY) 180 170 160 150 140 130 120 110 100 90 80 70 SPDR Cumulative Opening Price Change (The "Emotional Money") 195 190 185 180 175 170 165 160 155 -60 SPDR Cumulative Intraday Price Change (The "Smart Money") -70 -80 -90 Morning hype has lately been giving way to afternoon weakness… a sign the smart money may be "distributing" stock. 2007 2008 2009 8 2010 2011 2012 2013 -100 -110 -120 -130 Rates and stocks prices can rise together Stocks & Interest Rates Can Sometimes Go Up Together 2400 1900 1500 1200 900 700 S&P 500 500 400 300 200 100 6 9 7 5 10 8 11 4 12 14 3 2 1 12 10 8 6 U.S. 10-Yr. Treasury Bond Yield (weekly close) 4 2 © 2013 The Leuthold Group 1950 1960 1970 1980 1990 9 2000 2010 Rising rates/ rising stock prices (cont.) Dates 10-Yr. Bond Yield S&P 500 Stock Market/ Bond Yield Action © 2013 The Leuthold Group S&P 500 P/E on 5-Yr. Normalized EPS 1 May 2, 1958 July 31, 1959 2.89 4.41 43.69 60.51 Stock Market Up: Bond Yields Up: 38.5 % 152 Basis Points 15.1 2 January 11, 1963 February 11, 1966 3.80 4.86 64.85 93.81 Stock Market Up: Bond Yields Up: 44.7 % 106 Basis Points 21.0 3 January 27, 1967 November 29, 1968 4.47 5.78 86.16 108.37 Stock Market Up: Bond Yields Up: 25.8 % 131 Basis Points 21.2 4 November 5, 1971 January 5, 1973 5.72 6.42 94.46 119.73 Stock Market Up: Bond Yields Up: 26.8 % 70 Basis Points 15.2 5 March 3, 1978 November 28, 1980 8.04 12.72 87.04 139.33 Stock Market Up: Bond Yields Up: 60.1 % 468 Basis Points 11.3 6 November 5, 1982 July 22, 1983 10.48 11.43 143.02 170.35 Stock Market Up: Bond Yields Up: 19.1 % 95 Basis Points 8.8 7 April 18, 1986 August 21, 1987 7.09 8.77 242.42 336.77 Stock Market Up: Bond Yields Up: 38.9 % 168 Basis Points 16.5 8 January 19, 1996 June 7, 1996 5.54 6.93 612.79 662.06 Stock Market Up: Bond Yields Up: 8.0 % 139 Basis Points 24.6 9 October 2, 1998 January 14, 2000 4.31 6.69 1002.60 1465.15 Stock Market Up: Bond Yields Up: 46.1 % 238 Basis Points 27.8 10 June 13, 2003 May 5, 2006 3.13 5.12 988.61 1325.76 Stock Market Up: Bond Yields Up: 34.1 % 199 Basis Points 23.0 11 March 20, 2009 April 2, 2010 2.65 3.96 768.54 1178.10 Stock Market Up: Bond Yields Up: 53.3 % 131 Basis Points 11.3 12 June 1, 2012 September 6, 2013 (To 1.47 2.94 1278.04 1655.17 Stock Market Up: Bond Yields Up: 29.5 % 147 Basis Points 18.6 35.4 % 36.3 % 17.9 17.6 Average Stock Market Gain (Excl. 2012-13): Median Stock Market Gain (Excl. 2012-13): Average Bond Yield Increase (Excl. 2012-13): Median Bond Yield Increase (Excl. 2012-13): 10 170 Basis Points 143 Basis Points S&P 500 Normalized P/E At Bull Market Peaks, 1957 To Date Bull markets have frequently topped near current valuations S&P 500 Normalized P/E At Bull Market Peak Date Of S&P 500 Bull Market Peak December 31, 1961 February 28, 1966 22.3 x November 29, 1968 20.6 January 31, 1973 20.8 September 29, 1976 13.6 November 29, 1980 August 31, 1987 11.3 22.3 July 31, 1990 18.4 S&P 500 July 31, 1998 March 31, 2000 27.7 Bull Market High October 31, 2007 20.9 Median At Modern Era Bull Market Peaks (1957 To Date) 20.9 x 23.0 32.1 "Normal" 1695 © 2013 The Leuthold Group .ec S&P 500 P/E On 5-Yr. Normalized EPS (1926 To Date - Monthly) 35 August 30, 2013 = 20.1x (76th percentile since 1926) 1957-to-Date Median = 18.6x 30 25 20 15 1926-to-Date Median = 16.6x 10 5 Great Depression earnings wipeout © 2013 The Leuthold Group 1920 1930 1940 1950 1960 1970 11 1980 1990 2000 2010 Profit margins have probably peaked for this business cycle… U.S. Corporate Profits As A Percent Of GDP 10.3% 10.1% (2Q) [from National Income and Product Accounts (NIPA); Profits are after tax and Include inventory valuation allowance and capital consumption adjustment] 8.6% 65-Yr. Median = 6.0% 5.5% 4.7% © 2013 The Leuthold Group 1947 1950 1951 1954 1957 1960 1961 1964 1967 1970 1970 1974 1977 1980 1980 1983 12 1987 1990 1990 1993 1996 2000 2010 2013 2000 2003 2006 2009 201 10.5 10.0 9.5 9.0 8.5 8.0 7.5 7.0 6.5 6.0 5.5 5.0 4.5 4.0 Implications of high margins… © 2013 The Leuthold Group 5-Yr. Annualized Growth In NIPA Corporate Profits 20 (scale at left) 4.0 18 4.5 16 14 5.0 12 5.5 10 6.0 8 6.5 6 4 7.0 2 7.5 0 8.0 -2 8.5 -4 Margins Are An Excellent (But Unfortunately Inverse) Predictor Of Future Profit Growth -6 -8 -10 -12 . NIPA Corporate Profits As A Pct.Of GDP - 9.0 9.5 advanced five years and shown on inverted scale (right) 10.0 Concept courtesy of Hussman Research & Insight. 1952 1952 1956 1960 1960 1964 19681970 1972 1976 1980 1980 1984 19881990 1992 1996 2000 2000 2004 20082010 2012 2016 2 Today's profit margins are so inflated that substantially slower profit growth over the next three to five years is almost baked in the cake. 13 The bond bull has been a big driver of margin gains.. 18 1950 16 14 1960 1970 1980 1990 How The Bond Bull Boosted Earnings... 2000 70 2010 65 Net Interest Expense As A Pct Of Earnings Before Interest And Taxes (EBIT) (right scale) 60 55 50 12 45 40 10 35 likely path 8 30 25 Moody's BAA Corporate Bond Yield (quarterly average - left scale) 6 4 20 best case 15 10 5 2 © 2013 The Leuthold Group 2010 47 491950 51 53 55 57 591960 61 63 65 67 691970 71 73 75 77 791980 81 83 85 87 891990 91 93 95 97 992000 01 03 05 07 010 11 13 14 14 15 “Bookkeepers” have also helped boost margins… 65 1950 1960 1970 1980 1990 2000 65 2010 How Bookkeepers Have Boosted Earnings... 60 55 60 55 50 50 Top Marginal Corporate Tax Rate 45 45 40 40 35 35 30 30 25 25 Corporate Income Taxes As A Percent Of Pretax Corporate Profits (Effective Tax Rate) 20 15 200 20 19.9% (2Q) 15 47 491950 51 53 55 57 591960 61 63 65 67 691970 71 73 75 77 791980 81 83 85 87 891990 91 93 95 97 992000 01 03 05 07 010 11 13 14 2010 15 Effective Corporate Tax Rate As A Percentage Of Statutory Rate 150 200 150 66-Yr. Median = 80% 100 50 100 57% (2Q) © 2013 The Leuthold Group 47 49 51 53 551960 57 59 61 63 65 1970 67 69 71 73 75 77 79 81 83 85 871990 89 91 93 95 97 2000 99 01 03 05 07 010 11 13 14 1950 1980 2010 15 50 15 Virtually all margin improvement has been “below” the line… Margin Expansion: From The Late 1990s Profitability Peak To Today NIPA Income Statement Earnings Before Interest & Taxes As Pct. Of "Sales" (i.e., GDP) Net Interest Payments Pct Sales Corporate Income Taxes Pct Sales Net Corporate Profit Margin © 2013 The Leuthold Group 16 1997:Q3 15.1% 4.8% 2.9% 7.3% 2013:Q2 15.3% 2.7% 2.5% 10.1% On the positive side, EBIT margins have room to move higher… Earnings Before Interest And Taxes (EBIT) 16.7% As A Percent Of GDP 18 17 16.4% 16 15.1% 15.3% (2Q) 15 14 13 66-Yr. Median = 13.7% 12.2% 12 11.9% 11 10 © 2013 The Leuthold Group 1947 1950 1951 1954 1957 1960 1961 1964 1967 1970 1970 1974 1977 1980 1980 1983 1987 1990 1990 1993 1996 From National Income and Product Accounts (NIPA); Profits include inventory valuation allowance and capital consumption adjustment. 17 2000 2010 2013 2000 2003 2006 2009 201 Breadth of earnings gains has narrowed dramatically in last year… 2 yrs. of strong earnings breadth 4+ yrs. Of strong earnings breadth 6 yrs. of strong earnings breadth 75 70 65 60 55 50 Percent Of Companies With Rising Year-Over-Year Earnings* 45 40 © 2013 The Leuthold Group 1990 2000 *Based on tabulation of all earnings reports published in Investor's Business Daily. 18 2010 35 60% = recession alert February 17, 2011: Peak in earnings breadth Earnings breadth & the leadership “inversion” Earnings Breadth & Stock Market Leadership Percent Of Companies With Rising Year-Over-Year Earnings 75 70 65 60 55 50 Ratio, Morgan Stanley Cyclical Index/ Consumer Index 45 40 140 130 120 110 100 90 80 70 Ratio, S&P 500 High Beta/ Low Volatility Index 180 160 140 120 100 80 Ratio, Russell 2000 to S&P 500 62 60 58 56 54 52 © 2013 The Leuthold Group 2008 2009 2010 19 2011 2012 2013 50 Industry groups are enjoying “positive feedback” Ratio, Strong To Weak Global Industries (Relative price performance of top to bottom quintile of MSCI World Level III industry porfolios formed monthly on trailing 12-mo. price momentum.) 1050 1000 950 900 850 800 2011 correction low 2009 bear market low 750 700 650 2002 bear market low 600 550 The stock market is in a "positive feedback" loop in which winning industry themes tend to keep winning over the short- to intermediate-term. This is likely to continue on a relative basis until well into the next bear market. 500 450 400 350 300 250 © 2013 The Leuthold Group 2000 2001 2002 2003 2004 2005 2006 2007 20 2008 2009 2010 2011 2012 2013 Momentum strategies work best near the end of a bull market… Performance Of Price Momentum In Last 12 Months Of Bull Markets © 2013 The Leuthold Group Stocks With High Price Momentum Stocks With Low Price Momentum August 1929 68.3 20.1 February 1937 34.6 18.6 October 1938 8.1 10.3 May 1946 61.1 31.4 July 1956 24.4 11.2 December 1961 27.3 19.7 January 1966 33.9 4.3 November 1968 22.9 23.8 December 1972 23.7 6.5 September 1976 26.1 26.6 November 1980 76.2 15.9 August 1987 30.0 39.8 June 1990 19.3 1.8 June 1998 35.3 19.5 March 2000 38.7 3.7 October 2007 25.6 8.7 Average 34.7 % Number Of Times With Highest Return 12 Date Of Monthly Bull Market High 16.4 % 4 Monthly total returns for large-cap stocks based on Fama-French Momentum Portfolios, Tuck School of Business. Boxes highlight higher return in last year of bull market. 21 …And momentum even wins during bear markets! Performance Of Price Momentum During Cyclical Bear Markets © 2013 The Leuthold Group Bear Market Dates (Monthly) Stocks With High Price Momentum Stocks With Low Price Momentum Sep 1929 - Jun 1932 -77.3 -94.5 Mar 1937 - Mar 1938 -51.2 -56.3 Nov 1938 - Apr 1942 -24.2 -28.7 Jun 1946 - Jun 1949 -16.0 -26.3 Aug 1956 - Oct 1957 -12.6 -19.1 Jan 1962 - Jun 1962 -21.5 -30.2 Feb 1966 - Sep 1966 -11.4 -16.2 Dec 1968 - Jun 1970 -31.3 -35.3 Jan 1973 - Sep 1974 -39.8 -64.0 Oct 1976 - Feb 1978 4.2 -20.7 Dec 1980 - Jul 1982 -21.8 -13.2 Sep 1987 - Nov 1987 -30.4 -19.3 Jul 1990 - Oct 1990 -12.1 -31.9 Jul 1998 - Aug 1998 -14.6 -17.8 Apr 2000 - Sep 2002 -38.1 -56.4 Nov 2007 - Feb 2002 -48.3 -68.8 Average -27.9 % -37.4 % Median -21.8 -28.7 14 2 Number Of Times With Highest Return Monthly total returns for large-cap stocks based on Fama-French Momentum Portfolios, Tuck School of Business. Boxes highlight better performer during bear market. 22 New bull markets see the “Revenge of the Nerds” Performance Of Price Momentum In First Year Of New Bull Markets © 2013 The Leuthold Group Date Of Bear Market Low June 1932 Stocks With High Price Momentum 100.4 % Stocks With Low Price Momentum 287.7 % March 1938 25.1 62.4 April 1942 66.6 61.1 June 1949 40.9 38.3 October 1957 31.9 31.6 June 1962 38.1 26.9 October 1966 39.7 34.2 May 1970 39.6 64.3 October 1974 37.7 52.4 March 1978 27.5 18.5 August 1982 66.3 64.1 December 1987 20.5 32.5 October 1990 37.6 74.0 August 1998 43.4 49.2 October 2002 14.9 51.1 February 2009 35.5 116.7 Average Number Of Times With Highest Return 41.6 % 66.6 % 7 9 Monthly total returns for large-cap stocks based on Fama-French Momentum Portfolios, Tuck School of Business. Boxes highlight higher return in first year of bull market. 23 Investors remain in love with yield, at a time it scarcely exists… 11.5 Total Yield On A 60/40 Portfolio 11.0 (60% S&P 500/40% 10-Yr. Treasurys) 10.5 10.0 9.5 9.0 8.5 8.0 7.5 7.0 6.5 1878-To-Date Median = 4.15% 6.0 5.5 5.0 4.5 4.0 3.5 3.0 2.5 2.0 August 30, 2013 = 2.43% 1.5 © 2013 The Leuthold Group 1870 1880 1890 1900 1910 1920 1930 24 1940 1950 1960 1970 1980 1990 2000 2010 A sober portfolio forecast… 11.5 11.0 10.5 Total Yield On A 60/40 Portfolio Vs. 10-Yr. Total Portfolio Return 21 20 19 10.0 9.5 8.5 Correlation Coefficient (1878 To Date) = 8.0 0.66 9.0 10-Yr. Trailing Return On 60/40 Portfolio 18 (right scale) 13 17 16 15 14 7.5 12 7.0 11 6.5 10 6.0 9 5.5 8 7 5.0 6 4.5 5 4.0 4 3.5 3 3.0 2 2.5 1 2.0 Total Yield On 60/40 Portfolio 0 (advanced 10 yrs. - left scale) -1 1.5 © 2013 The Leuthold Group 1870 1880 1880 1890 1890 1900 1900 1910 1910 1920 1920 1930 1930 1940 25 1940 1950 1950 1960 1960 1970 1970 1980 1980 1990 1990 2000 2000 2010 2010 2020 The bipolar modern history of bonds… 45 U.S. 10-Yr. Treasury Bond Real Total Return Index 40 (Cumulative Total Return Deflated By CPI) 35 1926 To Date 30 25 Annualized Real Total Return, Jan26 - Jan13 = +2.38% Annualized Real Total Return, Oct81 - Jan13 = +6.67% 20 15 10 September 30, 1981 the best date in U.S. history to retire… Annualized Real Total Return, Jan26 - Sep81 = +0.01% 1920 1930 1940 1950 1960 © 2013 The Leuthold Group 1970 26 1980 1990 2000 2010 5 0 A simple way to forecast bond returns © 2013 The Leuthold Group 17 16 Correlation, January 1930 To Date = Current Bond Yields Have Historically Been An Excellent Estimate Of Bonds' 10-Yr. Future Total Return Potential... 0.96 15 14 13 12 11 10-Yr. U.S. Treasury Bonds 10-Yr. Annualized Total Return 10 9 8 7 6 5 4 3 2 U.S. 10-Yr. Treasury Bond Yield, Advanced 10 Years 1 0 1930 1940 1950 1960 1970 27 1980 1990 2000 2010 2020 September 1981 yield peak = 15.32% Bond market symmetry! © 2013 The Leuthold Group 16 Correlation Between Actual Yield and "Mirror Image" Forecast, October 1981 To Date = The Bond Bull Market Has Essentially Been The Mirror Image Of The Previous Bear! 15 14 0.92 13 12 11 10 9 Oct81-To-Date Actual U.S. 10-Yr. T-Bond Yield (mo. avg.) 8 7 6 5 Sep41-Sep81: U.S. 10-Yr. Treasury Bond Yield (mo. avg.) 940 1950 1960 1970 1980 Oct81-Sep21: "Mirror Image" of 1941-1981 U.S. 10-Yr. T-Bond Yield (mo. avg.) 1990 4 3 2 1 2000 2010 20 To preserve its near-perfect symmetry with the preceding bear market, the secular bond bull begun in September 1981 would need to last until July 2017. 28 29 A Simple, Single-Asset Annual Allocation Strategy: Invest Using Last Year's Performance Rank, 1973-2012 18 T O T A L 16 R E T U R N 10 © 2013 The Leuthold Group 14 12 8 6 4 (%) 2 50 0 P A tP er fo rm in g W or s 30 S& ss et es t B th Si x Fi fth B es t B es t Fo ur th Th ird B es t es t B Se co nd B es tP er fo rm in g A ss et 0 Buy last year’s “Bridesmaid” asset class! 2012 Total Return REITs (NAREIT Index) MSCI EAFE Russell 2000 S&P 500 Gold 10-Yr. U.S. Treasury Bonds Commodities (GSCI) 20.1 % 17.9 16.4 16.0 5.9 2.8 0.1 S&P 500 Total Return Year 1973 1974 1975 1976 1977 1978 1979 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 -14.7 % -26.5 37.2 23.8 -7.2 6.6 18.4 32.4 -4.9 21.4 22.5 6.3 32.2 18.5 5.2 16.8 31.5 -3.2 30.5 7.7 10.0 1.3 37.4 23.1 33.4 28.6 21.0 -9.1 -11.9 -22.1 28.7 10.9 4.9 15.8 5.5 -37.0 26.5 15.1 2.1 16.0 Bridesmaid Asset Class Owned During Year Commodities Gold Commodities Large Caps REITs Gold EAFE Small Caps Large Caps Govt. Bonds REITs REITs REITs Large Caps Govt. Bonds Commodities Commodities Large Caps Govt. Bonds REITs REITs Small Caps Commodities Small Caps Commodities Small Caps EAFE EAFE REITs Govt. Bonds Gold EAFE EAFE Gold EAFE Gold Gold REITs REITs Gold EAFE 1973-2012, Annualized Total Return: 9.8 % Std. Deviation: 18.1 % No. Yrs Matching Or Exceeding S&P 500: Correlation With S&P 500 (Annual Returns): © 2013 The Leuthold Group 31 Bridesmaid Strategy (Own Previous Year's Runner-Up Asset Class) Total Return 75.0 % 66.3 -17.2 23.8 19.1 37.0 6.2 38.6 -4.9 39.3 25.5 14.8 5.9 18.5 -2.2 27.9 38.3 -3.2 18.8 12.2 18.5 -1.8 20.3 16.5 -14.1 -2.5 27.4 -14.0 15.5 15.4 20.9 20.7 14.0 22.5 11.6 4.3 26.5 27.6 7.3 5.9 15.6 % 19.0 % 28/40 -0.11 Bridesmaid Strategy With Monthly Rebalancing (Using 12-Mo. Momentum) 95.1 47.5 -33.1 30.3 6.0 21.7 25.2 17.9 8.3 22.0 29.9 11.8 18.1 5.6 -10.8 30.0 31.6 4.7 10.8 0.2 20.0 -6.4 21.7 27.0 15.9 24.0 19.4 -24.3 13.5 26.1 12.4 22.6 5.0 26.8 8.6 14.1 24.0 11.9 -15.9 16.3 14.2 % 20.2 % 23/40 -0.09 “Bridesmaid” has been a winning sector strategy, too S&P 500 Sectors Financials Consumer Discretionary Telecom Services Health Care Industrials Materials Information Technology Consumer Staples Energy Utilities S&P 500 2012 Total Return 28.8 % 24.1 18.3 17.9 15.3 15.0 14.8 10.8 4.6 1.3 16.0 % S&P 500 Total Return 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 30.5 % 7.6 10.1 1.3 37.6 23.0 33.4 28.6 21.0 -9.1 -11.9 -22.1 28.7 10.9 4.9 15.8 5.5 -37.0 26.5 15.1 2.1 16.0 Bridesmaid Sector (Last Year's Second Best Sector) Consumer Staples Financials Consumer Discretionary Industrials Health Care Financials Financials Health Care Telecom Services Materials Health Care Consumer Discretionary Materials Materials Utilities Utilities Energy Materials Health Care Materials Industrials Consumer Staples Consumer Discretionary 1991-2012 Annaulized: Total Return 9.1 % Std. Deviation 18.7 % No. Yrs. Outperforming S&P 500: Correlation With S&P 500 (Annual Returns): Results assume annual rebalancing of S&P 500 sectors; numbers include dividends, but exclude transactions costs. © 2013 The Leuthold Group 32 Sector Bridesmaid Strategy Total Return 41.7 % 23.3 14.6 -2.4 58.0 35.2 48.2 43.9 19.1 -15.7 -11.9 -23.8 38.2 13.2 16.8 21.0 34.4 -45.7 19.7 22.2 -0.6 10.8 13.3 % 25.3 % 13/22 0.94 Bridesmaid Strategy With Monthly Rebalancing (Using 12-Mo. Momentum) 45.7 13.5 19.2 1.4 82.8 22.5 58.1 35.3 19.1 -2.5 -14.0 2.3 20.4 7.6 16.8 22.9 7.2 -35.8 24.5 23.8 3.0 0.9 14.6 % 24.5 % 15/22 0.86