Tracking Clean Energy Progress 2013

Tracking Clean

Energy Progress 2013

IEA Input to the Clean Energy Ministerial

Tracking Clean Energy Progress 2013

IEA Input to the Clean Energy Ministerial

The 22 countries that participate in the Clean Energy Ministerial (CEM) share a strong interest in the development and deployment of clean energy technologies.

As these same countries represent more than 75% of global energy consumption,

80% of global CO the transition to a cleaner energy system and, since CEM first convened in 2010, have taken steps toward this challenging goal. So how much progress has been made thus far?

2

emissions and 75% of global GDP, they have the power to drive

This comprehensive overview examines the latest developments in key clean energy technologies:

Technology penetration: how much are clean energy technologies being used?

Market creation: what is being done to foster the necessary markets?

Technology developments: how are individual technologies performing?

Each technology and sector is tracked against interim 2020 targets in the IEA

2012 Energy Technology Perspectives 2°C scenario, which lays out pathways to a sustainable energy system in 2050. www.iea.org/etp/tracking

Visit our website for interactive tools, additional

Stark messages emerge: progress has not been fast enough; large market failures are preventing clean energy solutions from being taken up; considerable energy-efficiency potential remains untapped; policies

data, presentations and more.

need to better address the energy system as a whole; and energy-related research, development and demonstration need to accelerate. The report also introduces a new IEA index, tracking the carbon intensity of energy supply since 1970, that shows no recent improvement and underscores the need for more concerted effort.

Alongside these grim conclusions there is positive news. In 2012, sales of hybrid electric vehicles passed the 1 million mark. Solar photovoltaic systems were being installed at a record pace. The costs of most clean energy technologies fell more rapidly than anticipated.

The report provides specific recommendations to governments on how to scale up deployment of these key technologies.

Tracking Clean

Energy Progress 2013

IEA Input to the Clean Energy Ministerial

Visualise and explore the data behind Tracking Clean Energy Progress 2013

Visit

www.iea.org/etp/tracking

for interactive data visualisation tools.

The figures that appear in the report – and the data behind them – are also available for download free of charge.

INTERNATIONAL ENERGY AGENCY

The International Energy Agency (IEA), an autonomous agency, was established in November 1974.

Its primary mandate was – and is – two-fold: to promote energy security amongst its member countries through collective response to physical disruptions in oil supply, and provide authoritative research and analysis on ways to ensure reliable, affordable and clean energy for its 28 member countries and beyond. The IEA carries out a comprehensive programme of energy co-operation among its member countries, each of which is obliged to hold oil stocks equivalent to 90 days of its net imports.

The Agency’s aims include the following objectives: n Secure member countries’ access to reliable and ample supplies of all forms of energy; in particular, through maintaining effective emergency response capabilities in case of oil supply disruptions. n Promote sustainable energy policies that spur economic growth and environmental protection in a global context – particularly in terms of reducing greenhouse-gas emissions that contribute to climate change. n Improve transparency of international markets through collection and analysis of energy data. n Support global collaboration on energy technology to secure future energy supplies and mitigate their environmental impact, including through improved energy efficiency and development and deployment of low-carbon technologies.

n Find solutions to global energy challenges through engagement and dialogue with non-member countries, industry, international organisations and other stakeholders.

IEA member countries:

© OECD/IEA, 2013

International Energy Agency

9 rue de la Fédération

75739 Paris Cedex 15, France www.iea.org

Australia

Austria

Belgium

Canada

Czech Republic

Denmark

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Japan

Korea (Republic of)

Luxembourg

Netherlands

New Zealand

Norway

Poland

Portugal

Slovak Republic

Spain

Sweden

Switzerland

Turkey

United Kingdom

United States

Please note that this publication is subject to specific restrictions that limit its use and distribution.

The terms and conditions are available online at http://www.iea.org/termsandconditionsuseandcopyright/

The European Commission also participates in the work of the IEA.

IEA member countries:

Australia

Austria

Belgium

Canada

Czech Republic

Denmark

Finland

France

Germany

Greece

Hungary

Ireland

Italy

Japan

Korea (Republic of)

Luxembourg

Netherlands

New Zealand

Norway

Poland

Portugal

Slovak Republic

Spain

Sweden

Switzerland

Turkey

United Kingdom

United States

The European Commission also participates in the work of the IEA.

3

Table of Contents

Introduction

Chapter 1

Chapter 2

Tracking Progress: How and Against What?

Power Generation

21

Carbon Capture and Storage 55

Chapter 3 End Use Sectors

Electric and Hybrid-Electric Vehicles

63

4

Table of Contents

Chapter 4

Chapter 5

Annex

Systems Integration

Co-Generation and District Heating and Cooling

Energy Sector Carbon Intensity Index

Energy Technology RD&D and Innovation

Why Governments Must Invest in Clean Energy RD&D and Innovation

Innovation and RD&D Investment Trends

Bridging the RD&D Investment Gap

R&D and Innovation in Emerging Economies

Acronyms, Abbreviations and Units

105

121

Foreword Introduction

Foreword

We built our civilisation by harnessing energy, which is at the core of economic growth and prosperity. But in 2012, in a weak world economy, oil prices soared and carbon dioxide emissions from energy reached record highs. The ways we supply and use energy threaten our security, health, economic prosperity and environment. They are clearly unsustainable.

We must change course before it is too late.

This is the International Energy Agency’s (IEA) third comprehensive tracking of progress in clean energy technology. It is a reality check for policy makers: it reflects what is happening here and now. Stark messages emerge from our analysis: progress is not fast enough; glaring market failures are preventing adoption of clean energy solutions; considerable energy efficiency potential remains untapped; policies must better address the energy system as a whole; and energy-related research, development and demonstration all need to accelerate.

In this year’s report we launch the Energy Sector Carbon Intensity Index (ESCII), which shows the carbon emitted for each unit of energy we use and provides a cumulative overview of progress in the energy sector. The picture is as clear as it is disturbing: the carbon intensity of the global energy supply has barely changed in 20 years, despite successful efforts in deploying renewable energy.

I am particularly worried about the lack of progress in developing policies to drive carbon capture and storage (CCS) deployment. Without CCS, the world will have to abandon its reliance on fossil fuels much sooner – and that will come at a cost.

There is a danger, however, in focusing on individual technologies without considering the larger picture. We must invest heavily in infrastructure that improves the system as a whole.

Smart grids, for example, make it easier and cheaper to replace fossil-fired power with renewables without jeopardising the reliability of the energy system.

Alongside these grim messages there are also positive developments. In 2012, sales of hybrid-electric vehicles passed the one million mark. Solar photovoltaic systems continued to be installed at a record pace, contrary to many expectations. Emerging economies are stepping up their efforts to promote and develop clean energy. The costs of most clean energy technologies fell more rapidly than anticipated. Many countries, including emerging economies, introduced or strengthened energy efficiency regulations. Given that the world’s energy demand is set to grow by 25% in the next decade, it is hard to overstate the importance of energy efficiency. The world must slow the growth of energy demand while making the energy supply cleaner.

Each time the IEA assesses the role that technology and innovation can play in transforming the energy system, we are astonished by the possibilities. The 2012 edition of Energy

Technology Perspectives showed how the world can slash emissions and save money while doing so. In this report, besides the high-level findings and conclusions in the introduction, each chapter offers specific recommendations by technology and sector.

It is time the governments of the world took the actions needed to unleash the potential of technology. Together with industry and consumers, we can put the energy system on track to a sustainable and secure energy future. We owe it to our economies, our citizens and our children.

Maria van der Hoeven , Executive Director

5

© OECD/IEA, 2013.

Key Findings Introduction

Key Findings

Renewable energy and emerging country efforts are lights in the dark as progress on clean energy remains far below a 2°C pathway.

■ Governments have the power to create markets and policies that accelerate development and deployment of clean energy technologies, yet the potential of these technologies remains largely untapped.

This report demonstrates that for a majority of technologies that could save energy and reduce carbon dioxide (CO

2

) emissions, progress is alarmingly slow (Table I.1). The broad message to ministers is clear: the world is not on track to realise the interim 2020 targets in the IEA Energy Technology Perspectives 2012 (ETP) 2°C Scenario (2DS).

Industry and consumers will provide most of the investment and actions needed, but only with adequate opportunities and the right market conditions.

■ The growth of renewable power technologies continued in 2012 despite economic, policy and industry turbulence. Mature technologies – including solar photovoltaic (PV), onshore wind, biomass and hydro – were the most dynamic and are largely on track for 2DS targets. Solar PV capacity grew by an estimated 42%, and wind by 19% compared with 2011 cumulative levels. Investments remained high in 2012, down only 11% from the record level of 2011, but policy uncertainty is having a negative impact, notably on US and Indian wind investments.

■ Emerging economies are stepping up efforts in clean energy, but global policy development is mixed. Markets for renewable energy are broadening well beyond OECD countries, which is very positive. This reflects generally rising ambitions in clean energy although developments are not homogenous. For instance,

China and Japan strengthened policies and targets for renewables in 2012 while other governments (e.g. Germany, Italy and Spain) scaled back incentives. Industry consolidation continued and competition increased. Partly as a result, investment costs continued to fall rapidly, particularly for onshore wind and solar PV.

The global energy supply is not getting cleaner, despite efforts to advance clean energy.

■ Coal technologies continue to dominate growth in power generation. This is a major reason why the amount of CO

2

emitted for each unit of energy supplied has fallen by less than 1% since 1990 (Box I.1). Thus the net impact on CO

2

intensity of all changes in supply has been minimal. Coal-fired generation, which rose by an estimated 6% from 2010 to 2012, continues to grow faster than non-fossil energy sources on an absolute basis. Around half of coal-fired power plants built in 2011 use inefficient technologies. This tendency is offsetting measures to close older, inefficient plants. For example China closed 85 GW in 2011 and was continuing these efforts in

2012, and the United States closed 9 GW in 2012.

7

© OECD/IEA, 2013.

8

Introduction Key Findings

■ The dependence on coal for economic growth is particularly strong in emerging economies. This represents a fundamental threat to a low-carbon future. China and, to a lesser extent India, continue to play a key role in driving demand growth. China’s coal consumption represented 46% of global coal demand in 2011; India’s share was 11%. In 2011 coal plants with a capacity of 55 GW were installed in China, more than Turkey’s total installed capacity.

■ Natural gas is displacing coal-fired generation in some countries but this trend is highly regional.

Coal-to-gas fuel switching continued in 2012 in the

United States, as the boom in unconventional gas extraction kept gas prices low.

The opposite trend was observed in Europe, where low relative prices for coal led to increased generation from coal at the expense of gas. In total, global natural gas-fired power generation is estimated to have increased by more than 5% from 2010 to

2012, building on strong growth over the past few years.

The IEA Energy Sector Carbon Intensity Index (ESCII)

Box I.1

The IEA Energy Sector Carbon Intensity Index

(ESCII) tracks how many tonnes of CO

2

are emitted for each unit of energy supplied. It shows that the global aggregate impact of all changes in supply technologies since 1970 has been minimal.

Responses to the oil shocks of the 1970s made the energy supply 6% cleaner from 1971 to 1990. Since

1990, however, the ESCII has remained essentially static, changing by less than 1%, despite the important climate policy commitments at the 1992

Rio Conference and under the 1997 Kyoto Protocol as well as the boom in renewable technologies over the last decade (Figure I.1). In 1990 the underlying carbon intensity of supply was 57.1 tCO

2

/TJ (2.39 tCO

2

/toe); in 2010 it was 56.7 tCO

2

/TJ (2.37 tCO

2

/toe). This reflects the continued domination of fossil fuels - particularly coal - in the energy mix and the slow uptake of other, lower-carbon supply technologies.

The ESCII shows only one side of the decarbonisation challenge: the world must slow the growth of energy demand as well as make its energy supply cleaner.

To meet 2DS targets, aggressive energy efficiency improvements are needed as well as a steep drop in the global ESCII. The index needs to break from its

40-year stable trend and decline by 5.7% by 2020, and 64% by 2050.

Figure I.1

The Energy Sector Carbon Intensity Index (ESCII)

120

100

80

60

40

20

6DS

4DS

2DS

0

1970 1980 1990 2000 2010 2020 2030 2040 2050

Sources: IEA 2012a, IEA 2012b. Note: the ETP scenarios (2DS. 4DS and 6DS) are defined in Box I.2. Figures and data that appear in this report can be downloaded from www.iea.org/etp/tracking.

Key point The carbon intensity of global energy supply has hardly improved in 40 years, despite efforts on renewable energy.

© OECD/IEA, 2013.

Introduction Key Findings

9

■ Construction began on seven nuclear power plants in 2012, but meeting 2DS goals will require far more significant construction rates.

The policy landscape is starting to stabilise after Fukushima, but some key countries remain undecided.

Public opinion seems to be improving in many regions. Most safety evaluations after the Fukushima accident found that existing reactors can continue to operate if safety upgrades are implemented.

■ Carbon capture and storage (CCS) technologies – essential in a world that continues to rely heavily on fossil fuels – are mature in many applications but still await their cue from governments.

While construction began on two new integrated projects in 2012, eight projects were publicly cancelled. There are signs of commercial interest in CCS technologies – public and private funds spent on

CCS projects increased by USD 1 2.6 billion in 2012 – but CCS will not be deployed in the power and industrial sectors until policies are in place that motivate industry to accelerate demonstration efforts.

A window of opportunity is opening in transport.

■ Hybrid-electric (HEV) and electric vehicles (EV) show very encouraging progress. HEV sales broke the one million mark in 2012, and reached 1.2 million, up

43% from 2011. Japan and the United States continue to lead the market, accounting for

62% and 29% of global sales in 2012 (740 000 and 355 000 vehicles sold). In order to hit

2020 2DS targets, sales need to increase by 50% each year. EV sales more than doubled in 2012, passing 100 000. This rate of sales growth puts EV deployment on track to meet

2DS 2020 targets, which require a 80% annual growth rate. Cumulative government targets for EV sales increased in 2012, with India announcing a total target of 6 million

EVs and HEVs on the road by 2020. The target is to be backed by government funding of

USD 3.6 billion to USD 4.2 billion, representing more than half of total required investment.

■ Fuel economy levels for new passenger light-duty vehicles LDV vary by up to

55% from country to country, demonstrating enormous scope for improving efficiency through policy.

Fuel economy improvements accelerate where implementation of fuel economy standards and other policy measures has been scaled up. The pace of improvement in some regions shows the strong potential to bring fuel-saving technologies

– most of which are already commercially available – into the market through policy action.

■ Global biofuels production – including bioethanol and biodiesel – was static in

2012 . Despite strong growth of 7% in biodiesel output in the United States (to 4 billion litres) and Latin America (to 7 billion litres), global volumes remained at roughly

110 billion litres. The slowdown in production growth reflects higher feedstock prices and lower production volumes in key producing regions. This is principally due to extreme weather conditions such as the 2012 drought that compromised the US corn harvest. The events in 2012 highlight the vulnerability of conventional biofuels production to high feedstock prices, which account for 50% to 80% of total production costs.

■ The advanced biofuels 2 sector added about 30% of capacity in 2012. More than

100 plants are now operating, including commercial-scale projects, with 4.5 billion litres in total capacity by end-2012. Yet some large-scale projects were cancelled or shelved in 2012; 3 in part, this reflects a lack of adequate policy mechanisms for advanced biofuel deployment in most regions.

1 Unless otherwise stated, all costs and prices are in real 2010 USD, i.e.

adjusted for inflation. Other currencies have been converted into USD using purchasing power parity (PPP) exchange rates.

2 Conversion technologies that are still in the R&D, pilot or demonstration phases.

3 For instance, the BP Biofuels 135 million litres per year (Ml/yr) cellulosic-ethanol project in Florida, United States, and the NSE

Biofuels 115 Ml/yr BtL project in Finland.

© OECD/IEA, 2013.

10

Introduction Key Findings

More effort needed in industry, buildings and systems integration.

■ Industrial energy consumption could be reduced by around 20% in the medium to long term by using best available technologies (BAT). To meet

2DS goals, it is necessary to optimise production and process techniques, and achieve technological advances, in both OECD and emerging economies. There has been reasonable progress in implementing these changes across industrial sectors but more is needed.

■ Several regions stepped up industry energy and emissions-reduction policies in 2012 , including Europe, South Africa and Australia. The South African

Department of Trade and Industry’s Manufacturing Competitive Enhancement

Programme announced a new project that provides USD 640 million over five years from 2012 to support companies that invest in clean technology among other areas of investment. Australia’s Clean Energy Future plan commenced in 2012. The plan includes a carbon price and complementary programmes to support energy efficiency measures in industry, including a USD 10.3 billion Clean Energy Finance

Corporation and a USD 1.24 billion Clean Technology programme.

■ In 2012 governments implemented several important policy measures to promote energy-efficient buildings and appliances.

These include the EU

Energy Efficiency Directive (EED), the United Kingdom’s Green Deal and Japan’s

Innovative Strategy for Energy and Environment. All of these include measures to address financing barriers to improvements of new and existing building stock.

For appliances, the Indian Bureau of Energy Efficiency increased the stringency of energy performance standards for air conditioners by 8%, following introduction of a mandatory labelling programme in 2010. Forty-six countries agreed to phase out incandescent lamps by 2016 under the “en-lighten” 4 initiative, which aims to accelerate a global market transformation to environmentally sustainable lighting technologies. Australia introduced a first-of-a-kind phase-in policy for best available lighting products.

■ Technologies for improved systems integration and flexibility, such as stronger and smarter grids, are vital. Demonstration and deployment of smart-grid technologies intensified in 2012, but better data and deployment indicators are required to provide an accurate picture of progress. Smart-grid deployment is starting to provide experience that can be built on. Investment in advanced metering infrastructure, distribution automation and advanced smart-grid applications increased in 2012, to reach USD 13.9 billion.

Progress in individual technology areas is important; what matters most is the successful transition of the whole energy system to a clean energy platform. The deployment of smart grids is vital.

4 The en-lighten initiative was established in 2009 as a partnership among UNEP, GEF, OSRAN AG, Philips Lighting and the

National Test Centre in China. See www.enlighten-initiative.org.

© OECD/IEA, 2013.

Introduction Key Findings

11

Public investments in energy RD&D must at least triple, as the energy share of research budgets remains low.

■ Energy’s share of IEA countries’ 5 total RD&D investments is small; it has varied between 3% and 4% since 2000, after peaking in 1980 when it was more than 10%. Governments have preferred other areas of research, such as health, space programmes and general university research. Defence research receives the most government support, and while it has also seen its share of funding decline, it remains dominant with 30%.

■ Nuclear fission accounts for the largest share (24% in 2010) of investment in energy technology RD&D among IEA countries, but renewables, hydrogen and fuel cells have seen the biggest increases since 2000.

In particular, spending on renewable energy RD&D has risen sharply over the last decade and now accounts for more than 24% of total public spending on clean energy RD&D. In general, the United States and Europe spend more on RD&D for renewables than the

Pacific region or emerging economies.

Poor quality and availability of data are still serious constraints in tracking and assessing progress.

■ A broad concern for much energy data, quality is a particular constraint in emerging economies, for energy-efficiency data in buildings and industry, and in cross-cutting areas such as smart grids and integration of heat and electricity systems.

Data that define the energy balance of each country need to be more timely and reliable so that the energy system as a whole can be analysed accurately and so that effective policies and investments can be replicated. RD&D data in emerging economies are still scarce, and data for private RD&D are collected in few countries.

© OECD/IEA, 2013.

5 Due to data constraints it is not possible to aggregate CEM country investments.

12

Introduction Key Findings

Table I.1

On track?

Summary of progress

Status against 2DS objectives Policy Recommendations

Renewable power

On track to meet 2DS objectives in terms of absolute generation and investment levels.

Concentrating solar power, offshore wind, enhanced geothermal not advancing quickly enough.

n n n n

For more mature markets and technologies, policies to enable greater market and system integration of higher penetrations of variable renewables are vital.

For less developed markets and technologies, strategies should focus on market expansion or stimulating early-stage deployment.

Policies must be predictable and transparent.

Markets must be designed to allow recuperation of capital cost of investments. This is particularly important for technologies with very low marginal costs.

Nuclear power

Projected 2025 capacity 15%-32% below 2DS objectives.

Both new-build activity and longterm operation of existing reactors required to meet 2DS goals. n n

More favourable electricity market mechanisms and investment conditions required to de risk investments and allow investors to recuperate high upfront capital cost.

Post-Fukushima safety upgrades should be quickly implemented to foster public confidence.

Gas-fired power

Share in thermal generation has increased at the expense of coal in some regions, but not all.

n n

Higher carbon prices and other regulatory mandates are required to drive coal-to-gas switching outside the United States.

Development of unconventional gas resources would help bring down gas prices and potentially trigger coal-to-gas switching in regions that currently rely heavily on coal. Scaling up unconventional gas extraction requires careful regulation and monitoring, in order to avoid adverse effects on the environment.

Coal-fired power

Growth is outpacing increases in generation from non-fossil energy sources.

Projected global coal demand exceeds 2DS levels by 17% in 2017, higher than 6DS pathway. n n n

Governments must explicitly recognise the impact of increasing coalfired power generation.

To reduce the impact of increasing coal use, ultra-supercritical units should be installed unless there is strong reason not to do so.

Pricing and regulation that reduce CO

2

emissions, control pollution and reduce generation from inefficient units are vital.

CCS

Capture capacity of projects currently operational or in pipeline is only 25% of 2DS 2020 target.

Still no large-scale integrated projects in power sector; and few in industry.

n n n n

Governments must show real financial and policy commitment to CCS demonstration and deployment.

Near term policies should be supported by credible long-term climate change mitigation commitments.

Recognise the large investments and long-lead time required to discover and develop viable storage capacity.

Address CO

2

emissions from industrial applications and introduce

CCS as a solution.

Industry

Reasonable progress in improving energy efficiency, but there remains significant potential to deploy best available technology and optimise processes.

n n n n

Implement policies to ensure that new capacity is developed with best available technology and that industrial plant refurbishment projects are promoted to meet energy efficiency targets.

Measures to facilitate access to financing are vital.

Particular efforts are needed to improve energy efficiency in light industry and SMEs.

To avoid technological lock-in of inefficient technology in developing countries, technology transfer efforts must be enhanced.

●

Not on track

●

Improvement, but more effort needed

●

On track, but sustained deployment and policies required

© OECD/IEA, 2013.

13

Introduction Key Findings

Table I.1

On track?

Summary of progress (continued)

Status against 2DS objectives Policy Recommendations

Fuel economy

Annual fuel economy improvement was 1.8% between 2008 and 2011, below the 2.7% 2DS target. 55% variation between countries shows the potential for improvement.

n n n

Fuel economy standards should immediately be implemented in all OECD regions as part of comprehensive fuel-economy policy packages, including for heavy duty vehicles (HDV).

For non-OECD regions, labelling measures is a key near-term priority, and full LDV policy packages should be in place by 2015 to 2020.

Stronger economic incentives for consumers are critical, e.g. through

CO

2

-based vehicle taxes, fee/rebate systems (feebates), or fuel taxes.

Electric and hybrid-electric vehicles

Deployment of EVs and HEVs on track to meet 2DS 2020 targets, but sales must increase by around

80% (EVs) and 50% (HEVs) each year to 2020. Large discrepancy between government targets and stated industry plans.

n n n

Strengthen policies to enhance cost-competitiveness of EVs and HEVs and boost manufacturer and consumer confidence.

Develop standards for charging stations, integrate EVs in city mobility programmes ( e.g.

car sharing schemes) and underscore broader benefits of EVs, including lessened local air pollution.

Public fleet acquisitions can reduce costs of EVs and HEVs, through economies of scale.

Biofuels

Annual biofuels production must more than double to reach 2DS 2020 target. Advanced biofuels capacity must increase six-fold to 2020.

n n n

Lessen the risks for early investors through mechanisms such as loan guarantees, guaranteed premiums for advanced biofuels, or direct financial support for first-of-a-kind investments.

Targeted policy support for advanced biofuels required to ensure large-scale deployment.

Monitor sustainability in feedstock production.

Buildings

Large untapped potential to enhance energy performance of buildings and appliances.

Only three countries have bestpractice building code.

n n n

Enforce stringent, performance-based energy codes for entire building stock and strong minimum energy performance standards for building elements, appliances and equipment.

Energy reduction targets should be set with a long-term view and must ensure that renovation is deep enough to avoid “locking in” energy efficiency potential.

Develop dedicated renewable heat policies.

Smart grids

Demonstration and deployment of smart grid technologies is accelerating, but better data collection required for a complete picture of progress.

n n n

Accelerate national data collection and international data coordination.

Develop and demonstrate new electricity regulation that enables practical sharing of smart grid costs and benefits. Current regulation often supports conventional approaches to system development.

Ensure that privacy concerns do not become a barrier to smart grid deployment.

●

Not on track

●

Improvement, but more effort needed

●

On track, but sustained deployment and policies required

© OECD/IEA, 2013.

Global recommendations

CEM governments have the power to transform the global energy system. It is time to use it.

member governments

23

13 initiatives

share of global CO

2

22 GtCO

2

emissions

80%

in 2010, up 30% from 2000

population (billion)

4.1

61% of global population

90% of global clean energy investment

75%

of global energy consumption

390 EJ consumed in 2010

75%

of global GDP

62%

of global renewable production

43 EJ in 2010

69%

of global energy imports

but only 49% of exports

Rapid and large-scale transition to a clean energy system requires action on an international scale; individual, isolated efforts will not bring about the required change. Governments need to give the private sector and financial community strong signals that they are committed to moving clean energy technologies into the mainstream.

Governments should: n

Make more ambitious efforts to deepen international collaboration on clean energy deployment, through joint, actionable and monitored commitments.

n

Set clear and ambitious clean energy technology goals, underpinned by stringent and credible policies.

Global recommendations

Unless we get prices and policies right, a cost-effective clean-energy transition just will not happen.

trillion USD

19 estimated business as usual energy investment to 2020

billion USD

523 fossil-fuel subsidies in 2011, up 20% from 2010

EUR/tCO

2

50 estimated carbon price to effect coal-to-gas switch in Europe

USD/bbl

112

2012 average crude oil price, almost five times 2002 levels. Energy’s economic importance keeps rising

5

trillion USD

additional investment required to 2020 for the clean-energy transition

88

billion USD

renewable energy subsidies in 2011

7.1

EUR/tCO

2

2012 average carbon price in Europe

24% drop in average EU import prices for steam coal in

2012 vs 2011

Spending on low-carbon technologies must be smart, given increasing fiscal pressure and the rate of required investment. Large-scale markets for clean energy technology will depend on appropriate energy pricing and effective government policy to boost private sector investment.

Governments should: n

Reflect the true cost of energy in consumer prices, including through carbon pricing.

n

Phase out direct and indirect fossil-fuel subsidies and increase economic incentives for clean energy technologies.

n

Develop and implement long-term, predictable policies that will encourage investors to switch from traditional energy sources to low-carbon technologies.

Global recommendations

Policies must address the entire energy system and take a long-term view.

60% average share of energy input lost as heat in power generation

10% share of wind and solar in global electricity by 2020 in the

2DS, a five-fold increase on current levels.

By 2050, this share needs to be 30%

km

2

33 000 global parking space in 2010, roughly the size of Belgium; expected to grow by 40% by 2020

46% share of global energy consumption used for heating and cooling

500 000

km

length of new transmission and distribution lines needed globally by 2020.

As many need refurbishing or replacing

1:3 typical cost/benefit ratio in smart grids investments

Smart infrastructure investments that enable system-wide gains make sense. Clean energy solutions like electric vehicles and solar PV depend on them. Integrated systems enable more effective energy delivery and consumption; they also enable investment in one sector to be leveraged in others. Infrastructure takes time to build, so action is needed now.

Governments should: n

Draw up strategic plans that support and guide long-term public and private energy infrastructure investments.

n

Take a long-term view, thinking beyond electoral cycles, so that technologies that facilitate the transformation of the energy system are put in place early.

n

Design policy based on analysis of local conditions that affect the operation of the system.

Global recommendations

Energy efficiency: the easy win. Unleashing its potential requires stronger economic incentives and more ambitious regulation.

45% share of required emissions reductions to 2020

that can be delivered by energy efficiency

countries

3 have performance based

Building Energy Codes

20% share of energy that is converted to mobility in a typical gasoline or diesel car

0.5% annual improvement in energy intensity 2000-2010 (energy/GDP); target improvement rate is over 2%

56.7

tCO

2

/TJ

Energy Sector Carbon Intensity in 2010.

Almost static since 1990

Zero

energy

targeted performance from 2021 for new buildings in the

European Union

130-200

gCO

2

/km

range in average car fuel economy in CEM countries; global average in 2011 was 167 gCO

2

/km

30%

Potential energy savings in industry with implementation of an energy management system

Barriers such as high upfront capital costs, customer indifference, and lack of awareness or capacity, leave much cost-effective energy-efficiency potential untapped. Economic incentives are crucial to drive change and investment; standards and codes have also proven effective, as have awareness building and training schemes.

Governments should: n

Integrate energy efficiency into economic, health, environment and energy policies in order to achieve the full range of benefits and better value its impact.

n

Set, enforce and regularly strengthen building energy codes, fuel economy standards, energy management in industry and other energy efficiency measures.

n

Put in place policies that create clear economic incentives for energy efficiency investments.

n

Improve awareness and knowledge in industry and among consumers about the benefits of energy efficiency.

Global recommendations

Accelerating government RD&D support is vital to bring promising clean energy technologies to the market.

11% proportion of IEA governments’

RD&D budget dedicated to energy in 1981

billion USD

17

IEA government energy RD&D spending in 2011, down 15% since 1980, but up 75% since 2000

billion USD

1.9

government spending on fossil-fuel research in 2011

13

out of

14 top PV innovations developed with government support in the United States since 1980

4% proportion of IEA governments’ RD&D budgets dedicated to energy in 2011

3.5

billion USD

government spending on renewable energy and energy efficiency research in 2011

50%-80% estimated required government share in RD&D costs of energy technology development, compared to private sector

3-6

times

required increase of RD&D investments. For advanced vehicles and CCS the gap is much higher

Early deployment provides vital opportunities for learning and cost reduction for more mature technologies, but strategic RD&D is also critical to enable technologies to meet the performance and cost objectives that make clean energy competitive. The private sector will not act on its own.

Governments should: n

Enhance investment in RD&D in new clean energy technologies and double its share in public budgets. Public RD&D investment should be supplemented with targeted policies that foster demand for these technologies.

n

Improve quality and availability of technology-specific data on public energy

RD&D investment. Understanding RD&D gaps requires greater clarity on current spending, both public and private.

n

Expand international collaboration on energy RD&D, including sharing lessons on innovative RD&D models, to more effectively leverage limited government resources, avoid duplication and improve efficiency of investments.

19

Introduction

Tracking Progress:

How and Against What?

■ Tracking Clean Energy Progress 2013 assesses how effective current policy is at achieving a more sustainable and secure global energy system.

What rates of deployment do recent trends demonstrate for key clean energy technologies? Are emerging technologies likely to be demonstrated and commercially available in time to fully contribute?

■ Tracking against near-term targets but aiming for the long term.

This report uses interim, 2020 2DS benchmarks to provide an overview of whether technologies and energy savings measures are on track to achieve 2DS objectives by 2050. The near-term focus shows whether actions that are necessary for more profound decarbonisation post-2020 are progressing as required. The report highlights how the overall deployment picture has evolved since the 2012 Clean Energy Ministerial (CEM3) and, vitally, key policy and technology measures that energy ministers and their governments can take to scale up deployment for each technology and sector with energy savings potential.

Graphical overviews 6 that introduce each section summarise the data behind the section’s key findings. The book is structured by technology and sector. This year’s edition contains new sections dedicated to natural gas technologies and smart grids, and a special feature on RD&D innovation. As a separate annex to this report there is a publication on CCS applications in industry.

■ Technology penetration, market creation and technology developments are key measures of progress in clean energy deployment.

All three are essential to the success of individual technologies. The 2DS relies on development and deployment of lower-carbon and energy-efficient technologies across the power generation, industry, transport and buildings sectors (Figure I.2). For each sector, this report assesses, on the basis of available quantitative and qualitative data:

■

■

■

Technology penetration.

What is the current rate of technology deployment?

What share of the overall energy mix does the technology represent? Is the technology being distributed or diffused globally at the rate required?

Market creation.

What mechanisms are in place to enable and encourage technology deployment, including government policies and regulations? What level of private sector investment can be observed? What efforts are being made to drive public understanding and acceptance of the technology? Are long-term deployment strategies in place?

Technology developments.

Is technology reliability, efficiency and cost evolving and if so, at what rate? What level of public investment is being made into technology RD&D?

6 Enhanced interactive data visualisations are available on www.iea.org/etp/tracking.

© OECD/IEA, 2013.

20

Introduction

Figure I.2

38

37

36

35

34

33

32

31

30

29

2009

Sector contributions to emissions reductions

6DS emissions 38 Gt

2DS emissions 32 Gt

2015

Key point All sectors must contribute to achieve the 2DS.

2020

Other transformation 1%

Buildings 18%

Transport 22%

Industry 23%

Power generation 36%

Box I.2

ETP 2012

scenarios

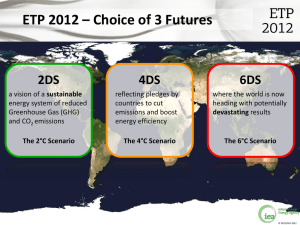

The 6°C Scenario (6DS) is largely an extension of current trends. By 2050, energy use almost doubles (compared with 2009) and greenhouse gas emissions rise even more. The average global temperature rise is projected to be at least 6°C in the long term.

The 4°C Scenario (4DS) takes into account recent pledges made by countries to limit emissions and step up efforts to improve energy efficiency. It serves as the primary benchmark when comparisons are made between scenarios. In many respects, this is already an ambitious scenario that requires significant changes in policy and technologies.

Moreover, capping the temperature increase at 4°C requires significant additional cuts in emissions in the period after 2050.

The 2°C Scenario (2DS) is the focus of ETP 2012 .

The 2DS describes an energy system consistent with an emissions trajectory that recent climate science research indicates would give an 80% chance of limiting average global temperature increase to 2°C. It sets the target of cutting energy-related CO

2

emissions by more than half in

2050 (compared with 2009) and ensuring that they continue to fall thereafter. The 2DS acknowledges that transforming the energy sector is vital, but not the sole solution: the goal can only be achieved if

CO

2

and greenhouse gas emissions in non-energy sectors are also reduced.

© OECD/IEA, 2013.

© OECD/IEA, 2013.

Chapter 1

Power Generation

22

Chapter 1

Power Generation Renewable Power

Renewable Power

● On track

Renewable power technologies are broadly on track to meet 2DS targets by 2020, as performance improves, deployment is scaled up and markets expand globally. Improving economic competitiveness is likely to support robust growth but effective policy support is vital, including market design reforms to facilitate grid integration. Wider deployment of concentrating solar power and offshore wind is needed, as well as enhanced RD&D for promising new technologies, such as ocean power.

Technology penetration

1.1 Renewable power generation by technology

TWh

More online

3 016 3 516 4 102

220

2000

2 700

360

2005

723

2010

1 566

2015 projecon

Bioenergy

Geothermal

Wind

Ocean

Solar Hydropower

2 864

4 571

2020 2DS target

19%

ShaRE OF

RENEwaBlES

IN GlOBal

ElECTRICITy

GENERaTION

IN 2011 (25%

2DS TaRGET

IN 2020)

More online

1.2 Renewable power generation by region

Projecons

8 000

6 000

4 000

2 000

0

2000 2005 2010 2015 2017

2DS target

2020

Other non-OECD

India

China

Brazil

OECD Asia Oceania

OECD Americas

OECD Europe

© OECD/IEA, 2013.

Chapter 1

Power Generation Renewable Power

23

Market creation

1.3 Annual capacity investment

300

200

100

0

2001 2012 2011

Fossil fuels

Large hydro

Small hydro

Ocean

Biomass

Geothermal

Wind

Solar

Recent developments

Policy uncertainty contributed to a slowdown in renewable capacity investment in

2012. Clear and predictable policy support is vital to keep deployment on track

2012 investment was still in line with 2DS objectives, at an estimated USD 270 billion

Technology developments

1.4 Technology investment costs

8 000

6 000

4 000

2 000

0

Solar PV large scale

Solar PV rooop

CSP Onshore wind

2011

Offshore wind

Geothermal flash

Geothermal binary

Bioenergy

2012 2020 2DS target

Large hydro

Small hydro

Combined cy cle g as turbine

Supercrical coal

1.5 IEA public RD&D spending

4

Renewable power 3

Renewables for heat

Liquid biofuels

2

1

0

2000 2011

Bioenergy

Hydro

Geothermal

Ocean

Wind

CSP

Solar PV

0 0.6 1.2

For sources and notes see page 141

© OECD/IEA, 2013.

24

Chapter 1

Power Generation Renewable Power

Recent developments

■ Globally, renewable energy continued to grow strongly in 2012 in both OECD and non-OECD countries. Preliminary analysis suggests that capacity expanded in the most dynamic sectors

– solar PV, by an estimated 29-30 GW (+42%), and wind (onshore and offshore), by 44-45 GW

(+19%). This builds on robust performance in 2011, when total generation (as well as capacity) showed strong growth. Non-hydropower generation rose by an estimated 142 TWh from 2010 (+19%) and hydropower generation increased by 108 TWh (+3%), to bring total growth in renewable power generation to 250 TWh (+6%). Non-hydropower capacity increased by 77 GW (+19%) in 2011, while hydropower capacity expanded by 35 GW (+3%).

■ Global investment in new renewable power plants excluding large hydropower was

USD 240 billion in 2012. This is 11% lower than the record USD 1 270 billion in 2011, but remains in line with 2DS objectives. The slowdown in investment reflects policy uncertainty and “stop-and-go” policy decision-making in key regions, in addition to falling equipment costs – in particular for solar PV and wind – and challenging financing conditions in several markets, including Europe.

■ In the United States, for example, uncertainty regarding the potential expiration of a production tax credit for wind generation at the end of 2012 continued to slow investment in future wind capacity (Figure 1.6). A one-year extension enacted at the start of 2013 means that the tax credit, and consequently investment, still lack long-term certainty.

Similarly, wind investment fell in India after tax- and generation-based financial incentives expired in 2012, with uncertainty remaining over their reinstatement.

■ While several governments reduced economic incentives for renewable technologies as their competitiveness improved, and to control policy costs ( e.g.

Germany, Italy and Spain), others increased or upgraded economic incentive schemes or policy frameworks. Japan introduced a feed-in tariff scheme across a range of renewable technologies, in the face of rising electricity needs. China introduced measures to facilitate the grid connection of distributed solar PV systems and a deployment target of 10 GW of new solar PV for 2013. Korea replaced its feed-in tariff scheme with a renewable portfolio standard, supported by renewable energy certificates and tax incentives.

■ The renewable energy industry, largely in solar PV and wind, entered a phase of deeper consolidation, particularly among smaller and higher-cost manufacturers. Increased competition in the manufacturing sector, however, continued to boost other parts of the industry value chain.

■ Investment costs for renewable electricity technologies continued to fall in 2012, particularly for solar PV and onshore wind. However, cost reductions are proceeding more slowly for other technologies, such as offshore wind and CSP.

1 Unless otherwise stated, all costs and prices are in real 2010 USD, i.e.

excluding inflation. Other currencies have been converted into USD using purchasing power parity (PPP) exchange rates.

© OECD/IEA, 2013.

Chapter 1

Power Generation Renewable Power

25

Figure 1.6

Wind capacity additions in the United States

14

12

10

8

6

4

Expiration of production tax credit

2

0

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009

Note: Figures and data that appear in this report can be downloaded from www.iea.org/etp/tracking.

Source: IEA, 2012c; American Wind Energy Association www.awea.org/learnabout/industry_stats/index.cfm (for 2012 data).

2010 2011 2012

Key point Policy uncertainty has a direct impact on investments.

Overall progress assessment

The role of renewable power in the 2DS

Renewables dominate power generation in the 2DS: the scenario assumes an increase in renewable energy’s share of world electricity generation from 20% in

2010 to 28% by 2020 and 57% by 2050.

In the 2DS, 7 500 TWh of renewable electricity is generated in 2020, versus total generation of 27 165 TWh. Hydropower makes the largest contribution (17% of total electricity generation), followed by wind (6%), biomass and waste

(3%), and solar (2%). Renewable energy contributes around 15% to emissions reductions relative to the 4DS by 2020, the second-largest contribution after end-use fuel and electricity efficiency.

In the 2DS, the largest proportion of global renewable electricity generation in 2020 comes from

China (24%), followed by OECD Europe (19%), the US (11%), Brazil (7%) and India (5%).

Technology penetration

as a portfolio of renewable technologies continues to become more competitive, renewable power is on track to meet 2020 2DS objectives in terms of absolute generation (Figure 1.1). In 2011, renewable generation (including pumped hydro storage) reached an estimated 4 540 TWh, up from 4 290 TWh in 2010 (+5.8%). This follows strong growth over the last decade, with global renewable generation growing by 1 620 TWh from

2000-11 (+4.1% annually). Non-hydropower sources increased by 680 TWh (+13.6% annually) and hydropower by 940 TWh (+2.8% annually) over the period. Robust growth is expected to continue, 2 with renewable generation forecast to increase to almost 6 400 TWh in 2017

(+5.8% per annum from 2011 levels), in line with 2DS goals. Non-hydropower technologies are projected to expand by over 1 100 TWh (+14.3% annually) and hydropower by 730 TWh

(+3.1% annually) (IEA, 2012c).

Renewable deployment, particularly non-hydro, is continuing to spread geographically . In 2011, the number of countries with installed capacity above 100 MW rose significantly compared with 2005 levels for several non-hydro technologies, including onshore

2 The IEA Medium-Term Renewable Energy Market Report 2012 sets out market trends and projections to 2017 for the renewable electricity market.

© OECD/IEA, 2013.

26

Chapter 1

Power Generation Renewable Power

Figure 1.7

and offshore wind, bioenergy, and solar PV (Figure 1.7). Such diffusion is vital to meet 2DS objectives across different regions, and is projected to continue and deepen in the medium term. Growth is shifting beyond traditional support markets in Europe to an increasing number of non-OECD areas.

Led by Brazil, China and India, in 2011 non-OECD regions accounted for an estimated 2 410 TWh, or around 53%, of renewable electricity production, up from 45% in 2000 (Figure 1.2).

Market concentration of non-hydro renewables

70

60

50

40

30

20

10

0

2005 2011 2017 2005 2011 2017 2005 2011 2017 2005 2011 2017 2005 2011 2017 2005 2011 2017 2005 2011 2017

Onshore wind Offshore wind Bioenergy Solar PV CSP

OECD Non-OECD

Source: unless otherwise noted, all tables and figures in this report derive from IEA data and analysis.

Geothermal Ocean

Key point Deployment of renewable electricity is spreading geographically.

Solar PV generation is growing fast, expanding from marginal levels in 2000 to an estimated 65 Twh in 2011 (+47% annually), up from 32 TWh in 2010.

Despite increased turbulence in the upstream manufacturing industry and incentive cuts in some key markets ( e.g.

Germany and Italy), growth in capacity remained robust in 2012, spurred by falling system prices and stronger policy frameworks in markets such as Japan and China. Preliminary analysis suggests 2012 global solar PV installations near 30 GW, similar to capacity additions in 2011. Generation growth is projected to continue over the medium term, to nearly 280 TWh in 2017, putting solar PV on track to achieve 2020 2DS objectives (380 TWh in 2020). Until recently, deployment was concentrated in countries with strong policy support, such as Germany, Italy and the United States. However, improving competitiveness is helping deployment to spread into Africa, the rest of Asia, Latin America and the Middle East. This trend must continue if 2DS objectives are to be met.

Concentrating solar power (CSP) has not had the same explosive growth as solar PV. In 2000-2011, total growth was just over 3 TWh (+20% annually), reaching an estimated 4 TWh in 2011, from over 2 TWh in 2010. Though it is projected to grow significantly through 2017, to more than 30 TWh, development is likely to fall short of the

2DS 2020 goal of 100 TWh. Competition from lower-cost solar PV is challenging deployment, with some projects in the United States having converted from CSP to solar PV. However, the suitability of CSP for hybridisation ( e.g. integration with a fossil fuel plant) and storage can enhance its value through dispatchability, which may lead to increased market penetration.

Commercial capacity has been concentrated in a few areas, largely Spain and the United States, but numerous projects are being developed in the Middle East and North Africa, as well as in

Australia, India, China and South Africa. In Morocco, the first phase (160 MW) of the 500 MW

Ouarzazate project secured financing in 2012 and is expected to be operational by 2015.

© OECD/IEA, 2013.

© OECD/IEA, 2013.

Chapter 1

Power Generation Renewable Power

27

Onshore wind generation is on track to achieve the 2DS 2020 objective of almost

1 500 Twh generation.

One of the most cost-competitive renewable energy sources, onshore wind has been deployed in several countries with good resource areas. From 2000 to

2011, generation increased by 400 TWh (+27% per year), reaching an estimated 435 TWh in

2011, up from 335 TWh in 2010, reflecting sizeable expansions in China and the United States in particular. By 2017, generation is expected to reach almost 1 000 TWh. In some countries with good wind resources, such as Brazil and Turkey, projects are competing well against fossil fuels in wholesale electricity markets without economic incentives. Global growth rates have started to slow, however, because of grid integration challenges, in China for example, and uncertainty over key policy incentives in some areas, such as the United States and India.

Offshore wind generation growth has accelerated in the past few years, but from low levels, reaching an estimated 12 Twh in 2011, up from almost 9 Twh in 2010 (+40%).

The technology is still emerging and requires further deployment to bring down costs. The United Kingdom, where exploitation rights to developers have been offered via three tendering rounds over the past decade (47 GW total), and Denmark, with its long-standing wind experience, have led deployment. Most medium-term developments are expected in Northern Europe and China. Still, meeting the 2DS objective of 130 TWh may be difficult; at current expected growth rates, generation should reach 80 TWh in 2017. Progress will depend on securing grid connections and tackling technical and financial difficulties.

Geothermal generation grew by over 19 Twh from 2000 to 2011 (+2.9% annually), to over 70 Twh. Generation costs from high-temperature geothermal resources are competitive with fossil fuels, and medium-term projections see generation rising to 90 TWh in

2017, but development is trailing the 2DS objective of 150 TWh, because of risks associated with well exploration. Geothermal represents a significant portion of electricity production in

Iceland (27%), El Salvador (26%), Kenya (19%) and the Philippines (15%). The United States,

Indonesia and the Philippines have the largest installed capacity and most medium-term development is expected in these areas. In Japan, the government has approved development in parts of national parks, bringing total exploitable potential to 12 GW.

Electricity from solid biomass, biogas, renewable municipal waste and liquid biofuels grew by over 170 Twh from 2000 to 2011 (+8% per year), to reach an estimated 310 Twh, up from almost 280 Twh in 2010.

Deployment is on pace to meet the 2DS goal of 655 TWh. Not every country has great domestic bioenergy potential, but municipal waste can contribute to renewable power production anywhere in the world.

Moreover, some bioenergy feedstocks, such as wood pellets, are internationally traded, which is rare among renewable energy sources. Medium-term projections see generation rising to over 530 TWh in 2017. The largest developments are expected in China, Brazil and

Japan. Other players include the United States, with the largest current capacity; Nordic countries, with co-generation plants producing both electricity and heat for district heating systems; and the United Kingdom, which is taking a lead in co-firing with coal and the conversion of coal-fired plants. Meeting 2DS objectives will depend heavily on the cost and availability of biomass.

Ocean power generation remains small, at less than 1 Twh in 2011, but has taken important strides towards commercialisation. In 2011, the largest commercial ocean project came on line in Korea; large plants also exist in France and

Canada. The potential for ocean technologies is significant and widespread. Still, the technology remains costly and much activity remains at the demonstration level. Further

RD&D support is needed to bring deployment in line with 2DS objectives.

28

Chapter 1

Power Generation Renewable Power hydropower grew from 2 700 Twh (including pumped hydro storage) in 2000 to an estimated 3 640 Twh in 2011 (+3% annually).

China, Brazil, Canada, the United States and Russia have the largest hydro output, with China and Brazil accounting for most growth.

Medium-term projections see generation expanding to near 4 380 TWh in 2017, with globally capacity at 1 300 GW, a pace that exceeds the 2DS objective of 4 570 TWh by 2020. Significant global resource potential remains, however, especially in developing countries, where hydropower can provide cheap and reliable electricity. With long project lead times, the on-time commissioning of plants as well as addressing project sustainability issues remain key to achieving the 2DS goal.

Market creation

Investment in new renewable electricity capacity, including in emerging markets, has more than doubled over the last decade and is currently in line with the sizeable levels required to meet the 2DS goals (Figure 1.3). In the 2DS, renewables account for 56% of average annual investment in power generation between

2010 and 2020, or around USD 210 billion per annum. Wind accounts for 20% of average annual investment (USD 75 billion); solar 16% (USD 61 billion); and other renewables 20%

(USD 74 billion). Global investment in new renewable energy capacity, excluding large hydropower capacity, increased by USD 230 billion between 2001 and 2012, reaching an estimated USD 240 billion in 2012 (+34% annually), in line with 2DS objectives. In 2012 investment reached USD 143 billion in solar, USD 78 billion in wind, and USD 19 billion in other renewables. Investment is expanding in many emerging markets, including Brazil and other countries in Latin America and in Asia, supported by attractive project economics and rising electricity demand. This progress needs to extend to newer markets, such as the

Middle East and Africa, in order to meet 2DS objectives.

Investment slowed in some technologies and regions in 2012 not only because of continued falls in technology costs and increased economic headwinds, but also because of policy uncertainty in key markets. This highlights the importance of clear, predictable and long-term policy support, backed by long-term targets.

Government support schemes, including generation and deployment targets, economic incentives ( e.g.

feed-in tariffs, tradable green certificates, tenders, tax incentives and grants) and measures to facilitate the system integration of variable renewables ( e.g.

through increased power system flexibility) have driven the strong growth in renewable energy deployment over the last decade. The challenge for governments is to design policies that achieve several goals at once: help renewables to compete; effectively match the pace of cost reductions for renewable technologies, to avoid excessive policy costs; and maintain investor certainty and confidence, through transparent and predictable frameworks that reduce investment risk and cost, and increase availability of finance.

Some 110 countries had national renewable electricity policies in place at the end of 2012.

The extent of revisions to government policy in 2012 demonstrates the complexity in implementing effective policy support. Table 1.1 provides an overview of key policy shifts in national economic incentives for renewable power in 2012. The largest changes in incentives pertained to markets where solar PV deployment had accelerated amid rapid cost reductions, or occurred in countries with deteriorating economic conditions – with some markets experiencing both trends. Many of the decreases in economic incentives were adjustments to feed-in tariffs (FITs) and the implementation of mechanisms for reducing

FITs for future projects over time. Even highly developed markets, such as Germany, faced difficulty in reconciling investor certainty with policy flexibility in the adjustment of solar

PV feed-in tariffs. Still, changes in economic incentives should not be confused with overall support frameworks. In general, countries have not scaled down renewable electricity deployment targets, with some even increasing them ( e.g.

China, Denmark and Italy).

© OECD/IEA, 2013.

Chapter 1

Power Generation Renewable Power

29

Table 1.1

Changes in key national economic incentives for the renewable electricity sector in 2012

Change of regime

Increase

Decrease

Incentive Countries

FITs

Japan: feed-in tariffs (FITs) replaced renewable portfolio standard (RPS).

South Korea: RPS system replaced FITs.

Sweden and Norway: introduced joint Green Certificates Market.

Indonesia: tariffs for geothermal energy implemented.

Jordan, Malaysia, Rwanda and Ukraine: FIT systems introduced.

Other economic incentives Australia: AUD 2 billion for investments via Clean Energy Finance Corporation.

Brazil: introduced discounts on transmission and distribution fees and net metering.

China: waived charges for grid connections for small-scale solar PV.

Romania: implemented allocation floor for Green Certificates.

FITs Australia: 3 FIT levels for solar PV reduced by 41%.

Canada: 4 FIT levels reduced for wind by 15% and and solar PV by 9.6%-31.5%.

Germany: under EEG 2012, FIT rates revised down and degression rates increased for several technologies, particularly solar PV.

Italy: FIT levels for solar PV lowered by 20% and annual support cap imposed.

Portugal: moratorium on FITs for new installations.

Spain: moratorium on FITs for new installations.

FITs and other economic incentives

Bulgaria: FIT cuts of 10%-50%. Biggest decrease of tariffs for solar PV.

Retroactive tax for solar PV operators introduced.

Greece: FIT levels reduced up to 46% for solar PV, new licenses for solar PV installations were suspended and retroactive tax on renewable systems introduced.

United Kingdom: cuts in FIT levels up to 40% for solar PV. Announced future adjustments to Renewable Obligation Certificates (both increases and decreases depending on technology).

Other economic incentives Belgium: 5 adoption of a retroactive grid access tariff for the use of the grid for

PV systems benefiting from net-metering.

United States: expiration of cash grant programme (Section 1603). Uncertainty over the expiration of the production tax credit (extended for one year at the start of 2013).

India: expiration of accelerated depreciation and generation-based incentives.

© OECD/IEA, 2013.

3 Changes refer to FITs in the state of Victoria.

4 Changes refer to decrease of FITs in the province of Ontario.

5 For Flanders only; adoption December 2012.

30

Chapter 1

Power Generation Renewable Power

Technology developments

while renewable electricity remains generally more expensive than conventional wholesale power and economic policy incentives play a large role in sustaining development, leading technologies are becoming increasingly competitive (Figure 1.4). Capital costs for onshore wind, hydropower and geothermal are decreasing in line with assumptions. Capital costs for solar PV continue to fall – in 2012, large-scale systems were at USD 1 500-3 500/kW and small-scale systems were at

USD 2 400-6 000/kW – but remain above 2020 2DS levels (USD 1 211-1 880/kW for large systems and USD 1 534-2 303/kW for small systems). Cost reductions are proceeding more slowly for other technologies, however. Turbines and associated equipment suited for an ocean environment make offshore wind costlier than onshore wind. CSP costs are also high, though hybridisation and storage features add value that should enhance attractiveness over time.

These trends in investment costs have translated into increasingly attractive generation economics versus other sources.

In Brazil, average onshore wind auction prices fell to USD 42/MWh on average in December 2012 (12% lower than the prior year).

There, wind competes well with natural gas and with other historically less expensive renewable sources, such as hydropower and bioenergy, though delivering projects at the most recent low bid prices will be challenging in practice. Onshore wind has been competitive in New Zealand for several years, thanks to excellent wind resource conditions and relatively expensive fossil-based alternatives. Geothermal and most hydropower are already competitive with their fossil alternatives in places with favourable resource conditions.

Large-scale bioenergy plants can also be competitive, depending on feedstock prices.

Solar PV generation costs are higher, but are falling rapidly.

While utility-scale solar PV costs are still significantly higher than base-load generation from conventional fuels, they approach peak power prices in places with summer peak demand ( e.g.

due to air-conditioning needs) and unsubsidised fossil-fuel alternatives. Small-scale solar PV systems are more expensive, but mini-grid and off-grid applications are already competitive with alternatives in many cases. Grid-connected residential PV systems can achieve lower generation costs than retail electricity prices for households in countries with good solar resource and high retail prices. Still, these generation costs may vary with the allocation of the fixed costs associated with grid connections. With PV expanding in all world regions, the combination of decreasing capital costs and favourable financing is expected to further decrease generation costs.

Increased RD&D investment in emerging technologies, particularly solar

CSP, ocean and enhanced geothermal, is needed to enhance competitiveness.

OECD government RD&D spending in renewable power technologies has grown over the past decade, from USD 0.9 billion in 2000 to USD 3.9 billion in 2011 (Figure 1.5). Recent spending has remained high, boosted by stimulus packages starting in 2009. However, outlays for renewables remain smaller than those for conventional fuels; in 2011, public

RD&D expenditure on fossil fuel and nuclear combined was more than twice that for renewable electricity.

© OECD/IEA, 2013.

Chapter 1

Power Generation Renewable Power

31

Recommendations for governments

■ Countries should implement transparent and predictable renewable energy strategies that will sustain market deployment of a portfolio of renewable technologies that best fit local market conditions (in terms of costs, resources and technology maturity) over the long term. Policy uncertainty is currently undermining investment in some markets. A transparent process of policy adjustment according to changing market conditions and technology cost development will reinforce investor confidence.

■ Strengthening the flexibility of the energy system will be key to enabling the grid and system integration of higher penetrations of variable and distributed generation technologies like wind and solar PV. This can first be done through better utilisation of existing infrastructure and optimisation of operations (e.g. generation forecasts). New infrastructure, particularly to strengthen the grid, will also be necessary.

■ Governments at the forefront of renewable energy deployment should take measures to ensure timely investments in additional flexibility infrastructure such as smart grids, transmission, flexible generation or storage. In this regard, Ireland may provide the best current example of an integrated approach for providing the flexibility needed to support ambitious deployment targets of variable renewables. Taking a regional rather than national approach wherever possible can greatly enhance flexibility.

■ The expansion of renewables into newer markets with large resource potential and good economic attractiveness is essential to reaching 2DS goals. Many developing areas fall under this category, including countries in the Middle East, Latin America, Africa and Southeast Asia, where renewable deployment for some technologies is still at its inception phase. Governments in these regions should review potential policy measures prior to CEM 5, and commence policy planning and development as soon as possible.

■ Continued RD &D into emerging technologies, such as offshore wind, CSP and enhanced geothermal, is essential in order to realise the potential that these technologies offer.

© OECD/IEA, 2013.

32

Chapter 1

Power Generation Nuclear Power

Nuclear Power

● Not on track

The nuclear policy landscape is stabilising after the Fukushima accident in Japan, but major construction of new reactors is needed in order to meet 2DS targets. Achieving this will require greater public acceptance of nuclear energy, and more favourable electricity market mechanisms and investment conditions.

Technology penetration

1.8 Installed gross nuclear capacity

700

600

500

400

300

200

100

0

2000 2006

Projecons 2DS target

2012

Low High

2025 2025

1.9 Capacity additions and reactors under construction

30

2DS target

180

20

10

120

60

0

1979 1987 2006

Net GW connected to the grid

2012 2015 2025

0

Reactors under construcon

Rest of the world

Russia

China

Japan

France

United States

16

Gw REquIRED

CaPaCITy aDDITIONS

TO 2020

30

Gw hISTORIC hIGh IN

CaPaCITy aDDITIONS

© OECD/IEA, 2013.

Chapter 1

Power Generation Nuclear Power

33

Market creation

1.10 Nuclear policy status in 2012

United States construcon projects launched aer

34-year hiatus (4 AP1000 reactors, at Vogtle and Summers sites)

Japan considering reducing share of nuclear power, but will not phase out

United Kingdom government introducing contracts

for difference to support low-carbon

technologies, including nuclear

Nuclear expansion acve or planned

No acve or proposed changes

China aer a pause, has restarted the world’s most significant construcon programme

Currently debang the role of nuclear energy

Nuclear reducon under way or planned

1.11 Annual capacity investment

80

40

Recent developments

Post-Fukushima safety evaluations concluded in 2012, allowing continued operation of most reactors, but recommending improved resistance to extreme natural events

Germany, Belgium and Switzerland announced a phase-out of nuclear power following the Fukushima accident. Most countries’ deployment targets remain unchanged, although debate on nuclear energy policy continues

0

2001 2006 2012 2025

2DS target

Technology developments

1.12 IEA government RD&D spending

2010

2005

2000

0 5 10

Other energy

15

Nuclear fission

20 25

USD billion

Key point

IEA government spending on nuclear fission

RD&D has declined as a percentage of total RD&D spending; from

34% in 2000 to

24% in 2010.

For sources and notes see page 141

© OECD/IEA, 2013.

34

Chapter 1

Power Generation Nuclear Power

Recent developments

■ Seven projects globally started construction in 2012, an increase from 2011 when new projects fell to only four after the Fukushima accident. In 2010 there had been 16 new projects.

■ Most safety evaluations ordered by governments after the Fukushima accident have found that existing reactors can continue to operate if systems to improve resistance to extreme natural events and loss of off-site power are implemented. Preliminary assessments of the cost of upgrades to ensure resistance to Fukushima-type events range from USD 100 to USD 200/kW for generation II reactors, which make up about 95% of existing reactors

(NEA, 2012a).

6 Only minor design changes are anticipated for generation III reactors – which represented 26 of the 68 reactors under construction at the end of 2012 and half of the capacity under construction 7 – so that overnight generation costs for new nuclear construction will probably not increase much as a result of the strengthening of safety regulations related to Fukushima-type events.

8

■ Some countries continue to debate nuclear policy in the wake of the Fukushima accident.

Japan is considering reducing its dependency on nuclear power; the new government is to review from scratch the former government’s energy strategy. Nuclear power supplied 26% of electricity in 2010 (288 TWh) but this figure fell to just over 18% in 2011 (102 TWh) and only two reactors out of 50 operational reactors had been restarted by the end of 2012.

The French government is considering reducing the share of nuclear electricity (79% of generation in 2011) to 50% by 2025, and has scheduled closure of the country’s oldest plant in 2016.

9