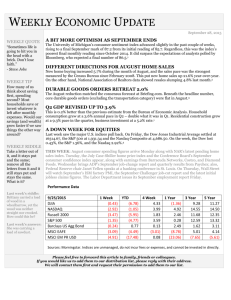

Weekly Economic Update - Main Line Financial Advisors

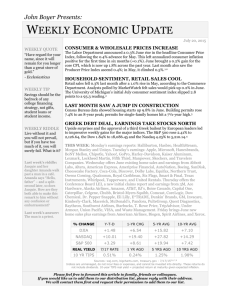

advertisement

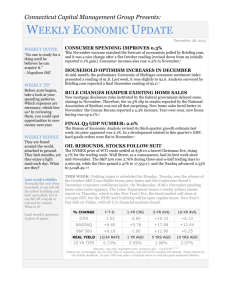

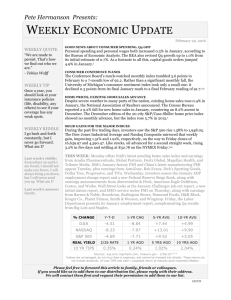

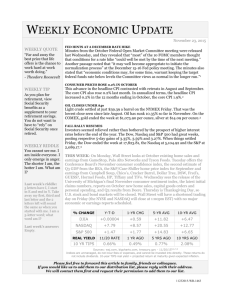

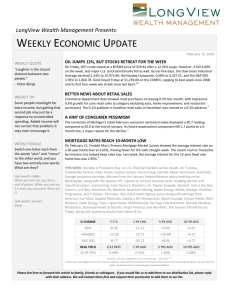

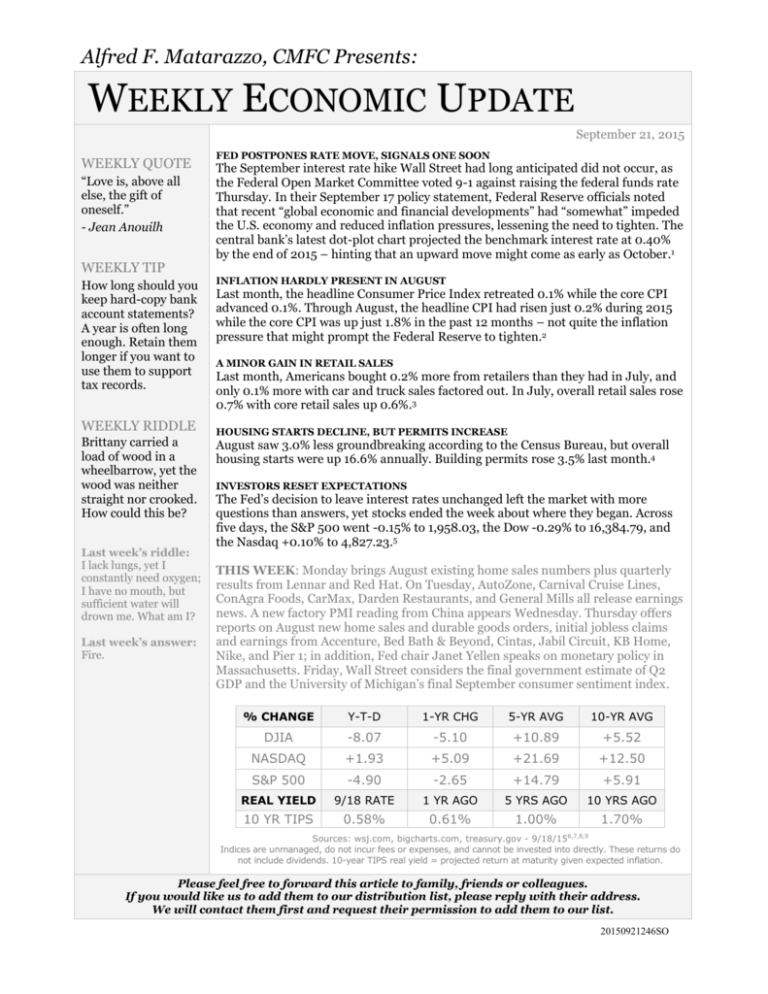

Alfred F. Matarazzo, CMFC Presents: WEEKLY ECONOMIC UPDATE September 21, 2015 WEEKLY QUOTE “Love is, above all else, the gift of oneself.” - Jean Anouilh WEEKLY TIP How long should you keep hard-copy bank account statements? A year is often long enough. Retain them longer if you want to use them to support tax records. WEEKLY RIDDLE Brittany carried a load of wood in a wheelbarrow, yet the wood was neither straight nor crooked. How could this be? Last week’s riddle: I lack lungs, yet I constantly need oxygen; I have no mouth, but sufficient water will drown me. What am I? Last week’s answer: Fire. FED POSTPONES RATE MOVE, SIGNALS ONE SOON The September interest rate hike Wall Street had long anticipated did not occur, as the Federal Open Market Committee voted 9-1 against raising the federal funds rate Thursday. In their September 17 policy statement, Federal Reserve officials noted that recent “global economic and financial developments” had “somewhat” impeded the U.S. economy and reduced inflation pressures, lessening the need to tighten. The central bank’s latest dot-plot chart projected the benchmark interest rate at 0.40% by the end of 2015 – hinting that an upward move might come as early as October.1 INFLATION HARDLY PRESENT IN AUGUST Last month, the headline Consumer Price Index retreated 0.1% while the core CPI advanced 0.1%. Through August, the headline CPI had risen just 0.2% during 2015 while the core CPI was up just 1.8% in the past 12 months – not quite the inflation pressure that might prompt the Federal Reserve to tighten.2 A MINOR GAIN IN RETAIL SALES Last month, Americans bought 0.2% more from retailers than they had in July, and only 0.1% more with car and truck sales factored out. In July, overall retail sales rose 0.7% with core retail sales up 0.6%.3 HOUSING STARTS DECLINE, BUT PERMITS INCREASE August saw 3.0% less groundbreaking according to the Census Bureau, but overall housing starts were up 16.6% annually. Building permits rose 3.5% last month.4 INVESTORS RESET EXPECTATIONS The Fed’s decision to leave interest rates unchanged left the market with more questions than answers, yet stocks ended the week about where they began. Across five days, the S&P 500 went -0.15% to 1,958.03, the Dow -0.29% to 16,384.79, and the Nasdaq +0.10% to 4,827.23.5 THIS WEEK: Monday brings August existing home sales numbers plus quarterly results from Lennar and Red Hat. On Tuesday, AutoZone, Carnival Cruise Lines, ConAgra Foods, CarMax, Darden Restaurants, and General Mills all release earnings news. A new factory PMI reading from China appears Wednesday. Thursday offers reports on August new home sales and durable goods orders, initial jobless claims and earnings from Accenture, Bed Bath & Beyond, Cintas, Jabil Circuit, KB Home, Nike, and Pier 1; in addition, Fed chair Janet Yellen speaks on monetary policy in Massachusetts. Friday, Wall Street considers the final government estimate of Q2 GDP and the University of Michigan’s final September consumer sentiment index. % CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG DJIA -8.07 -5.10 +10.89 +5.52 NASDAQ +1.93 +5.09 +21.69 +12.50 S&P 500 -4.90 -2.65 +14.79 +5.91 REAL YIELD 9/18 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO 10 YR TIPS 0.58% 0.61% 1.00% 1.70% Sources: wsj.com, bigcharts.com, treasury.gov - 9/18/156,7,8,9 Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation. Please feel free to forward this article to family, friends or colleagues. If you would like us to add them to our distribution list, please reply with their address. We will contact them first and request their permission to add them to our list. 20150921246SO Securities and investment advisory services offered through FSC SECURITIES CORPORATION * A Registered Broker Dealer * Member FINRA and SIPC Main Line Financial Advisors, LLC is a registered investment advisor and not affiliated with FSC Securities Corp. This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a priceweighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. Citations. 1 - marketwatch.com/story/federal-reserve-keeps-interest-rates-unchanged-but-forecasts-hike-this-year-2015-09-17 [9/17/15] 2 - news.investors.com/economy/091615-771278-inflation-eases-but-homebuilder-sentiment-rises.htm [9/16/15] 3 - marketwatch.com/economy-politics/calendars/economic [9/18/15] 4 - 247wallst.com/housing/2015/09/17/housing-starts-slow-in-august-after-july-estimates-revised-down/ [9/17/15] 5 - markets.on.nytimes.com/research/markets/usmarkets/usmarkets.asp [9/18/15] 6 - markets.wsj.com/us [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F18%2F14&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F18%2F14&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F18%2F14&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F17%2F10&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F17%2F10&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F17%2F10&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F19%2F05&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F19%2F05&x=0&y=0 [9/18/15] 7 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F19%2F05&x=0&y=0 [9/18/15] 8 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/18/15] 9 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/18/15] 20150921246SO