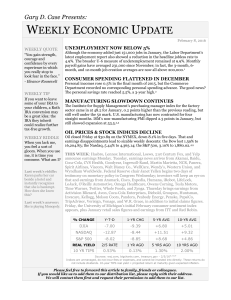

January 18, 2016

advertisement

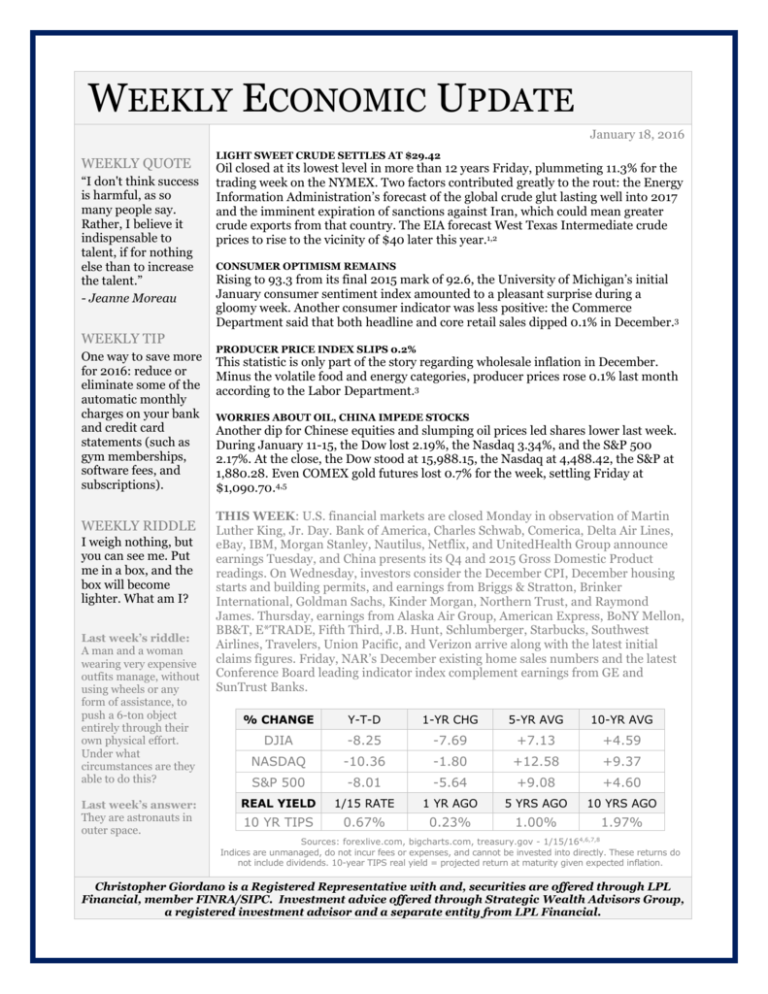

WEEKLY ECONOMIC UPDATE January 18, 2016 WEEKLY QUOTE “I don't think success is harmful, as so many people say. Rather, I believe it indispensable to talent, if for nothing else than to increase the talent.” - Jeanne Moreau WEEKLY TIP One way to save more for 2016: reduce or eliminate some of the automatic monthly charges on your bank and credit card statements (such as gym memberships, software fees, and subscriptions). WEEKLY RIDDLE I weigh nothing, but you can see me. Put me in a box, and the box will become lighter. What am I? Last week’s riddle: A man and a woman wearing very expensive outfits manage, without using wheels or any form of assistance, to push a 6-ton object entirely through their own physical effort. Under what circumstances are they able to do this? Last week’s answer: They are astronauts in outer space. LIGHT SWEET CRUDE SETTLES AT $29.42 Oil closed at its lowest level in more than 12 years Friday, plummeting 11.3% for the trading week on the NYMEX. Two factors contributed greatly to the rout: the Energy Information Administration’s forecast of the global crude glut lasting well into 2017 and the imminent expiration of sanctions against Iran, which could mean greater crude exports from that country. The EIA forecast West Texas Intermediate crude prices to rise to the vicinity of $40 later this year.1,2 CONSUMER OPTIMISM REMAINS Rising to 93.3 from its final 2015 mark of 92.6, the University of Michigan’s initial January consumer sentiment index amounted to a pleasant surprise during a gloomy week. Another consumer indicator was less positive: the Commerce Department said that both headline and core retail sales dipped 0.1% in December.3 PRODUCER PRICE INDEX SLIPS 0.2% This statistic is only part of the story regarding wholesale inflation in December. Minus the volatile food and energy categories, producer prices rose 0.1% last month according to the Labor Department.3 WORRIES ABOUT OIL, CHINA IMPEDE STOCKS Another dip for Chinese equities and slumping oil prices led shares lower last week. During January 11-15, the Dow lost 2.19%, the Nasdaq 3.34%, and the S&P 500 2.17%. At the close, the Dow stood at 15,988.15, the Nasdaq at 4,488.42, the S&P at 1,880.28. Even COMEX gold futures lost 0.7% for the week, settling Friday at $1,090.70.4,5 THIS WEEK: U.S. financial markets are closed Monday in observation of Martin Luther King, Jr. Day. Bank of America, Charles Schwab, Comerica, Delta Air Lines, eBay, IBM, Morgan Stanley, Nautilus, Netflix, and UnitedHealth Group announce earnings Tuesday, and China presents its Q4 and 2015 Gross Domestic Product readings. On Wednesday, investors consider the December CPI, December housing starts and building permits, and earnings from Briggs & Stratton, Brinker International, Goldman Sachs, Kinder Morgan, Northern Trust, and Raymond James. Thursday, earnings from Alaska Air Group, American Express, BoNY Mellon, BB&T, E*TRADE, Fifth Third, J.B. Hunt, Schlumberger, Starbucks, Southwest Airlines, Travelers, Union Pacific, and Verizon arrive along with the latest initial claims figures. Friday, NAR’s December existing home sales numbers and the latest Conference Board leading indicator index complement earnings from GE and SunTrust Banks. % CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG DJIA -8.25 -7.69 +7.13 +4.59 NASDAQ -10.36 -1.80 +12.58 +9.37 S&P 500 -8.01 -5.64 +9.08 +4.60 REAL YIELD 1/15 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO 10 YR TIPS 0.67% 0.23% 1.00% 1.97% 4,6,7,8 Sources: forexlive.com, bigcharts.com, treasury.gov - 1/15/16 Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation. Christopher Giordano is a Registered Representative with and, securities are offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Strategic Wealth Advisors Group, a registered investment advisor and a separate entity from LPL Financial. This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. Citations. 1 - marketwatch.com/story/oil-plunges-into-the-20s-a-barrel-on-iran-supply-woes-2016-01-15/ [1/15/16] 2 - reuters.com/article/us-eia-outlook-idUSKCN0UQ2BD20160112 [1/12/16] 3 - foxbusiness.com/markets/2016/01/15/stocks-nosedive-as-global-oil-prices-plunge.print.html [1/15/16] 4 - news.forexlive.com/!/us-stock-indices-end-the-day-down-but-off-lows-20160115 [1/15/16] 5 - marketwatch.com/story/gold-gains-for-the-session-but-falls-for-the-week-2016-01-15 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F15%2F15&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F15%2F15&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F15%2F15&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F14%2F11&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F14%2F11&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F14%2F11&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F13%2F06&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F13%2F06&x=0&y=0 [1/15/16] 6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F13%2F06&x=0&y=0 [1/15/16] 7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [1/15/16] 8 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [1/15/16]