140 Greenhill Road, Unley South Australia 5061 // T: +61 8 8373 5588 // F: +61 8 8373 5933 // E: kennedy@kennedy.com.au

Tax Planning 2013/14

•

Changes to Personal Tax Offsets

•

Payroll Tax Concessions

•

PAYG Income Tax Instalments

TAX

PLANNING

2013/14

•

30 June 2013 Trust

Distibution Resolutions

•

Bank Details Required

•

Loss Carry Back Rules

•

Tax Rates

•

Record Keeping Essentials

•

Superannuation

Changes Update

It’s that time of the year once again as we close in on another end of financial year. This

tax planning newsletter will highlight areas to concentrate on leading up to 30 June 2013

including superannuation contributions, deferring taxable income, accelerating deductions and other tax planning measures. We also look at record keeping requirements.

In particular, an important area to note is that of Trust distribution minutes and the actions

required before 30 June 2013.

Please do not hesitate to contact any of the partners or staff at Kennedy & Co so we can

discuss your individual needs and make the tax season a lot less stressful for you. We

hope you all have a successful end to the financial year.

Strategies for reducing your taxable income include:

• Reducing taxable income - this may include postponing invoicing until after 30 June.

Please note that the ATO will generally require you to pay tax on income that you

have either received or become entitled to due to the completion of work;

• Capital Gains are determined at the time a contract is entered into. If you are considering selling shares or property you may wish to delay signing the contract until the

new financial year;

• Consider realising capital losses if you have already realised capital gains on other

assets for the year ending 30 June 2013;

• Maximise your deductions - this may include:

-- A review of debtors and writing off any that are not recoverable;

-- Making superannuation contributions - if you are under contributions limits and eligible to claim a deduction (see our section on superannuation);

-- Review trading stock and assets schedule;

-- Pay professional fees or other employment or business related deductions prior to 30 June; and

-- If you are a small business you may be eligible to claim the full cost of depreciable items costing less than $6,500 (excluding GST). If you are considering

making a capital purchase it may be prudent to do so before 30 June 2013. All

other eligible acquisitions will be allocated and depreciated in a single pool at

15% for the first year and 30% from the second year. Small businesses will also

be allowed an immediate deduction for up to $5,000 if they purchase any new or

used motor vehicles after 1 July 2012.

It is important to note that there may be reasons why you would not want to reduce your

taxable income for the year ending 30 June 2013, but instead have the reduction in the

following tax year. These may include having had low levels of income this year and

therefore low or no tax will be applicable.

www.kennedy.com.au

Net Medical Expenses Tax Offset (“NMETO”)

CHANGES TO

PERSONAL TAX)

OFFSETS

This NMETO offset will be income-tested for the first time in the 2012-13 income year.

The change will only effect the claiming of this offset if your adjusted taxable

income (“ATI”) (e.g. your taxable income, reportable super contributions and net

investment losses) is greater than $84,000 for singles or $168,000 for a couple

or family. If your ATI is above the thresholds, you are only eligible to claim 10%

of eligible out of pocket medical expenses incurred in excess of $5,000.

The offset will be phased out from the 2013/14 financial year and you will only be

eligible to make a claim if a claim has been made for the 2012/13 income year.

Please refer to our budget newsletter for further information on the amendments.

The Mature Age Worker Tax Offset

The eligibility for the offset is now limited to individuals born before 1 July 1957.

Dependent Spouse Tax Offset

The Government has restricted the offset to only taxpayers with spouses born

before 1 July 1952. The change will not affect taxpayers whose spouse is an

invalid or a carer or who receives zone or overseas forces tax offsets.

Consolidation of Dependency Tax Offsets

The following tax offsets will be consolidated into a single offset:

•

•

•

•

•

•

•

•

Invalid spouse tax offset;

Carer spouse tax offset;

Housekeeper tax offset;

Housekeeper (with child) tax offset;

Child-housekeeper tax offset;

Child-housekeeper (with child) tax offset;

Invalid relative tax offset; and

Parent/parent-in-law tax offset.

The new offset is available only to those who maintain a dependent who is genuinely

unable to work due to a carer obligation or disability. The offset will be based on the

highest rate of the existing tax offset that would apply but for the changes made.

Employment Termination Payments (ETP) Tax Offset

On 1 July 2012 the Government introduced an additional $180,000 “whole

of income” cap to apply in addition to existing ETP cap rules.

A taxpayer whose employment has been terminated will receive an ETP cap that is the

lesser of:

•

•

The existing lifetime benefit ETP cap ($175,000 in 2012/13) and

The $180,000 “whole of income” cap that is reduced by other kinds of taxable income that the individual received during the year.

The new cap does not apply to ETPs relating to genuine redundancy, invalidity, compensation received due to a genuine employment related dispute or death benefit payments.

Should you have any queries on the changes to personal tax offsets please do not

hesitate to contact our office.

2 // KEN * NOTES // TAX PLANNING

www.kennedy.com.au

PAYROLL TAX

CONCESSIONS

ANNOUNCED

IN THE STATE

BUDGET

The State Government has introduced a payroll tax concession for eligible employers

with taxable payrolls of less than or equal to $1.2 million per annum. This concession is

only available in the 2012/13 and 2013/14 financial years and is only applicable to South

Australian wages. For example, the tax concession would provide a relief of $4,900 per

year for eligible employers with an annual payroll greater than $800,000 and less than

$1,000,000.

The following table summarises the tax concessions available to eligible employers for

the 2012-13 and 2013-14 payroll periods in the various payroll brackets.

Should you have any questions about what constitutes taxable payroll or any other

queries regarding the above, please do not hesitate to contact our office.

PAY AS YOU GO

(“PAYG”) INCOME

TAX INSTALMENTS

30 JUNE

2013 TRUST

DISTRIBUTION

RESOLUTIONS

If you make PAYG Instalments using the amount method (as opposed to the

rate method) you may have a substantial PAYG Instalment for the quarter

ended 30 June 2013 which will be due for payment on 28 July 2013. This

can be caused by an increase in your income tax payable for the year

ended 30 June 2012 compared to the year ended 30 June 2011.

You may vary the amount of the PAYG instalment if you believe the

instalments will be too high and will exceed your tax liability at the end of the

year. Please contact our office should you wish to discuss this further.

All trustees of discretionary trusts who elect beneficiaries to be entitled to

trust income by way of a resolution must do so by the end of the income

year (being 30 June). This resolution will determine who is assessed

on the trust’s distributable income for income tax purposes.

Trustees need to review their 2012/13 expected distributable income and determine

which beneficiaries will be receiving a distribution from the trust and what portion

of the trust’s income each beneficiary will be presently entitled to by 30 June 2013.

It is important to note that the tax free threshold for minors (including offsets) is

only $416 so there is limited scope to include minors in the distributions.

Please contact us should this be relevant to your circumstances.

3 // KEN * NOTES // TAX PLANNING

www.kennedy.com.au

BANK ACCOUNT

DETAILS REQUIRED

FOR REFUNDS

LOSS CARRY

BACK RULES

From 1 July 2013 the ATO will no longer be issuing refund cheques for individual income

tax returns. If you are expecting an amount refundable for your next return please bring

along your bank account information so your refund can be processed via electronic

funds transfer.

In the 2012-2013 Federal Budget, the Government announced measures which

will enable corporate tax entities to carry back losses to offset prior year’s

profits. Effectively, corporate tax entities will be permitted to claw back company

tax that has been paid on prior year’s profits. The clawback is in the form of

a tax refund in the loss year income tax return. The claw back measures were

introduced to alleviate pressures on corporate tax entities operating during

the economic downturn and provide incentive for growth and investment.

The loss carry back refundable tax offset is capped at the lesser of $1 million multiplied

by the corporate tax rate, $300,000, and the balance of the entity’s franking account.

For the year ending 30 June 2013, corporate tax entities will be able to carry back

losses to obtain a refund of tax paid in the financial year ended 2012. For the year

ending 30 June 2014, corporate tax entities will be able to carry back losses to obtain

a refund of tax paid in the previous two financial years ending June 2012 and 2013.

Please do not hesitate to contact Steven Zammit of this office

should you have any queries or require further information.

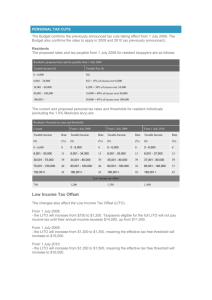

TAX RATES

The government has made no changes to the legislated taxation rates from the 2012/13

financial years to later years.

As announced in the 2013/14 budget the Medicare levy will increase to 2% from 1 July

2014 in order to fund a national disability care program.

Australian residents tax rates 2013/2014 and future years

Australian Non-resident Tax Rate: 2013 – 2015 and future years

4 // KEN * NOTES // TAX PLANNING

www.kennedy.com.au

Now is the perfect time to start your motor vehicle logbook prior to 30 June 2013;

RECORD KEEPING

ESSENTIALS PRIOR

TO 30 JUNE 2013

•

If you use the logbook method for your vehicle please remember

to record your vehicles closing kilometers at 30 June 2013;

•

If you use a home office please start a diary of your home office usage

prior to 30 June 2013 to enable us to claim a cents per hour deduction;

•

Reminder you must keep your records for five years from the date you lodge your tax

return;

If you have any queries about substantiation or record keeping requirements please do

not hesitate to contact us.

SUPERANNUATION

Given the significant debate and proposed changes to superannuation laws we have

detailed these below and at what stage of the legislative process they are at.

Superannuation Guarantee Contributions Increase

From 1 July 2013 employers will be required to pay an increased amount of superannuation guarantee on behalf of their employees; the new rates are detailed below.

This has now passed both houses of Parliament, but we do note that the coalition, if

elected, plan to delay the 2014 increase by two years until 1 July 2016. Whatever the

result come election time, the 2013/14 financial year employers will need to increase their

superannuation guarantee payments to 9.25%. This change has received Royal Assent

and will come into effect from 1 July 2013.

Superannuation Guarantee Age Limit

Prior to 30 June 2013 employers were not required to make superannuation guarantee

contributions for employees over the age of 70. However, from 1 July 2013 this age

restriction will be removed and superannuation guarantee will need to be paid regardless

of the age of the employee. This change has received Royal Assent and will come into

effect from 1 July 2013.

Information on Employee Payslips

In order to provide an early warning to employees if their superannuation entitlements are

not being paid, from 1 July 2013, employers will be required to disclose on payslips when

contributions are due to be paid to the employees superannuation fund. This change has

received Royal Assent and will come into effect from 1 July 2013.

Market Valuations of SMSF Assets

While it has been common practice at Kennedy and Co to value all assets within SMSFs

at market value, however, for the year ended 30 June 2013 this has become mandatory.

While this is simple enough for many assets, such as shares and trusts, it can be difficult

for property and unlisted shares. Therefore, it will be incumbent on trustees to carefully

consider the asset, its condition, potential market, and general economic conditions

to determine a value themselves, or obtain an independent valuation. This change has

received Royal Assent and will come into effect from 1 July 2013.

5 // KEN * NOTES // TAX PLANNING

www.kennedy.com.au

Concessional Contributions Cap

SUPERANNUATION

The government announced an increase in the concessional contribution cap from

$25,000 to $35,000 (un-indexed) from 1 July 2013. This will first only apply to members

aged over 60 but will be extended to those over 50 from 1 July 2014. This change is now

before the Senate; therefore, it is not currently law.

Tax on Earnings above $100,000

Currently, all earnings made by a superannuation fund during the pension phase are

tax free. However, from 1 July 2014, the current tax exemption for earnings on assets

supporting a pension will only be applicable to the first $100,000 earned per annum

per pension member. Any income above $100,000 will be taxed at 15%. For example,

if in pension phase your single member superannuation fund earns $120,000, the first

$100,000 will be tax free with the remainder ($20,000) being taxed at 15%.

Due to the special and long term nature of capital gains tax assets the transitional rules

that will apply to capital gains arising during pension phase as detailed in the below

table:

Legislation is yet to be released for this change. However, given the complex nature of the

changes and administrative difficulty in implementing them we would not expect to see any

legislation before the next federal election.

Excess Contributions Tax Changes

From 1 July 2013, any excess concessional contributions will be able to be withdrawn from

the superannuation fund. In addition the excess contribution will be taxed at the individual’s

marginal tax rate rather than the current arrangement of being taxed at the top marginal

rate. This will only apply for first time breaches. This change has received Royal Assent and

will come into effect from 1 July 2013.

Low Income Super Contribution

As previously announced, from 1 July 2012, the government will provide a superannuation

contribution of up to $500 per annum for individuals with an adjusted taxable income of up

to $37,000 per annum.

The amount payable will be calculated by applying a 15 per cent matching rate to the

concessional contributions made by or for eligible individuals.

For example if your annual salary is $20,000, your employer is obliged to contribute $1,850

into your nominated superannuation account. In addition to this the government would then

contribute an additional $277.50 (15% of $1,850) into your nominated superannuation account. This change has received Royal Assent and will come into effect from 1 July 2012.

6 // KEN * NOTES // TAX PLANNING

www.kennedy.com.au

140 Greenhill Road, Unley South Australia 5061

T: +61 8 8373 5588 // F: +61 8 8373 5933 // E: kennedy@kennedy.com.au

Changes to Tax Concessions for High Income Earners

SUPERANNUATION

Announced in last year’s budget and effective from 1 July 2012, the superannuation

contributions tax will double from 15% to 30% for individuals with an adjusted taxable

income in excess of $300,000.

If the individual’s income, including concessional contributions exceeds the $300,000

threshold, the 30% tax will apply to the portion that is over the threshold.

For example, if the individual’s taxable income is $285,000 and the concessional contributions are $25,000 in the 2012/2013 financial year, the 30% tax rate will only apply to

$10,000. The ATO will issue assessments to the individual for the additional tax, which

taxpayers can have paid out of their superannuation.

While effective from 1 July 2012, this change is still before the Senate, therefore, it is not

currently law.

SMSF Levy Changes

Currently an SMSF pays its SMSF levy after the year when lodging their income tax return.

This will be changed to bring forward the payments of the levy to the year in question.

This change will be phased in over the 2014 and 2015 financial years.

In addition to this change, the Supervisory Levy for SMSF’s will increase from $191 for

the year ending 30 June 2013 to $259 for the year ending 30 June 2014. These changes

have passed both houses of Parliament and now await Royal Assent.

Superannuation Government Co-Contributions

The below table details the recent changes to the Government Co-Contributions, namely

a reduction in the higher threshold from $61,920 to $46,920 and a reduction in the

maximum co-contribution to $500.

These changes are yet to pass Parliament and are therefore not currently law.

Should you have any queries regarding any of these Superannuation changes please

contact our office.

JARGON BOX

MAKING SENSE

OF YOUR ABC’S

IN BUSINESS

ATO

Australian Taxation Office

NMETO

Net Medical Expenses Tax Offset

CGT

Capital Gains Tax

PAYG

Pay As You Go

ETP

Employment Termination Payments

SGC

Super Guarantee Contributions

FBT

Fringe Benefit Tax

TFN

Tax File Number

PLEASE NOTE This newsletter is for the general information and exclusive benefit of

clients and associates of Kennedy & Co. It contains brief comments not intended to be the

basis for decision making nor to be taken as a substitute for specific advice. Please contact

Kennedy & Co to discuss any matters that may be relevant to your individual situation.

7 // KEN * NOTES // TAX PLANNING

All Rights Reserved. E&OE © Kennedy & Co 2013