Pursuant to section 761G(7) Corporations Act, all clients are treated

advertisement

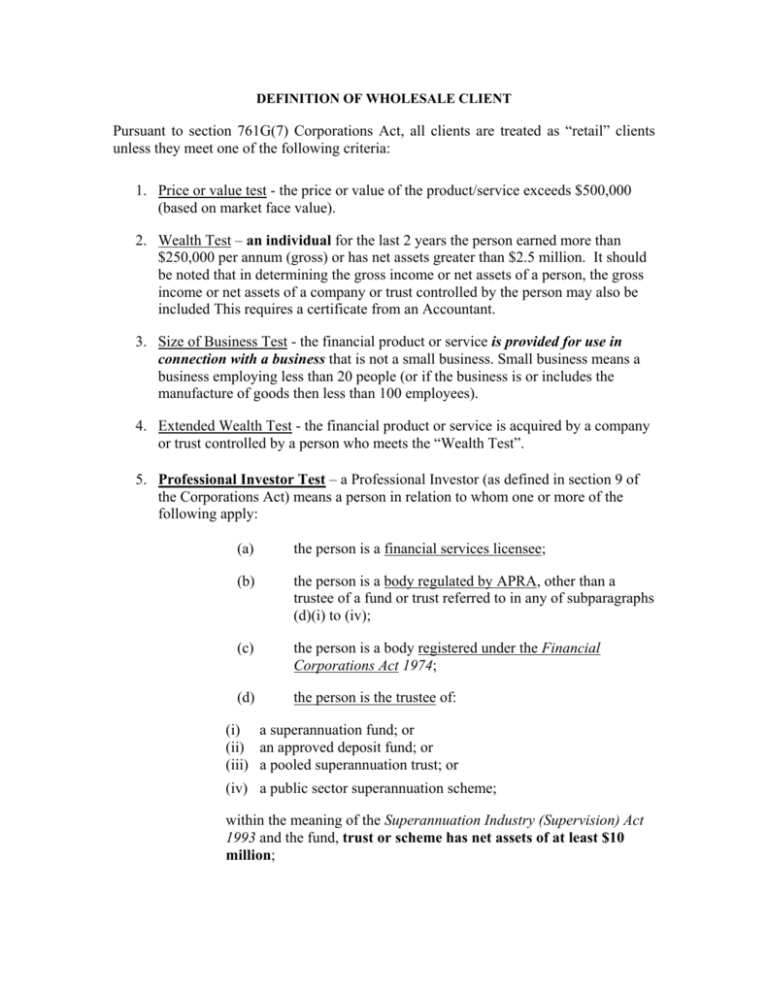

DEFINITION OF WHOLESALE CLIENT Pursuant to section 761G(7) Corporations Act, all clients are treated as “retail” clients unless they meet one of the following criteria: 1. Price or value test - the price or value of the product/service exceeds $500,000 (based on market face value). 2. Wealth Test – an individual for the last 2 years the person earned more than $250,000 per annum (gross) or has net assets greater than $2.5 million. It should be noted that in determining the gross income or net assets of a person, the gross income or net assets of a company or trust controlled by the person may also be included This requires a certificate from an Accountant. 3. Size of Business Test - the financial product or service is provided for use in connection with a business that is not a small business. Small business means a business employing less than 20 people (or if the business is or includes the manufacture of goods then less than 100 employees). 4. Extended Wealth Test - the financial product or service is acquired by a company or trust controlled by a person who meets the “Wealth Test”. 5. Professional Investor Test – a Professional Investor (as defined in section 9 of the Corporations Act) means a person in relation to whom one or more of the following apply: (a) the person is a financial services licensee; (b) the person is a body regulated by APRA, other than a trustee of a fund or trust referred to in any of subparagraphs (d)(i) to (iv); (c) the person is a body registered under the Financial Corporations Act 1974; (d) the person is the trustee of: (i) a superannuation fund; or (ii) an approved deposit fund; or (iii) a pooled superannuation trust; or (iv) a public sector superannuation scheme; within the meaning of the Superannuation Industry (Supervision) Act 1993 and the fund, trust or scheme has net assets of at least $10 million; (e) the person has or controls gross assets of at least $10 million (including any assets held by an associate or under a trust that the person manages); (f) the person is a listed entity, or a related body corporate of a listed entity; (g) the person is an exempt public authority; (h) the person is a body corporate or business, that: (i) carries on a business of investment in financial products, interests in land or other investments; and (ii) for those purposes, invests funds received (directly or indirectly) following an offer or invitation to the public, within the meaning of section 82, the terms of which provided for the funds subscribed to be invested for those purposes; (i) the person is a foreign entity that, if established or incorporated in Australia, would be covered by one of the preceding paragraphs. 6. Wholly-owned subsidiary of a company that is a “Professional Investor” (as defined above). The term ‘control’ (used in a number of the above criteria) is defined in s50AA of the Corporations Act and generally follows the accounting definition so that a person may control a company or unit trust yet hold less than 50% of the shares or units.