Client presentation – MLC branded

advertisement

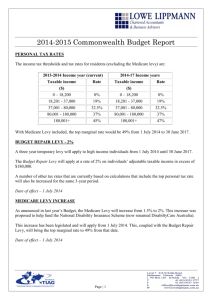

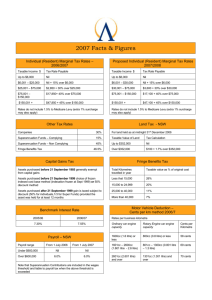

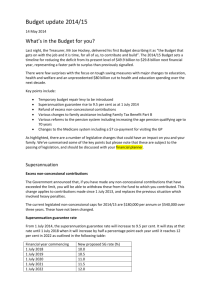

2014 Budget summary A presentation to Client Name Date Presented by Firstname Surname Jobtitle/Position Disclaimer • <Adviser name> is not a registered tax agent. If you wish to rely on this determine your personal tax obligations you should seek advice from a Registered Tax Agent. PRESENTATION TITLE | 00 MONTH YEAR 2 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 TAXATION • Temporary Budget Repair Levy ‒ Additional levy of 2% will be payable on taxable incomes over $180,000pa ‒ Top marginal tax rate to 49% ‒ Fringe Benefit Tax (FBT) rate will increase to 49% ‒ From 1 July 2017, top marginal tax rate returns to 47% PRESENTATION TITLE | 00 MONTH YEAR 3 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 TAXATION • HELP debt changes ‒ 1 June 2016 interest accrued @ 10 year Government bond rate, maximum rate of 6%pa ‒ 1 July 2016, HELP debt repayments from a lower income level PRESENTATION TITLE | 00 MONTH YEAR 4 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 TAXATION • Tax offsets to be abolished ‒ Dependent Spouse and Mature Age Worker Tax offsets to cease from 1 July 2014. PRESENTATION TITLE | 00 MONTH YEAR 5 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 TAXATION ‒ Company tax rate to reduce by 1.5% to 28.5% from 1 July 2015. ‒ Introduction of fuel excise indexation by CPI. PRESENTATION TITLE | 00 MONTH YEAR 6 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 SUPERANNUATION • Excess non-concessional contribution (NCC) ‒ Option for excess from 1 July 2013 to withdraw those NCC’s that exceed the cap plus the related earnings on the excess ‒ No tax on the excess amount withdrawn ‒ Tax on earnings @ individual’s marginal tax rate ‒ If no election is made, the excess will be taxed under the existing regime @ top marginal tax rate PRESENTATION TITLE | 00 MONTH YEAR 7 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 SUPERANNUATION • Revised SG rate increase ‒ Increase to 9.5% will take effect on 1 July 2014 ‒ Increase will remain at 9.5% for four years ‒ From 1 July 2018, it will increase by 0.5%pa, before reaching 12% on 1 July 2022. PRESENTATION TITLE | 00 MONTH YEAR 8 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 SOCIAL SECURITY • Increase in Age Pension age to 70 ‒ Age Pension will increase to 67.5 from 1 July 2025 as previously legislated. It will then continue to rise by six months every two years, until the pension age reaches 70 by 2035 ‒ Currently the Age Pension age is due to increase from 65 starting on 1 July 2017, and gradually reach 67 by 1 July 2023 PRESENTATION TITLE | 00 MONTH YEAR 9 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 SOCIAL SECURITY • Increasing cost of medical care ‒ A contribution of $7 may be charged from 1 July 2015 for certain services. ‒ Relief for holders of concessions cards and children under 16 years of age PRESENTATION TITLE | 00 MONTH YEAR 10 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 SOCIAL SECURITY • Family Payment Reform from 1 July 2015 ‒ Changes to payment rates ‒ Changes to eligibility thresholds ‒ Changes to eligibility ‒ Other Changes PRESENTATION TITLE | 00 MONTH YEAR 11 2014 FEDERAL BUDGET ANALYSIS 13 May 2014 SOCIAL SECURITY • Commonwealth Seniors Health Card (CSHC) changes ‒ Current thresholds $50K singles $80K couples to be indexed from 20 September 2014 to Consumer Price Index ‒ From 1 January 2015, the definition of income for the card will be expanded to include income from superannuation pensions assessed at pre-determined rates (deemed) ‒ Grandfathering rules will apply. ‒ 20 September 2014, the seniors supplement will no longer be payable. However, Clean Energy Supplement remains payable. PRESENTATION TITLE | 00 MONTH YEAR 12 THANK YOU Contact details line 1 Contact details line 2 Insert disclaimer here