Business School - The University of Western Australia

advertisement

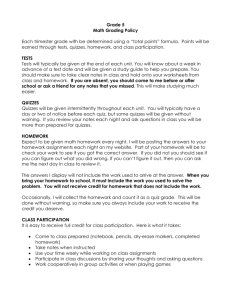

Unit Outline* ACCT8432 Introductory Financial Accounting Semester 2, 2011 Crawley Assistant Professor Leo Langa Business School www.business.uwa.edu.au * This Unit Outline should be read in conjunction with the Business School Unit Outline Supplement available on the StudentNet web site http://www.business.uwa.edu.au/studentnet ACCT8432/Crawley/LL/1.07.2011 All material reproduced herein has been copied in accordance with and pursuant to a statutory licence administered by Copyright Agency Limited (CAL), granted to the University of Western Australia pursuant to Part VB of the Copyright Act 1968 (Cth). Copying of this material by students, except for fair dealing purposes under the Copyright Act, is prohibited. For the purposes of this fair dealing exception, students should be aware that the rule allowing copying, for fair dealing purposes, of 10% of the work, or one chapter/article, applies to the original work from which the excerpt in this course material was taken, and not to the course material itself. © The University of Western Australia 2011 2 UNIT DESCRIPTION Introduction The Unit Coordinator/Lecturer : A/Prof Leo Langa PhD, MEc, BAcc, CPA Leo is currently a Lecturer in the Accounting and Finance area of the Business School at the University of Western Australia. Prior to joining the UWA Business School, Leo was Coordinator of Advanced Financial Accounting at La Trobe University. Leo has also worked for several other organizations during his professional career. His positions have included – Internal Auditor at Cadbury Schweppes PLC; Management Accountant and Cost Analyst at Ford Motor Co. Ltd; Lecturer in Accounting at RMIT University; and as Company Listings Executive at the Australian Stock Exchange. Leo has taught both at the undergraduate and post-graduate level in a number of different areas. These include Accounting for Decision Making, Financial Accounting, Accounting for Small Business, Financial Markets & Institutions, Management Accounting, Advanced Accounting Theory, Corporate Reporting and in Accounting & Management for Entrepreneurs. Leo’s research interests are varied and include the fields of Financial Accounting, Investment Behaviour, Insider Trading and Financial Markets Investment Strategies. His Masters research focussed on the impact of Insider Trading and the effectiveness of Australian regulatory bodies in curtailing its practice. His interest in behavioural finance resulted in his Doctorate being completed in the area of how the Internet has affected investment behaviour and investment segmentation in Australia. Overview of the Unit: ACCT8432 Introductory Financial Accounting ACCT8432 Introductory Financial Accounting, offered by the Business School at UWA, is a core unit in the MPA and the Master of Commerce. The aim of this unit is to introduce students to financial accounting theory and concepts. This unit covers key accounting concepts so as to help you navigate your way around published financial statements. For MPA students, this unit marks the beginning of your studies of accounting. For Master of Commerce students, the unit will help you understand and use accounting information in a way that enhances both your own effectiveness and that of the organisation to which you belong. This unit introduces and emphasises the use of accounting information in decision-making. Unit Content Accounting aims to develop the ability to understand, interpret and use financial statements. The unit is structured to provide an understanding of accounting concepts, issues and problems. The first and major part of the unit develops the skills necessary to read and interpret the financial statements of large listed corporate entities. These financial statements comprise the statement of comprehensive income, balance sheet, statement of changes in equity and cash flow statement. These reports are an example of General Purpose Financial Reports, which are normally prepared for the benefit of users external to the entity (e.g., shareholders and lenders). In order to develop the analytical skills, and to evaluate the usefulness of accounting information, we examine the conceptual basis for financial accounting. The second part of the unit concentrates on how accounting records and financial statements are prepared. In this part, we learn about the accounting cycle (analysing transactions, recording journal entries, making adjusting entries, preparing ledger accounts and preparing financial statements). Finally, we consider techniques to examine the performance and position of the entity as revealed by financial statement analysis. 3 The Goal of the Unit “The ability to understand and make use of financial data is the cornerstone of business strategy and business decision making in all its forms.” (Anonymous) Therefore, ACCT8432 Introductory Financial Accounting has effectively two broad goals. The first is to develop your ability to understand, interpret and use financial statements. The second is to develop your awareness of how the accounting information is prepared. When achieved, these goals will provide a strong foundation for other management studies or for more detailed accounting studies. Learning Outcomes On completion of this unit, you should be able to: • • • • Appreciate the difficulties and assumptions involved in the preparation of financial statements; Identify the concepts in relation to, and be aware of the major requirements impacting upon, the preparation of conventional financial statements; Analyse and interpret information contained in those financial statements (with particular emphasis on using ratio analysis and cash flow analysis) bearing in mind the inherent limitations of such information; Prepare accounting records and financial statements. Educational Principles and Graduate Attributes In this unit, you will be encouraged and facilitated to develop the ability to: • • • • Critically evaluate and solve accounting problems; Listen, speak and write effectively and appropriately to peers and the wider community, especially in relation to accounting matters; and Work effectively in a team situation, to resolve accounting issues, through regular team based learning exercises; and Research and learn independently, through the preparation and submission of an individual assignment. 4 TEACHING AND LEARNING RESPONSIBILITIES Teaching and learning strategies The classes in this unit are interactive, where you make a real contribution both by asking questions and providing relevant examples from your experience when appropriate. Our objective is to foster a learning environment where all students feel comfortable to ask questions when they require clarification about an issue or principle. Classes will include plenty of scope for discussion and a variety of team-based learning exercises. Students will be expected to prepare themselves for each seminar by reading the work and preparing the questions prescribed for the week. The seminars will aim to reinforce understanding of the content of each topic, with particular emphasis on difficult or contentious areas. As part of the structure of the unit, feedback on your performance in various areas will be provided as follows: • Technical concepts – you will take part in regular quizzes and team based exercise work. • Team skills - through peer assessment • In written and comprehension language skills – through voluntary attendance at the additional study support sessions. The UWA Business School uses this unit as an opportunity to strengthen students’ written business communication and language skills – skills that have been found wanting by the Accounting profession in a significant proportion of accounting graduates from Masters of Professional Accounting programs, or equivalent. To this end, all students will have the opportunity, and are actively encouraged, to take part in language support classes, which are organised at a convenient time and specifically tailored to the requirements of this unit. The support classes will begin with a diagnostic assessment, which all students will be asked to complete, and then provide on-going support and feedback to those students who choose to attend, including guidance on techniques to assist students in preparation for the individual assignment. Teaching and learning evaluation You may be asked to complete two evaluations during this unit. The Student Perception of Teaching (SPOT) and the Students’ Unit Reflective Feedback (SURF). The SPOT is optional and is an evaluation of the lecturer and the unit. The SURF is completed online and is a university wide survey and deals only with the unit. You will receive an email from the SURF office inviting you to complete the SURF when it is activated. We encourage you to complete the forms as your feedback is extremely important and can be used to make changes to the unit or lecturing style when appropriate. For example, the use of quizzes regularly throughout this unit is a direct response to a student’s suggestion in a prior SPOT survey. Since implementing the regular quizzes, students rate this part of the assessment very highly. Attendance Participation in class, whether it be listening to a lecture or getting involved in other activities, is an important part of the learning process, therefore it is important that you attend classes. More formally, the University regulations state that ‘to complete a course or unit students shall attend prescribed classes, lectures, seminars and tutorials’. Where a student, due to exceptional circumstances, is unable to attend a scheduled class, they are required to obtain prior approval of the unit coordinator to be absent from that class. Any student absent from class without having had such absence approved by the unit coordinator may be referred to the faculty for advice and may be required to withdraw from the unit. 5 CONTACT DETAILS We strongly advise students to regularly access their student email accounts. Important information regarding the unit is often communicated by email and will not be automatically forwarded to private email addresses. Web Site URL www.webct.uwa.edu.au Unit Coordinator/Lecturer: Assistant Professor Leo Langa Email: leo.langa@uwa.edu.au Phone: 6488 5838 Consultation Hours: Lecture Times & Venue: To be advised. Wednesday 5.00 pm - 8.00 pm (BUSN:EYLT) TEXTBOOK(S) & RESOURCES Unit Website The unit makes use of WebCT. You will have access to course materials, solutions to practice questions, past exam papers and a discussion board. To access WebCT go to www.webct.uwa.edu.au and log on using your student number and Pheme password. The units in which you are enrolled which use WebCT will automatically appear under your name. If this is not the case please contact me. Recommended/required text Bazley, M., Hancock, P. and Porter, S., (2010) Financial Accounting – a conceptual approach, 1st Edition, Cengage Learning, Melbourne. This text will be used extensively throughout the course. Copies of this text are held in closed reserve in the Reid Business Library. The seminar materials for Semester 2, 2011 have been aggregated in a course lecture notes reader which can also be purchased from the Co-op Bookshop. The title of the reader is Introductory Financial Accounting – ACCT 8432 Lecture Notes. Text Website This will be available through WebCT and you will be automatically enrolled in a WebCT unit giving you access to these student resources. The Student Resources contain a review of each chapter and practice tests. The practice tests are a very useful way to test your understanding of the material covered in each chapter of the book. Additional resources & reading material 6 Journals and Newspapers The following journals and newspapers are all very good references for current issues facing the accounting profession and users of accounting information and can all be found within the Business Library system (i.e., either in hard copy or electronically). As this course is designed to address the needs of managers as users of accounting information you may find that your best source for additional reading is something like the Australian Financial Review. Using current business transactions and events reported in these newspapers is a good way to challenge your understanding of the concepts and learning outcomes that we address in this unit. • • • • In the Black (published by CPA Australia) Charter Magazine (published by the Institute of Chartered Accountants in Australia) Australian Accounting Review, Melbourne Australian Financial Review Closed Reserve The following references have been placed in Closed Reserve in the Business Section of the Reid Library for your use: • Accounting Handbook, (2011), CPA, Prentice Hall, Melbourne. • Alfredson, K., Leo, K., Picker, R., Pacter, P. & Radford, J., (2009), Applying International Financial Reporting Standards, Wiley, Milton. • Epstein, B. J. & Jermakowicz, E.K., (2010), Interpretation and Application of International Accounting Standards, Wiley, New York. • Henderson, S. & Peirson, G., (2010), Issues in Financial Accounting, 13th edn, Longman, South Melbourne. • Kimmel, P.D., Weygandt, J.J. & Keiso, D.E., (2000), Financial Accounting: Tools for Business Decision Making, 2nd edn, Wiley, New York. • Libby, R., Libby, P.A. & Short, D.G., (2009), Financial Accounting, 6th edn, McGraw-Hill, Boston. • Peirson, G. & Ramsay, A., (2003), Accounting: an Introduction, 3rd edn, Prentice Hall, Frenchs Forest. • Trotman, K. & Gibbins, M., (2009), Financial Accounting : An Integrated Approach, 4th edn, Cengage Learning, Melbourne. 7 UNIT SCHEDULE Week Number 1 2 3 Week Beginning (Monday) 1st August 8th August 15th August Topic Number Seminar Topic Title 1 An Introduction to Accounting 2 The Australian financial reporting framework 3 The Balance sheet and an introduction to the Worksheet 4 Statement of Comprehensive Income and Statement of Changes in Equity 5 Transactions and Journal entries 22nd August 4 5 29th August 6 5th September 6 The Accounting Cycle & Cash and Accrual Accounting 7 12thSeptemb er 7 Adjusting entries 8 19thSeptember 8 Closing entries and preparation of Financial Statements Additional Tasks Quizzes & Exercises Quiz 1 Team Exercise 1 Quiz 2 * (The Mid –Semester study break will cover the period from 26th September – 2nd October) 9 10 11 12 13 9 Accounting for Receivables 10 Non-Current Assets and Depreciation 11 Internal Control and Cash Flow Statements 12 Financial Statement Analysis 12 Financial Statement Analysis (continued) 3rd October 10th October 17th October 24th October 31st October Quiz 3 Team Exercise 2 Revision Final Examination (Date and Time TBC) 8 ASSESSMENT MECHANISM The purpose of assessment There are a number of reasons for having assessable tasks as part of an academic program. The assessable tasks are designed to encourage you to explore and understand the subject more fully. The fact that we grade your work provides you with an indication of how much you have achieved. Providing feedback on your work also serves as part of the learning process. Assessment mechanism summary Item Weight Assessment Due Date Submission Date Individual and Team based Quizzes 15% Week 4 Week 8 Week 10 These three Quizzes will be completed during class. Team based Exercises 20% Week 6 Week 12 These two Exercises will be completed during class. Individual Assignment 15% Final Examinatio n 50% 7th October Uniprint by 5.00 pm November Remarks Technical component - 10% & English expression and structure - 5%. Open book. Multiple choice and short answer problem questions Note 1: Results may be subject to scaling and standardisation under faculty policy and are not necessarily the sum of the component parts. Note 2: The grade FC indicates failure to complete an identified essential assessment component and means failure of the unit. Note 3: Your assessed work may also be used for quality assurance purposes, such as to assess the level of achievement of learning outcomes as required for accreditation and audit purposes. The findings may be used to inform changes aimed at improving the quality of Business School programs. All material used for such processes will be treated as confidential, and the outcome will not affect your grade for the unit. Note 4: Your work throughout semester may be subject to peer review. 9 Assessment components Individual and Team based Quizzes (15% of final mark)* There will be three quizzes over the duration of the semester. You will complete each quiz individually and then in teams. This will be explained in class. Each quiz will consist of 10 multiple choice questions. There will be 20 minutes allowed for the individual quiz. Each team will then complete the same quiz and will be allowed a further 15 minutes. The allocation of the marks between the individual and team quizzes will be 10% for individuals and 5% for teams. *There will be no alternative time set to sit missed team based/individual exercises or quizzes, so if you are absent due to illness, the team based/individual marks missed will be added to the final exam, but only upon receipt of a medical certificate to the Unit Coordinator. Team based Exercises (20% of final mark)* The lecturer will allocate students into teams of approximately four/five people and these teams will remain fixed for the semester. Teams will be required to complete two team based exercises during class time, details of which to be provided in class. Teams will also complete a further three quizzes as outlined in the next section. Peer feedback and assessment will be used to allow all team members to comment on and assess the contribution of all team members to the team tasks, which includes the team performance for the quizzes. Details of how the peer assessment is to be completed will be distributed in class. Peer assessment will also be used to mathematically determine the proportion of the team score that each member receives. This score will then be used to weight your team score for all team based activities. For example, a team scores 16 out of 20 which equates to an overall mark of 80% for all team tasks, and two individuals in the team receive peer scores of 110 and 90. Individual 1 final score = 80% x 110 = 88% which equates to a mark of 17.6 out of 20. Individual 2 final score = 80% x 90 = 72% which equates to a mark of 14.4 out of 20. Individual Assignment (15% of final mark) Students will complete an individual assignment on a topic to be advised by the lecturer. Marks will be allocated separately for the technical content (10%) and quality of the academic writing (5%). Final Examination (50% of final mark) The final exam will be 2 hours and 10 minutes in duration and will cover all Topics. Details of the final exam will be provided in class. To pass this unit, students are required to achieve a score of at least 45% in the final exam. Students who fail to achieve the minimum standard in the final exam but achieve an accumulated score based on all assessment components for the unit of 50 and above will be awarded a final grade of FC. 10 Submission of individual Assignments Submit your assignment in an electronic formatted PDF file by going to the Uniprint web site http://www.uniprint.uwa.edu.au/current-students, then click on “Student Assignments” and follow the instructions. Student Guild Phone: (+61 8) 6488 2295 Facsimile: (+61 8) 6488 1041 E-mail: enquiries@guild.uwa.edu.au Website: http://www.guild.uwa.edu.au Charter of Student Rights and Responsibilities The Charter of Student Rights and Responsibilities outlines the fundamental rights and responsibilities of students who undertake their education at UWA (refer http://handbooks.uwa.edu.au/undergraduate/poliproc/policies/StudentRights ). Appeals against academic assessment The University provides the opportunity for students to lodge an appeal against assessment results and/or progress status (refer http://www.secretariat.uwa.edu.au/home/policies/appeals ). 11