The CMA

Accreditation

Process

®

2012

becomeacma.com

Earning the CMA Designation

Step 1

Degree with all required topics

Graduate from accredited program

FREE Transcript Evaluation

post secondary Degree

Step 2

More Topics Required — Complete

through Part-time Studies

CMA Accelerated Program

Entrance Examination

Preparation Program

Step 3

AND

CMA Entrance Examination

Spring or fall

SLP Phase I: Development

Blue indicates

necessary steps

Red indicates

optional steps

CMA Case Examination

SLP Phase II: Application

Step 4

CMA Strategic

Leadership

Program™ and

Practical Experience

CMA Board Report

TM

What is the first step in earning the CMA designation?

The first step in earning the CMA designation is to complete a post secondary degree with required topics. These topics

cover a wide range of business disciplines and provide the foundation of knowledge that is essential for advanced

business studies in the CMA Strategic Leadership Program™.

The required topics for the post secondary degree consist of the following subject areas:

Management Studies

General Accounting Studies

•

•

•

•

•

•

•

•

•

•

Management Accounting:

• Introductory*

• Intermediate

• Advanced

Financial Management

Operations Management

Information Technology

Strategic Management

Human Resources

Marketing

Financial Accounting:

• Introductory*

• Intermediate

• Advanced

Taxation

Internal Control

Related Studies

• Economics (Macro and Micro)*

• Statistics*

• Canadian Business Law**

* Available online through CMA Ontario

**Not required for June 2012 Entrance Examination. Bridging available at no extra cost for October 2012 Entrance Examination and 2012 Accelerated Program entrance.

Your Path to Becoming a CMA

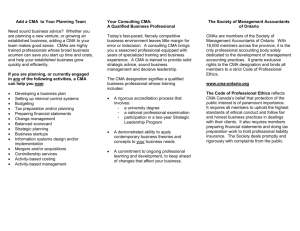

Why should I pursue the CMA designation?

The CMA designation opens the door to a competitive income, a broad range of career opportunities and exciting

workplace challenges. CMAs provide employers with the ideal balance of three essential and interdependent business

disciplines: accounting, management and strategy. This powerful combination of skills defines the CMA’s unique value

to an organization and makes the CMA the designation of choice for accounting professionals in management.

CMAs are able to apply contemporary and emerging best practices in a wide array of business functions, including

accounting and finance, sales and marketing, operations, strategic planning and analysis, information technology and

human resources. They bring a strong market focus

to strategic management and resource deployment,

synthesizing and analyzing financial and non-financial

information to develop total business solutions,

identify new market opportunities, and maximize

shareholder value.

The CMA understands the business formula for

delivering value to the customer, arriving at strategies

for identifying, developing, marketing and evaluating

a product or service throughout its entire lifecycle.

The CMA is able to assess all aspects of a product

or service: its quality, performance, cost, and

responsiveness to customer needs and expectations.

The CMA profession draws equally from the

disciplines of accounting, management and strategy.

CMAs do more than measure value

– they create it.

The CMA Competency Map™ is a conceptual framework

that presents CMA competencies within the context that

they are practised. They are the competencies CMAs

acquire, hone and ultimately master over the course of their

careers.

The Creating Value quadrant focuses on strategy, including

the design and formulation of strategies, policies, plans,

structure, and initiatives. The second quadrant, Enabling

Value, comprises the execution of strategy and the planning,

implementing, monitoring, and improving of supporting

processes. Preserving Value involves the protection

of value against strategic and operational risks. Finally,

Reporting Value represents the traditional accounting role

– the transparent communication of the delivery of value to

stakeholders and the general public.

The CMA Competency Map™

Required Topics

Can I get exemptions for my post secondary degree courses, and, if so, which ones?

Students enrolled in business, commerce or accounting programs can typically cover the required topics as part of their

degree course requirements – but it is critical to choose course electives carefully. For candidates who have already

graduated, part-time study programs are available to enable them to complete the required topics.

What part-time programs are available to help me complete outstanding required

topics?

Candidates who are required to complete outstanding required topics have one of two options:

• Complete the required courses at any of the institutions listed at: www.cmaontario.org/coursechart

• Register for the CMA Accelerated Program, if eligible

The CMA Accelerated Program enables candidates to proceed more quickly to the CMA Entrance Examination. The

following CMA required topics are covered in the program:

CORE TOPICS

Management TOPICS

•

•

•

•

•

•

•

•

•

•

•

•

Intermediate Financial Accounting

Advanced Financial Accounting

Intermediate Management Accounting

Advanced Management Accounting

Financial Management

Taxation

Operations Management

Information Technology

Strategic Management

Human Resources

Marketing

Internal Control

The topics are covered in 22 lessons plus four tests over a seven-month period split into two segments. The program is

available by full-day Saturday lectures in selected centres, or Sundays in downtown Toronto, and by online study.

For a more flexible learning schedule, a 14-month Extended Accelerated Program is available. The Extended Program is

offered via lecture in downtown Toronto on weekday evenings and by online study with test centres throughout Ontario.

Candidate evaluation is based on two three-hour tests worth 20 marks each and two four-hour tests worth 25 marks each,

and quizzes worth 10 marks. A minimum grade of 60% is required in each segment to pass the program. The candidates

must also write and pass six online tests on the management topics covered through online self-study.

After enrolling, candidates are provided with access to an interactive web-based learning environment. This website contains

detailed lesson notes, reinforcement problems with solutions, and related materials. All students receive access to online

videos of lecture sessions. Online students can pose specific questions about the material to an instructor via an online

discussion board, whereas lecture students will be able to attend classes and ask questions directly to their instructor in

person or online. Additionally, all students will be provided with a Financial Accounting primer to review prior to beginning the

program to assist in reinforcing the Introductory Financial Accounting material.

The lesson notes and related reinforcement problems and solutions have been designed to assist candidates in developing a

good understanding of the topics. It is recommended that candidates allow for 20 or more hours of study time, on average,

per week of the program material in addition to the in-class or online lectures.

Eligibility:

To be eligible for the Accelerated Program, candidates must:

✓Have a post secondary degree; and

✓Have achieved a minimum grade of 60% in an undergraduate course or 70% in a graduate course counting towards the following CMA required topics:

• Introductory Financial Accounting

• Introductory Management Accounting

• Economics (Macro and Micro)

• Statistics

• Canadian Business Law*

To determine your eligibility for the Accelerated Program, which begins in September or January, mail, email, or fax a copy of

your transcripts to CMA Ontario’s Accreditation Department for a free evaluation. In order for an evaluation to be completed on

transcripts, the transcript must include the institution name, courses completed, grades achieved, year in which the course was

completed, and the date of degree conferral. A transcript evaluation form can be obtained at: www.cmaontario.org/transcript

*Bridging available for Canadian Business Law at no extra charge for 2012 Accelerated Program.

After You’ve Completed the Required Topics

Pre-requisite courses to qualify for the CMA Accelerated Program

CMA Ontario offers the pre-requisite courses required to qualify for the Accelerated Program online. In addition to

Introductory Financial Accounting and Introductory Management Accounting, CMA Ontario now offers Economics and

Statistics. Canadian Business Law will be available in January 2012. Students will receive CMA credit as a pre-requisite for the

Accelerated Program upon successful completion of the course. Successful completion of Introductory Financial Accounting

is a pre-requisite for entrance into Introductory Management Accounting.

Students must achieve a minimum grade of 60% to pass the course. The course fee includes a textbook, online quizzes

(worth 40% of the overall grade), and a final exam (worth 60% of the overall grade). Students will also receive lesson notes

outlining the objectives of each chapter. Final exams are available in centres across Ontario, eight times per year to fit your

schedule. Each course must be completed within six months of registration. To register and for more information, please visit:

www.cmaontario.org/APqualify

For more information on the Accelerated Program, visit: www.cmaontario.org/accelerated

Language Assistance

Registered candidates who speak English as a second language can participate in a free online English language selfassessment at: http://english.thinkpass.com

When you register for the assessment, you will receive, free of charge, a CMA ESL “Lecture Ready” Accelerated Program

workbook, developed by Language Education for Accounting Professionals (LEAP). This will assist you throughout the

program with definitions, study coaching and more. CMA Ontario will also provide you with online support from an

experienced CMA instructor. The Accelerated Program online lecture videos are closed captioned to enhance understanding.

If candidates discover that additional English language skills are required, they can participate in a series of courses provided

by LEAP at: www.leapesl.ca

What do I do after completing the required topics?

Once you have completed the required topics, either through a post secondary degreee or successful completion of the CMA

Accelerated Program, you are ready to prepare for and write the CMA Entrance Examination.

What is included in the CMA Entrance Examination and Preparation Program and

when are they offered?

CMA Ontario’s Preparation Program assists candidates in preparing for the multiple choice Entrance Examination. It is

available through in-class lectures or online study. Registering for the Entrance Examination automatically enrolls you in the

Preparation Program. The CMA Entrance Examination Preparation Program will prepare you with examination writing skills

and techniques to be successful on the CMA Entrance Examination. The program includes two mock Entrance Examinations

and feedback as to how you performed relative to your peers across Ontario.

The primary objective of the CMA Entrance Examination is to evaluate whether candidates have mastered the technical skills

in management accounting, financial accounting, financial management, taxation and internal control. Please refer to the CMA

Competency Map Entrance Requirements at www.cmaontario.org/EntranceExam for a full listing of required topics.

The Entrance Examination is held twice each year, in mid-June and mid-October. The examination is four hours in duration

and is comprised of approximately 100-120 multiple choice questions.

The pass mark for the examination is 60%. Candidates must pass the Entrance Examination to proceed into the Strategic

Leadership Program.

Note: University students who qualify for exemption under the CMA Canada University Accreditation Program are not required to write this

examination. Please visit www.cmaontario.org/postsecondary for further details.

The Strategic Leadership Program (SLP)

What is the content of the Strategic Leadership Program?

After successfully completing the Entrance Examination, candidates progress through the two-year Strategic Leadership

Program concurrent with full-time employment in the field of the management accountant. CMA Ontario’s Strategic

Leadership Program equips the prospective CMA with the strategic management capabilities demanded by today’s leading

enterprises.

Enabling Competencies

✓Problem-Solving and Decision-Making

✓Leadership and Group Dynamics

✓Professionalism and Ethical Behaviour

✓Communication

The foundation of the program is the CMA Competency Map. In the SLP, Candidates learn to Create Value in organizations

by learning best practices in strategy and governance. They learn to Enable Value through the implementation of strategy for

achieving sustainable value, and the planning, monitoring, and improvement of supporting processes.

They learn to Preserve Value, which is the protection of a sustainable value strategy against strategic and operational risks.

Finally, they learn to Report Value, which is the transparent communication of the delivery of sustainable value to

stakeholders and the general public.

Throughout the SLP they develop the Enabling Competencies which are distributed throughout the Competency Map.

The Strategic Leadership Program is presented in two phases. Year One is the Development Phase and will consist of an

orientation session and three modules. Cases will be assigned for each module and will focus on different industry sectors

including manufacturing, services, government and not-for-profit. The majority of the assessments in this phase will be

individually-based.

At the heart of the SLP are two-day interactive sessions during which candidates exchange views and experiences on

program aspects under the guidance of moderators with extensive business experience. Each of the program modules

include a two-day interactive session. Candidates also complete a series of individual assignments applying the concepts to

their own organizations.

Upon completion of the SLP Development Phase (Year 1), candidates will be required to write the CMA Case Examination.

This four-hour exam will test a candidate’s understanding of the competencies and the higher order skills of strategic thinking,

analysis, integration, judgment and written communication introduced thus far in the program. This exam is offered twice

each year, in May and August.

Candidates will then enter the SLP Application Phase (Year 2), consisting of three modules within a team environment,

focusing on communication, leadership, decision-making, professionalism, ethics, and problem-solving skills, in preparation for

the CMA Board Report.

The final evaluation component of the SLP is the CMA Board Report. Here candidates will demonstrate, both orally and

through a written submission, their mastery of the knowledge and competencies required to join the profession – and

become Certified Management Accountants™.

Note: If your employment takes you outside of Canada, you are still required to complete all of the Strategic Leadership interactive weekend

sessions in Canada in order to meet the designation’s requirements.

What are the requirements for Practical Experience?

Practical experience in a management accounting environment, concurrent with the CMA Strategic Leadership Program,

is an essential component of becoming a CMA. The candidate must demonstrate competency through verifiable work

experience. Candidates must be able to apply the acquired knowledge and skills from the CMA Competency Map at an overall

Professional Proficiency.

The duration of work experience will be 24 months, at least 12 of which should be concurrent with the SLP. Up to 12 months

of applicable and verifiable experience can be obtained prior to beginning the SLP, either in co-op or full-time employment.

CMA Ontario will recognize up to 12 months of recent work experience, going back up to three years, within or outside of

Canada as long as it can be verified by the employer. To verify work experience, all candidates submit an online Practical

Experience report outlining the nature, duration and time of the practical experience completed, which is verified by the

candidate’s employer. For more information, visit: www.cmaontario.org/work

Other Paths to the CMA Designation

The following programs describe how the designation can be obtained through alternate channels:

Combined Programs – earn your CMA concurrently with your Masters/MBA degree

This alternate path to the designation is a unique opportunity for qualified candidates to pursue the CMA designation while

earning their Masters/MBA degree, resulting in a significant saving in cost and time. Combined programs are available through

the following university programs:

Brock University

MBA (Full-Time, Part-Time)

Sprott School of Business, Carleton University

MBA

DeGroote School of Business, McMaster University

MBA (Full-Time, Part-Time or Co-op), AMBA (Accelerated)

Telfer School of Management, University of Ottawa

Executive MBA, MBA

Queen’s University

Accelerated MBA, Executive MBA, MBA, Queen’s-Cornell

Executive MBA

Joseph L. Rotman School of Management, University

of Toronto

Executive MBA

Royal Military College

MBA

University of Toronto - Mississauga

Masters of Management and Professional Accounting

(MMPA)

University of Waterloo

Bachelor of Accounting and Financial Management with

Masters of Accounting

Wilfrid Laurier University

MBA (Part-Time, Weekends, Accounting Stream)

Schulich School of Business, York University

MBA (Full-Time and Part-Time), IMBA

For details concerning each of the programs listed above,

visit: www.cmaontario.org/combinedcma

CMA for MBAs

Candidates who have completed an MBA program have the opportunity to fast-track their learning. To qualify, MBAs must

meet the program requirements to be eligible for the SLP. Candidates will then complete a CMA program designed specifically

with MBAs in mind. The CMA Case Examination, the CMA Board Report, and eligible practical experience are also required

components in this condensed pathway to the CMA designation.

For more information, visit: www.cmaontario.org/cmaformbas

CMA Executive Program

Executive Program candidates have an opportunity to earn their CMA designation through up to two years of part-time study

in a program commensurate with the challenges and achievements of a senior-level executive. Delivered through independent

learning and interactive sessions, this program carefully balances the benefits of interaction with peers with the demanding

schedule of a senior executive. The Foundation Phase, the first year of the program, is available through online study. The

Application Phase, the second year of the program, is offered through in-person sessions.

2012 is the final intake for the Executive Program. Completed applications are due by February 29, 2012. For more information,

visit www.cmaontario.org/executive, or contact Bryan Jacobs, CMA, at 905-709-3652 or bjacobs@cmaontario.org.

CMA/PFA Program

CMA Canada has designed a program for the Canadian public service sector in conjunction with the Chartered Institute of Public

Finance and Accountancy (CIPFA). This unique Public Finance Accountant (PFA) program reinforces a government-led initiative

to ensure professionally qualified managers are at the core of public service financial services, providing the right mix of skills

and expertise to perform their responsibilities in an accountable manner. The dual CMA/PFA credential will create opportunities

for career advancement in Canada while providing portable qualifications that will open doors to public finance management

positions around the world.

For more information, visit: www.cmaontario.org/pfa

Take Your First Step to the CMA Designation

Submit your transcripts to CMA Ontario for a free evaluation. Complete the cover sheet at

www.cmaontario.org/transcript and submit it by mail, fax or email to the coordinates below.

Become a CMA Student for exclusive discounts, access to career resources and more. Request

an application when you submit your transcripts for evaluation. If you are in the workforce and

have already graduated, please request the CMA Pre-Professional Student application. If you are a

full-time student, please request the CMA Associate Student application.

For more information on the CMA accreditation programs and enrollment fees,

please visit www.cmaontario.org, call CMA Ontario at 416 204 3102, or toll-free at 1 866 999

3102, or email us at info@cmaontario.org.

Contact Us

CMA Ontario

25 York Street, Suite 1100

Toronto, ON M5J 2V5

416 204 3102 or 1 866 999 3102

Fax: 416 977 2128

info@cmaontario.org

www.cmaontario.org

Regional Representatives

Southwestern Ontario

877 318 2422

Deborah Clarke, MBA, CMA

dclarke@cmaontario.org

Greater Toronto Area

905 709 3652

Bryan Jacobs, CMA

bjacobs@cmaontario.org

Mid-Western Ontario & Niagara

647 828 8303

Dana Gies, MBA, CMA

dgies@cmaontario.org

GTA West, Halton and Peel Regions

416 738 7865

Melissa Gansham, CMA

mgansham@cmaontario.org

Northern and Eastern Ontario

613 898 0834

Marcie Chase, CMA, PFA

mchase@cmaontario.org

GTA East, York, Durham and Liftlock Regions

905 604 3644

Lori Dalton

ldalton@cmaontario.org

GTA Universities

416 482 5556

Mira Sirotic, CMA

msirotic@cmaontario.org

becomeacma.com

TM

Follow CMA Ontario on Twitter at www.twitter.com/becomeacma

Join Certified Management Accountants of Ontario on Facebook

www.cmaontario.org/facebook

© 2011 Certified Management Accountants of Ontario. All rights reserved.

®/™ Registered Trade-Marks/Trade-Marks are owned by The Society of Management Accountants of Canada. Used under license.

01/2012