Frequently Asked Questions (FAQs)

advertisement

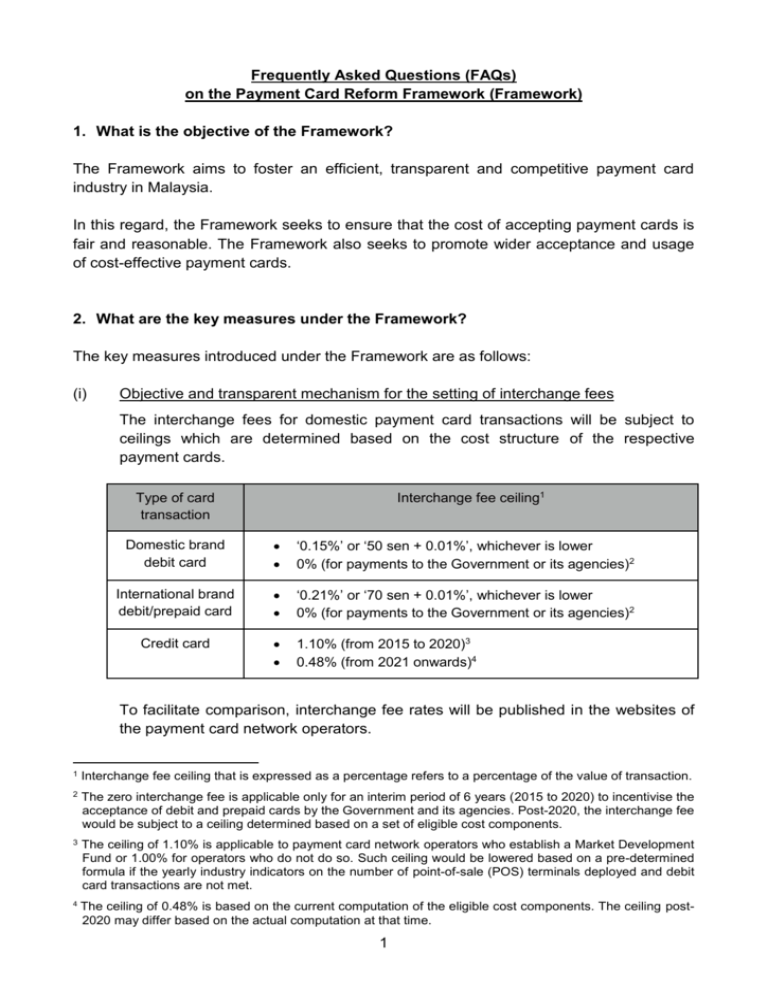

Frequently Asked Questions (FAQs) on the Payment Card Reform Framework (Framework) 1. What is the objective of the Framework? The Framework aims to foster an efficient, transparent and competitive payment card industry in Malaysia. In this regard, the Framework seeks to ensure that the cost of accepting payment cards is fair and reasonable. The Framework also seeks to promote wider acceptance and usage of cost-effective payment cards. 2. What are the key measures under the Framework? The key measures introduced under the Framework are as follows: (i) Objective and transparent mechanism for the setting of interchange fees The interchange fees for domestic payment card transactions will be subject to ceilings which are determined based on the cost structure of the respective payment cards. Interchange fee ceiling1 Type of card transaction Domestic brand debit card ‘0.15%’ or ‘50 sen + 0.01%’, whichever is lower 0% (for payments to the Government or its agencies)2 International brand debit/prepaid card ‘0.21%’ or ‘70 sen + 0.01%’, whichever is lower 0% (for payments to the Government or its agencies)2 Credit card 1.10% (from 2015 to 2020)3 0.48% (from 2021 onwards)4 To facilitate comparison, interchange fee rates will be published in the websites of the payment card network operators. 1 Interchange fee ceiling that is expressed as a percentage refers to a percentage of the value of transaction. 2 The zero interchange fee is applicable only for an interim period of 6 years (2015 to 2020) to incentivise the acceptance of debit and prepaid cards by the Government and its agencies. Post-2020, the interchange fee would be subject to a ceiling determined based on a set of eligible cost components. 3 The ceiling of 1.10% is applicable to payment card network operators who establish a Market Development Fund or 1.00% for operators who do not do so. Such ceiling would be lowered based on a pre-determined formula if the yearly industry indicators on the number of point-of-sale (POS) terminals deployed and debit card transactions are not met. 4 The ceiling of 0.48% is based on the current computation of the eligible cost components. The ceiling post2020 may differ based on the actual computation at that time. 1 (ii) Measures to empower merchants to accept cost-effective payment cards A list of measures will be introduced to improve the price signals and for merchants to be: informed of the cost of accepting different payment cards; able to distinguish debit and prepaid cards from other payment cards; able to identify the different payment card networks available in a co-badged debit card (i.e. a debit card with two debit card networks/brands); in a position to encourage customers to use lower cost payment cards by offering discounts or other benefits; and able to choose the lower cost debit card network to route a debit card transaction made using a co-badged debit card. 3. What type of payment card transactions is covered in the Framework? The Framework is applicable to domestic transactions originating from the use of Malaysian-issued debit, prepaid and credit cards at merchants in Malaysia. 4. What is the impact of the Framework on consumers, merchants and banks? (i) Consumers Consumers would be able to use payment cards more widely as the lower card acceptance cost brought about by the Framework would facilitate more merchants to accept payment cards. Hence, there would be less need for consumers to carry cash. Consumers are less likely to be surcharged (i.e. imposed with an additional fee by merchants) for the use of payment cards, in particular the debit card. Due to the lower card acceptance cost, there is also less risk that merchants will pass on the cost of accepting payment cards to the customers by raising the price of goods and services. (ii) Merchants Merchants would benefit from lower acceptance cost for debit and prepaid cards. Merchants would be protected from rising cost of payment card acceptance caused by indiscriminate increases in interchange fees. Merchants would be able to manage their cost of card acceptance more effectively througho greater transparency in the cost of payment card acceptance; 2 o ability to encourage customers to use a lower cost payment card; and o ability to choose the lower cost debit card network/brand to route a transaction made using a co-badged debit card. (iii) Banks Banks’ earnings are unlikely to be impacted as the interchange fee revenue after covering the related expenditure to process the transactions, are mainly used to fund cardholder’s rewards and loyalty programs.This is based on a cost study conducted by Bank Negara Malaysia. Acquiring banks would benefit from higher revenue due to increases in the number of payment card transactions as more merchants accept payment cards due to their affordability. As payment card transactions increase, banks, in general, would benefit from cost savings and efficiency gains through a reduction in their cash handling cost. 5. What is the impact of indiscriminate increases in the interchange fee? One of the objectives of the Framework is to address the risk of indiscriminate increases of interchange fees through the establishment of an objective and transparent mechanism for the setting of interchange fees as explained in paragraph 2(i) above. Indiscriminate increases in interchange fees may lead to an industry-wide increase in the merchant fee or merchant discount rate (MDR). This would make payment card acceptance less affordable and discourage smaller merchants from accepting payment cards.. Merchants who incur higher MDR are likely to pass on the higher cost to consumers by raising prices of goods and services or by surcharging their customers. 6. Would there be an increase in cardholder fees or introduction of new cardrelated fees after the implementation of the Framework? Cardholders are protected from increases in cardholder fees or introduction of new cardrelated fees through the following measures: Cardholders will be provided with an option to obtain a basic payment card with zero or nominal fees. Any increase in cardholder fees or introduction of new card-related fees is subject to Bank Negara Malaysia’s prior approval and must comply with a set of principles to avoid excessive fees and charges. 3 7. Would the Framework cause consumers to be worse-off as banks are likely to cut back on loyalty points, cash rebates and other cardholder rewards? Cardholder rewards such as loyalty points and cash rebates are funded by merchants through the payment of MDR. Merchants are likely to recover such cost through higher prices of goods and services. As such, consumers who do not use payment cards may end up subsidising the cardholder rewards enjoyed mostly by premium cardholders. With the implementation of the Framework, there is likely to be a dampening in the cardholder rewards. Nevertheless, consumers are not worse-off. With more affordable payment card acceptance cost, merchants will be less pressured to pass on such cost to consumers through higher prices of goods and services. In addition, more merchants would be able to afford the acceptance of payment cards, in particular the debit card. This would provide consumers with the convenience of using their payment cards widely at more merchant outlets, thus lessening the need to carry cash. 4 Glossary What is interchange fee? Interchange fee is a fee payable between the merchant’s bank (also known as the “acquirer”)5 and the cardholder’s bank (also known as the “issuer”)6 in a payment card transaction as illustrated in Diagram 1 below. Interchange fee is typically payable by the acquirer to the issuer to compensate the issuer for certain costs incurred by the issuer in facilitating a payment card transaction. Interchange fee may also flow from the issuer to the acquirer to compensate acquirers for the cost of enabling payment card acceptance by merchants.7 What is merchant fee or merchant discount rate (MDR)? Merchant fee or MDR is a fee payable by a merchant to an acquirer for enabling the merchant to accept payment cards. What is the relationship between the interchange fee and the MDR? Interchange fee is incorporated into the MDR by the acquirer. Increases in the interchange fee would cause acquirers to raise the MDR. Diagram 1: Transaction flow of a payment card transaction 5 An acquirer is the party who provides payment card acceptance services to a merchant. An issuer is the party who issues a payment card to a cardholder. 7 Prior to October 2011, the interchange fee for EFTPOS, the domestic debit card scheme in Australia, was payable by the issuer to the acquirer. 6 5