Taxation of share buy backs - Australian Government, The Treasury

advertisement

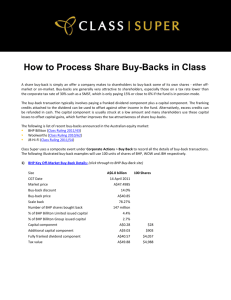

Chapter BB Buy-backs of shares and non-share equity interests Outline of chapter 1.1 Schedule BB to this Bill implements the recommendations of the Board of Taxation to improve the taxation arrangements relating to the buy-back of shares and non-share equity interests. Context of amendments 1.2 The provisions relating to the buy-back of shares and non-share equity interests are currently contained in Division 16K of Part III of the Income Tax Assessment Act 1936 (ITAA 1936). 1.3 Division 16K applies where a company buys back a share or non-share equity interest in itself and cancels the share or interest. In these circumstances, no income tax consequences arise for the company (the buying company) that acquires a share or non-share equity interest under the buy-back. 1.4 The taxation consequences for a taxpayer who disposes of a share or non-share equity interest under an off-market buy-back (the seller) depend on whether the buy-back is an off-market buy-back or an on-market buy-back. 1.5 If the buy-back is an off-market buy-back, a part of the proceeds paid to the seller may be taxed as a frankable dividend. The rationale for this approach is that some of the proceeds effectively represent a distribution of the buying company’s profits to the seller. 1.6 If the buy-back is an on-market buy-back, all the proceeds paid to the seller are taxed as an ordinary disposal of shares or non-share equity interests. 1.7 In October 2006, the former government requested the Board of Taxation to undertake a review of the taxation treatment of off-market buy-backs. 1 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 1.8 The Board of Taxation completed its report to the Treasurer in June 2008. In broad terms, the Board concluded that the current taxation treatment of off-market buy-backs is appropriate and recommended that Division 16K be rewritten and transferred to the Income Tax Assessment Act 1997 (ITAA 1997) with several refinements to reduce compliance costs and administration costs. 1.9 As part of the 2009-10 Budget, the Government agreed to implement the recommendations in the Board’s report. Summary of new law 1.10 Schedule BB to this Bill implements the recommendations of the Board of Taxation to improve the taxation arrangements relating to the buy-back of shares and non-share equity interests. 1.11 In broad terms, the Schedule rewrites the taxation rules relating to buy-backs of shares and non-share equity interests and transfers them from Division 16K of Part III of the ITAA 1936 to Division 190 of the ITAA 1997. 1.12 Consistent with the recommendations of the Board of Taxation, some changes are made to: • specify a method for working out the capital/dividend split, with a discretion available to the Commissioner of Taxation to permit the use of other methods when appropriate; • where the approved method for determining the capital/dividend split is used, switch off the application of certain integrity provisions; • where the off-market buy-back is conducted by a listed company: – deny notional losses on the disposal of the shares or non-share equity interests; – remove the market value uplift rule (which increases the consideration received where the purchase price of a share or non-share equity interest under the buy-back is less than its market value); and – extend the time for giving a distribution statement in respect of the dividend or non-share dividend component; and 2 Buy backs of shares and non share equity interests • specify the amount of a franking debit that arises in the franking account of a company conducting an off-market buy-back where the company has foreign resident shareholders. Comparison of key features of new law and current law New law Current law Off-market buy-backs When a company conducts an off-market buy-back, part of the purchase price of the share or non-share equity interest that is bought back may be taken to be a dividend that can be franked. When a company conducts an off-market buy-back, part of the purchase price of the share or non-share equity interest that is bought back may be taken to be a dividend that can be franked. The capital/dividend split can be worked out based on the average capital per share or using another method approved by the Commissioner. If the average capital per share method is used, certain integrity rules in the income tax law do not apply. The remaining part of the purchase price is taken to be consideration received for the purpose of working out the amount of gain or loss on the disposal of the share or non-share equity interest. However, the consideration received is increased where: The remaining part of the purchase price is taken to be consideration received for the purpose of working out the amount of gain or loss on the disposal of the share or non-share equity interest. However, the consideration received is increased where: • the dividend component is not fully taxed; • the purchase price is less than the market value; or • the seller is a corporate tax entity and part of the purchase price is a franked dividend. • the dividend component is not fully taxed; The Commissioner applies integrity rules in the income tax law to: • if the buy-back is conducted by a listed company, a notional loss would otherwise arise on the disposal of the shares or interests; • if the buy-back is conducted by a listed company: • control the basis for working out the dividend/capital split and the amount of the dividend component; and • – the purchase price is less than the market value; or cause a debit to arise in the franking account of the company conducting the buy-back where the company has foreign resident shareholders. – the seller is a corporate tax entity and part of the purchase price is a franked dividend. No taxation consequences arise for the buying company as a result of the acquisition and cancellation of the 3 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 No taxation consequences arise for the buying company as a result of the acquisition and cancellation of the shares. However, to the extent that the purchase price exceeds the market value, the dividend or non-share dividend component is unfrankable. In addition, the buying company must give a distribution statement in respect of the dividend or non-share dividend on or before the day on which the distribution is made. However, if the buying company is a listed company, the time for giving the distribution statement is seven days after the distribution is made. shares. However, to the extent that the purchase price exceeds the market value, the dividend or non-share dividend component is unfrankable. In addition, the buying company must give a distribution statement in respect of the dividend or non-share dividend on or before the day on which the distribution is made. On-market buy-backs No change. When a company conducts an on-market buy-back, no part of the purchase price of the share or non-share equity interest that is bought back is taken to be a dividend. Instead, the whole of the purchase price is taken to be consideration received for the purposes of working out the amount of gain or loss on the disposal on the share or non-share equity interest. No taxation consequences arise for the buying company as a result of the acquisition and cancellation of the shares. In addition, in some circumstances a franking debit will arise in the franking account of the buying company. 4 Buy backs of shares and non share equity interests Detailed explanation of new law 1.13 A buy-back occurs where a company (the buying company) purchases shares or non-share equity interests in itself from a member or non-share equity holder (the seller), and cancels the shares. 1.14 The taxation consequences that arise under a buy-back depend on whether the buy-back is an off-market buy-back or an on-market buy-back. Off-market buy-backs 1.15 A buy-back of a share or non-share equity interest is an off-market buy-back unless: • the share or non-share equity interest is listed for quotation on an approved stock exchange; and • the purchase is made in the ordinary course of trading on that stock exchange. [Schedule BB, items 11 and 23, section 190-10 and the definition of ‘off-market buy-back’ in subsection 995-1(1)] 1.16 If a company undertakes an off-market buy-back: • part of the purchase price paid to the seller is taken to be a dividend or non-share dividend (Subdivision 190-A); • modifications apply for the purpose of determining the amount of consideration received by the seller on the disposal of the shares or non-share equity interests in some circumstances (Subdivision 190-B)—this is relevant for determining the amount of the gain or loss made by the seller on the disposal of the shares or interests; • no taxation consequences arise for the buying company (Subdivision 190-C); and • various implications arise under the imputation system (Subdivision 190-C). 5 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 Off-market buy-backs: Part of the purchase price taken to be a dividend 1.17 If a company conducts an off-market buy-back, part of the purchase price is taken to be a dividend or non-share dividend if there is a difference between: • the purchase price for the share or non-share equity interest; and • the capital component for the share or non-share equity interest. [Schedule BB, item 11, subsection 190-5(1)] 1.18 The amount of the dividend or non-share dividend is the amount of the difference between the purchase price and the capital component. [Schedule BB, item 11, subsection 190-5(2)] 1.19 In addition, to ensure that the amount that is taken to be a dividend or non-share dividend is included in the seller’s assessable income under section 44 of the ITAA 1936, the dividend or non-share dividend component is taken to be paid on the day of the buy-back out of profits derived by the company. [Schedule BB, item 11, subsection 190-5(3)] What is the purchase price? 1.20 The purchase price for a share or non-share equity interest under an off-market buy-back is the sum of: • all amounts of money that the member or non-share equity holder is entitled to receive in respect of the buy-back; and • the market value at the time of the buy-back of any property (other than money) that the member or non-share equity holder is entitled to receive in respect of the buy-back. [Schedule BB, item 11, subsection 190-5(4)] What is the capital component? 1.21 The capital component of the purchase price for a share or non-share equity interest under an off-market buy-back is: • for a share—that part of the purchase price which is debited against the company’s share capital account; or 6 Buy backs of shares and non share equity interests • for an non-share equity interest—that part of the purchase price which is debited against the company’s share capital account or non-share capital account. [Schedule BB, item 11, subsection 190-5(5)] 1.22 The amount of the capital component of the purchase price for a share or non-share equity interest is: • the average capital amount; or • the amount worked out under another calculation method approved by the Commissioner of Taxation. [Schedule BB, item 11, subsection 190-15(1)] 1.23 For a share, the average capital amount is worked out using the formula: [Schedule BB, item 11, subsection 190-15(2)] 1.24 For a non-share equity interest, the average capital amount is worked out using the formula: [Schedule BB, item 11, subsection 190-15(3)] Example 1.1 In 2005 Company B issued 1000 shares for $2 each. In November 2011 the shares are listed for $2.50 each on the Australian stock exchange. Company B conducts an off-market share buy-back and buys back the shares for $2.50 each. The average capital amount is worked out using the formula: Therefore: • the average capital amount is $2 (that is, $2000 / 1000); and 7 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 • the dividend component is $0.50 (that is, the total purchase price ($2.50) less the average capital amount ($2). 1.25 In some circumstances a company that undertakes an off-market share buy-back may consider that the average capital amount results in an insufficient amount being treated as the capital component of the purchase price. Therefore, the company can seek the Commissioner’s approval to use another method to work out the capital component. Other methods that have previously been accepted by the Commissioner in appropriate circumstances are: • the share capital/retained earnings ratio (or slice approach); and • the embedded value method. Certain imputation system integrity rules do not apply to listed companies 1.26 Currently, a listed company that undertakes an off-market share buy-back generally needs to seek a ruling from the Commissioner to clarify that certain imputation system integrity rules do not apply to the buy-back. The ruling is necessary to provide certainty for the holders of shares or non-share equity interests in the company who are eligible to participate in the buy-back. 1.27 Therefore, to provide greater certainty and to reduce compliance costs, these integrity rules will not apply if: • the shares or non-share equity interests in the company conducting the buy-back are listed for quotation on an official list of an approved stock exchange; and • the amount of the capital component of the purchase price for a share or non-share equity interest is the average capital amount. [Schedule BB, item 11, subsection 190-20(1)] 1.28 The imputation system integrity rules that do not apply in these circumstances are: • section 204-30 of the ITAA 1997, which operates where imputation benefits are streamed; • section 45A of the ITAA 1936, which operates where capital benefits and dividends are streamed; 8 Buy backs of shares and non share equity interests • section 45B of the ITAA 1936, which operates when a company enters into a scheme to provide capital benefits or demerger benefits; and • section 177EA of the ITAA 1936, which operates when a company enters into a scheme to provide imputation benefits. [Schedule BB, item 11, subsection 190-20(2)] 1.29 The imputation system integrity rules are switched off only if the listed company uses the average capital per share method to work out the capital component. If that method is used, the opportunities for streaming imputation system benefits are minimised. 1.30 If a company seeks the Commissioner’s discretion to use another method to work out the capital component, the imputation system integrity rules still operate. This is because other methods can give rise to the streaming of imputation system benefits in some circumstances. Off-market buy-backs: Amount of consideration received by the seller 1.31 When a share or non-share equity interest is disposed of by a member or equity holder (the seller) under an off-market buy-back, the seller will generally: • make a capital gain or capital loss; or • make a revenue gain or revenue loss. 1.32 The amount of the gain or loss will generally be the amount of the difference between: • the amount of consideration received by the seller on the disposal of the share or interest; and • the amount paid to acquire (or reduced cost base of) the share or interest. 1.33 For these purposes, the amount of consideration received by the seller on the disposal of a share or non-share equity interest will generally be: • if part of the purchase price is taken to be a dividend or non-share dividend, the capital component of the purchase price for the share or interest worked out under subsection 190-5(5); or 9 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 • if no part of the purchase price is taken to be a dividend or non-share dividend, the purchase price for the share or interest. [Schedule BB, item 11, section 190-70] 1.34 However, for the purpose of working out the amount of gain or loss made by the seller on the disposal of a share or non-share equity interest, the amount of consideration received is increased if, broadly: • the dividend component is not fully taxed; • the buy-back is conducted by a listed company and the seller makes a notional loss; • the buy-back is conducted by an unlisted company and the purchase price of the share or interest is less than its market value; or • the buy-back is conducted by an unlisted company that franks the dividend component and the seller is a corporate tax entity which makes a notional loss. 1.35 In some circumstances more than one provision could apply to increase the amount of consideration that is taken to be received by the seller. In that event, the amount of consideration that is taken to be received by the seller is increased by the amount of the adjustment under each provision. Consideration received increased if dividend component not fully taxed 1.36 If part of the purchase price of shares or non-share equity interests under an off-market buy-back is taken to be a dividend or non-share dividend, the amount of the dividend is included in the seller’s assessable income under section 44 of the ITAA 1936. 1.37 Alternatively, if the seller is a non-resident, the dividend will be taxed indirectly because: • the dividend will be fully franked; or • the dividend will be subject to dividend withholding tax. 10 Buy backs of shares and non share equity interests 1.38 However, in some circumstances the seller may not be taxed, directly or indirectly, on all or part of the dividend component. This could happen, for example, if the amount that is taken to be a dividend is specifically exempt from tax under section 23AJ of the ITAA 1936 because it is a non-portfolio dividend paid by a non-resident company. 1.39 In these circumstances, unless the dividend is paid out of realised profits, the amount of consideration received is increased to ensure that the seller pays Australian tax on the dividend component of the purchase price. 1.40 That is, the amount of consideration received is increased if a part of the dividend or non-share dividend that is taken to be paid is not included in the assessable income of the seller, and: • is debited against a share capital account, non-share capital account or asset revaluation reserve; or • is attributable directly or indirectly to amounts transferred from a share capital account, non-share capital account or asset revaluation reserve. [Schedule BB, item 11, subsection 190-75(1)] 1.41 In these circumstances, the amount of consideration received by the seller is taken to be the capital component of the purchase price increased by the part of the dividend or non-share dividend that is untaxed. [Schedule BB, item 11, subsection 190-75(2)] 1.42 However, for the purpose of determining whether a part of the dividend or non-share dividend that is taken to be paid is not included in the assessable income of the seller, the following provisions which treats certain amounts as non-assessable non-exempt income, are disregarded: • section 802-15 of the ITAA 1997, which applies to a distribution made by an Australian corporate tax entity to a foreign resident to the extent that the distribution is conduit foreign income; and • section 128D of the ITAA 1936, which applies to dividends that are subject to dividend withholding tax. [Schedule BB, item 11, subsection 190-75(3)] 11 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 1.43 In addition, for the purpose of determining whether a part of the dividend or non-share dividend that is taken to be paid is debited against a share capital account, non-share capital account or asset revaluation reserve, or is attributable directly or indirectly to amounts transferred from such an account, the dividend or non-share dividend is taken to have been debited against the account or reserves against which the purchase price was debited, and to the same extent. [Schedule BB, item 11, subsection 190-75(4)] 1.44 A share capital account is defined in subsection 975-300 of the ITAA 1997 to mean, broadly, an account that a company keeps of its share capital. However, if a company transfers amounts to its share capital account from other accounts, the company’s share capital account may become tainted. In most cases, if a company’s share capital account becomes tainted, the account is no longer treated as a share capital account. 1.45 For the purpose of applying section 190-75, a tainted share capital account continues to be treated as a share capital account. This prevents the operation of section 190-75 being avoided by a company tainting its share capital account. [Schedule BB, items 20 to 22, subsection 975-300(3)] 1.46 An asset revaluation reserve is a reserve (however called) comprising profits arising from the revaluation of an asset or assets to the extent that those profits have not been realised by disposing of the asset. If a reserve contains such profits in addition to other amounts, only that part of the reserve comprising the revaluation profits is taken to be an asset revaluation reserve. In such a case, the company will determine to what extent a debit to the reserve is a debit to that part of the reserve comprising profits arising from the revaluation of assets which have not been disposed of. Consideration received increased if the buy-back is conducted by a listed company and the seller makes a notional loss 1.47 If part of the purchase price of shares or non-share equity interests under an off-market buy-back is taken to be a dividend or non-share dividend, then the seller could make a capital loss or revenue loss on the disposal of the share or non-share equity interest. 1.48 A loss will arise if the capital component is less than the amount paid to acquire (or reduced cost base of) the share or interest. To the extent that the loss arises because part of the purchase price is taken to be a dividend or non-share dividend, the loss is a notional loss. 12 Buy backs of shares and non share equity interests 1.49 The Board of Taxation recommended that, where an off-market buy-back is conducted by a listed company, notional losses should be denied. The Board concluded that the denial of notional losses will make shareholder compliance simpler and easier and make the treatment of amounts received on the disposal of shares or non-share equity interests under an off-market buy-back more consistent with other parts of the law, including the outcomes that arise when a company cancels shares or goes into liquidation. 1.50 Although the Board of Taxation acknowledged that the denial of notional losses will reduce returns for some taxpayers who participate in off-market buy-backs conducted by listed companies, the Board considered that, when viewed in combination with its other recommendations, the overall outcomes result in a balanced package. 1.51 Therefore, consistent with the recommendation of the Board of Taxation, the amount of consideration received is increased if: • the shares or non-share equity interests in the company conducting the off-market buy-back are listed for quotation in the official list of an approved stock exchange just before the buy-back; and • a loss would be realised for income tax purposes for the seller in respect of the buy-back (ignoring this adjustment). [Schedule BB, item 11, subsection 190-80(1)] 1.52 In these circumstances, the amount of consideration received by the seller is taken to be the capital component of the purchase price increased by the lesser of: • the amount of the loss; and • the amount of the purchase price that is taken to be a dividend or non-share dividend. [Schedule BB, item 11, subsection 190-80(2)] Example 1.2 Katherine receives a purchase price of $100 in respect of an off-market buy-back of shares by Company M, a listed company. Company M debits $70 against its share capital account. Company M is taken to pay Katherine a dividend of $30 (section 190-5). Katherine has a cost base and reduced cost base of $90 for the shares and must work out a capital gain or loss on the disposal. 13 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 Apart from section 190-80, Katherine would be taken to have received the $70 capital component in respect of the buy-back. However, this would give Katherine a capital loss of $20 (that is, the reduced cost base ($90) less the capital component ($70)). Section 190-80 applies to increase the amount of consideration received by $20 (which is the lesser of the dividend amount ($30) and the loss amount ($20)). Therefore, the amount of consideration that is taken to be received by Katherine is $90. Katherine’s capital loss after applying section 190-80 is nil (that is, the reduced cost base ($90) less the consideration received ($90)). Example 1.3 Kenny receives a purchase price of $100 in respect of an off-market buy-back of shares by Company C, a listed company. Company C debits $60 against its share capital account. Company C is taken to pay Kenny a dividend of $40 (section 190-5). Kenny has a cost base and reduced cost base of $120 for the shares and must work out a capital gain or loss on the disposal. Apart from section 190-80, Kenny would be taken to have received the $60 capital component in respect of the buy-back. However, this would give Kenny a capital loss of $60 ((that is, the reduced cost base ($120) less the capital component ($60)). Section 190-80 applies to increase the amount of consideration received by $40 (which is the lesser of the dividend amount ($40) and the loss amount ($60)). Therefore, the amount of consideration that is taken to be received by Kenny is $100. Kenny’s capital loss after applying section 190-80 is $20 (that is, the reduced cost base ($120) less the consideration received ($100)). Consideration received increased if the buy-back is conducted by an unlisted company and the purchase price is less than market value 1.53 Tax advantages may be obtained if an off-market share buy-back could be conducted by an unlisted company at a price lower than the market value of the share or non-share equity interest that is bought back. In such a case, the taxable gain on the disposal of the share or interest could be reduced or a tax loss could be created. 1.54 14 Therefore, the amount of consideration received is increased if: Buy backs of shares and non share equity interests • the shares or non-share equity interests in the company conducting the off-market buy-back are not listed for quotation in the official list of an approved stock exchange just before the buy-back; and • the amount that would have been the market value of the share or interest at the time of the buy-back if the buy-back did not occur and was never proposed to occur exceeds the purchase price for the share or interest. [Schedule BB, item 11, subsection 190-85(1)] 1.55 In these circumstances, the amount of consideration received by the seller is taken to be the capital component of the purchase price increased by the amount by which the market value of the share or interest exceeds its purchase price. [Schedule BB, item 11, subsection 190-85(2)] 1.56 Under the current law, this market value uplift rule applies to off-market buy-backs conducted by both listed and unlisted companies. The Board of Taxation recommended that the market value uplift rule no longer apply to off-market buy-backs conducted by listed companies. This is because, where an off-market buy-back is conducted by a listed company, section 190-80 applies to increase the consideration received by a seller and deny any notional losses. Consideration received increased if the buy-back is conducted by an unlisted company that franks the dividend component and the seller is a corporate tax entity which makes a notional loss 1.57 Where a corporate tax entity disposes of shares or non-share equity interests under an off-market buy-back conducted by an unlisted company and the dividend component of the purchase price is franked, the consideration received is increased to deny notional losses. This is appropriate because corporate tax entities effectively pay no tax on the franked dividends. 1.58 Therefore, the amount of consideration received is increased if: • the shares or non-share equity interests in the company conducting the off-market buy-back are not listed for quotation in the official list of an approved stock exchange just before the buy-back; • a loss would be realised for income tax purposes for the seller in respect of the buy-back (ignoring this adjustment); and 15 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 • the seller is a corporate tax entity that is entitled to a tax offset for franking credits attached to the dividend or non-share dividend component of the purchase price. [Schedule BB, item 11, subsection 190-90(1)] 1.59 In these circumstances, the amount of consideration received by the seller is taken to be the capital component of the purchase price increased by the lesser of: • the amount of the loss; and • the amount worked out applying the formula: [Schedule BB, item 11, subsection 190-90(2)] 1.60 Under the current law, corporate tax entities are denied notional losses in respect of off-market buy-backs conducted by both listed and unlisted companies where the dividend component of the purchase price is franked. However, section 190-90 applies only to off-market buy-backs conducted by unlisted companies because, where an off-market buy-back is conducted by a listed company, section 190-80 applies to increase the consideration received by a seller and deny notional losses in all cases. Off-market buy-backs: Tax neutral for buying companies 1.61 When a company conducts an off-market buy-back, the buy-back and subsequent cancellation of the shares or non-share equity interests are disregarded for the purpose of working out whether: • the company makes a capital gain or capital loss; • the company has an amount included in their assessable income (other than as a capital gain); or • the company is allowed a deduction. [Schedule BB, item 11, section 190-140] 1.62 As a result, the buy-back is effectively tax neutral for the buying company. Therefore, the buying company will not, for example, make a capital gain or loss as a result of the cancellation of the shares. In addition, the buying company is not allowed a deduction in respect of any expenditure incurred in respect of the buy-back. 16 Buy backs of shares and non share equity interests Off-market buy-backs: Imputation system rules 1.63 When a company conducts an off-market buy-back, the imputation system is modified so that: • the dividend or non-share dividend component is unfrankable to the extent that the purchase price of the share or interest exceeds its market value; • if the buy-back is conducted by a listed company, the time for giving distribution statements is extended; and • a franking debit arises in the company’s franking account if it has foreign resident shareholders. Dividend component unfrankable where the purchase price is greater than market value 1.64 If a company conducts an off-market buy-back, the company can generally attach franking credits to the dividend or non-share dividend component of the purchase price. 1.65 However, as an integrity rule, the dividend or non-share dividend is unfrankable to the extent that the purchase price for the share or non-share equity interest exceeds the market value (as normally understood) of the share or interest at the time of the buy-back assuming that the buy-back did not occur and was never proposed to occur. [Schedule BB, items 11 and 12, section 190-145 and paragraph 202-45(c)] 1.66 This integrity rule prevents a company from being able to pass on franking credits to sellers which could not ordinarily be accessed where: • the amount of the purchase price for a share or non-share equity interest exceeds its market value; and • the excess purchase price is taken to be a dividend or non-share dividend. Extension of the time for listed companies to give distribution statements 1.67 A company that makes a franked distribution must give the recipient a distribution statement. Generally, the distribution statement must be given on or before the day on which the distribution is made (section 202-75 of the ITAA 1997). 17 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 1.68 Listed companies that undertake off-market buy-backs often have difficulty in satisfying the requirement to give recipients a distribution statement on or before the day the distribution is made. This difficulty arises because of the buy-back process used by listed companies. 1.69 Therefore, the time for giving a distribution statement for a frankable distribution is extended if: • the distribution is a dividend or a non-share dividend paid in relation to a share or non-share equity interest under an off-market buy-back; and • the shares or interests are listed for quotation in the official list of an approved stock exchange just before the buy-back. [Schedule BB, items 11 and 13, section 190-150 and the note to subsection 202-75(2)] Franking debit where companies have foreign resident shareholders 1.70 A primary attraction for companies to use off-market buy-backs as a capital management tool is that part of the purchase price is treated as a frankable dividend or non-share dividend for income tax purposes. Consequently, shareholders and non-share equity interest holders who can fully utilise franking credits have greater incentive to participate in off-market buy-backs than other shareholders or interest holders. 1.71 As a result, when a company undertakes an off-market buy-back, the Commissioner routinely applies the general anti-avoidance provision in section 177EA of the ITAA 1936 to debit the company’s franking account to prevent the streaming of franking credits from foreign resident shareholders or interest holders to Australian resident shareholders or interest holders. 1.72 The Board of Taxation concluded that it is appropriate to protect the Australian tax base by preventing the streaming of franking credits from foreign resident shareholders or interest holders to Australian resident shareholders or interest holders. However, the Board recommended that, to ease compliance costs, a specific provision should cause a franking debit to arise in the company’s franking account and specify the basis for working out the amount of the franking debit. 1.73 Therefore, a franking debit will arise in the franking account of a company conducting an off-market buy-back if: • just before the buy-back, one or more foreign residents are members or equity holders in the company; and 18 Buy backs of shares and non share equity interests • the dividend or non-share dividend component of the purchase price is franked to any extent. [Schedule BB, items 11 and 14, subsections 190-155(1) and 205-30(1)] 1.74 The franking debit will arise in the franking account of a company conducting the off-market buy-back on the day of the buy-back. [Schedule BB, items 11 and 14, subsections 190-155(5) and 205-30(1)] 1.75 The amount of the franking debit that arises in the franking account of the company conducting the off-market buy-back is worked out using the formula: where: • the franking credits allocated is the sum of the franking credits allocated to all the franked distributions for the shares and non-share equity interests bought back; • the number of foreign interests is the number of shares or non-share equity interests in the company that: – are held just before the buy-back by foreign residents; – are of the same kind as those bought back; and – are not bought back; • the number of total interests is the number of shares or non-share equity interests in the company just before the buy-back of the same kind as those bought back (including those that are bought back); and 19 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 • the weighted WHT rate is the weighted average of the rates set out in subsection 190-155(3) for the foreign interests. [Schedule BB, items 11 and 14, subsections 190-155(2) and 205-30(1)] 1.76 For the purpose of working out the weighted WHT rate, the rate for a foreign interest is: • the rate set out in paragraph 7(a) of the Income Tax (Dividends, Interest and Royalties Withholding Tax) Act 1974—currently 30 per cent; or • if the member who holds the foreign interest is a resident of a country that Australia has a double tax agreement with, the rate of withholding tax applying to dividends under the relevant double tax agreement. [Schedule BB, item 11, subsections 190-155(3) and (4)] 1.77 The company can use the register of its members just before the buy-back to determine whether a member is a resident of a country that Australia has a double tax agreement with. [Schedule BB, item 11, subsection 190-155(4)] On-market buy-backs 1.78 A buy-back of a share or non-share equity interest is an on-market buy-back if: • the share or non-share equity interest is listed for quotation on an approved stock exchange; and • the purchase is made in the ordinary course of trading on that stock exchange. [Schedule BB, items 11 and 25, section 190-210 and the definition of ‘on-market buy-back’ in subsection 995-1(1)] 1.79 If a company undertakes an on-market buy-back: • no part of the purchase price paid to the seller is taken to be a dividend or non-share dividend (section 190-205); • the purchase price is the amount of consideration that is taken received by the seller on the disposal of the shares or non-share equity interests (section 190-215)—this is relevant for determining the amount of the gain or loss made by the seller on the disposal of the shares or interests; 20 Buy backs of shares and non share equity interests • no taxation consequences arise for the buying company (section 190-220); and • a franking debit arises in the franking account of the buying company in some circumstances (section 190-225). No part of the purchase price is taken to be a dividend 1.80 If a company conducts an on-market buy-back, no part of the purchase price is taken to be a dividend or non-share dividend. [Schedule BB, item 11, subsection 190-205(1)] 1.81 The purchase price for a share or non-share equity interest under an on-market buy-back is the sum of: • all amounts of money that the member or non-share equity holder is entitled to receive in respect of the buy-back; and • the market value at the time of the buy-back of any property (other than money) that the member or non-share equity holder is entitled to receive in respect of the buy-back. [Schedule BB, item 11, subsection 190-205(2)] Amount of consideration received by the seller 1.82 When a share or non-share equity interest is disposed of by a member or equity holder (the seller) under an on-market buy-back, the seller will generally: • make a capital gain or capital loss; or • make a revenue gain or revenue loss. 1.83 The amount of the gain or loss will generally be the amount of the difference between: • the amount of consideration received by the seller on the disposal of the share or interest; and • the amount paid to acquire (or reduced cost base of) the share or interest. 1.84 For these purposes, the amount of consideration received by the seller on the disposal of a share or non-share equity interest is equal to the purchase price for the share or interest. [Schedule BB, item 11, section 190-215] 21 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 Tax neutral for buying companies 1.85 When a company conducts an on-market buy-back, the buy-back and subsequent cancellation of the shares or non-share equity interests are disregarded for the purpose of working out whether: • the company makes a capital gain or capital loss; • the company has an amount included in their assessable income (other than as a capital gain); or • the company is allowed a deduction. [Schedule BB, item 11, section 190-220] 1.86 As a result, the buy-back is effectively tax neutral for the buying company. Therefore, the buying company will not, for example, make a capital gain or loss as a result of the cancellation of the shares. In addition, the buying company is not allowed a deduction in respect of any expenditure incurred in respect of the buy-back. Franking debit arises in the franking account of the buying company 1.87 A franking debit will arise in the franking account of a company conducting an on-market buy-back if a franking debit would have arisen if: • the purchase of the share or interest were a frankable distribution equal to the one that would have arisen if the buy-back had been an off-market share buy-back; and • the distribution were franked at the entity’s bench market franking percentage for the franking period in which the purchase was made or, if the entity does not have a benchmark franking percentage for the period, at a franking percentage of 100 per cent. [Schedule BB, items 11 and 15, subsections 190-225(1) and 205-30(1)] 1.88 The franking debit will arise in the franking account of a company conducting the on-market buy-back on the day of the buy-back. [Schedule BB, items 11 and 15, subsections 190-225(3) and 205-30(1)] 1.89 The amount of the franking debit that arises in the franking account of the company conducting the on-market buy-back is the amount of the franking debit that would have arisen. [Schedule BB, items 11 and 15, subsections 190-225(2) and 205-30(1)] 22 Buy backs of shares and non share equity interests Application and transitional provisions 1.90 These amendments apply to off-market buy-backs and on-market buy-backs announced by the company conducting the buy-back after the day this Bill receives Royal Assent. [Schedule BB, item 26] Consequential amendments 1.91 Consequential amendments will: • repeal the existing provisions relating to buy-backs in Division 16K of Part III of the ITAA 1936; • update the check lists in section 10-5 and 12-5 of the ITAA 1997; • update references to the buy-back provisions in the capital gains tax provisions (including, for example, a note to clarify that the amount of consideration received under an off-market buy-back or an on-market buy-back is treated as capital proceeds for capital gains tax purposes); • update a reference to the buy-back provisions in the taxation of financial arrangement provisions; • update references to the buy-back provisions in the value shifting provisions; and • repeal a redundant definition of ‘off-market purchase’. [Schedule BB, items 1 to 4, 6 to 10, 16 to 19 and 24, sections 10-5, 12-5, 116-10, 116-20, 118-1, 118-20, 125-70, 230-515, 725-230, and 995-1] Legislative history of Division 16K 1.92 Division 16K of Part III of the ITAA 1936 was added by Taxation Laws Amendment Act (No. 3) 1990 [Act No.58 of 1990]. 23 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 1.93 These Acts have amended Division 16K. Act title 24 Act No. Effect of amendments Taxation Laws Amendment Act (No. 2) 1994 82 of 1994 The amendments ensured that the consideration received under an off-market buy-back included the amount of a rebatable dividend paid in relation to a revaluation reserve. Taxation Laws Amendment Act (No. 3) 1995 170 of 1995 The amendments were consequential upon the introduction of the former disqualifying account rules which prevented dividends paid out of share capital accounts or asset revaluation reserves from being rebatable or frankable. Taxation Laws Amendment Act (No. 1) 1996 31 of 1996 The amendments introduced modifications to increase the amount of consideration received where: • the purchase price is less than the market value; • the dividend component is not fully taxed; or • the seller is a corporate tax entity and part of the purchase price is a franked dividend. Tax Laws Improvement Act (No. 1) 1998 46 of 1998 The amendments were minor consequential amendments upon the introduction of Tax Law Improvement Project rewrites of other provisions. Taxation Laws Amendment (Company Law Review) Act 1998 63 of 1998 The amendments were minor consequential amendments resulting from changes to the Corporations Law. Buy backs of shares and non share equity interests New Business Tax System (Debt and Equity) Act 2001 163 of 2001 The amendments were consequential upon the introduction of the debt/equity rules and extended the scope of the buy-back provisions to cover non-share equity interests. Tax Laws Amendment (2004 Measures No 6) Act 2005 23 of 2005 The amendments were minor consequential amendments resulting from the introduction of the simplified imputation system. Tax Laws Amendment (Loss Recoupment and Other Measures) Act 2005 147 of 2005 The amendments were minor consequential amendments resulting from the introduction of the conduit foreign income rules. Finding tables 1.94 The amendments substantially rewrite Division 16K of Part III of the ITAA 1936. These finding tables help locate which provision in the Bill corresponds to a provision in the current law that has been rewritten, and vice versa. 1.95 References to the old law in the finding table are to provisions in Division 16K of Part III of the ITAA 1936, unless otherwise stated. 1.96 References to the new law are to provisions in Division 190 of the ITAA 1997. Also, in the finding tables: • No equivalent means that this is a new provision that has no equivalent in the current law. These reflect changes to implement the recommendations of the Board of Taxation. • Omitted means that the provision in the old law has not been rewritten in the new law. 25 Tax Laws Amendment (2011 Measures No. 9) Bill 2011 Table 1.1 — Old law to new law Old law New law 159GZZZIA 190-10, 190-210 159GZZZJ 190-10, 190-210 159GZZZK 190-10, 190-210 159GZZZL Omitted 159GZZZM 190-5 159GZZZN 190-140, 190-220 159GZZZP 190-5 159GZZZQ 190-70, 190-75, 190-85, 190-90 159GZZZR 190-205 159GZZZS 190-215 Table 1.2 — New law to old law New law 26 Old law 190-1 No equivalent 190-5 159GZZZP, 159GZZZM 190-10 159GZZZIA, 159GZZZJ, 159GZZZK 190-15 No equivalent 190-20 No equivalent 190-70 159GZZZQ(1) 190-75 159GZZZQ(3) to (7) 190-80 No equivalent 190-85 159GZZZQ(2) 190-90 159GZZZQ(8) and (9) 190-140 159GZZZN 190-145 202-45(c) of the ITAA 1997 190-150 No equivalent 190-155 No equivalent 190-205 159GZZZR 190-210 159GZZZIA, 159GZZZJ, 159GZZZK 190-215 159GZZZS 190-220 159GZZZN 190-225 205-30 of the ITAA 1997 Buy backs of shares and non share equity interests 27