How to Process Share Buy-Backs in Class

advertisement

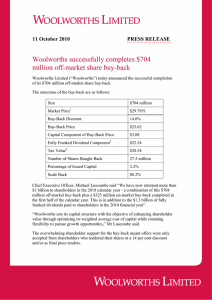

How to Process Share Buy-Backs in Class A share buy-back is simply an offer a company makes to shareholders to buy-back some of its own shares - either offmarket or on-market. Buy-backs are generally very attractive to shareholders, especially those on a tax rate lower than the corporate tax rate of 30% such as a SMSF, which is only paying 15% or close to 0% if the fund is in pension mode. The buy-back transaction typically involves paying a franked dividend component plus a capital component. The franking credits attached to the dividend can be used to offset against other income in the fund. Alternatively, excess credits can be refunded in cash. The capital component is usually struck at a low amount and many shareholders use these capital losses to offset capital gains, which further improves the tax attractiveness of share buy-backs. The following is list of recent buy-backs announced in the Australian equity market: BHP Billiton (Class Ruling 2011/43) Woolworths (Class Ruling 2010/62) JB Hi-Fi (Class Ruling 2011/54) Class Super uses a composite event under Corporate Actions > Buy Back to record all the details of buy-back transactions. The following illustrated buy-back examples will use 100 units of shares of BHP, WOW and JBH respectively. 1) BHP Key Off-Market Buy-Back Details: (click through to BHP Buy-Back site) Size CGT Date Market price Buy-back discount Buy-back price Scale back Number of BHP shares bought back A$6.0 billion A$47.4985 14.0% A$40.85 78.27% 147 million % of BHP Billiton Limited issued capital 4.4% % of BHP Billiton Group issued capital 2.7% Capital component Additional capital component 100 Shares 14 April 2011 A$0.28 $28 A$9.03 $903 Fully franked dividend component A$40.57 $4,057 Tax value A$49.88 $4,988 2) WOW Key Off-Market Buy-Back Details: (click through to WOW Buy-Back site) Size CGT Date Market price Buy-back discount Buy-back price Scale back Number of WOW shares bought back % of Woolworths Limited issued capital Capital component Additional capital component Fully franked dividend component Tax value A$704 million 100 Shares 11 October 2010 A$29.7951 14.0% A$25.62 88.2% 27.5 million 2.2% A$3.08 $308 A$2.92 A$25.46 A$28.54 $292 $2,546 $2,854 3) JBH Key Off-Market Buy-Back Details: (click through to JBH Buy-Back site) Size A$173 million CGT Date Market price Buy-back discount Buy-back price Scale back Number of JBH shares bought back 100 Shares 16 May 2011 A$18.60 14.0% A$16.00 81.06% 27.5 million % of JB Hi-Fi Limited issued capital Capital component 9.9% A$0.58 $58 Additional capital component Fully franked dividend component A$2.31 A$15.42 $231 $1,542 Tax value A$18.31 $1,831 © 2011 Class Super Pty Ltd. ABN 46 121 158 503. AFSL 313512. Level 1, 219 Castlereagh Street, Sydney, NSW 2000.