61. The management of the Wish We Could Co. has numerous

advertisement

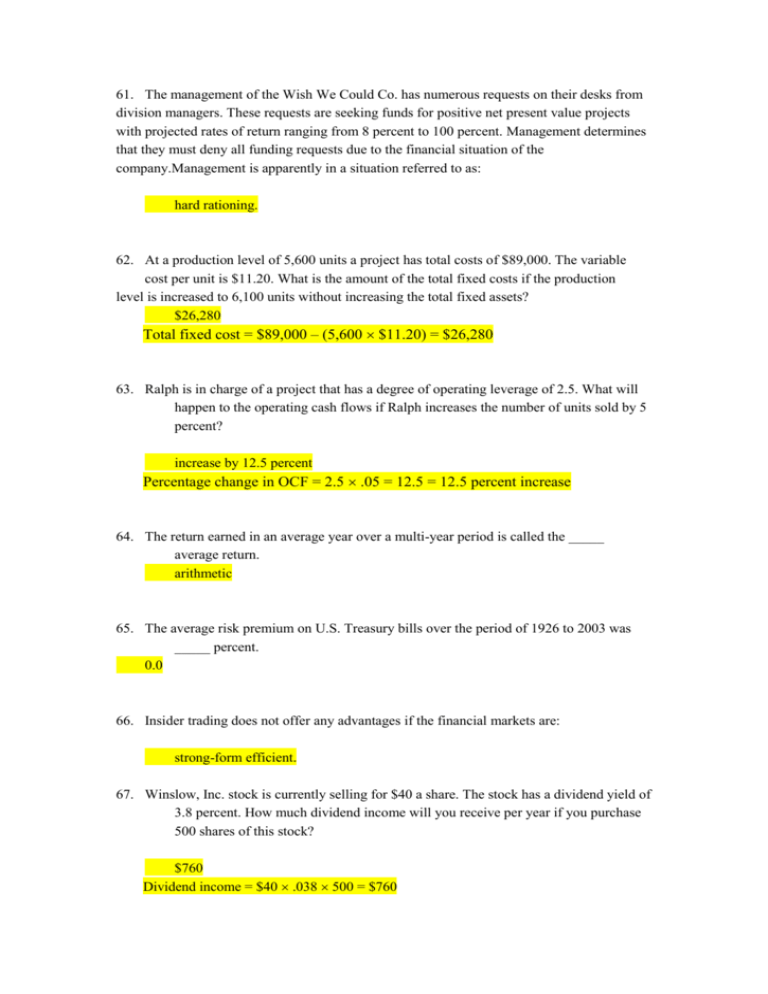

61. The management of the Wish We Could Co. has numerous requests on their desks from division managers. These requests are seeking funds for positive net present value projects with projected rates of return ranging from 8 percent to 100 percent. Management determines that they must deny all funding requests due to the financial situation of the company.Management is apparently in a situation referred to as: hard rationing. 62. At a production level of 5,600 units a project has total costs of $89,000. The variable cost per unit is $11.20. What is the amount of the total fixed costs if the production level is increased to 6,100 units without increasing the total fixed assets? $26,280 Total fixed cost = $89,000 – (5,600 $11.20) = $26,280 63. Ralph is in charge of a project that has a degree of operating leverage of 2.5. What will happen to the operating cash flows if Ralph increases the number of units sold by 5 percent? increase by 12.5 percent Percentage change in OCF = 2.5 .05 = 12.5 = 12.5 percent increase 64. The return earned in an average year over a multi-year period is called the _____ average return. arithmetic 65. The average risk premium on U.S. Treasury bills over the period of 1926 to 2003 was _____ percent. 0.0 66. Insider trading does not offer any advantages if the financial markets are: strong-form efficient. 67. Winslow, Inc. stock is currently selling for $40 a share. The stock has a dividend yield of 3.8 percent. How much dividend income will you receive per year if you purchase 500 shares of this stock? $760 Dividend income = $40 .038 500 = $760 68. A stock had returns of 8 percent, 39 percent, 11 percent, and -24 percent for the past four years. Which one of the following best describes the probability that this stock will NOT lose more than 43 percent in any one given year? 97.5 percent Average return = (.08 + .39 + .11 .24) 4 = 8.5 percent; Total squared deviation = (.08 – .085)2 + (.39 – .085)2 + (.11 – .085)2 + (-.24 – .085)2 = .000025 + .093025 + .000625 + .105625 = .1993; Standard deviation = .1993 (4 – 1) = .06643333 = 25.7747 percent; Lower bound of the 95 percent probability range = 8.5 percent – (2 25.7747 percent) = -43.05; Probability of NOT losing more than 43 percent in any given year is 97.5 percent 69. Risk that affects at most a small number of assets is called _____ risk. unsystematic 70. Which one of the following is an example of a nondiversifiable risk? a well respected chairman of the Federal Reserve suddenly resigns