course philosophy - Benedictine University

advertisement

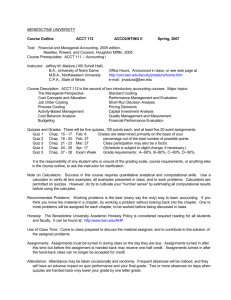

BENEDICTINE UNIVERSITY Course Outline ACCT 111 ACCOUNTING I Fall, 2013 Text: Financial and Managerial Accounting, 12th edition; Warren, Reeve, and Duchac; South-Western/Cengage, 2014. 978-1-285-72669-4 (Aplia) or 978-1-133-95242-8 Aplia interactive learning/assignment system. TI-83/84 calculator is also required. Course Prerequisites: MATH 105 (Finite Math I) or MATH 110 (College Algebra) Instructor: Jeffrey M. Madura (160 Scholl Hall) B.A., University of Notre Dame M.B.A., Northwestern University C.P.A., State of Illinois Office Hours: Announced in class, or see web page at http://www.ben.edu/faculty/jmadura/home.htm e-mail: jmadura@ben.edu Course Description: ACCT 111 is the first of two introductory accounting courses. Major topics: Introduction to Accounting and Business Analyzing Transactions The Adjusting Process Completing the Accounting Cycle Accounting for Merchandising Businesses Inventories Sarbanes-Oxley, Internal Control, & Cash Receivables Fixed and Intangible Assets Current Liabilities and Payroll Corporations: Organiz., Stock Transactions, & Dividends Long-Term Liabilities: Bonds and Notes Investments and Fair Value Accounting Statement of Cash Flows Financial Statement Analysis The course addresses the following College of Business Program Objectives: Students in this program will receive a thorough grounding in: The principles pertinent to the functional areas of business, accounting and finance. Financial accounting principles and applications. Your student evaluation of this course will be completed online using the IDEA system. This course emphasizes the following IDEA objectives: Learning fundamental principles, generalizations or theories. Learning to apply course material to improve thinking, problem-solving and decision-making. Developing specific skills, competencies and points of view needed by professionals in the fields most closely related to this course (accounting, finance, management). Quizzes and Grades: There will be five quizzes and 15 homework assignments. Quiz 1 Chap. 1 - 3 Sep. 19 Grades are determined primarily on the basis of your Quiz 2 Chap. 4 - 6 Oct. 10 percentage out of the total number of possible points. Quiz 3 Chap. 7 - 9 Oct. 31 Class participation may also be a factor. Quiz 4 Chap. 10 - 12 Nov. 21 (Schedule is subject to slight change, if necessary.) Quiz 5 Chap. 13 - 15 Exam Week Grade requirements: A--90%, B--80%, C--60%, D--50%. The quizzes are worth 2/3 of the course grade. It is the responsibility of any student who is unsure of the grading scale, course requirements, or anything else in the course outline, to ask the instructor for clarification. Homework Assignments: There will be 15 homework assignments--one each week for 15 weeks. Due dates are listed in the Aplia system. The assignments will constitute 1/3 of the course grade. To accommodate the occasional instance when you cannot meet the deadline, the lowest two assignments will be dropped, except that Assignment 15 cannot be dropped. Assignments will be handled by Aplia. You will be required to access the Aplia website, which means you need to register for an account at: http://www.aplia.com Please register within 24 hours of the first class meeting. Please note: The computer is absolutely unforgiving about accepting late assignments. Time is kept at Aplia, and not by the computer you are working on. You may appeal grading decisions made by the computer, if you can demonstrate that an error has been made. Faculty have observed that the worst thing students do, and not just in accounting, is not think about course material every day. They sometimes let weeks go by and then try to learn all the material in one or two days. This usually does not work. The weekly assignments will require keeping up-to-date. Note on Calculators: Success in this course requires quantitative analytical and computational skills. Use a calculator to verify all text examples, all examples presented in class, and to work problems. Calculators are permitted on quizzes. However, try to cultivate your "number sense" by estimating all computational results before using the calculator. Estimating percentages and percent changes is a particularly valuable skill in business. Recommended Problems: Working problems is the best (many say the only) way to learn accounting. If you think you know the material in a chapter, try working an end-of-chapter problem without looking back into the chapter. One or more problems will be suggested for each chapter, to be worked before being discussed in class. Honesty: The following is from the Benedictine University Academic Honesty Policy: The search for truth and the dissemination of knowledge are the central missions of a university. Benedictine University pursues these missions in an environment guided by our Roman Catholic tradition and our Benedictine heritage. Integrity and honesty are therefore expected of all members of the University community, including students, faculty members, administration, and staff. Actions such as cheating, plagiarism, collusion, fabrication, forgery, falsification, destruction, multiple submission, solicitation, and misrepresentation, are violations of these expectations and constitute unacceptable behavior in the University community. The penalties for such actions can range from a private verbal warning, all the way to expulsion from the University. Use of Class Time: Come to class prepared to discuss the material assigned, and to contribute to the solution of the assigned problems. Attendance: Attendance may be taken occasionally and randomly. Frequent absences will be noticed, and they will have an adverse impact on quiz performance and your final grade. Two or more absences on days when quizzes are handed back mayl lower your grade by one letter grade. Missed Quizzes: Make-up quizzes will be given only if a quiz was missed for a good and documented reason. If a make-up is given. the quiz score will be reduced 20% in an effort to maintain some degree of fairness to those to took the quiz at the proper time. Special Needs: If you have a documented learning, psychological, or physical disability, you may be eligible for reasonable academic accommodations or services. To request accommodations or services, please contact Tina Sonderby in the Student Success Center, 012 Krasa Student Center, 630-829-6512. All students are expected to fulfill essential course requirements. The University will not waive any essential skill or requirement of a course or degree program. Academic Honesty Policy: The search for truth and the dissemination of knowledge are the central mission of a university. Benedictine University pursues these missions in an environment guided by our Roman Catholic tradition and our Benedictine heritage. Integrity and honesty are therefore expected of all members of the community, including students, faculty members, administration, and staff. Actions such as cheating, plagiarism, collusion, fabrication, forgery, falsification, destructions, multiple submission, solicitation, and misrepresentation, are violations of these expectations and constitute unacceptable behavior in the University community. The penalties for such actions can range from a private verbal warning, all the way to expulsion from the University. The University’s Academic Honesty Policy is available at http://www.ben.edu/AHP. In this course, academic honesty is expected of all class participants. If your name is on work submitted, it is expected that you alone did the work. For example, in terms of quizzes, this means that copying from another paper, unauthorized collaboration of any sort, or the use of “cribs” of any kind is a breach of academic honesty. The penalties for a breach of academic honesty in this course are (1) a zero for the assignment or quiz for the first offense, and (2) an “F” for the course for a subsequent offense by the same person(s). Electronic Devices Policy: One aspect of being a member of a community of scholars is to show respect for others by the way you behave. One way of showing respect for others in the educational community is to do your part to create or maintain an environment that is conducive to learning. That being said, allowing your cell phone to ring in class is completely inappropriate because it distracts your classmates and thus degrades their overall classroom experience. For the sake of your classmates, you are expected to turn off your cell phone or set it to mute/silence before you enter class. If you use your cell phone or any other electronic device in any manner during a quiz, you will receive a zero for that test or quiz. Using the TI83/84 calculator is permitted. Feel free to see me if there is anything else of concern to you. Your comments about this course or any course are always welcome and appreciated. The student is responsible for the information in the syllabus and should ask for clarification for anything in the syllabus about which they are unsure. COURSE PHILOSOPHY -- FINANCIAL ACCOUNTING In an article in the Chronicle of Higher Education, Sharon Rubin, assistant dean at the University of Maryland, states that all course syllabi, in addition to providing the basic information on texts, topics, schedule, etc., should answer certain questions. The instructor of this course would like to share these questions with you, as well as provide some answers. 1. WHY SHOULD A STUDENT WANT TO TAKE THIS COURSE? You are what you know. You are what you can do. The purpose of accounting is to provide financial information upon which decisions are based. To be an effective decision-maker in business, or even for your own investment decisions, you must learn how to analyze and interpret financial information. Such skills will improve your ability to adopt the questioning attitude and independence of thought that are essential to leadership and success in any field. 2. WHAT IS THE RELEVANCE OF THIS COURSE TO THE DISCIPLINE? Since this course is part of the curriculum in BU's undergraduate Economics and Business department, the word "discipline" in this question is interpreted to mean "management." Management is the process of guiding an organization to the fulfillment of its goals. For a business enterprise, one of the most important goals is profitability because, without that, the firm may not be able to continue in existence. Non-profit organizations also have financial objectives, usually a "balanced" budget, in which expenses are controlled so that they do not exceed income. Financial accounting provides information that assists external users in making decisions regarding the organization whose financial statements are being studied. Is the company's stock a good investment? Are the company's bonds good investments? Should credit be extended to this company when it buys our product? Is the company likely to be financially stable enough to provide secure employment, or to be a reliable supplier of parts we need to make our own product? Managerial accounting provides information to management, enabling it to better guide the organization toward its goals. It also assists management in taking corrective action when goals are not being achieved. This is an aspect of the managerial function of "control," which is like the navigation function on a ship or aircraft--if the vehicle is off course, corrective action is needed. In business, accounting can detect if the organization is off its financial course and, if so, it can often identify what must be done to get things back on track. 3. HOW DOES THIS COURSE FIT INTO THE "GENERAL EDUCATION" PROGRAM? There are different systems of mathematics, each with its own axioms and operations. There are different systems of philosophy, each with its own concepts and principles. Languages (including computer languages) and games (card games, checkers, chess, athletic games, etc.) are also well-defined systems with strict rules and procedures. Your mental capacity can be enhanced by studying and learning how to operate within these various systems--like mental aerobics. Quite often, these systems present problems to be solved. Analysis of the problem is needed, followed by some action directed toward a solution. This is the same kind of mental activity that is needed in management--the recognition, analysis, and solution of problems. Accounting, also, is a system with its own concepts, principles, and operations rules. The study of accounting, therefore, can be very intellectually satisfying. You will learn how the system works and then learn how to use it to accomplish various tasks. This has educational value in itself, in additional to the importance of learning about accounting for business purposes. 4. WHAT ARE THE OBJECTIVES OF THE COURSE? The most important objective is the development of your ability to learn this kind of material on your own, and to continue learning more about the subject after the course is over. Continuous and independent learning is an important activity of every successful person. With respect to specific objectives, they are: that students learn the terminology, theory, principles, and computational procedures related to basic accounting; and the careful cultivation of the logical processes involved. This will enable students to understand the subject and communicate its ideas using generallyaccepted terminology. Another important objective is that students become aware of the limitations of accounting. This is particularly important since most students in this course will be consumers rather than providers of accounting information. It is important that decision-makers know how accounting information is generated, so that they do not place more faith and reliance on the information than is warranted in light of its inherent limitations. 5. WHAT MUST STUDENTS DO TO SUCCEED IN THIS COURSE? Your activities in this course should include: reading and studying the textbook; attending class and taking notes; rewriting, reviewing, and studying your notes; working the recommended problems in the text; asking and answering questions in class; spending time just thinking about the procedures and their underlying logic; forming a study group with other students to review notes on terminology and concepts, and to practice problem-solving skills; and taking the quizzes. These activities should help you to further develop your abilities to read, listen, record, and organize important information; and to communicate, analyze, compute, and learn independently the subject matter of accounting, as well as to understand how business works. As with most courses, this course is organized with the most fundamental material coming first. In learning a new language, or how to play a musical instrument, or any new set of skills, mastery of the basics is essential to success later on. This subject matter is not like history, where, if you did not study 14th century France, it probably did not affect your ability to learn about 17th century England. In accounting, failure to obtain a good understanding of earlier material will adversely affect your ability to make sense out of what comes later. It is therefore essential to build a solid foundation of fundamental knowledge early in the course in order to support the more elaborate logical and computational structures involved later, 6. WHAT ARE THE PREREQUISITES FOR THE COURSE? The primary (and perhaps the only) prerequisite is a logical mind. This course is computational, but it is not a "math" course. To do well, you must be a good reader, listener, and note-taker; you must be willing to learn many new terms and concepts; you must spend time just thinking about the subject; and you must practice the computational procedures. 7. WILL THE COURSE BE PRIMARILY DISCUSSIONS, LECTURES, OR GROUP WORK? The course is primarily lecture, with frequent questioning by the instructor as a check on student comprehension. A substantial portion of class time is spent working problems from the text. Students are expected to ask appropriate questions whenever necessary. 8. OF WHAT IMPORTANCE IS CLASS PARTICIPATION? In this course, class participation means frequently asking relevant questions and supplying answers (right or wrong) to the instructor's questions as problems and examples are worked out and discussed. These behaviors are evidence of active involvement with the material and will result in better learning and an automatic positive effect on your grade. In grade border-line cases, a history of active participation will enable the instructor to award the higher grade to the deserving student. 9. WILL STUDENTS BE GIVEN ALTERNATIVE WAYS TO ACHIEVE SUCCESS, BASED ON DIFFERENT LEARNING STYLES? Different learning styles do exist. Some prefer a deductive method (deriving specific knowledge from general principles), while others tend to prefer an inductive method (deriving the generalities from examples). The inductive learners may need to work a number of problems before seeing the patterns that are present. The deductive learners may never need to work a problem--they will know instinctively what to do. But the intended outcomes are the same for all--see number 4 above. 10. WHAT IS THE PURPOSE OF THE ASSIGNMENTS? Problems from the text are suggested, for the purpose of providing practice in analyzing what must be done, and in performing the required computations. Even though computer software is available for accounting, students can gain insight into the logical structure of a sequence of computational steps if they go through them several times by hand (i.e. using simple calculators). 11. WHAT WILL THE TESTS TEST? -- MEMORY? UNDERSTANDING? ABILITY TO SYNTHESIZE? TO PRESENT EVIDENCE LOGICALLY? TO APPLY KNOWLEDGE IN A NEW CONTEXT? The tests will test your ability to recognize and use terminology correctly, and they will test your understanding of the logic, principles, and computations of accounting and business. There is a place for memorization in learning. It is not a substitute for comprehension, but it is better than getting something wrong on a quiz that you were expected to know. As with prayers among small children, memorization is often a first step, eventually followed by understanding. But if the memorization (of terminology or the debit/credit rules, for example) is not done, it is less likely that the comprehension will ever occur. 12. WHY HAS THIS PARTICULAR TEXT BEEN CHOSEN? The text used in this course is one of the most widely adopted for introductory accounting. It combines both financial and managerial accounting in one book, which makes it unnecessary to purchase another textbook for Accounting 112. 13. WHAT IS THE RELATIONSHIP BETWEEN KNOWLEDGE LEVEL AND GRADES? Consider this hypothetical but realistic situation. Knowledge Percentage Grade Course A Course B 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 100% 81% 64% 49% 36% 25% 16% 9% 4% 1% Course A might be like philosophy, history, or management, where reward is more-or-less proportional to knowledge level. Course B might be like accounting, math, or other skills courses, where small deficiencies in knowledge can have disastrous effects on results. Overstudying is the best strategy for coping with this, with the dual payoffs of higher grades and, more importantly, greater knowledge.