ECON 311 - Intermediate Macroeconomics (Professor Gordon)

advertisement

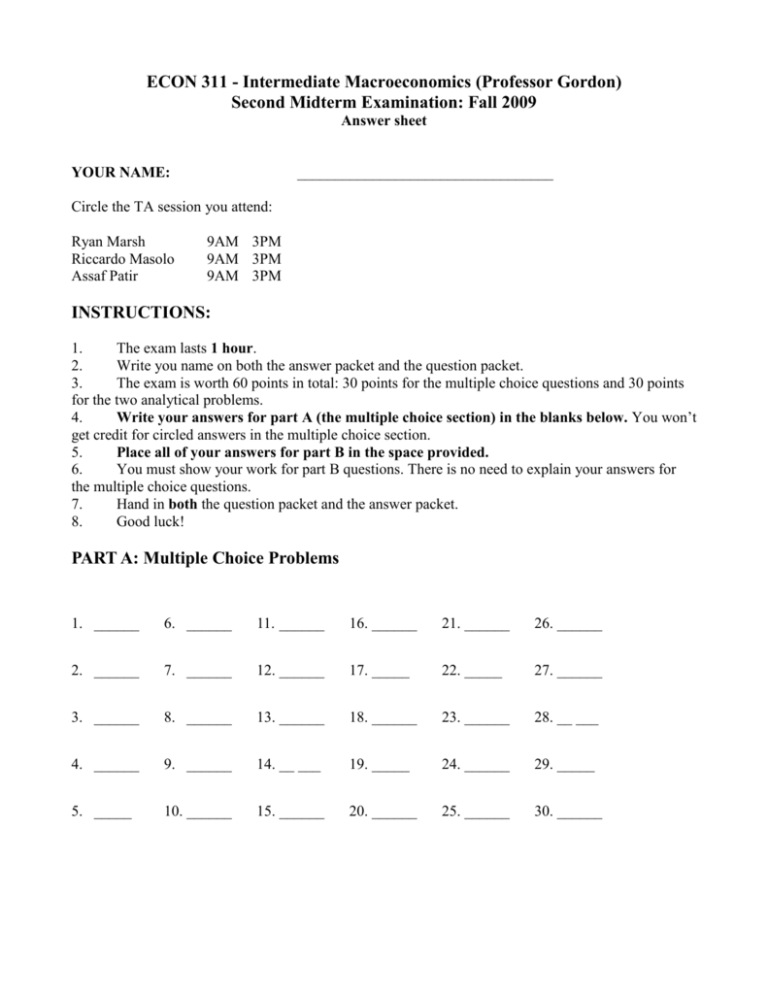

ECON 311 - Intermediate Macroeconomics (Professor Gordon) Second Midterm Examination: Fall 2009 Answer sheet YOUR NAME: __________________________________ Circle the TA session you attend: Ryan Marsh Riccardo Masolo Assaf Patir 9AM 3PM 9AM 3PM 9AM 3PM INSTRUCTIONS: 1. The exam lasts 1 hour. 2. Write you name on both the answer packet and the question packet. 3. The exam is worth 60 points in total: 30 points for the multiple choice questions and 30 points for the two analytical problems. 4. Write your answers for part A (the multiple choice section) in the blanks below. You won’t get credit for circled answers in the multiple choice section. 5. Place all of your answers for part B in the space provided. 6. You must show your work for part B questions. There is no need to explain your answers for the multiple choice questions. 7. Hand in both the question packet and the answer packet. 8. Good luck! PART A: Multiple Choice Problems 1. ______ 6. ______ 11. ______ 16. ______ 21. ______ 26. ______ 2. ______ 7. ______ 12. ______ 17. _____ 22. _____ 27. ______ 3. ______ 8. ______ 13. ______ 18. ______ 23. ______ 28. __ ___ 4. ______ 9. ______ 14. __ ___ 19. _____ 24. ______ 29. _____ 5. _____ 10. ______ 15. ______ 20. ______ 25. ______ 30. ______ PART B: Analytical Problems PROBLEM 1 (15 points) Let the following represent the structure of a small open economy with a flexible exchange rate: C = CA + 0.9(Y-T) CA = 450-5r T = 200+0.1Y (M/P)D = 0.1Y-4r MS/P = 1150 IP = 850-10r G = 1350 NX = 730-0.06Y-100e (a) Initially, assume that the foreign and domestic interest rates are equal, or that r = rf. You will solve for these interest rates in part (b). Also let the foreign exchange rate e equal 2. Find the IS and LM equations in terms of the domestic interest rate r. (4 points) k = 1/[(1-0.9)(1-0.1)+0.1+0.06] = 4 AP = 450-5r-0.9*(200)+850-10r+1350+730-100*(2) = 3000-15r IS: Y=k*AP = 4(3000-15r) = 12000-60r LM: MS/P=(M/P)D => 1150 = 0.1Y-4r => Y = 11500+40r (b) Find equilibrium output and the domestic interest rate. Set the foreign interest rate equal to your answer for the domestic interest rate in this problem (Problem 1, part (b)). The foreign interest rate will remain fixed at this value for the remainder of Problem 1. (2 points) Solve IS and LM simultaneously, 12000-60r = 11500+40r r= rf =5 Y = 11500+40(5) = 11700 (c) Now let the domestic interest rate diverge temporarily from the foreign interest rate. Suppose the Government decreases money supply by 50. Compute the new equilibrium domestic interest rate r and the new (temporary) equilibrium real output Y. (3 points) (HINT: Solve as in part (b) with the original IS equation and the new LM equation) New LM: 1100 = 0.1Y-4r => Y =11000+40r New Temporary Equilibrium is 11000+40r = 12000-60r => r = 10%, Y = 11400 (d) Given the decrease in the real money supply above, compute the level of real output that equalizes domestic and foreign interest rates. (3 points) (HINT: The foreign interest rate is the same as you solved in Part (b). Given that interest rate, use the new LM curve to solve for output, since you don't know what the IS curve is at this point.) In a small open economy, the domestic and foreign exchange rates must be equal. The final true equilibrium interest rate is 5 and output Y = 11000+40(5) = 11200. (e) Find the new foreign exchange rate that equalizes domestic and foreign interest rates. (3 points) ( HINT: Find the new exchange rate that will make the IS curve shift to the left by enough to cross the foreign interest rate at the same output level that you solved for in Part (d).) Since the final true equilibrium (r, Y) equals to (5, 11200), the new IS curve must be as follows: Y=4*Ap’-60r => 11200=4Ap’-300 => Ap’=2875 ∆ Ap = 2875-3000 = -125 = -100 ∆e =>∆e = 1.25 e’= 2+1.25 = 3.25 PROBLEM 2 (15 points): (a) Write down the numerical SP equation using the following information. Be sure to remember that supply shocks enter into this. (2 points) • Expected inflation is given by the relation: pe = 0.68p-1 + 0.32pe-1 • When the (log) output ratio increases by one point, inflation increases by 3 points. p = pe + gŶ + z p = 0.68 p-1 + 0.32 pe-1 + 3 Ŷ + z (b) Write down the DG equation (no need to derive anything, just write it down). (1 points) Ŷ = Ŷ-1 + x̂ - p (c) Find p as a function of p-1, pe-1, Ŷ-1, , and z. Show how you derive your result. (2 point) p = 0.68 p-1 + 0.32 pe-1 + 3 Ŷ + z = 0.68 p-1 + 0.32 pe-1 + 3(Ŷ-1 + x̂ - p) + z 4p = 0.68 p-1 + 0.32 pe-1 + 3 Ŷ-1 + 3 x̂ + z p = 0.17 p-1 + 0.08 pe-1 + 0.75 Ŷ-1 + 0.75 x̂ + z (d) Complete the next two segments using the following information. Use the equations you derived above. In period 0, the economy is in long run equilibrium with x̂ = p-1 = pe-1 = 4 and z0 = 0. The economy experiences a supply shock in period one according to z1 = +2 and the supply returns to zero in period two z2 = 0. 1. Starting from the long run equilibrium described above, suppose the economy is following an extinguishing policy. Complete the following table. (5 points) Period (t) p et-1 pt-1 Ŷt-1 x̂t p et pt Ŷt zt 0 4 4 0 4 4 4 0 0 1 4 4 0 3.33 4 4 -0.67 +2 2 4 4 -0.67 4.67 4 4 0 0 2. Starting from the long run equilibrium described above in period 0, suppose the economy is following an accommodating policy. Complete the following table. (5 points) Period (t) p et-1 pt-1 Ŷt-1 x̂t p et pt Ŷt zt 0 4 4 0 4 4 4 0 0 1 4 4 0 6 4 6 0 +2 2 4 6 0 5.36 5.36 5.36 0 0 YOUR NAME: __________________________________ 1) The growth of nominal GDP (a) can be broken down into the growth of the price level times the growth of real GDP. (b) is equal to the index of prices times the level of real GDP. (c) can be broken down into the growth of money supply plus the growth of velocity. (d) is the same as the growth of aggregate supply. Answer: C 2) The quantity theory of money is based on the quantity equation and what key assumption? (a) wage rates are flexible (b) only cash, currency, and demand deposits are considered money (c) the velocity of money is relatively stable (d) the money supply grows at a steady rate over the long run Answer: C 3) Which of the following will not create an adverse supply shock (a) Appreciation of the dollar (b) Depreciation of the dollar (c) Higher real price of oil (d) Drought in a large farming state Answer: A 4) A single aggregate demand curve records how IS-LM equilibrium output changes as _____________ changes. (a) the IS curve (b) the nominal money supply (c) government expenditure (d) the price level Answer: D 5) Under the assumption of perfect capital mobility, a small open economy (a) can control its interest rate through either fiscal or monetary policy. (b) can control its interest rate only through fiscal policy. (c) can control its interest rate only through monetary policy. (d) cannot control its interest rate through either fiscal or monetary policy. Answer: D 6) As discussed in class, the latest CBO forecast for the Federal budget from 2014 to 2019 projects (a) A steadily declining budget deficit initially exceeding the previous pre-2008 postwar peak percent-of-GDP but reaching balance by 2019. (b) A steadily increasing budget deficit exceeding the previous pre-2008 postwar peak percent-ofGDP by 2019. (c) An unchanging budget deficit remaining above the pre-2008 postwar peak percent-of-GDP through 2019. (d) An unchanging budget deficit maintained below the pre-2008 postwar peak percent-of-GDP through 2019. Answer: C 7) Which of the following is not a criticism of the theory of purchasing power parity? (a) Countries can each have different rates of inflation. (b) Countries can discover new natural resources like oil which is traded internationally. (c) Governments can impose tariffs on imports. (d) The price index of a country includes goods and services not traded internationally. Answer: A 8) The central bank is forced to accommodate fiscal policy under _________ exchange rates, which makes fiscal policy a ________ influence on equilibrium income. (a) fixed, powerful (b) fixed, powerless (c) flexible, powerful (d) flexible, powerless Answer: A 9) The absence of a central bank in the United States from 1836 to 1914 reflected primarily the views of (a) Washington (b) Adams (c) Jefferson (d) Hamilton Answer: C 10) Actual output exceeds the natural output when (a) the actual budget deficit is above the structural deficit. (b) the actual budget deficit is below the structural deficit. (c) the structural deficit is positive. (d) the structural deficit is negative. Answer: B 11) The actual government budget deficit ________ be used to determine the effectiveness of discretionary fiscal policy actions because ________. (a) cannot; it excludes non-discretionary spending changes (b) can; it includes non-discretionary spending changes (c) cannot; it includes non-discretionary spending changes (d) can; it excludes automatic stabilization expenditures Answer: C 12) The governments of individual European countries as described in lecture and in the readings are ____________ about the benefits to them of national fiscal stimulus programs because ____________ (a) enthusiastic; they can spend money faster than the US and fiscal multipliers are high (b) skeptical; their bureaucracies spend money slower than the US and fiscal multipliers are low (c) enthusiastic; even though their bureaucracies spend money slower than the US, fiscal multipliers are high (d) skeptical; even though they can spend money faster than the US, fiscal multipliers are low Answer: 13) In (a) (b) (c) (d) D the 1980s, expansionary fiscal policy is believed to have crowded out domestic investment as interest rates rose. exports and imports as interest rates rose. exports and domestic investment as interest rates rose. domestic investment as interest rates fell. Answer: C 14) The bursting of the asset-price ʺbubbleʺ in countries with fixed exchange rates and unrestricted capital flows caused (a) large capital outflows and a falling exchange rate. (b) large capital outflows and a rising exchange rate. (c) large capital inflows and a falling exchange rate. (d) large capital inflows and a rising exchange rate. Answer: A 15) The appreciation of the dollar in late 2008 and early 2009 reflected __________ and implied __________ (a) assets flocked to the dollar safe haven; decline in US net international indebtedness position. (b) investors saw that the US recession was milder than elsewhere; increase in US net international indebtedness position. (c) assets flocked to the dollar safe haven; increase in US net international indebtedness position. (d) investors saw that the US recession was milder than elsewhere; decline in US net international indebtedness position. Answer: A 16) The three policies which referred to as the ʺtrilemmaʺ) (a) independent control of (b) independent control of (c) fixed exchange rates. (d) free flow of capital. cannot be maintained simultaneously by a nation (sometimes do not include the money supply. fiscal policy. Answer: B 17) According to PPP theory, the yen price of the dollar would rise in a year from 130 to 135 yen if along with a U.S. inflation rate of 6 percent, the Japanese inflation rate is ________ percent. (a) 11.00 (b) 1.00 (c) 23.08 (d) 2.15 (e) 9.85 Answer: E 18) As reviewed on a classroom slide, when the stock market decline starting in 2007 is compared to the two major previous declines starting in 1973 and 2000, the recent percentage decline from the previous decline is _______ than 1973 or 2000 but the duration of the top-to-bottom decline was __________ than 1973 and _______ than 2000. (a) larger; longer; longer (b) smaller; shorter; longer (c) larger; longer; shorter (d) smaller; longer; shorter (e) larger; shorter; shorter Answer: D 19) In the first half of 1989 the inflation rate in the United States exceeded that of Japan yet the dollar appreciated relative to the yen. Which of the following facts would explain the failure of the PPP theory to explain the strength of the $ during this period? (a) the Japanese produced a number of new electronic gadgets much in demand by U.S. consumers (b) the Exxon oil spill (c) the Japanese purchased an increasingly large percentage of U.S. government and corporate securities (d) U.S. citizens participated heavily in the Japanese stock market Answer: C 20) Suppose that the administration proposes to follow a contractionary fiscal policy. This would cause the (a) AD to shift rightward and raise the price level. (b) SAS to shift rightward and lower the price level. (c) AD to shift leftward and lower the price level. (d) SAS to shift leftward and raise the price level. Answer: C 21) We have inflation (a) only when the price of every good is rising. (b) when the prices of most goods are rising. (c) when the prices of most goods are falling. (d) only when the price of every good is falling. Answer: B 22) Which of the following is evidence of too little government regulation in the 1920s; which of the following is evidence of too much government regulation in the 1920s (a) State bank branch laws; Federal reserve control of interest rates. (b) Stock market borrowing requirements; State bank branch laws. (c) Federal reserve control of interest rates; Stock market borrowing requirements (d) State bank branch laws; Stock market borrowing requirements Answer: B 23) Evidence that a horizontal LM curve occurred during the middle depression years would require showing that individuals (a) refused to spend excess money. (b) increased the spending of excess money. (c) sold bonds and bought goods. (d) were indifferent between holding money and bonds. Answer: D 24) Even in the event of a horizontal LM curve, classicists argued that government intervention would not be required if the IS curve shifts in response to changes in (a) the price level (the Pigou effect). (b) the unemployment level (the real balance effect). (c) interest rate (the Keynes effect). (d) exchange rate (the expectations effect). Answer: A 25) Each SP curve is drawn assuming (a) The expected rate of inflation as embodied in wage contracts is ʺfixed.ʺ (b) The expected rate of inflation and prices are rigid. (c) The expected rate of inflation and real wages are rigid. (d) None of the above. Answer: A 26) Which of the following is not a valid criticism of the new deal (a) It encouraged wages and prices to rise. (b) It never ran a full employment deficit. (c) It failed to create employment on government-funded relief programs. (d) It failed to run an actual budget deficit. Answer: C 27) The slope of the SP curve depends on (a) how business changes its markups when output varies. (b) whether the expansionary force in the economy is coming through monetary policy or fiscal policy. (c) the amount worker productivity declines as employment expands. (d) Both A and C. Answer: D 28) If the inflation rate is 10% and nominal GDP growth is 8% then real GDP must have (a) increased by 2%. (b) decreased by 18%. (c) decreased by 2%. (d) increased by 18%. Answer: C 29) Suppose that successive AD/SAS equilibrium points run up a vertical line to the right of the LAS curve. It must be the case that inflation is ________ the average expected inflation figured into the wage contracts in force, which allows output to ________ the natural GDP. (a) (b) (c) (d) (e) greater than, remain below greater than, remain above less than, remain below less than, remain above equal to, be maintained at Answer: B 30) From an initial situation where P=1.00 and Y=100, 6 percent nominal GDP growth that causes P to go to 1.10 also causes Y to go to (a) 116. (b) 104. (c) 96. (d) 94. Answer: C