Balance of Payments Accounts

advertisement

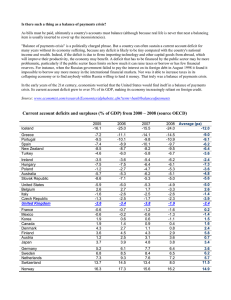

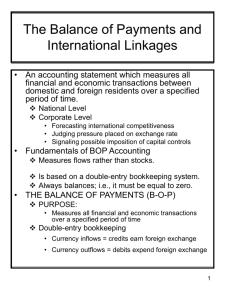

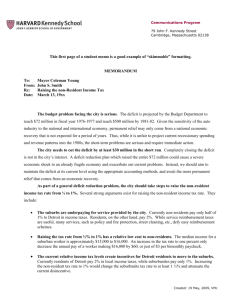

CHAPTER 5 SAVING AND INVESTMENT IN THE OPEN ECONOMY Lecture Outline: I. Balance of Payments Accounting II. Goods Market Equilibrium in an Open Economy III. S and I in a Small Open Economy IV. S and I in Large Open Economies V. Fiscal Policy and Current Account I. Balance of Payments Accounting Balance of Payments Accounts — are the record of a country’s international transaction Current Account — measures a country’s trade in currently produced goods and services, along with net transfers between countries. 2. The Capital Account Capital and Financial Account It records trade in existing assets, either real (direct investment) or financial (portfolio investment). a). Financial Inflow: Canada sells assets to foreign country b). Financial Outflow: Canada buys assets from foreign country 2. The Capital Account Official Reserve Assets It — are assets, other than domestic money or securities, that can used in making international payments Official Settlements Balances ( or the Balance of Payments): — is the net increase (domestic less foreign) in a country’s official reserve assets. 3. The Relationship Between The Current Account and The Capital Account CA KA 0 Why? Every international transaction involves a swap of goods, services or assets between countries. The two sides of the swap has offsetting effects. 4. Net Foreign Assets Net Foreign AssetsI t = Foreign assets – Foreign liabilities Net amount of new foreign assets = a country’s current account surplus II. Goods Market Equilibrium in an Open Economy Equilibrium Condition: S d Assume I C A I ( N X N FP ) d d NFP 0 , S d I NX d Alternative way to express: Y C I G NX d d III. S and I in a Small Open Economy Small Open Economy: — too small to affect the world real interest rate. World Real Interest Rate ( r w ) — the real interest rate that prevails in the international capital market. Assume: financial markets are fully accessible to all savers and borrower. 4. Effects of Economic Shocks At a given r w , any change that desired national saving relative to desired investment will net foreign lending, CA and NX. Examples: (i) A Temporary Adverse Supply Shock (ii) An Increase in M PK f CA IV. S and I in a Large Open Economy Large Open Economy: — large enough to affect the world real interest rate. Two large economies: (i) home economy (ii) foreign economy r will be such that: Desired international lending w = Desired international borrowing IV. S and I in a Large Open Economy Alternative equilibrium condition: lending country’s CA surplus = borrowing country’s CA deficit Any factor that desired international lending relative to desired international borrowing r w V. Fiscal Policy and the Current Account Q: Does government budget deficit cause a CA deficit? A: It could — through the response of national saving. budget deficit S D CA V. Fiscal Policy and the Current Account A deficit caused by G S D G CA A deficit resulting from a tax cut (i) If Ricardian Equivalence holds: no effect on CA D (ii) If consumers C : S D CA