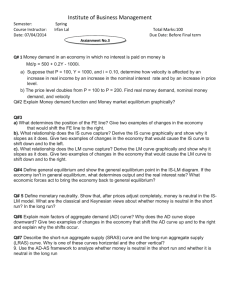

Intermediate Macroeconomics 311 (Professor Gordon)

advertisement

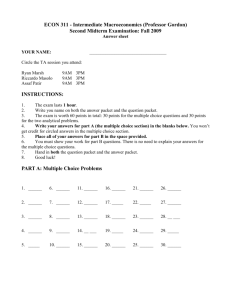

Intermediate Macroeconomics 311 (Professor Gordon) SECOND Mid-Term Examination Fall, 2006 YOUR NAME: Circle the T.A session you are attending: Michel Wednesday Costel Wednesday Michel Thursday Costel Thursday INSTRUCTIONS: 1. The exam lasts 1 hour. 2. The exam is worth 60 points in total: 30 points for the two analytical questions, and 30 points for the multiple choice questions. 3. Write your answers to Part A (the multiple choice section) in the blanks on page 1. You won’t get credit for circled answers in the multiple choice section. 4. Place all of your answers for part B in the spaces provided 5. Show your work for part B questions 6. Good Luck! PART A Choose the ONE alternative that BEST completes the statement or answers the question. Your answers must be in the space provided below. USE CAPITAL LETTERS. 1. ____ 6. ____ 11. ____ 16. ____ 21. ____ 26. ____ 2. ____ 7. ____ 12. ___ 17. ____ 22. ___ 27. _ _ 3. ____ 8. ____ 13. ____ 18. ____ 23. ____ 28. __ _ 4. ____ 9. ____ 14. _ __ 19. ____ 24. ____ 29. ____ 5. ____ 10. ____ 15. ____ 20. ____ 25. ____ 30. __ _ 1 1) The natural employment deficit __________ be used to identify changes in discretionary fiscal policy actions because __________. A) can; it includes non-discretionary spending changes B) cannot; it excludes non-discretionary spending changes C) cannot; it includes non-discretionary spending changes D) can; it excludes automatic stabilization expenditures 2) If inflation is greater in Mexico by 10% than it is in the rest of the world then the purchasing power parity theory predicts that the A) Mexican peso would remain stable. B) Mexican peso would depreciate. C) Mexican peso would appreciate. D) U.S. dollar would weaken. 3) If, other things constant, the actual real wage is below the equilibrium real wage, the short-run aggregate supply curve in the next period would A) be unaffected and the price level would remain constant. B) shift upward and the price level would increase. C) be vertical and the price level would increase. D) shift downward and the price level would fall. 4) Which of the following effects takes place as a result of automatic stabilization? A) leakages increase during a recession, helping to stimulate the economy B) extra tax revenues are generated in a boom C) tax revenues remain constant during a recession D) Both A and C are correct. 5) Suppose that the nominal exchange rate between the dollar and the English pound was 1 pound per $2 and that the English price level was twice that of the U.S., then the real exchange rate is A) 1 pound/$1. B) 2 pounds/$1. C) 1 pound/$4. D) 1 pound/$2. 2 6) Suppose the United States and Canada were the only two countries in the world. There is an excess supply of U.S. dollars on the foreign-exchange market. This implies that A) there is also an excess supply of Canadian dollars. B) the U.S. balance of payments is in surplus. C) the Canadian balance of payments is in deficit. D) the U.S. dollar is overvalued. 7) The SAS curve will be steeper the A) greater is the nominal wage. B) greater is the stock of capital. C) greater is the marginal product of each additional worker. D) the faster the marginal product of labor falls for each additional worker. 8) The "twin deficits" refer to government expenditures being __________ than net tax revenues at the same time as exports __________ imports. A) greater, are below B) less, are below C) greater, exceed D) less, exceed 9) The "trilemma problem" implies that countries that opt for A) flexible exchange rates may experience exchange rates that "overshoot" when there are large capital inflows. B) fixed exchange rates may experience exchange rates that "overshoot" when there are large capital inflows. C) flexible exchange rates lose control of domestic monetary policy. D) fixed exchange rates lose control of domestic monetary policy. 10) In a small open economy, an increase in government spending, while taxes remain the same, will be accompanied by: A) a decrease in private investment and an increase in private saving B) an increase in national savings and a decrease in foreign borrowing C) a decrease in national savings and an increase in foreign borrowing D) an increase in private investment and a decrease in private saving 11) As discussed frequently in lectures, the evolution of the Fed funds interest rate and the 10-year bond rate over the period 2003 has resulted in: A) A one-for-one increase in the 10-year rate to the Fed funds rate between 2003 and 2006 B) A negatively sloped yield curve in 2003 3 C) A negatively sloped yield curve in 2006 D) A positively sloped yield curve in 2006 12) Japan’s decade-long slump resulted from A) B) C) D) E) A belief that monetary policy was impotent because short run interest rates were zero A belief that the debt/GDP ratio was well above 100% A belief that monetary policy could raise the money supply by any needed amount A) and B) B) and C) 13) The relation S + (T - G) = I + NX describing the equilibrium of an economy explicitly demonstrates A) a government budget deficit must reduce private saving if net foreign investment remains unchanged B) as private saving increases net foreign investment must decrease, exports decline. C) as private saving increases the deficit must decline if investment decreases. D) deficit spending by the government reduces either investment and/or net foreign investment. 14) Under a fixed exchange rate system, if the British pound is undervalued, the British monetary authorities must A) buy foreign exchange or gold and sell pounds. B) buy pounds or sell dollars. C) sell pounds or buy dollars. D) devalue their currency. 15) Stagflation (the combination of higher inflation and low or null economic growth) may be explained by A) an upward shift in the SP curve. B) a stagnating level of SAS. C) a downward shift in the SP curve. D) a stagnating level of AD. 16) The long-run Phillips curve is A) dependent on the rate of inflation. B) vertical at the natural level of output C) dependent on price expectations. D) horizontal at the level of expected inflation p(e). 4 17) The exchange rate affects a nation's imports, essentially, because A) it gives the price of domestic goods to foreigners. B) it gives the price of foreign goods to foreigners. C) it is one element of the foreign price of domestic goods. D) it is one element of the domestic price of foreign goods. 18) With flexible exchange rates the fiscal policy multiplier becomes A) smaller because the increase in interest rate raises the exchange rate. B) larger because the increase in interest rate raises the exchange rate. C) larger because exports leak out of the economy. D) smaller because the increase in interest rate lowers the exchange rate. 19) A deliberate change in the government's deficit A) is implemented by the Fed. B) constitutes discretionary fiscal policy. C) leads to automatic stabilization. D) acts as a drag on the economy. 20) If e is the real exchange rate, e is the nominal exchange rate, P is the domestic price level, and Pf is the foreign price level, then A) e Pf /( e * P ) . B) e e * Pf / P . C) e e * P / Pf . D) e e * P / Pf . 21) Suppose we have an initial equilibrium with curves IS0 and LM0. The price level then rises. At every point on LM0 there is now an excess __________ real balances, which is eliminated at each income level by a __________ in the interest rate, meaning that the new LM curve is __________ LM0. A) demand for, fall, below B) supply of, fall, below C) demand for, fall, above D) demand for, rise, above E) supply of, rise, above 22) The US current account deficit includes A) Exports minus imports of goods B) Exports minus imports of goods and services 5 C) B) plus net transfers to foreign nations D) None of the above 23) The Economist’s Big Mac PPP index implies that A) B) C) D) The U. S. has the highest per-capita real standard of living in the world Current exchange rates overstate the standard of living in poor countries Current exchange rates overstate the standard of living in rich countries Beef prices increase at a different rate than nominal wage rates. 24) The classical economists believed that shifts in the AD and SAS curves offset each other such that the A) unemployment level is constant B) price level is constant C) price level rose and output fell unidirectionally given any change in aggregate demand D) price level is cyclical 25) A stronger dollar implies that foreigners will find U.S. exports __________ and U.S. citizens will find imports __________. A) less expensive; more expensive B) more expensive; more expensive C) less expensive; less expensive D) more expensive; less expensive 26) The short-run SAS curve is positively sloped because as A) AD increases, mark-ups are increased, indicating variable mark-up pricing. B) SAS increases, mark-ups are increased, indicating variable mark-up pricing. C) AD increases, raw materials prices set by auction tend to rise. D) (A) and (C) are both correct. 6 27) In the figure below, in going from points A to B the real wage __________, and then from point B to point C (where the exact price level is 1.1025, rounded to 1.10 in the diagram) the real wage __________. A) rose, rose again B) rose, remained constant C) fell, remained constant D) fell, fell again E) remained constant, remained constant 28) A myth of the Great Depression emphasized in our readings was: A) B) C) D) The New Deal stimulated the economy by cutting taxes The New Deal depressed the economy by raising taxes The New Deal failed to make the structural budget deficit larger The New Deal succeeded in making the structural budget deficit smaller 29) The twin peaks of inflation in the 1970s demonstrate that A) Inflation accelerates whenever there is an increase in nominal GDP growth minus natural output growth B) Inflation accelerates whenever there is an increase in nominal GDP growth C) The decade of the 1970s were a time of adverse supply shocks D) The decade of the 1970s were a time of beneficial supply shocks 30) The biggest difference between the environment of monetary policy in the late 1980s and 1990s was A) B) C) D) Saddam Hussein invaded Kuwait in August, 1990 Oil prices went up in the late 1990s and went down in the late 1980s Several beneficial supply shocks held down inflation in the late 1990s Several beneficial supply shocks held down inflation in the late 1980s 7 PART B QUESTION 1 (20 pts) Consider an economy described by the following statements: A 1% increase in the log-output ratio raises inflation by 1%; pe = .5pe-1 + .5p-1, that is the expected rate of inflation this period equals a weighted average between the expected rate of inflation last period and the actual rate last period. (a) Write down the general SP and DG equations and then substitute the relevant parameters for this economy. (2 points) p = pe + g Ŷ + z = = .5pe-1 + .5p-1 + Ŷ + z (DG) Ŷ = Yˆ1 + x̂ - p (SP) (b) Let us assume that at t=0 we start in long-run equilibrium, with p = pe = x̂ = 5 and Ŷ = 0. Initially the supply-shock variable z=0. Also, assume that in the past history before t=0, p = pe = x̂ = 5 and Ŷ =0. Suppose now that there is a beneficial shock that decreases z to a value of -2 for two periods, followed by a return after that to z=0 (that is, at t=1,2: z=-2 and at t=3,4.. : z=0) (1) Assuming a neutral policy, and using the equations derived in part (a), fill in the following table (6 points) Period (t) p-1 0 1 2 5 5 4 Yˆ1 0 0 1 x̂ z p 5 5 5 0 -2 -2 5 4 17/4 Yˆ 0 1 7/4 Recall: a neutral policy implies x̂ =5 for all t. Relevant equations: 1 1 1 p p 1 p e1 (Yˆ1 xˆ ) z 2 2 2 Yˆ = Yˆ1 + x̂ - p 8 (2) Assuming an accommodating policy, and using the equations derived in part (a), fill in the following table (6 points) Period (t) p-1 0 1 2 5 5 3 Yˆ1 0 0 0 x̂ z p 5 3 2 0 -2 -2 5 3 2 Yˆ 0 0 0 Recall: an accommodating police gives Ŷ =0 for all t. Relevant equations are: x̂ = p = 0.5p-1 + 0.5 pe-1 + z pe = 0.5p-1 + 0.5 pe-1 (3) Assuming an extinguishing policy, and using the equations derived in part (a), fill in the following table (6 points) Period (t) p-1 0 1 2 5 5 5 Yˆ1 0 0 2 x̂ z p 5 7 5 0 -2 -2 5 5 5 Yˆ 0 2 2 Recall: an extinguishing policy implies p=5 for all t. The relevant equations are: Yˆ =5/2 - 0.5 pe-1 –z; x̂ = 5 + Yˆ - Yˆ1 9 QUESTION 2 (10 pts) Let the following represent the structure of a large open economy with a fixed exchange rate: C = CA + 0.6(Y-T) CA = 500-5r T = 1000 (M/P)D = 0.2Y-10r MS/P = 1000 IP = 1000-20r G = 1000 NX = 1000-0.1Y-100e (A) Initially let foreign and domestic interest rates be equal so that r = rf and let the foreign exchange rate e=2. Find the IS and LM equations. (2 points) k = 1/[(1-0.6)(1-0)+0+0.1] = 2 AP = 500-5r-0.6(1000)+1000-20r+1000+800 = 2700-25r IS: Y=k*AP = 2(2300-25r) = 5400-50r LM: MS/P=(M/P)D => 1000 = 0.2Y-10r => Y = 5000+50r (B) Find the equilibrium domestic and foreign interest rates and the equilibrium output. (2 points) Solve IS and LM simultaneously r=4 Y = 5200 (C) Suppose the balance of payments (BOP) is zero if Y and r satisfy: r=-101+0.02*Y. Calculate the new level of equilibrium output, the interest rate, and the money supply after an increase of autonomous consumption by 100. (so that now CA = 600-5r) (6 points). (Hint: Use the new IS curve and the BOP equation to determine the new level of output and interest rate. Then determine the money supply that makes the LM curve pass through the new equilibrium) New IS : Y = 5600-50r BOP : r=-101+0.02Y. Solving for r and Y: Y=5325 and r=5.5 New money supply: MS/P=0.2(5325)-10(5.5)=1010 10