Chapter 06. Portfolio theory Chapter 6 Word Document

advertisement

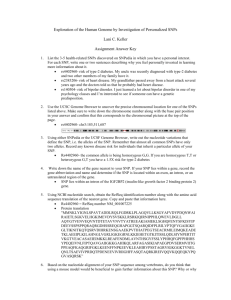

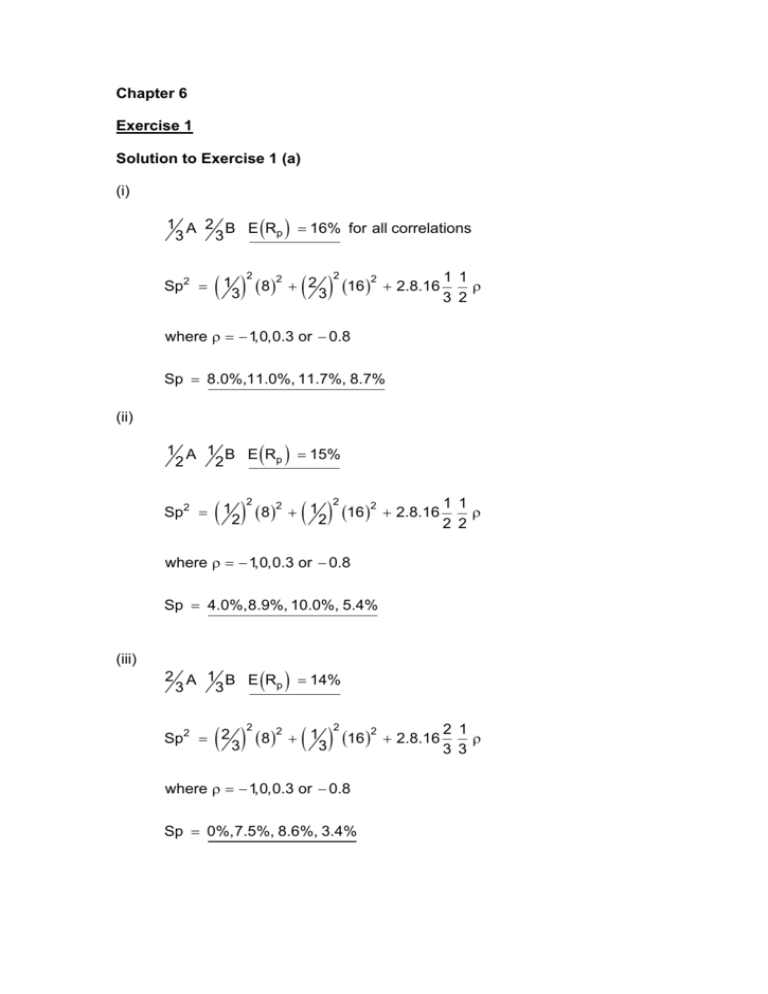

Chapter 6 Exercise 1 Solution to Exercise 1 (a) (i) 1 A 2 B E R 16% for all correlations p 3 3 Sp2 13 2 8 2 3 2 2 16 2 2.8.16 1 1 3 2 where 1,0,0.3 or 0.8 Sp 8.0%,11.0%, 11.7%, 8.7% (ii) 1 A 1 B E R 15% p 2 2 Sp2 12 2 8 2 1 2 2 16 2 2.8.16 1 1 2 2 2.8.16 2 1 3 3 where 1,0,0.3 or 0.8 Sp 4.0%,8.9%, 10.0%, 5.4% (iii) 2 A 1 B E R 14% p 3 3 3 Sp2 2 2 8 2 1 3 2 16 2 where 1,0,0.3 or 0.8 Sp 0%,7.5%, 8.6%, 3.4% Solution to Exercise 1 (a) 20 B 18 C 16 D 14 A E(Rp) 12 10 8 6 4 2 0 4 2 0 10 8 6 12 14 16 Sp (i) The highest expected return will be 100% in B. However the highest expected return given the risk in the diagram is point C, E(RP) = 16%, Sp = 8%. (ii) The minimum risk is point D, E(RP) = 14%, Sp = 0%. Exercise 2 Solution to Exercise 2 (a) (i) Equal X and Y E Rp 12.375% Sp2 12 Sp 7.9% 2 7.8 2 12 11.7 2 2. 2 2 1 .11.7.7.8.0.3 3 3 18 (ii) Equal X and Z E Rp 14.1% Sp2 12 2 7.8 2 12 17.6 2 2. 2 1 1 .7.8.17.6.0.9 2 2 Sp 11.6% (iii) Equal Y and Z E Rp 15.9% Sp2 12 2 Sp 11.0% 11.7 2 13 17.6 2 2. 2 1 1 .11.7.0.7.6.0.10 2 2 Solution to Exercise 2 (b) The standard deviation to the equal YZ portfolio is less than the risk of the XZ portfolio because of the lower correlation. Solution to Exercise 2 (c) Equal X,Y, Z E Rp 1 10.5 14.25 17.60 3 14.1% Sp2 13 7.8 13 11.7 13 17.60 2 1 3 1 2 3 1 2 3 2 2 2 2 2 2 1 . 7.8.11.7.0.3 3 1 .7.8.17.6.0.9 3 1 11.7.17.6.0.1 3 Sp 11.7% The expected return is very slightly higher than for the XZ combination as is the standard deviation of returns. Adding Y does little to improve the risk return tradeoff. Exercise 3 Solution to Exercise 3 (a) E R 12% Sp2 12 Sp 6.0% 2 112 12 23 2 2. 2 1 1 .11.2.3. 1 2 2 Solution to Exercise 3 (b) WSp 1 W SQ 0 Sp 0 11W 1 W 23 0 W 0.67 One third and two third of gives a perfectly hedged portfolio (with an ECR) of 1/3 x 9 + 2/3 x 15 = 13% Solution to Exercise 3 (c) 18 15 Q (23,15) E(Rp) 12 (0,13) P (9,11) (6,12) 9 6 3 0 0 3 6 9 12 15 18 21 24 Sp Solution to Exercise 3 (d) Options and futures can be structured to be negatively correlated with the underlying security. Exercise 4 Solution to Exercise 4 (a) Sp2 13 150 13 150 13 Sp 7.1% 2 2 2 2 2 150 50 27 Solution to Exercise 4 (b) E Rp 15% Sp2 0.4 150 0.4 150 0.2 150 2 2 2 2 Sp 7.3% Solution to Exercise 4 (c) The minimum risk portfolio will have equal proportions in J, K and L. Solution to Exercise 4 (d) Yes, as she would not sacrifice return.