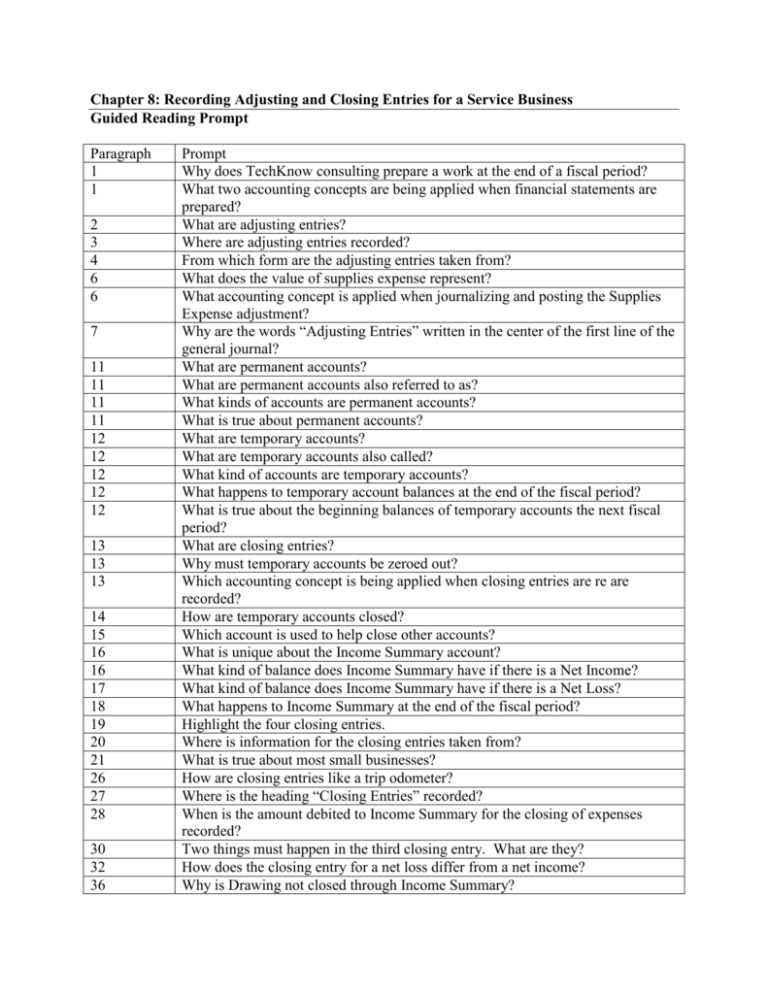

Chapter 8: Recording Adjusting and Closing Entries for a

advertisement

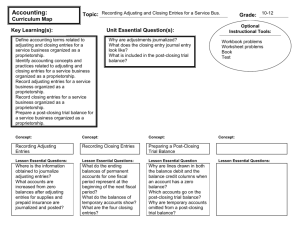

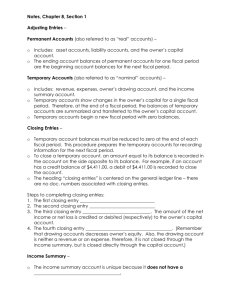

Chapter 8: Recording Adjusting and Closing Entries for a Service Business Guided Reading Prompt Paragraph 1 1 2 3 4 6 6 7 11 11 11 11 12 12 12 12 12 13 13 13 14 15 16 16 17 18 19 20 21 26 27 28 30 32 36 Prompt Why does TechKnow consulting prepare a work at the end of a fiscal period? What two accounting concepts are being applied when financial statements are prepared? What are adjusting entries? Where are adjusting entries recorded? From which form are the adjusting entries taken from? What does the value of supplies expense represent? What accounting concept is applied when journalizing and posting the Supplies Expense adjustment? Why are the words “Adjusting Entries” written in the center of the first line of the general journal? What are permanent accounts? What are permanent accounts also referred to as? What kinds of accounts are permanent accounts? What is true about permanent accounts? What are temporary accounts? What are temporary accounts also called? What kind of accounts are temporary accounts? What happens to temporary account balances at the end of the fiscal period? What is true about the beginning balances of temporary accounts the next fiscal period? What are closing entries? Why must temporary accounts be zeroed out? Which accounting concept is being applied when closing entries are re are recorded? How are temporary accounts closed? Which account is used to help close other accounts? What is unique about the Income Summary account? What kind of balance does Income Summary have if there is a Net Income? What kind of balance does Income Summary have if there is a Net Loss? What happens to Income Summary at the end of the fiscal period? Highlight the four closing entries. Where is information for the closing entries taken from? What is true about most small businesses? How are closing entries like a trip odometer? Where is the heading “Closing Entries” recorded? When is the amount debited to Income Summary for the closing of expenses recorded? Two things must happen in the third closing entry. What are they? How does the closing entry for a net loss differ from a net income? Why is Drawing not closed through Income Summary? 38 40 40 42 43 44 45 47 50 What is the balance of the Capital account compared to after all closing entries are recorded? How can you tell when an account is closed (or has a zero balance)? What does a line in the balance column show? What is a post-closing trial balance? What accounts show up on the post-closing trial balance? When debits and credits equal on the post-closing trial balance, what does this show? Is totals are not equal, what must be done? What is an accounting cycle? Highlight the steps in the Accounting Cycle