Basic Real Estate Appraisal - Lecture Outline for Chapter 12

advertisement

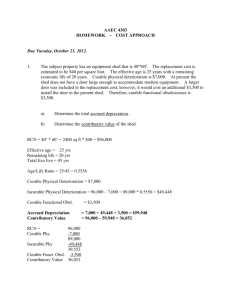

Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 CHAPTER 12 ESTIMATING LOSS IN VALUE: ACCRUED DEPRECIATION STUDENT LEARNING OUTCOMES A lesson in accrued depreciation should cover the following topics: 12.1 12.2 12.3 12.4 Depreciation Defined Types and Causes of Accrued Depreciation Methods of Measuring Accrued Depreciation Cost Approach Summary Class Activities [Instructor: Complete as needed.] Lecture [ ] Discussion [ ] Breakout Groups [ ] Other _____________ [ ] 12.1 DEPRECIATION DEFINED Depreciation is both an accounting term and an appraisal term. Depreciation as Used in Accounting Depreciation assumes a gradual “wasting away” of the value of an asset. In accounting, it is a bookkeeping expense, or an allowable deduction from income in the calculation of income taxes. For real estate, accounting depreciation is allowed only on the improvements. It is usually calculated on the historical acquisition cost, or “cost basis” of the improvements. Example 12.1 Accounting Depreciation Purchase price: Less: Land value Equals: Building cost basis Divided by: Depreciation period Equals: Annual depreciation $275,000 - 65,000 $210,000 ÷ 40 years $ 5,250 Accrued Depreciation in Appraisals Depreciation is deducted from reproduction or replacement cost new on the date of value, rather than historical cost. The amount deducted is the appraiser’s best estimate of the actual loss in market value. 12-1 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 Depreciation is the difference between the cost new of the improvements and their market value, as of the valuation date. This difference is also referred to as diminished utility. Purposes of Depreciation Estimates in Appraisals Cost Approach — To estimate the value contribution of the improvements. 1. Depreciated improvement value is added to the land value. 2. Total property value by the cost approach is the result. 3. The exact amounts deducted for depreciation depend on whether replacement cost estimates or reproduction cost estimates have been used. Example 12.2 Appraisal Depreciation Reproduction cost new: Less: Estimated accrued depreciation (say, 10%) Equals: Reproduction cost less accrued depreciation Plus: Land value Equals: Total indicated value of the property $150,000 - 15,000 $135,000 +170,000 $305,000 Other Approaches — Depreciation estimates assist the appraiser in adjusting for age differences in market and income studies. 12.2 TYPES AND CAUSES OF ACCRUED DEPRECIATION Types of Accrued Depreciation 1. Physical deterioration 2. Functional obsolescence 3. Economic or external obsolescence (also called locational) Each could be either curable or incurable. Curable depreciation means that the cost to fix the problem is equal to or less than the value that would be gained. Physical Deterioration Physical deterioration is the wear and tear that a building suffers from use, age, neglect, and the elements. It can be either curable or incurable. Curable Physical Deterioration This refers to conditions that are economically feasible to correct: the correction would add at least as much to the value as the cost of the repairs. 12-2 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 Incurable Physical Deterioration Incurable physical deterioration describes building conditions that are likely to cost more to repair than the value that is added. There are two types: Short-lived incurable: partially used-up items too good to replace now (for example, air conditioning systems). Also called curable postponed. When ready to replace, the loss in value is considered to be curable. Long-lived incurable: basic structural components. This is value loss attributed to the age of the building’s major components. Gradual aging of the foundation, framework, plumbing, fixtures or electrical wiring, etc. Why incurable? The cost to repair is more than the value that would be added. Functional Obsolescence Functional obsolescence describes a loss of utility that results from some aspect of the improvements. Problems associated with functional obsolescence include: Faulty design or floor plan Misplaced improvement (i.e. out of place) Underimprovement (inadequacy) Overimprovement (superadequacy) Outmoded equipment Functional obsolescence can be curable or incurable. Curable—where the correction cost is less than the benefit in increased market value Incurable—where the cost is greater than the benefit Economic or External Obsolescence Economic (external) obsolescence is loss in value caused by factors located outside the subject property. Examples: Environmental hazards Changes in the highest and best use, or zoning changes Inharmonious nearby land uses Economic or external obsolescence (also referred to as locational or environmental obsolescence) is generally considered to be incurable. Appraisers should take care not to estimate a land value that also reflects economic or external obsolescence, otherwise deducting the same from the improvement cost new would be double-counting. 12-3 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 12.3 METHODS OF MEASURING ACCRUED DEPRECIATION There are four methods of measuring accrued depreciation. Straight-Line or Age-Life Method This method is based upon the theory that all buildings have a useful life expectancy, referred to as the “economic life.” Economic life is usually less than physical life. The annual loss in value is proportional to the total useful life of improvements. Value loss can be based on either actual or effective age. If actual age is used, unwarranted depreciation may result. If effective age is used, care is needed to arrive at a supportable number! [Instructor: In the following, we have revised the text examples to show significantly different results using actual vs. effective age.] 1. Example based on actual age: A 50-year old residence with an economic life of 100 years: Age 50 years Divided by: Economic life ÷ 100 years Equals: Accrued depreciation 50% 2. Example using effective age: A 50-year old building with an effective age of 25 years, and a 100-year economic life: Age, 50 years, but effective age 25 years Divided by: Economic life ÷ 100 years Equals: Accrued depreciation 25% Many published depreciation tables are based on age-life concepts. Limitations of the age-life method: Economic life is at best a judgment as to what the market expects. Explicit adjustments for deferred maintenance or other problems frequently will be needed. Effective age is also quite subjective. Different appraisers rarely reach estimates of effective age that are similar. Despite its limitations, the age-life method is used most often by appraisers because of its simplicity. Sales Data (or Market) Method This method uses market sales to estimate the loss in value. If old buildings are worth less than new buildings, they will sell for less. Follow these steps: 1. Estimate the land value for each improved comparable. 2. Abstract the building value portion of your improved comparable sale price, by subtracting the land value from the selling price. 3. Estimate the cost new for the improvements of each comparable sale as of the sale date. 12-4 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 4. Deduct the abstracted building value from the cost new. 5. The difference is the accrued market depreciation; expressed as a percentage of cost new. 6. To account for age differences, solve for annual depreciation. Example 12.3 Calculating Depreciation by the Sales Data Method Reproduction cost new of improvements Less: Improvement value: Sales price: $240,000 Less: Land value - 80,000 Equals: Improvement value Equals: Accrued depreciation Divided by: Cost new of improvements Equals: Value loss as a decimal Value loss as a percent Divided by: Age of improvements (in years) Equals: Annual percent depreciation $200,000 (-) $160,000 $ 40,000 ÷ $200,000 0.20 20% ÷ 20 1% Cost-to-Cure (or Observed Condition) Method This method measures the accrued depreciation by the cost-to-cure (or repair) any observed building defects. Each defect or condition is first classified as being physical, functional, or economic depreciation. Each also must be classified as economically curable, if the market value loss is greater than the cost to cure, or incurable if the cost to cure is greater. Note that this method is often used to estimate the depreciation for a specific problem. It is rarely used as the sole method to calculate depreciation, due to its complexity. Physical Deterioration All of the building components belong to one of three categories: Items with deferred maintenance (curable or incurable) Short-lived components Long-lived components The steps in calculating the depreciation deduction for physical deterioration are: 1. Estimate the cost new as of the value date for each building component or category to be analyzed. Separate them into the three categories. 2. Estimate and subtract depreciation due to the cost to cure the deferred maintenance. 3. Estimate and subtract the depreciation for the short-lived items. Multiply the cost new of each short-lived item by the percentage of useful life already used up. 4. Deduct the cost new of the deferred maintenance items and the short-lived items from the total cost new. The balance is the cost new for the long-lived components. 5. For each long-lived component, calculate the percentage of useful life already used up. Divide the actual age of the component on the value date by its total estimated life. 12-5 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 6. Multiply the estimated cost new of each component times the percentage of useful life already used up. 7. Total the depreciations for each component, to get the total physical depreciation for the longlived components. Functional Obsolescence [Instructor: This material on functional obsolescence is complex and difficult for many students. We believe that it is helpful to put it in this context: many appraisers never have occasion to need to use any of these methods. Few appraisers use them even once a year. But when the appraiser needs to use them, it is vital to remember that they exist and can be looked up in a textbook.] Five categories of functional obsolescence: 1. Curable functional obsolescence – an addition 2. Curable functional obsolescence – a replacement or substitution 3. Curable functional obsolescence – a super-adequacy 4. Incurable functional obsolescence – a deficiency 5. Incurable functional obsolescence – a super-adequacy [Instructor: We suggest reviewing the text examples for each category and asking class members for additional examples.] Calculating Functional Obsolescence 1. Identify the functional problems. 2. Separate the functional problems into the three categories: Deficiencies (missing components) needed replacements super-adequacies 3. Estimate the market value impact of each problem: the loss in value from deficiencies or needed replacements the increase or loss in value from super-adequacies 4. For deficiencies: estimate the cost new to install the needed component on the date of value estimate the cost new to install the component as if it had been part of the original construction if the market value loss is greater than the cost to install, the problem is curable. The cost to install, less the cost new to install if it was part of the original construction, is the depreciation deduction. if the market value loss is less, the problem is incurable. The market value loss, less the cost new to install if it was part of the original construction, is the deduction 12-6 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 5. For replacements: estimate the cost new on the date of value to replace the deficient component (the “cost to cure”) estimate the cost new on the date of value if the replacement component was part of the original construction calculate the cost new less physical deterioration for the deficient component if the market value loss is greater than the cost to replace, the problem is curable. The depreciation deduction is calculated as the cost to replace the old component, less the cost new to install the new component as if part of the original construction, and plus the deficient component’s cost new less physical deterioration if the market value loss is less, the problem is incurable. The depreciation deduction is the market value loss, less the cost new to install the new component as if part of the original building, and plus the deficient component’s cost less physical deterioration 6. For super-adequacies: can the original component be removed? at what cost? has it any salvage value? if the market value loss is greater than the cost to remove the item (net of salvage value), the problem is curable, otherwise it is incurable. if you are using replacement cost, the deduction for functional obsolescence is the cost to cure if the problem is curable, or the market value loss if it is incurable. if you are using reproduction cost, the calculation is more complex. First, calculate the cost new on the date of value of the existing component. If the obsolescence is curable, deduct from the cost new any physical deterioration previously charged, add back the cost to cure, and deduct the cost new of the replacement component as if it had been installed as a part of the original building. for incurable obsolescence using replacement cost, start with the cost new of the existing component, deduct any physical deterioration previously charged, add the market value loss, and deduct the cost new of the replacement component as if it had been installed as a part of the original building. [Instructor: Again, examples are helpful! My favorite super-adequacy problem was an 800 square foot 2 bedroom 1920s home in average condition, with no particular remodeling except a three-year-old $5,000 commercial stove!] Capitalized Income (or Rental Loss) Method This method applies when the value of a property can be related to the income it produces. Loss in value can be estimated either: a. In total, that is from all causes, or b. In part, from a single cause. 12-7 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 The total loss can be estimated using the gross income multiplier method of income capitalization. Example 12.7 The Capitalized Income Method Using the GIM Assume a 200 monthly multiplier. Monthly rental of new competitive property Less: Monthly rental of subject property Equals: Rental loss amount Multiplied by: Gross rent multiplier Equals: Accrued depreciation $ 1,450 -1,150 $300 x 200 $60,000 The total loss in value can also be estimated using net income capitalization: a. Estimate the building value of the subject property by capitalizing the income that can be attributed to the improvements. b. Subtract the estimated building value from the cost new. c. The result is the estimated loss in value. [Instructor: The capitalized income method is covered in detail in Chapters 13 and 14.] Estimating the loss in value from a single cause (whether physical, functional, or external depreciation): a. Estimate the rental loss that results from the defect or cause. b. Capitalize the rental loss, using either a gross income multiplier or a net income capitalization technique. Loss in Value from a Single Cause A poor floor plan causes a loss of rent of $150 per month. A gross income multiplier of 200 is derived from study of market sales. The depreciation deduction is calculated as: $150 x 200 = $30,000 12-8 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 12.4 COST APPROACH SUMMARY A cost approach summary example is given below, from your text. Example 12.8 Cost Approach Summary A. Reproduction cost of improvements: Living area: 1,800 sq. ft. x $75 Covered patio: 200 sq. ft. x $25 Garage: 400 sq. ft. x $30 Yard improvements: Total reproduction cost as if new = = = $135,000 5,000 12,000 + 5,000 $157,000 B. Less: Accrued depreciation: Physical deterioration: curable incurable Functional obsolescence: curable (old-style kitchen) incurable (poor floor plan) Economic obsolescence: (adjacent to commercial) Total accrued depreciation $10,000 5,000 6,000 5,000 10,000 – $36,000 C. Equals: Depreciated cost of improvements $121,000 D. Plus: Estimated land value from sales comparables + 70,000 E. Equals: Total property value indicated by cost approach $191,000 SUMMARY [Instructor: The list of important terms may assist in the summary.] Important Terms and Concepts Accrued depreciation Age-life method Book value Capitalized income method Cost basis Cost-to-cure method Curable depreciation Curable postponed Current value accounting Deferred maintenance Depreciation in: Loss of utility accounting Misplaced improvement obsolescence appraisal Physical deterioration Over-improvement Diminished utility Physical deterioration Economic life Rent loss method Economic or external Sales data method obsolescence Straight-line method Effective age Superadequacy Functional obsolescence Under-improvement Locational obsolescence 12-9 Instructor’s Manual: Basic Real Estate Appraisal, 8th. Edition Chapter 12 REVIEWING YOUR UNDERSTANDING [Instructor: See end of your text chapter for these review questions.] STUDENT EXERCISES [Instructor: Suggested Multiple Choice and True/False questions are available to use for Chapter 12.] 12-10