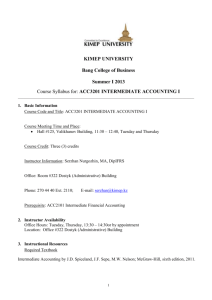

Course outline:

advertisement

International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 Course outline: INTERNATIONAL ISSUES IN FINANCIAL REPORTING AND VALUATIONS For: KIMEP INTERNATIONAL SUMMER SCHOOL, Kazakhstan, 2011 Instructor: Dr Ashish Varma Ph.D Fellow Institute of Cost and Works Accountants of India ( Set up by an Act of Indian Parliament, ) MBA ( Finance) Assistant Professor ( Accounting and Finance) IMT, Ghaziabad India. Email: avarma@imt.edu, sir_ashish@rediffmail.com Dr Ashish Varma / IMT / KIMEP / 2011 Page 1 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 (1) LEARNING OBJECTIVES: The course is designed to enrich the participant’s understanding of contemporary issues in Financial Reporting and Firm Valuation. The course is an interesting amalgam of practices and choices which a manager needs to appreciate and address in both strategic and tactical context. The course also brings to the fore the challenges and concerns which are relevant in this day and age for multinational managers engaged in financial reporting and business valuation. The course will also address contemporary developments in the field of accounting and valuations and discuss the perspective in which regulations are made. Certain aspects of Internal audit and internal controls, the convergence to IFRS, technological developments will also be discussed. At the end of the course the student should be able to address the following agenda: 1. Conceptualize the role of accrual based accounting data in determining firms value. 2. Appreciate good and bad accounting and valuation practices, undo any accounting distortions by recasting a firms accounting numbers and improve the reliability of conclusions. 3. Appreciate accounting as a system for measuring and forecasting value addition. 4. Synthesize accounting and valuations. 5. Distinguish between conservative and liberal accounting. Dr Ashish Varma / IMT / KIMEP / 2011 Page 2 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 The course should be interest to ( inter alia ) those contemplating a career in Business Analysis, banking, consulting, public accounting and corporate finance. PREREQUISITES: A basic understanding of Financial Reporting is needed to make the most of this course. The prior understanding of GAAP will ensure that a deeper understanding of industry practices in the international perspective can be build during this course. PEDAGOGY The course will be delivered with an amalgam of Lectures, Presentations, Cases discussions . The latest academic research will be integrated with the industry approaches. Role play will be conducted in a case study discussion to let the participant have a feel of the situational concerns which multinational managers face. The participants are especially encouraged to share their views on latest industry happenings. This will also be facilitated by working on the assignments given by the instructor at the end of the lecture. The cases will be pre distributed and the students are expected to go through the readings and be adequately prepared for the case assigned for the day. At the conclusion of the discussion of each case the participants are expected to write a 1 page summary of the entire discussion which needs to be submitted to the instructor. Dr Ashish Varma / IMT / KIMEP / 2011 Page 3 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 (2) COURSE CONTENT Session 1 to 9: (Each session of 1 hr duration) The international architecture of corporate reporting framework and the available GAAP choices , Experience of the Emerging Markets Fair Value in times of volatility : Relevance and challenges IFRS Convergence in India: Are we ready ? IFRS in China; IFRS in Canada Revenue recognition : US GAAP and IFRS , A comparison: BIOVAIL Revenue Recognition and FOB Sales Accounting Comparison between US GAAP and IFRS : An analysts perspective for Financial Statement Analysis and Firm Valuation Investors reaction to management’s earnings guidance : KRISPY KREME Do annual reports communicate corporate strategy ? The Indian Experience. CASELET FOR DISCUSSION: INFOSYS TECHOLOGIES, INDIA. Dr Ashish Varma / IMT / KIMEP / 2011 Page 4 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 CASE STUDY : Harnishfeger Inc. GE 2000: Quality of Earnings Assessment Kim Park (Assets and Liabilities ) ASSIGNMENT: Undertake a detailed library / internet search for the current financial reporting concerns and challenges faced by an industry of your choice with reference to a specific company. Then the participants are required to study its equity share valuation for the past few quarters and enlist peculiar trends ( if any) and link it to the financial performance during the period. Also the participant will submit a 3 page report to the instructor in session 9. My expectation from the write up is that it is well written, logically argued and supported by numbers. SUGGESTED READINGS: 1. Bloomenthal Harold S, “ Sarbanes Oxley Act in Perspective” ( St Paul, MN : West Group ) 2002 2. Bertoni M , Derosa B ( 2005) “ Comprehensive Income , Fair Value, and Conservatism: A conceptual framework for reporting financial performance” Paper presented to 5th International conference on European Integration, Competition and Cooperation, Lovran , April 22-23, 2005. 3. Ackerlof G (1970) The market for Lemons : Quality Uncertainty and the market mechanism. The Quarterly journal of Economics 84 , pp 488 -500. Dr Ashish Varma / IMT / KIMEP / 2011 Page 5 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 Session 10 to 20 (Each session of 1 hr duration): The organization and structure of audit market : The future direction ? Introduction to Inter corporate investment practices, Related Party Transactions, International taxation and Transfer Pricing issues : An Auditor’s challenge. Revisiting the ‘Going concern’ principle in times of financial turmoil. XBRL : Extensible Business Reporting Language; The imperatives for managers Sarbanes Oxley Act and its Indian equivalent of Clause 49 of the listing agreement: How successful are the regulations ? CASE: Jimmy Fu and Moog Inc. Silic: Cost or Fair Value on Adoption of IFRS Sipef : Biological Assets at Fair Value under IAS 41 Trans global ASSIGNMENT: Probe into the alleged or admitted accounting issues with the following companies and submit a brief note on the same: Bristol Myers, Computer Associates, Enron Worldcom Tyco and Vivendi. Dr Ashish Varma / IMT / KIMEP / 2011 Page 6 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 READINGS: 1. World Growth Grinds to a Virtual Halt, IMF Urges decisive global policy response, “ IMF Survey Online, January 28, 2009. 2. Vasal V K (2003) “ Internet XBRL and Online Business Reporting’, Chartered Accountant , Jun 1215- 1226. 3. Hemmer T and Labro E ( 2008) “On the optimal relation between properties of managerial and financial reporting systems” Journal of Accounting Research 46 (5) pp 1209 -1240 Session 21 to 29(Each session of 1 hr duration) Earning quality : Audit committee and Earnings quality, Models for measuring earnings quality and their shortcomings; Article Businessline Forecasting of earnings , Anchoring the value on earnings, Prototype valuation Disclosures in Annual reports: Content analysis of annual reports Disclosure quality : The impact of Foreign investment, Promoters Holding on the quality of disclosures. Detecting accounting manipulation and transaction manipulation Introduction to Valuation techniques and practices. CASE: SATYAM FIASCO , INDIA CITI Group 2007: Financial Reporting and Regulatory Capital Molex Dr Ashish Varma / IMT / KIMEP / 2011 Page 7 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 ASSIGNMENT: Re Work Satyam’s numbers on a spread sheet and do a detailed index, trend and vertical analysis for the restated numbers? Did the markets miss out on anything? Email the spread sheets to the instructor with your name clearly mentioned in the subject line. Read General Electrics (GE) opinion on the same. code of conduct and give your READINGS: Shafer W “ Effect of Materiality , Risk and Ethical perceptions on Fradulent Reporting by Financial Executives , Journal of Business Ethics 38, 3 ( 2002) : 243 – 263. Stephen H Penman, “ Financial Statement Analysis and Security Valuation”, Mc Graw Hill International Edition., Chapter 1 to 5. Timmons H and B Wassener (2009) “ Satyam chief admits huge fraud” New York Times , Jan 7, 2009. Session 30 to 39 (Each session of 1 hr duration) Valuation: A critique of DCF methodology, The comparable company method and its relevance. Quality of Corporate governance : Evidence from around the world For Innate and discretionary accrual quality and corporate governance Behavioural Issues in Accounting : Managerial choices Dr Ashish Varma / IMT / KIMEP / 2011 Page 8 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 Pension plan crisis in USA Off balance sheet financing , Reading the fine print for decision making. CASE: LEASING IN THE AIRLINE INDUSTRY Hurry Date: Valuation ASSIGNMENT: Read the Auditing complexities clearly understanding the role of an auditor in protection of minority interest, creation of stake holder value and business sustainability. OR The auditor oversight bodies : France – Compagnie Nationale des Commissaires aux Comptes, Germany – Institute der Wirtschaftsprüfer, Japan – Japanese Institute of Certified Public Accountants, Netherlands – Netherlands Institute of Register accountants, United Kingdom – Accountancy Foundation (2000), United States – Public Company Accounting Oversight Board (2002). Visit their websites and develop an understanding of their recommendations. ( Any two) Dr Ashish Varma / IMT / KIMEP / 2011 Page 9 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 READING: 1. Wild, Subramanyam, Halsey, “ Financial Statement Analysis” 8 e, Mc Graw Hill, International Edition. 2. Bhide, A and H H Stevenson , “ Why be honest if Honesty Doesn’t Pay” Harvard Business Review, ( September – October 1990), pp 121- 129. Session 40 to 45 (Each session of 1 hr duration) : VALUATIONS: Challenges in Valuation of Multi business Valuation Valuing cyclical companies Valuing foreign subsidiaries Valuation outside the united states Valuation in emerging market Using option pricing methods to value flexibility. Valuing banks Valuing Dot.coms Valuing insurance companies Key lessons from the financial crisis and stock market bubbles Corporate sustainability performance issues and ensuring sustainable earnings: What happened to BP in 2010 and the impact on DJSI. CEO envy and Merger waves: The truth! Dr Ashish Varma / IMT / KIMEP / 2011 Page 10 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 CASE STUDY: TATA CORUS DEAL MITTAL STEEL ASSIGNMENT: Write a brief note on the developments in IFRS IAS 18: DP Revenue Recognition IAS 27: ED Consolidated Financial Statements IAS 31: ED Joint Arrangements IAS 32, IAS 39, IFRS 7: Financial Instruments READINGS; 1.Richard J (2004) “ The secret past of Fair Value: Lessons from history applied to the French Case” Accounting in Europe , Vol 1, No.1, pp 95107. 2.Blumenstein R and Pulliam S , “ Worldcom Report finds Ebbers played a role in inflating revenue “ Wall Street Journal, June 6 , 2003. (3) EVALUATION PARAMETERS Class Assignment: 20% Case summary : 20% Final Exam: 60% Dr Ashish Varma / IMT / KIMEP / 2011 Page 11 International issues in Financial Reporting and Valuations / Dr Ashish / IMT/ KIMEP / 2011 (4) SUGGESTED READINGS 1. Wild, Subramanyam, Halsey “ Financial Statement Analysis” 8e , Mc Graw Hill International Edition 2003. 2. Epstein Barry J, Jermakowicz Eva K, “IFRS”, Wiley 2010-11, 3. Sidney Cottle , Roger F Murray and Frank E Block , Graham and Dodd’s Security Analysis , Reprinted Mc Graw Hill. 4. Alex Berenson “ The Number” New York, Random House, 2003. 5. Howard Schlitz “ Financial Shenanigans” 2 e, Mc Graw Hill, 2003 6. Choices , Values and Frames by Kahnerman and Twersky , Cambridge 2000. 7. Infosys, Annual Report 2009 8. The Financial Accounting Standards Board’s (FASB) statement of Financial Accounting Standards No. 142, “Goodwill and Other Intangible Assets”. Dr Ashish Varma / IMT / KIMEP / 2011 Page 12