Group Work Solutions

advertisement

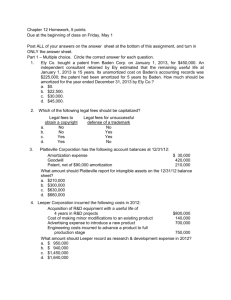

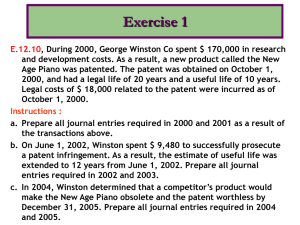

Chapter 12 Group Work 1. River Inc. has offered to purchase Ponds Unlimited for a price of $580,000. The Balance Sheet of Ponds Unlimited at the time of the purchase is as follows: Cash Receivables Inventory Equipment Copyright Total Assets Accts Payable 48,000 84,000 220,000 90,000 16,000 458,000 66,000 The account balances on the Balance Sheet approximate Fair Market Values except for Inventory [which has a FMV $315,000] and the Copyright [which has a FMV $35,000]. Prepare the journal entry that River Inc. would record at the time of the purchase. DR Cash 48,000 Accounts Receivable 84,000 Inventory 315,000 Equipment 90,000 Copyright 35,000 Goodwill 74,000 Accounts Payable Cash CR 66,000 580,000 2. Assume River Inc. offered to purchase Ponds Unlimited for a price of $450,000. How would you record what appears to be “Negative Goodwill”? Prepare the journal entry for River Inc. DR Cash 48,000 Accounts Receivable 84,000 Inventory 315,000 Equipment 90,000 Copyright 35,000 Accounts Payable Cash Gain on Purchase CR 66,000 450,000 56,000 3. The following information is available for Carter Company’s Patent: Cost Carrying Amount Expected Future Net Cash Flows Fair Value $850,000 $520,000 $490,000 $375,000 Prepare a journal entry to record the Impairment Loss for the value of Carter Company’s Patent. Loss on Impairment Patent 145,000 145,000 4. On October 1, 2014, Braxton Co. purchased a Patent for $90,000. Additional legal costs incurred to obtain the patent were $33,750. The Patent has a remaining legal life of 19 years, but the company expects a useful life of 15 years. What amount of amortization expense would Braxton Co. recognize for the year 2014 on the Patent asset? [Round answer to nearest dollar – ex) $42.51 = $43] ($90,000 + $33,750) = $8,250 * 3/12 = $2,063 15 Amortization Expense $2,063 Accumulated Amortization $2,063 5. Match Box Inc. purchased a patent on January 1, 2010 for $170,000. The patent had a remaining useful life of 8 years at that date. In January of 2014, Match Box Inc successfully defended its patent in court at a cost of $65,000, extending the patent’s life to 16 years. a. What would be the amount of amortization expense Match Box Inc would record in 2014? b. Prepare the journal entry to record 2014 amortization on the Patent. $170,000 = $21,250 * 4 yrs = $85,000 8 yrs ($170,000 - $85,000 + $65,000) = $12,500 Amortization Exp.for 2010 and each yr beyond 12 yrs Amortization Expense $12,500 Accumulated Amortization $12,500 6. During 2012, Coleman Company acquired Monet Company for $950,000, of which $110,000 was allocated to Goodwill. At the end of 2014, Coleman company tested for the possible impairment of Goodwill and provided the following information: Fair Value of Monte Fair Value of Monte’s net Assets [excluding Goodwill] Book Value of Net Assets [including Goodwill] $840,000 $790,000 $885,000 What, if any, is the impairment loss suffered on the value of Goodwill for Coleman Co.’s newly acquired business? FV - $840,000 is less than BV - $885,000 -- So there is an impairment loss. FV of Monte [with Goodwill] Less: FV of Monet [without Goodwill] Equals: Implied Value of Goodwill $840,000 ($790,000) $50,000 Carrying Value of Goodwill Less: Implied Value of Goodwill Equals: Goodwill Impairment Loss $110,000 ($ 50,000) 60,000 DR Loss on impairment of Goodwill Goodwill CR 60,000 60,000