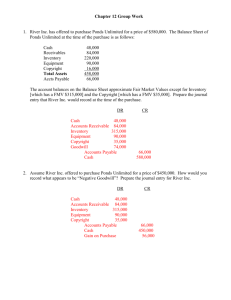

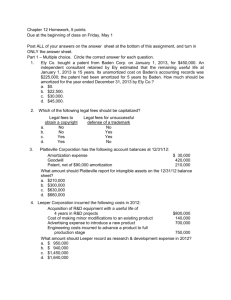

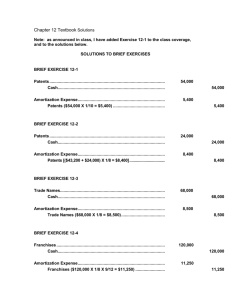

Exercise 1

advertisement

Exercise 1 E.12.10, During 2000, George Winston Co spent $ 170,000 in research and development costs. As a result, a new product called the New Age Piano was patented. The patent was obtained on October 1, 2000, and had a legal life of 20 years and a useful life of 10 years. Legal costs of $ 18,000 related to the patent were incurred as of October 1, 2000. Instructions : a. Prepare all journal entries required in 2000 and 2001 as a result of the transactions above. b. On June 1, 2002, Winston spent $ 9,480 to successfully prosecute a patent infringement. As a result, the estimate of useful life was extended to 12 years from June 1, 2002. Prepare all journal entries required in 2002 and 2003. c. In 2004, Winston determined that a competitor’s product would make the New Age Piano obsolete and the patent worthless by December 31, 2005. Prepare all journal entries required in 2004 and 2005. Answer of Exercise 1 a. Year 2000 Research and Development Expense 170,000 Cash 170,000 Patents 18,000 Cash 18,000 Patent Amortization Expense 450 Patents [($ 18,000 10) X 3/12] 450 Year 2001 Patent Amortization Expense 1,800 Patents ($ 18,000 10) 1,800 Answer of Exercise 1 b. Year 2002 Patents 9,480 Cash 9,480 Patent Amortization Expense Patents 1,940 1,940 Jan 1 – June 1, ($ 18,000 : 10) X 5/12 = $ 750) June 1 – Dec 31, ($ 18,000 - $ 450 - $ 1,800 - $ 750 + $ 9,480 = $ 24,480) ($ 24,480 : 12) x 7/12 = $ 1,190 Year 2003 Patent Amortization Expense Patents ($ 24,480 12) 2,040 2,040 Answer of Exercise 1 c. Year 2004 and 2005 Patent Amortization Expense Patents ($ 21,250 : 2 = $ 10,625) ($ 24,480 - $ 1,190 - $ 2,040 = $ 21,250) 10,625 10,625 Exercise 2 E.12.14, Presented below is information related to copy rights owned by Walter de La More Co at December 31, 2004 Cost $ 8,600,000 Carrying amount $ 4,300,000 Expected future net cash flow $ 4,000,000 Fair value $ 3,200,000 Assume that Walter de La More will continue to use this copyright in the future. As of December 31, 2004, the copyright is estimated to have remaining useful life of 10 years. Instructions : a. Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2004. The company does not use accumulated amortization account. b. Prepare the journal entry to record amortization expense for 2005 related to the copyrights. c. The fair value of the copyright at December 31, 2005 is $ 3,400,000. Prepare the journal entry (if any) necessary to record the increase in fair value. Answer of Exercise 2 (a) December 31, 2004 Loss on Impairment Copyrights 1,100,000 1,100,000 Carrying amount $ 4,300,000 Fair value $ 3,200,000 Loss on impairment $ 1,100,000 (b) Copyright Amortization Expense Copyrights New carrying amount Useful life Amortization per year $ 3,200,000 10 years $ 320,000 (c) Tidak dibutuhkan jurnal. 320,000 320,000 Exercise 3 P.12-5, On July 31, 2003, Postera Company paid $ 3,000,000 to acquire all of the common stock of Mendota Incorporated, which became a division of Postera. Mendota reported the following balance sheet at the time of the acquisition. Current assets Non current assets Total assets $ 800,000 Current liabilities $ 600,000 2,700,000 Long term liabilities 500,000 $ 3,500,000 Stockholders equity 2,400,000 Total liabilities & Equity $ 3,500,000 It was determined at the date of the purchase that the fair value of the identifiable net assets of Mendota was $ 2,650,000. Over the next 6 months of the operations, the newly purchased division experienced operating loss. In addition, it now appears that it will generate substantial losses for the foreseeable future. At December 31, 2003, Mendota reports the following balance sheet information : Current assets Non current assets (including goodwill) Current liabilities Long term liabilities Net assets $ $ $ $ $ 450,000 2,400,000 (700,000) (500,000) 1,650,000 Exercise 3 (P.12-5, continued), It determined that the fair value of the Mondeta Division is $ 1,850,000. The recorded amount for Mendota’s net assets (excluding goodwill) is the same as fair value, except for property, plant and equipment, which has a fair value $ 150,000 above the carrying value. Instructions : a. Compute the amount of goodwill recognized, if any, on July 31, 2003. b. Determine the impairment loss, if any, to be recorded on December 31, 2003. c. Assume that fair value of the Mendota Division is $ 1,500,000 instead of $ 1,850,000. Determine the impairment loss, if any, to be recorded on December 31, 2003. d. Prepare the journal entry to record the impairment loss, if any, and indicate where the loss would be reported in the income statement Answer of Exercise 3 (a) Goodwill = Fair value of the division less the fair value of the identifiable assets: $ 3,000,000 – $ 2,650,000 = $ 350,000 (b) No impairment loss is recorded, because the fair value of Mendota ($ 1,850,000) is greater than carrying value of the net assets ($ 1,650,000). (c) Computation of impairment: Implied Fair value of goodwill = Fair value of division less the carrying value of the division (adjusted for fair value changes), net of goodwill: Fair value of Mendota division $ 1,500,000 Carrying value of division $ 1,650,000 Increase in fair value of PP&E 150,000 Less Goodwill (350,000) Patents ($ 74,000 + $ 12,650) (1,450,000) Implied fair value of Goodwill 50,000 Carrying value of Goodwill (350,000) Impairment loss ($ 300,000) (d) Loss on Impairment Goodwill 300,000 300,000 This loss will be reported in income as a separate line item before the subtotal “income from continuing operations.”