advertising in ecommerce

advertisement

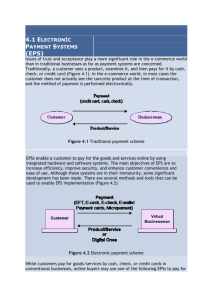

ADVERTISING IN ECOMMERCE By Prof Harman Mangat OBJECTIVES OF THE STUDY To understand the advertising methods. To realize and practically try find out how to make more profits through the advertising on Ecommerce. How are newspaper advertisements similar to ECommerce advertisements. What is an EPS, and the working of the EPS. ADVERTISING METHODS Banners 1)Keyword banners 2)Random banners 3)Static banners 4)Pop-up banners BENEFITS & LIMITATIONS OF BANNERS Users are directly transferred to the site Customization for individual suffers Viewing of banner is fairly high Disadvantages Cost Limited amount of information Click through rate is declining BENEFITS & LIMITATIONS OF BANNERS Banner swapping Banner exchanges Pop up ads Interstitials-a type of pop up ad, is a page or box that appears after user clicks a link. If one doesn't want these ads ,then these can be blocked by using special soft wares NEWSPAPER-LIKE STANDARD ADS Classified ads Search engine adv. Advertising in chat rooms Advertising in newsletter-eg.Ec times ADVERTISING STRATEGIES Associated ad display Posting press release online Google targeting Ads as a commodity Viral marketing Customized ads Online events, promotions, attractions ADMEDIATION People who specialize in promotions and develop a model that shows the role of third party vendors which they call ADMEDIARIES SELLING AND TRADING ONLINE ADVERTISING SPACE E-advertising is another type of direct marketing which makes use of e-mail as a mode of communicating fund raising or commercial messages to the customers. Every e-mail that is received by a potential client can be regarded as e-advertising. E-MAIL ADVERTISING Benefits Low cost Wide variety of audiences can be targeted Interactive Disadvantages Spamming blockers DIRECT ADVERTISING OPTIONS 1.Creating banner and text link advertisements 2.Creating a mini network for collective advertising 3.Offering content sponsorship opportunities 4.Creating a donation page to attract link hungry sponsors 5.Selling paid reviews on your blog 6.Using feed based direct advertising 7.Experimenting with pixel/ favicon style ads. 8.Selling contextual text links for existing content 9.Looking for interactive internet broadcast sponsors 10.Selling ads in e-mail newsletter SELLING OF SOFTWARE OF OTHER DOWNLOADABLE GOODS Product cart ,a robust shopping cart program developed by early impact, inc. is a typical Eg. of this. the shopping cart has following features: 1.Selling digital products effectively 2.Using a hidden download link 3.Using an expired download link 4.Requiring serial number or license delivery CHARGING VISITORS FOR ACCESS TO YOUR WEBSITE Any transfer of funds initiated through a telephone instrument ,electronic terminal or magnetic tape or computer so as to authorize order, or instruct a financial institution to credit or debit an account is known as electronic payment system or EPS. MAIN CATEGORIES OF EPS: 1.Banking and financial payments -large scale or whole payment -small scale or retail payment -home banking 2.Retail payments -credit cards -private label credit/debit cards -charge cards ONLINE E-BUSINESS PAYMENTS This category is divided further in 2 parts -electronic token based system 1.Electronic cash 2.Electronic cheques 3.Smart cards or debit cards-credit card based payment systems Encrypted credit cards Third party authorization no. TOKEN BASED EPS Earlier token as a form of monetary instrument was available. now, e-token in the form of electronic cash/cheque has been developed. it is recognized as equivalent to cash and is backed by banks. Types of e-token:3 types Cash or real time. Debit or prepaid. Credit or post paid. ELECTRONIC CASH E-cash is a form of electronic payment system based on encryption. this means it is a secure payment system. before a product is bought or services availed cash has to be obtained from a currency server. the safety of e-cash is scrutinized by digital signatures: Buying of e-cash from an online currency saver involves 2 steps: - Establishing an account - Keeping an adequate amount of money in the bank to back the purchases - In e-cash ,transactions take place in 3 steps. the are: GETTING E-CASH (i) The consumer requests his/her bank to transfer money to the currency server to get e-cash. (ii) The consumer bank transfers money from the consumers account to the currency server. (iii) The e-mint sends e-cash to the consumer. the consumer recieves his /her cash. PURCHASING WITH E-CASH 1. 2. 3. The consumers select the goods & transfer the e-cash to the merchant The product is made available to the customers by the merchant. Redeeming cash by the merchant The merchant may send the e-cash to its bank and the bank in turn redeems the money from the currency saver CURRENCY SERVER The currency server is a special term used in EPS. the customer and merchant can exchange the different currencies depending upon the machine used. currency server can be a type of ATM machine. Advantages of e-cash -Best suited for small transactions -Authentication is not an issue. ELECTRONIC CHEQUES E-cheque is a form of e-token. Working of an E-Cheque : 1.Purchasing goods -The consumer selects the goods and purchases them by sending an E-cheque to the merchant -The merchant may validate the E-cheque with its bank for payment authorization -Assuming the cheque is validated the merchant closes the transactions ELECTRONIC CHEQUES 2.Depositing cheques at the merchants bank The merchant electronically forwards the cheque to the bank The merchant bank fwd’s the E-Cheque to the clearing house for cashing The clearing house with the consumer bank clears the cheque and transfers money to the merchants bank The consumer bank updates the consumer with the wthdrawl information. ADVANTAGES OF E-CHEQUES It is similar to traditional cheques E-cheques are much faster than e-cash The risk is taken care by the accounting server. The following 2 systems provide e-chques for online payment Financial services technology corporation Cyber cash SMART CARDS Smartcards containing microprocessors are able to hold more information than cash based on the traditional magnetic strips. 2 types of smart cards: - Relationship based smart credit cards - Electronic purse and debit cards CREDIT CARD Consumer should have a legitimate credit card no. and expiration date while placing an order. Credits cards use personal information no. Pin prevents the misuse of the card in case it is stolen. SUMMARY The term internet marketing is interchangeably used for web marketing, e-marketing, internet advertising and online marketing Wide availability of www allows businessman across the world to millions of potential customers In the world of advertising ,internet marketing is one of the popular sources for promoting business, business products and services The EPS is becoming central to e-commerce as companies look for ways to serve the customers faster and at a lower cost. REVIEW QUESTIONS What was the exact method adopted by P&G to promote its product Was it the rite way to throw Colgate Palmolive out of competition What other strategy could be adopted by P&G to increase online sale What acc to you was the business model adopted by P&G.