28 June, 2013

Practice Group(s):

Labour, Employment

and Workplace Safety

Workplace Changes Applicable From 1

July 2013

By Alice DeBoos and Rachel Bevan

There are a number of workplace changes which come into effect on Monday 1 July 2013. Businesses

should be aware of these changes and review current practices, policies and procedures to ensure that

they are compliant.

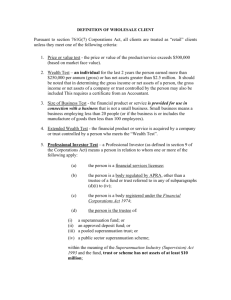

Superannuation

From 1 July 2013, the superannuation guarantee levy (SGL) will increase by 0.25% to 9.25%.

If an employee receives a salary/wages plus superannuation, then the employer will need to increase

contributions by 0.25%. However, if an employee's contract specifies a fixed sum inclusive of wages

and superannuation, then the total package remains the same and the ratio of wages to superannuation

is adjusted and a higher superannuation contribution made. You will need to check the specific terms

of your employment contracts or agreements to see whether the increase can be absorbed or is an

additional payment.

Under the current scheme, the SGL is set to increase by a further 0.25% in 2014, followed by five

consecutive 0.5% rises between 2015 and 2019, reaching 12% in 2019.

However, in his budget reply speech in May this year, Opposition Leader Tony Abbott promised to

push the timetable back two years if elected in September. So, if there is a change of government this

year, this timetable may well change.

Wages

On 3 June 2013, the Fair Work Commission minimum wage panel delivered a 2.6% increase to all

modern award rates from 1 July 2013.

As a result of the increase, the national weekly minimum wage increases by AUD15.80 to

AUD622.20 (or 41c to AUD16.37 an hour) on 1 July 2013.

If your employees are covered by an award, you need to be aware of, and apply, the 2.6% increase. If

your employees are covered by an award but are paid an over-award salary, now is a good time to do

some calculations and ensure your employees are receiving adequate compensation in light of the

award rate increase.

Unfair Dismissal Remuneration Cap

On 1 July 2013 the high-income threshold for unfair dismissal applications will increase from

AUD123,300 to AUD129,300. As the maximum compensation for unfair dismissals is half the

amount of the high-income threshold, the maximum compensation will rise from AUD61,650 to

AUD64,650 for dismissals that occur after 1 July 2013.

Workplace Changes Applicable From 1 July 2013

Authors:

Alice DeBoos

alice.deboos@klgates.com

+61.2.9513.2464

Rachel Bevan

rachel.bevan@klgates.com

+61.2.9513.2398

Anchorage Austin Beijing Berlin Boston Brisbane Brussels Charleston Charlotte Chicago Dallas Doha Dubai Fort Worth Frankfurt

Harrisburg Hong Kong Houston London Los Angeles Melbourne Miami Milan Moscow Newark New York Orange County Palo Alto Paris

Perth Pittsburgh Portland Raleigh Research Triangle Park San Diego San Francisco São Paulo Seattle Seoul Shanghai Singapore Spokane

Sydney Taipei Tokyo Warsaw Washington, D.C. Wilmington

K&L Gates practices out of 48 fully integrated offices located in the United States, Asia, Australia, Europe, the

Middle East and South America and represents leading global corporations, growth and middle-market companies,

capital markets participants and entrepreneurs in every major industry group as well as public sector entities,

educational institutions, philanthropic organizations and individuals. For more information about K&L Gates or its

locations, practices and registrations, visit www.klgates.com.

This publication is for informational purposes and does not contain or convey legal advice. The information herein should not be used or relied upon in

regard to any particular facts or circumstances without first consulting a lawyer.

©2013 K&L Gates LLP. All Rights Reserved.

2