Exam 3 Study Guide

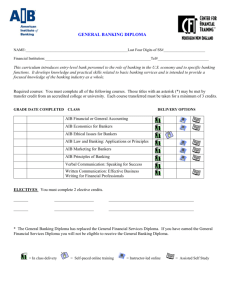

advertisement

ECON 40834 Financial History John Lovett Exam 3 Review – Spring 2015 What Material Does Exam 3 Cover? Quantitative expressions of the theoretical analysis of crystal formation in micro-gravity. Neal, Larry (2000). How it all began: the monetary and financial architecture of Europe during the first global financial capital markets. Financial History Review. 117-140. Walton & Rockoff (2011), Chapter 12 "Money & Banking in the Developing Economy" of History of the American Economy. Lecture notes and handouts to accompany the above What’s the format of Exam 3? Points are awarded based on how many letters are in your name. Maybe that explains why Ed Li took this class 3 times without passing it. Objective Section: 70 points, short answer, multiple choice, etc. Essay: 30 points. Choose 1 of 2 longer essays. What are the “objective” questions like? That reoccurring nightmare in which you are a piece of cheese facing the dreaded cheese-grater. Look over your class notes, handouts, and the study questions posted to the web site. I use the objective section to test your breadth of understanding. What are the essay questions like? Finding out your “friends” secretly filmed you last weekend when you revealed your most embarrassing thoughts and moments. Look over the list below. I will choose questions from the list below. Long Essay Study Problems: I will choose 2 of from the following X essays. You will have to answer 1 of the 2 (your pick). I may make minor changes to the questions that follow, but only minor changes. 1. Write a brief financial history of the Wisselbank. In particular, tell the reader: When, where, and why was the Wisselbank created? How were other banks and financial services affected by the formation of the Wisselbank? ** How did the Wisselbank work? How did it improve the financial system of its home country? What are some important things the Wisselbank did not do? For example, what are some major ways it differed from the later Bank of England? ECON 40834 2. 3. Financial History John Lovett Yowza! It’s 1690 and the English seem to be losing to the French in the “9 Years War”. Both the King and Parliament want money to rebuild the English military (mostly the fleet) and beat the French. Why is it getting hard for the English government to borrow money the “old way”? What does the English government create to help fund this increase in military spending? ** Explain how this creation operates in its early years (roughly the first two decades), and how it helps the British economy. What important things does this creation not do during its early years (roughly the first two decades) that it will later came to do? From about 1690 to the late 1700’s, both France and Britain conducted many “experiments” designed to improve it public finance (the way government gets money and handles its money). In both cases, a lot of thought and consideration preceded each action. Which country was better able to fund large levels of government spending during this period? (While you should give some evidence, your reply can be pretty short. A few sentences can suffice.) What were the fundamental reason (or reasons) for one country’s success and the other’s relative failure? Although details help (ex. the South Sea Company and Mississippi Company were very similar), concentrate on ultimate causation rather than getting bogged down in describing the different experiments. 4. Did the 1st Bank of the U.S. and (especially) the 2nd Bank of the U.S. act as a central bank for the United States? Explain. Were there any central bank roles performed by the 1st Bank of the U.S. and the 2nd Bank of the U.S. that the U.S. Federal Reserve system does not perform today? Are there any central bank roles performed by today’s the U.S. Federal Reserve system that the 1st Bank of the U.S. and the 2nd Bank of the U.S. did not perform way back then? 5. Briefly, tell the reader when the U.S. “state-banking period” was? Also, describe why this period is called the “state-banking” period? Describe one “experiment” that was designed to make a banking system operate more safely or efficiently. How and when was this system formed? How did it operate? How did it work to make the banking (and/or payment) better? What were some limitations of this system? Describe a second “experiment” that was designed to make a banking system operate more safely or efficiently. How and when was this system formed? How did it operate? How did it work to make the banking (and/or payment) better? What were some limitations of this system?