PARAMASIVAM GAUTHAMARAJAN ~ Contact No.: +971 56 324

advertisement

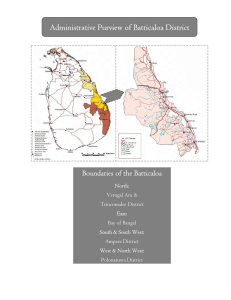

PARAMASIVAM GAUTHAMARAJAN ~ Contact No.: +971 56 324 1583, +94 652 222922 ~ E-Mail: gautham.paramasivam@yahoo.com SENIOR MANAGEMENT POSITIONS ~ Strategic Planning ~ Credit Administration ~ Branch Operations ~ PROFESSIONAL SUMMARY A competent professional with over 21 years of cross-cultural experience in Senior Management Grade, including involving Credit decision making with overseas experience across: - Banking Operations - Branch Operations & Management - Credit Administration - Documentation - Strategy Planning - Service Delivery Operations - CRM - Portfolio Management - Team Management Deft in managing Credit Administration encompassing Appraisal, Risk Analysis, Verification of Documents, Approval of Loans and administration of credit facilities. -Actively engaged in approving Loan Proposals of Large Corporate Clients in various segments. -Skilled in managing post approval activities; encompassing disbursement, portfolio monitoring, loan collateral management and reviewing solvency status. rescheduling, Proficient in heading branch operations by ensuring accomplishment of desired targets. Formulating operating budgets to ensure optimum utilisation of available funds towards accomplishment of overall corporate goals. Keen customer centric with chronicled success in building and sustaining strong business relations with clients and maintaining high customer satisfaction matrices by achieving delivery & service quality norms. Possess excellent interpersonal, communication and organizational skills with proven abilities in training & development, customer relationship management and planning. CORE COMPETENCIES Banking Operations Management Devising & implementing policies for all round development of the branch as well as reducing overall costs through various means. Implementing competent strategies for boosting the business with a view to penetrate new accounts and expand existing ones for meeting pre-determined business objectives and targets. Handling front-end operations for Savings, Current & Fixed Deposits, involved in Cash Management for branch as well as extending priority banking services. Ensuring compliance with statutory/ regulatory requirements specified under different acts governing banking regulations by statutory bodies. Credit Administration Performing the functions of assessing creditworthiness of contracting, manufacturing, trading and FI clients and taking adequate steps to ensure receipt of payments and recovery of debts. Analysing financial statements, risk analysis of all credit proposals and submitting reports, providing accurate information & sound judgments on credit worthiness of customers before sanctioning loans and credit limits. Ensuring completion of the processing activities and disbursement of loans within the turn around time. Operations Ensuring completion of documentation, stamping and all other formalities related to pre and post disbursement as per the rule and the regulatory authority’s requirements. Verifying and ensuring that documents submitted by clients are as per the credit norms. Client Relationship Management Managing customer centric banking operations & ensuring customer satisfaction by achieving delivery & service quality norms; responding to queries with regards to account opening and documentation. Ensuring maintenance of highest service standards for servicing clients and maintaining minimum turn-around-time. Building and maintaining healthy business relations with clients for cross selling various banking products and providing advisory services. Team Management Leading, training & monitoring the team members to ensure efficiency in sales & collection operations and meeting of individual & group targets. Conducting meetings for setting-up sales objectives and designing or streamlining processes to ensure smooth functioning of sales operations. CAREER CONTOUR Since Nov’ 10: Union Bank of Colombo, PLC as Senior Manager – Unit Manager Steering complete gamut of credit review operations including overseeing activities like Pre-sanction Appraisal, Credit Monitoring, Post Approval Administration, Risk Identification, Mitigation and Management. Primarily involved in reviewing proposals & ensuring approvals are received prior to expiry of valid limits, obtaining missing documentation & setting up limit. . Feb’ 08 – Aug’ 10: Sampath Bank, PLC, Batticaloa Branch, Sri Lanka Major Assignments Handled: May’ 10 – Aug’ 10 Senior Executive Officer 11 - Eastern Region Role: Headed and managed entire administrative operations for all branches allocated under purview and worked towards achievement of goals and budgeted targets. Approved credit proposals within Delegated Authority and recommend credit facilities. Maintain credit quality. Feb’ 08 – May’ 10 Branch Manager - Batticaloa (Senior Executive Officer 1) Role: Spearheaded services, operations and administration of the branch so as to maximize efficiency and productivity and deliver high standard of customer services and enhance banks’ image. Understood clients’ requirements and provided guidance on various investment opportunities. Extended support to customers during or outside normal office hours. Generated daily, weekly and month-end reports regarding branch operations and productivity; formulated recommendations and provided feedback to management regarding operational issues. Appraised proposals, conducted risk analysis & scrutinized relevant documents before sanctioning / disbursing loans, ensured compliance with bank’s credit policies. Maintained good credit quality in adherence to statutory/regulatory control requirements Aug’ 92 – Feb’ 08: Selvan Bank, PLC, Sri Lanka Major Assignments Handled: Aug’ 99 – Feb’ 08 Branch Manager - Batticaloa Branch Administered complete branch banking operations including Loans & Advances, Cash Management and International Money Transfer Systems as well as General Administration of the branch Junior Executive Officer – IT Department, Batticaloa Branch Key member involved in: o Implementation of Fiserv/ICBS Banking System & migration of previous versions of banking software. o Roll Out of Kapiti/ Cashier Banking System across branches Island wide. Rendered User Application support to branches. Apr’ 96 – Aug’ 99 Internal Control Officer - Kattankudy Branch Generated monthly profit and loss statement. Attended to resolved queries and complaints. Formulated and implemented budgets through strategic planning. Banking Assistant - Hatton Branch Aug’ 92 – Apr’ 96 Handled day to day banking and customer service operations. Assisted customers in money transfer systems & clearing operations. Managed term deposits including interest calculations and provisioning. Rendered assistance to Officer In-charge of Advances Unit. Ensured timely input of day-to-day transactions in the system. PROFESSIONAL COURSE 2011 Advanced Credit Skills from Academy of Banking & Financial Studies , Pune, India 2009 Basel II- The Way For Promotion Of Bank Risk Management from Institute of Bankers of Sri Lanka 1997 Intermediate Bankers Examination from Institute of Bankers of Sri Lanka. SCHOLASTICS Pursuing MBA (Finance) on Economics from ICFAI, India IT COURSE DETAILS 1992 2000 2000 Diploma in Computer Studies from DP Aides Limited, Sri Lanka Diploma in Computer Hardware Engineering from Turnkey Systems Certificate in Windows NT Administration from DP Aides Limited Date of Birth Languages Known : PERSONAL DOSSIER : 25th November 1971 English Address : No. 11/16, Maradana Road, 2nd Cross St, Hendala, Wattala, Sri Lanka Present Address : The Gardens Apartment, Building No 3,Apt 809, Discovery Gardens, Iban Bathutha, Dubai. (On Visitors Visa In Dubai) …… ,,,,,,… REFERENCES “Upon request”.I do hereby declare that all the particulars furnished above are true and accurate to the best of my knowledge. P Gauthamarajan