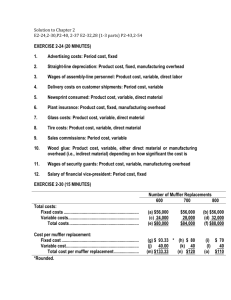

Albrecht 16 - BYU Marriott School

advertisement