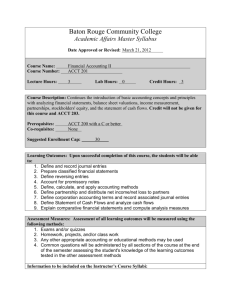

Document

advertisement

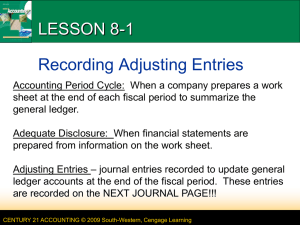

Chapter 8 Adjusting and Closing Entries Steps of the Accounting Cycle 1. Analyze Transactions 2. Journalize 3. Post 4. Prepare the work sheet 5. Prepare Financial Statements 6. Journalize Adjusting and Closing Entries 7. Post Adjusting and Closing Entries 8. Prepare Post-Closing Trial Balance 8-1 2 How is an account balance changed? By journalizing a transaction and posting the entry to the account. – Remember, when we prepared a work sheet, we only planned the adjusting entries. – No account balances were actually changed when making the work sheet. 8-1 3 8-1 Recording Adjusting Entries Adjusting Entries: journal entries recorded to update general ledger accounts at the end of the fiscal period. ADJUSTING ENTRY FOR SUPPLIES 8-1 page 202 5 ADJUSTING ENTRY FOR PREPAID INSURANCE 8-1 page 204 6 Audit Your Understanding Why are adjustments journalized? The accounts are not up to date until the entries on the work sheet are journalized and posted to the ledger accounts. Where is the information obtained from to journalize the adjusting entries? The work sheet adjustments column. Remember—just copy them from the work sheet 8-1 7 Work Together On website 8-1 8 8-2 Recording Closing Entries Permanent Accounts: accounts used to accumulate information from one fiscal period to the next. Examples: Asset and Liability Accounts and the Owner’s Capital Account Temporary Accounts: accounts used to accumulate information until it is transferred to the owner’s capital account. Examples: Examples include: Revenue, expense, owner’s drawing, and the income summary account. Closing Entries: journal entries used to prepare temporary accounts for a new fiscal period. Closing Entries, Continued To close a temporary account, an amount equal to its balance is recorded in the account on the side opposite its balance. Example: Sales has a credit balance of $4,000 A debit of $4,000 is recorded to close the Sales account. – Once the entry is posted, the Sales account balance = 0 8-1 10 Income Summary Account-Continued Remember: debits must equal credits If an account is debited for $4,000 to close it, some other account must be credited for the same amount. Income Summary is a temporary account used to summarize the closing entries for the revenue and expense accounts. 8-1 11 Four Closing Entries: Entry to close Income Statement Accounts with credit balances. (S) Entry to close Income Statement Accounts with debit balances. (E) Entry to record net income (or net loss) and close the Income Summary Account. (N) Entry to close the owner’s drawing account. (D) 8-1 12 CLOSING ENTRY FOR AN INCOME STATEMENT ACCOUNT WITH A CREDIT BALANCE (Sales) page 208 8-1 13 CLOSING ENTRY FOR INCOME STATEMENT page 209 ACCOUNTS WITH DEBIT BALANCES (expenses) 8-1 14 Remember... Purpose of closing entries is to bring the balance of temporary accounts to zero. Debits must equal credits—So the Income Summary account is the other account used in the closing entry for revenues and expenses. 8-1 15 CLOSING ENTRY TO RECORD NET INCOME OR LOSS AND CLOSE THE INCOME SUMMARY ACCOUNT (Net Income or Loss) 8-1 page 210 16 CLOSING ENTRY FOR THE OWNER’S DRAWING ACCOUNT 8-1 page 211 17 Audit Your Understanding What do the ending balances of permanent accounts for one fiscal period represent at the beginning of the next fiscal period? Beginning Balances What do the balances of temporary accounts show? Changes in the owner’s capital for a single fiscal period. 8-1 18 Work Together On Website 8-1 19 8-3 Preparing a Post-Closing Trial Balance Post-Closing Trial Balance: a trial balance prepared after the closing entries are posted. (The last step in the cycle) Accounting Cycle: the series of accounting activities included in recording financial information for a fiscal period. Why do this report? After the closing entries are recorded and posted, the business is almost ready to start recording transactions for the new accounting period. Before this is done, it is important to check if debits still equal credits. 8-1 21 GENERAL LEDGER ACCOUNTS AFTER ADJUSTING AND page 213 CLOSING ENTRIES ARE POSTED 8-1 22 POST-CLOSING TRIAL BALANCE page 216 8-1 23 Audit Your Understanding Which accounts go on the post-closing trial balance? Permanent Accounts: Assets, Liabilities, and the Owner’s Capital Account Why are temporary accounts omitted from a postclosing trial balance? Because they are closed and have zero balances. 8-1 24 Work Together Textbook Page 219 – Workbook page 167 –Only permanent accounts are listed. – Total debits must equal the total credits. 8-1 25 The End! 8-1 26