Study Unit 8 - CMAPrepCourse

advertisement

Study Unit 8

CVP Analysis and Marginal Analysis

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• CVP = Break-even analysis

• Allows us to analyze the relationship between revenue and fixed

and variable expenses

• It allows us to study the effects of changes in assumptions about

cost behavior and the relevant ranges (in which those assumption

are valid) may affect the relationships among revenues, variable

costs, and fixed costs at various production levels

• It considers the effects of:

•

•

•

•

Sales volume

Sales price

Product mixes

What else……?

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• CVP analysis is done with what assumptions? See page 314

“Simplifying assumptions of CVP”

• What is the break-even point and where is it on a graph?

CVP Graph

Break-Even Point

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• BEP = output level at which Total Rev = Total Exp

• It is also the point at which all fixed cost have been covered and

operating income is zero

Revenue

Var. Cost

Gross Margin

Fixed Cost

Oper. Income

$100,000

$ 80,000

$ 20,000

$ 20,000

$ 0

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• Other terms and def.

• Margin of safety = excess of “budgeted” sales over BE Sales

• Mixed costs - Costs that have both a fixed and variable component.

For example, the cost of operating an automobile includes some

fixed costs that do not change with the number of miles driven (e.g.,

operating license, insurance, parking, some of the depreciation, etc.)

Other costs vary with the number of miles driven (e.g., gasoline, oil

changes, tire wear, etc.).

• Revenue or sales mix

• Sensitivity analysis – examines the effect on the outcome of not

achieving the original forecast or of changing an assumption. Since

many decisions must be made due to uncertainty, probabilities can

be assigned to different outcomes (“what-if”).

Continued

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• Unit Contribution Margin (UCM) is an important term used

with break-even point or break-even analysis is contribution

margin. In equation format it is defined as follows:

Contribution Margin = Revenues – Variable Expenses

• The contribution margin for one unit of product or one unit of

service is defined as:

Contribution Margin per Unit = Revenues per Unit – Variable

Expenses per Unit

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• Break-even point in units

Fixed costs

UCM

• Break-even point in dollars

Fixed costs

CMR

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis – Theory - Question 1

Question 1 - CMA2 Study Unit 8: CVP

Analysis and Marginal Analysis

Cost-volume-profit (CVP) analysis is a key

factor in many decisions, including choice of

product lines, pricing of products, marketing

strategy, and use of productive facilities. A

calculation used in a CVP analysis is the

breakeven point. Once the breakeven point

has been reached, operating income will

increase by the

A.

B.

C.

D.

Gross margin per unit for each additional unit

sold.

Contribution margin per unit for each

additional unit sold.

Fixed costs per unit for each additional unit

sold.

Variable costs per unit for each additional unit

sold.

SU- 8.1 – Cost-Volume-Profit (CVP) Analysis –

Theory – Answer to Question 1

• Correct Answer: B

At the breakeven point, total revenue equals total fixed costs plus

the variable costs incurred at that level of production. Beyond the

breakeven point, each unit sale will increase operating income by

the unit contribution margin (unit sales price – unit variable cost)

because fixed cost will already have been recovered.

Incorrect Answers:

A: The gross margin equals sales price minus cost of goods sold,

including fixed cost.

C: All fixed costs have been covered at the breakeven point.

D: Operating income will increase by the unit contribution margin,

not the unit variable cost.

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis – Theory - Question 2

Question 2 - CMA2 Study Unit 8: CVP

Analysis and Marginal Analysis

One of the major assumptions limiting

the reliability of breakeven analysis is

that

A.

B.

C.

D.

Efficiency and productivity will

continually increase.

Total variable costs will remain

unchanged over the relevant range.

Total fixed costs will remain unchanged

over the relevant range.

The cost of production factors varies with

changes in technology.Correct Answer: C

SU- 8.1 – Cost-Volume-Profit (CVP) Analysis –

Theory – Answer to Question 2

Correct Answer: C

One of the inherent simplifying assumptions used in CVP analysis is

that fixed costs remain constant over the relevant range of activity.

Incorrect Answers:

A: Breakeven analysis assumes no changes in efficiency and

productivity.

B: Total variable costs, by definition, change across the relevant

range.

D: The cost of production factors is assumed to be stable; this is

what is meant by relevant range.

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis – Theory - Question 3

Question 3 - CMA2 Study Unit 8: CVP

Analysis and Marginal Analysis

The margin of safety is a key concept of

CVP analysis. The margin of safety is

the

A.

B.

C.

D.

Contribution margin rate.

Difference between budgeted

contribution margin and breakeven

contribution margin.

Difference between budgeted sales and

breakeven sales.

Difference between the breakeven point

in sales and cash flow breakeven.

SU- 8.1 – Cost-Volume-Profit (CVP) Analysis –

Theory – Answer to Question 3

Correct Answer: C

The margin of safety measures the amount by which sales may decline

before losses occur. It is the excess of budgeted or actual sales over

sales at the BEP.

Incorrect Answers:

A: The contribution margin rate is computed by dividing

contribution margin by sales. The contribution margin equals sales

minus total variable costs.

B: The margin of safety is expressed in revenue or units, not

contribution margin.

D: Cash flow is not relevant.

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis – Theory - Question 4

Question 4 - CMA2 Study Unit 8: CVP

Analysis and Marginal Analysis

The breakeven point in units increases

when unit costs

A.

Increase and sales price remains

unchanged.

B.

Decrease and sales price remains

unchanged.

C.

D.

Remain unchanged and sales price

increases.

Decrease and sales price increases.

SU- 8.1 – Cost-Volume-Profit (CVP) Analysis –

Theory – Answer to Question 4

Correct Answer: A

The breakeven point in units is calculated by dividing total fixed costs by

the unit contribution margin. If selling price is constant and costs increase,

the unit contribution margin will decline, resulting in an increase of the

breakeven point.

Incorrect Answers:

B: A decrease in costs will cause the unit contribution margin to

increase, lowering the breakeven point.

C: An increase in the selling price will increase the unit contribution

margin, resulting in a lower breakeven point.

D: Both a cost decrease and a sales price increase will increase the unit

contribution margin, resulting in a lower breakeven point.

SU- 8.1 – Cost-Volume-Profit (CVP)

Analysis - Theory

• Review:

• Diff. gross margin and contribution margin

• Effect of an increase in CM

• Effects on BEP by changes in CM

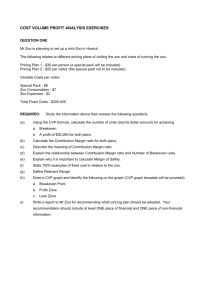

SU – 8.2 CVP Analysis – Basic

Calculations

• CVP Applications

• Target Operating Income

• Multiple products

• Choice of products

• Degree of Operating Leverage (DOL)

• Problems

• 8, 9, 10, 12 & 13 starting on page 330

SU – 8.3 CVP Analysis – Target Income

Calculations

• Target Operating Income

Fixed costs + Target operating income

UCM

• Target Net Income

Fixed costs + Target net income / (1.0 – tax rate)

UCM

• Problem 15, 16 and 18 on page 333

SU – 8.4 CVP Analysis – Multiproduct

Calculations

• Multiple Products (or Services)

S = FC + VC = Calculated Weighted Average Contribution

Margin

• Choice of Product decisions – When resources are limited

companies have to choose which products to produce

• Special Orders

SU- 8.4 CVP Analysis – Multiproduct

Calculations - Question 1

Moorehead Manufacturing Company produces two

products for which the data presented to the right

have been tabulated. Fixed manufacturing cost is

applied at a rate of $1.00 per machine hour. The sales

manager has had a $160,000 increase in the budget

allotment for advertising and wants to apply the

money to the most profitable product. The products

are not substitutes for one another in the eyes of the

company’s customers.

Per Unit

Selling price

Variable manufacturing cost

Fixed manufacturing cost

Variable selling cost

XY-7

BD-4

$4.00

2.00

$3.00

1.50

.75

1.00

.20

1.00

SU- 8.4 – CVP Analysis – Multiproduct

Calculations - Question 1 Continued

Suppose Moorehead has only 100,000 machine

hours that can be made available to produce

additional units of XY-7 and BD-4. If the potential

increase in sales units for either product resulting

from advertising is far in excess of this production

capacity, which product should be advertised and

what is the estimated increase in contribution

margin earned?

A.

Product XY-7 should be produced, yielding a

contribution margin of $75,000.

B.

Product XY-7 should be produced, yielding a

contribution margin of $133,333.

C.

Product BD-4 should be produced, yielding a

contribution margin of $187,500.

D.

Product BD-4 should be produced, yielding a

contribution margin of $250,000.

SU- 8.4 CVP Analysis – Multiproduct

Calculations – Answer to Question 1

Correct Answer: D

The machine hours are a scarce resource that must be allocated to the product(s) in a proportion

that maximizes the total CM. Given that potential additional sales of either product are in excess of

production capacity, only the product with the greater CM per unit of scarce resource should be

produced. XY-7 requires .75 hours; BD-4 requires .2 hours of machine time (given fixed

manufacturing cost applied at $1 per machine hour of $.75 for XY-7 and $.20 for BD-4). XY-7 has a

CM of $1.33 per machine hour ($1 UCM ÷ .75 hours), and BD-4 has a CM of $2.50 per machine hour

($.50 ÷ .2 hours). Thus, only BD-4 should be produced, yielding a CM of $250,000 (100,000 × $2.50).

The key to the analysis is CM per unit of scarce resource.

Incorrect Answers:

A: Product XY-7 actually has a CM of $133,333, which is lower than the $250,000 CM for product

BD-4.

B: Product BD-4 has a higher CM at $250,000.

C: Product BD-4 has a CM of $250,000.

SU- 8.4 CVP Analysis – Multiproduct

Calculations - Question 2

Question 2 - CMA2 Study Unit 8: CVP

Analysis and Marginal Analysis

Product A accounts for 75% of a

company’s total sales revenue and has a

variable cost equal to 60% of its selling

price. Product B accounts for 25% of total

sales revenue and has a variable cost

equal to 85% of its selling price. What is

the breakeven point given fixed costs of

$150,000?

A.

B.

C.

D.

$375,000

$444,444

$500,000

$545,455

SU- 8.4 CVP Analysis – Multiproduct

Calculations – Answer to Question 2

Correct Answer: B

Using the relationship: sales = total

variable costs + total fixed costs, the

combined breakeven point can be

calculated as follows:

S

=

0.75S(0.60) + 0.25S(0.85) + $150,000

S

=

0.45S + 0.2125S + $150,000

S – 0.6625S

=

$150,000

0.3375S

S

=

=

$150,000

$444,444

Incorrect Answers: A: This amount is

based on the contribution margin of

Product A only rather than a weighted

average. C: This amount is based on

half of the required sales at B’s

contribution margin. D: This amount is

based on an unweighted average of the

two contribution margins.

SU- 8.4 CVP Analysis – Multiproduct

Calculations - Question 3

Question 3 - CMA2 Study Unit 8: CVP Analysis and Marginal

Analysis

Von Stutgatt International’s breakeven point is 8,000 racing

bicycles and 12,000 5-speed bicycles. If the selling price and

variable costs are $570 and $200 for a racer, and $180 and $90

for a 5-speed respectively, what is the weighted-average

contribution margin?

A.

B.

C.

D.

$100

$145

$179

$202

SU- 8.4 CVP Analysis – Multiproduct

Calculations – Answer to Question 3

Correct Answer: D

Contribution margin

equals selling price

minus variable costs.

The product contribution margins are:

Racer:

$570 – $200

=

$370

5-Speed:

$180 – $90

=

$90

Racer:

8,000 ÷ (8,000 + 12,000) =

40%

5-Speed:

12,000 ÷ (8,000 +

12,000)

60%

The sales mix is:

Multiply the CM by the sales mix for each product,

and add the results.

Weighted-average CM = ($370 × 40%) + ($90 ×

60%)

= $148 + $54

= $202

=

SU- 8.4 CVP Analysis – Multiproduct

Calculations – Answer to Question 3

Incorrect Answers:

A: The sales mix dictates how much of the total CM will come from

sales of each product. Unit sales are attributable 40% to racers and

60% to 5-speeds, so 40% of the UCM for racers must be added to 60%

of the UCM for 5-speeds to get the weighted-average CM.

B: The sales mix dictates how much of the total CM will come from

sales of each product. Unit sales are attributable 40% to racers and

60% to 5-speeds, so 40% of the UCM for racers must be added to 60%

of the UCM for 5-speeds to get the weighted-average CM.

C: The sales mix dictates how much of the total CM will come from

sales of each product. Unit sales are attributable 40% to racers and

60% to 5-speeds, so 40% of the UCM for racers must be added to 60%

of the UCM for 5-speeds to get the weighted-average CM.

SU- 8.4 CVP Analysis – Multiproduct

Calculations - Question 4

Question 4 - CMA2 Study Unit 8: CVP

Analysis and Marginal Analysis

Catfur Company has fixed costs of $300,000.

It produces two products, X and Y. Product X

has a variable cost percentage equal to 60%

of its $10 per unit selling price. Product Y

has a variable cost percentage equal to 70%

of its $30 selling price. For the past several

years, sales of Product X have averaged 66%

of the sales of Product Y. That ratio is not

expected to change.

What is Catfur’s breakeven point in dollars?

A.

B.

C.

D.

$300,000

$750,000

$857,142

$942,857

SU- 8.4 CVP Analysis – Multiproduct

Calculations – Answer to Question 4

Correct Answer: D

A helpful approach in a multiproduct situation is to make calculations

based on the composite unit, i.e., 2 units of Product X and 3 units of

Product Y (a 66% ratio). The selling price of this composite unit is $110 [(2

× $10) + (3 × $30)]. The UCM of the composite unit is $35 {[2 × ($10 – $6)]

+ [3 × ($30 – $21)]}. Consequently, the breakeven point in composite units

is 8,571.43 ($300,000 FC ÷ $35 UCM), and the breakeven point in sales

dollars is $942,857 (8,571.43 × $110).

Incorrect Answers:

A: This amount equals the fixed costs.

B: This amount assumes a 40% contribution margin ratio.

C: This amount assumes a 35% contribution margin ratio.

SU 8.5 – Marginal Analysis

• Accounting Costs vs. Economic Costs

• Accounting Costs = The total amount of money or goods expended in an

endeavor. It is money paid out at some time in the past and recorded in

journal entries and ledgers.

• Economic Costs = The economic cost of a decision depends on both the

cost of the alternative chosen and the benefit that the best alternative

would have provided if chosen. Economic cost differs from accounting

cost because it includes opportunity cost.

As an example, consider the economic cost of attending college. The accounting cost

of attending college includes tuition, room and board, books, food, and other

incidental expenditures while there. The opportunity cost of college also includes the

salary or wage that otherwise could be earning during the period. So for the two to

four years an individual spends in school, the opportunity cost includes the money

that one could have been making at the best possible job. The economic cost of

college is the accounting cost plus the opportunity cost.

Thus, if attending college has a direct cost of $20,000 dollars a year for four years, and

the lost wages from not working during that period equals $25,000 dollars a year,

then the total economic cost of going to college would be $180,000 dollars ($20,000 x

4 years + the interest of $20,000 for 4 years + $25,000 x 4 years).

SU 8.5 – Marginal Analysis

• Explicit vs. Implicit Costs

• Implicit Costs = implicit cost, also called an imputed cost, implied

cost, or notional cost, is the opportunity cost equal to what a firm

must give up in order to use factors which it neither purchases

nor hires.

• Explicit Costs = An explicit cost is a direct payment made to

others in the course of running a business, such as wage, rent and

materials.

SU 8.5 – Marginal Analysis

• Accounting vs. Economic Profit

• See Utorial at http://www.khanacademy.org/economics-finance-domain/microeconomics/firmeconomic-profit/economic-profit-tutorial/v/economic-profit-vs-accounting-profit

• Accounting Profit = book income exceeds book expenses

• Economic Profit = includes Accounting Profit + Implicit costs

SU 8.5 – Marginal Analysis

• Marginal Revenue and Marginal Cost

• Marginal Revenue is the additional or incremental revenue of one

additional unit of output. See page 321

• See that Marginal Revenue is $540 between generating 4 vs. 5 units

of output.

• Marginal Cost is the additional or incremental cost incurred of

one additional unit of output.

• Note that while cost decrease over some range they will at some

point begin to increase due to the process becoming lest efficient.

• Profit Maximization is where MR = MC (see page 322)

SU 8.5 – Marginal Analysis

• Short-Run Cost Relationship – See graph on page 323

• Other considerations/applications of CVP

• Make-or-Buy

• Capacity Constraints and Product Mix

• Disinvestments

• Sell-or-Process further

SU 8.6 Short-run Profit Maximization

• Pure Competition

• Monopoly

• Monopolistic Competition

• Oligopoly

• Law of Demand

• Calculating Price elasticity of demand

• Def.

•

•

•

•

•

Greater than one

Equal to one

Less than one

Infinite or perfectly elastic

Equal to zero or perfectly inelastic