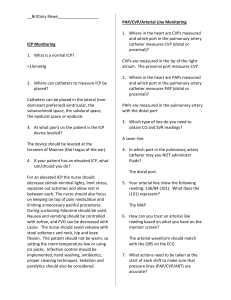

review of Chapter 3

advertisement

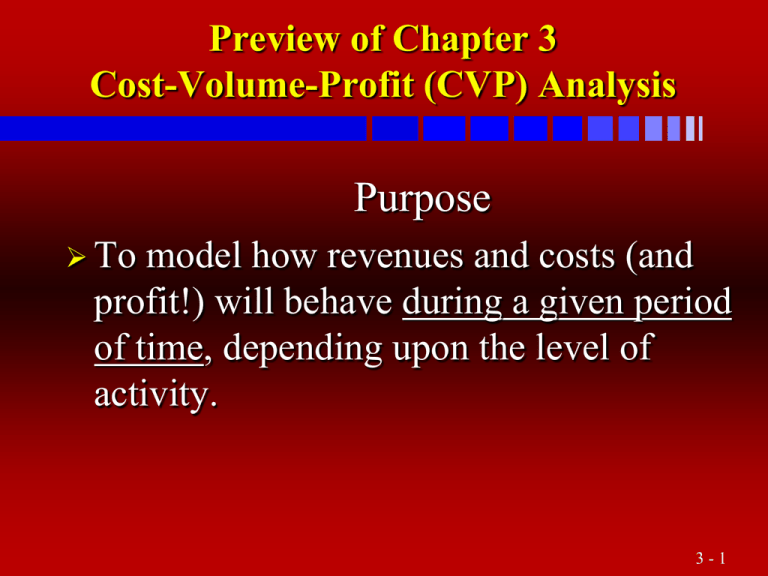

Preview of Chapter 3

Cost-Volume-Profit (CVP) Analysis

Purpose

To

model how revenues and costs (and

profit!) will behave during a given period

of time, depending upon the level of

activity.

3-1

CVP Model

Assumes a contribution margin income statement:

Contribution Mgn Approach vs Absorption Costing

Sales

- Variable Costs:

100%

- VC%

(Var. CGS, Selling, Admin.)

= Cont. Margin

- Fixed Costs:

= CM%

Sales

- CGS

= Gross Margin

- Period Costs

(Selling, Admin.)

(Mfg., Selling, Admin.)

Operating Income

Operating Income

Same only if inventories are constant (production = sales).

3-2

Questions

Besides “Where’s the breakeven point,” other questions

are of more interest:

How will the BEP increase if FC or VC increases?

How much higher could VC/unit rise before we’d

have a loss for the period?

How far could sales drop below the forecast before

Operating Income would fall below last year’s?

3-3

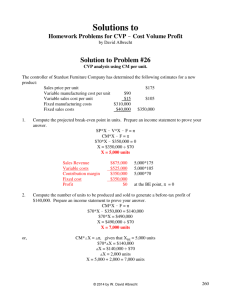

Equations For CVP Analysis

Graphs are for exposition only.

We must solve using equations.

A “definitional” equation, defining income:

Sales – Var Cost – Fixed Cost = Operating Income

–

Good starting point to attack unusual CVP

questions

3-4

Example of Relationships

For a particular item,

Unit Price

$2.50

100%

Unit VC

1.75

70% (VC%)

Unit CM

$ .75

30% (CM%)

3-5

Equations For CVP Analysis

Recognizing that VC and CM are % of sales:

Sales – (VariableCost%)Sales – FixedCost = Operating Income

Contribution Margin

{OR}

Sales x (CM%) – FC = Operating Income

CM

If FC = $10,000, how many must we sell to BE?

S - .7S – 10,000 = 0

.3S = 10,000

S = $33,333 [÷ $2.50 = 13,333 units]

3-6

Other Handy Equation Forms

Sales Dollars = (FC + Oper. Inc.) / CM%

Units Sold = (FC + Oper. Inc.) / (CM per unit)

3-7

Wide Applicability of CVP

CVP applies to any question about proposed

changes in cost structures and related volume

effects.

» Widely applicable.

» Assigned problems are representative.

3-8

Product-Mix Problem

PRODUCT

A

B

C

Price $10

VC

8

CM $ 2

$15

7

$ 8

CM% 20% 53.33%

$25

10

$15

The Weighted

Average CM%

will depend on

actual mix sold

60%

3-9

Product-Mix Problem

Weighted Average based on previous year’s results

(assumed numbers):

A

B

C

Tot. Wtd Avg

Units Sold 5000 10000 15000 30000

Sales

VC

CM

$50,000 150,000

375,000

575,000 1.000

40,000

70,000

150,000

260,000

.452

10,000

80,000

225,000

315,000

.548

3 - 10

Product-Mix Problem

What’s wrong with the following approach?

Product mix is 5/30 “A”, 10/30 “B” and 15/30 “C”

So 5/30 x .20 + 10/30 x .533 + 15/30 x .60 = .511 ≠ .548

Error: Done in terms of units, but the CM% is

contribution/$, not contribution/unit!

Correct:

(50/575)(.20) + (150/575)(.533) + (375/575)(.60) = .548

3 - 11

Considering Income Tax

Recall the “definitional” equation, defining

income:

Sales – Var Cost – Fixed Cost = Operating Income

(1-r)*(Sales – Var Cost – Fixed Cost) = Income after tax

Sales – Var Cost – Fixed Cost = (Income after tax)/ (1-r)

So, divide desired after-tax income by (1-r) to

get the desired before-tax income and use

the formulas as usual.

3 - 12

Effect of Income Taxes

Any

amount “after tax” or net of taxes =

(1-r) (The amount before taxes)

[Applies to an expense, revenue, or Operating Income]

$1,000 expense is tax deductible

So at 40% rate:

(1-.4) 1,000 = $600 net expense

$1,000 revenue is taxable

So at 40% rate:

(1-.4) 1,000 = $600 net

3 - 13

Effect of Income Taxes

All numbers in the CVP equations are before tax.

Therefore questions involving “after tax” effects require

you to convert to “before tax” before using the equation.

Ex. How many units sold to earn $900,000 after tax at a 45% tax

rate?

AT amt. = (1-r) BT amt.

900,000 = (1-.45) BT amt.

BT amt. = 900,000/.55 = $1,636,364

Thus, using my Eq. 4: Units = FC + 1,636,364

CM/unit

3 - 14